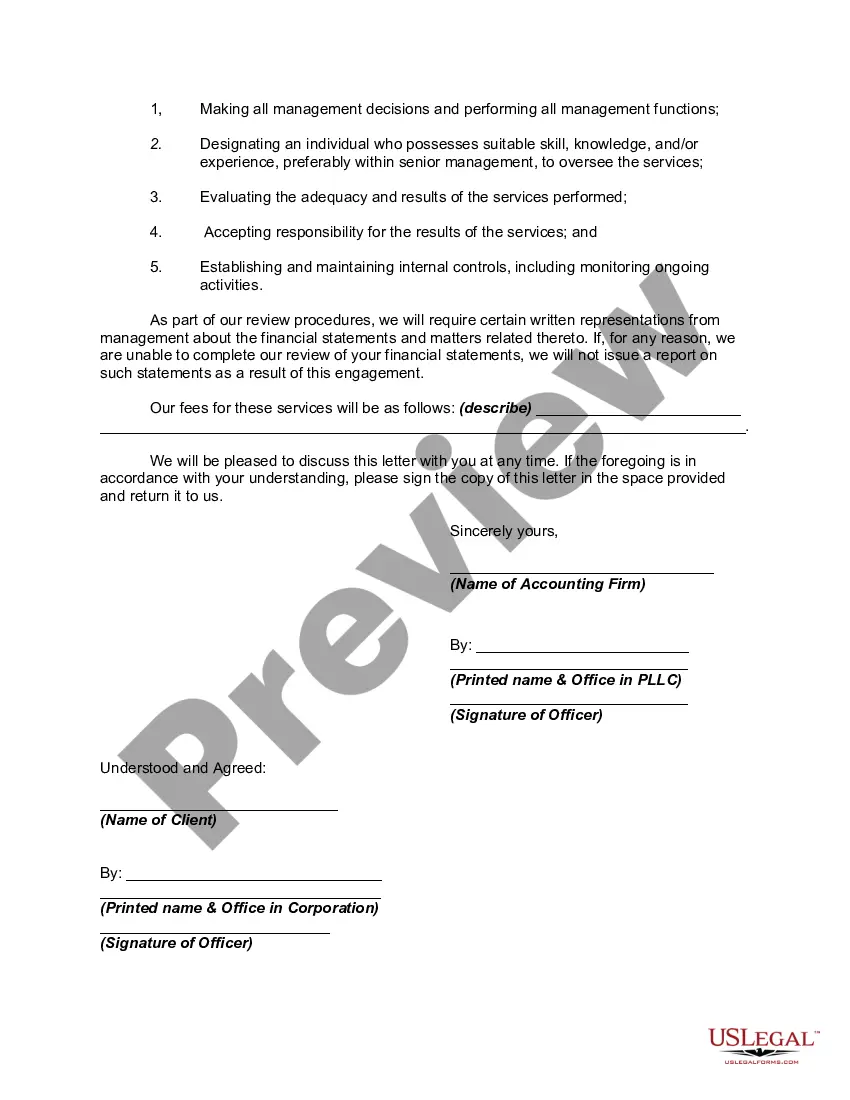

A limited review of financial statements is an audit restricted to an examination either for a limited period or of a limited part of the records. A review does not contemplate obtaining an understanding of the entity's internal control; assessing fraud risk; tests of accounting records by obtaining sufficient appropriate audit evidence through inspection, observation, confirmation, or the examination of source documents (for example, cancelled checks or bank images); and other procedures ordinarily performed in an audit. Accordingly, a review does not provide assurance that we will become aware of all significant matters that would be disclosed in an audit. Therefore, a review provides only limited assurance that there are no material modifications that should be made to the financial statements in order for the statements to be in conformity with generally accepted accounting principles.

The definition of nonattest services is very inclusive. It includes, for example, preparation of the client's depreciation schedule and preparation of journal entries even if management has approved the journal entries. I have confirmed these examples directly with the AICPA ethics division. The definition of nonattest services includes preparation of tax returns.

Title: Understanding the San Jose California Engagement Letter for Review of Financial Statements by an Accounting Firm Introduction: In the vibrant city of San Jose, California, businesses of all sizes require the expertise of accounting firms to ensure accurate and reliable financial reporting. An important document that sets the stage for this collaboration is the Engagement Letter for the Review of Financial Statements. In this article, we will delve into the intricacies of this letter, its significance, and highlight any variations that may exist. Keywords: San Jose California, Engagement Letter, Review of Financial Statements, Accounting Firm, importance, variations. 1. The Purpose of an Engagement Letter: The Engagement Letter for Review of Financial Statements serves as a legally binding contract between the accounting firm and its client. It outlines the scope of work, objectives, and responsibilities of both parties involved in the financial review process. 2. Key Components of the Engagement Letter: a) Objective and Scope: The engagement letter clearly defines the purpose of the review, whether it is to express limited assurance or no assurance on the financial statements. It also outlines the specific period covered and provides an overview of the review procedure. b) Responsibilities: The letter specifies the roles and responsibilities of the accounting firm and the client, ensuring a mutual understanding of the tasks to be performed, such as providing accurate and complete financial information. c) Professional Standards: It highlights the accounting standards or frameworks (e.g., Generally Accepted Accounting Principles or International Financial Reporting Standards) to be followed and provides assurance that the firm will conduct the review according to relevant professional guidelines. 3. Variation of Engagement Letters: While the general purpose of the engagement letter remains consistent, variations may arise based on the specific circumstances or requirements of the client. These may include: a) Standard Engagement Letter: This letter outlines a comprehensive review of financial statements, adhering to the standard procedures and guidelines applicable to the industry. b) Engagement Letter for Specialized Reviews: Certain industries or regulatory bodies may require specialized reviews, demanding additional procedures, expertise, or presenting unique challenges. In such cases, the engagement letter may incorporate these specific requirements. c) Recurring Engagement Letter: For clients seeking ongoing financial review services, a recurring engagement letter may be drafted, specifying the duration and frequency of the reviews to be conducted. 4. Importance of the Engagement Letter: a) Clear Expectations: The engagement letter sets clear expectations, ensuring both parties are aligned on the purpose, scope, and responsibilities related to the financial review. b) Legal Protection: By signing the engagement letter, both the accounting firm and the client establish a legal and enforceable agreement that safeguards their respective interests. c) Quality Control: The engagement letter acts as a foundation for delivering high-quality review services, emphasizing adherence to professional standards and ensuring a consistent approach. Conclusion: When seeking the expertise of an accounting firm in San Jose, California, it is crucial to establish a detailed Engagement Letter for the Review of Financial Statements. This contract sets the stage for a successful collaboration, providing a framework to facilitate accurate financial reporting, legal protection, and clear expectations for both parties involved. Keywords: San Jose California, Engagement Letter, Review of Financial Statements, Accounting Firm, importance, variations.Title: Understanding the San Jose California Engagement Letter for Review of Financial Statements by an Accounting Firm Introduction: In the vibrant city of San Jose, California, businesses of all sizes require the expertise of accounting firms to ensure accurate and reliable financial reporting. An important document that sets the stage for this collaboration is the Engagement Letter for the Review of Financial Statements. In this article, we will delve into the intricacies of this letter, its significance, and highlight any variations that may exist. Keywords: San Jose California, Engagement Letter, Review of Financial Statements, Accounting Firm, importance, variations. 1. The Purpose of an Engagement Letter: The Engagement Letter for Review of Financial Statements serves as a legally binding contract between the accounting firm and its client. It outlines the scope of work, objectives, and responsibilities of both parties involved in the financial review process. 2. Key Components of the Engagement Letter: a) Objective and Scope: The engagement letter clearly defines the purpose of the review, whether it is to express limited assurance or no assurance on the financial statements. It also outlines the specific period covered and provides an overview of the review procedure. b) Responsibilities: The letter specifies the roles and responsibilities of the accounting firm and the client, ensuring a mutual understanding of the tasks to be performed, such as providing accurate and complete financial information. c) Professional Standards: It highlights the accounting standards or frameworks (e.g., Generally Accepted Accounting Principles or International Financial Reporting Standards) to be followed and provides assurance that the firm will conduct the review according to relevant professional guidelines. 3. Variation of Engagement Letters: While the general purpose of the engagement letter remains consistent, variations may arise based on the specific circumstances or requirements of the client. These may include: a) Standard Engagement Letter: This letter outlines a comprehensive review of financial statements, adhering to the standard procedures and guidelines applicable to the industry. b) Engagement Letter for Specialized Reviews: Certain industries or regulatory bodies may require specialized reviews, demanding additional procedures, expertise, or presenting unique challenges. In such cases, the engagement letter may incorporate these specific requirements. c) Recurring Engagement Letter: For clients seeking ongoing financial review services, a recurring engagement letter may be drafted, specifying the duration and frequency of the reviews to be conducted. 4. Importance of the Engagement Letter: a) Clear Expectations: The engagement letter sets clear expectations, ensuring both parties are aligned on the purpose, scope, and responsibilities related to the financial review. b) Legal Protection: By signing the engagement letter, both the accounting firm and the client establish a legal and enforceable agreement that safeguards their respective interests. c) Quality Control: The engagement letter acts as a foundation for delivering high-quality review services, emphasizing adherence to professional standards and ensuring a consistent approach. Conclusion: When seeking the expertise of an accounting firm in San Jose, California, it is crucial to establish a detailed Engagement Letter for the Review of Financial Statements. This contract sets the stage for a successful collaboration, providing a framework to facilitate accurate financial reporting, legal protection, and clear expectations for both parties involved. Keywords: San Jose California, Engagement Letter, Review of Financial Statements, Accounting Firm, importance, variations.