Generally, a contract to employ a certified public accountant need not be in writing. However, such contracts often call for services of a highly complex and technical nature, and hence they should be explicit in their terms, and they should be in writing. In particular, a written employment contract is necessary in order to avoid misunderstanding with the employer regarding the amount of the accountant's fee or compensation and the nature of its computation. As most commonly used in legal settings, an audit is an examination of financial records and documents and other evidence by a trained accountant. Audits are conducted of records of a business or governmental entity, with the aim of ensuring proper accounting practices, recommendations for improvements, and a balancing of the books.

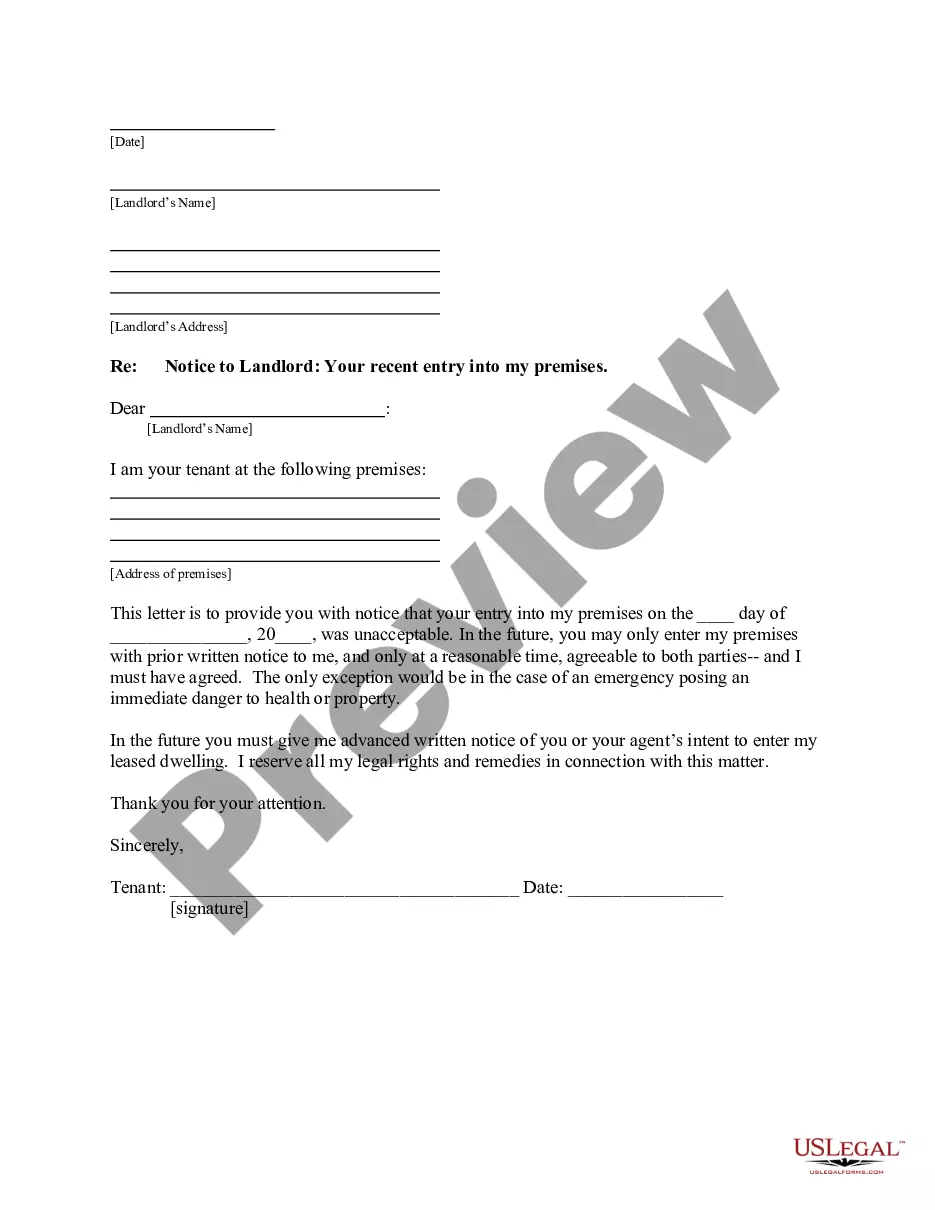

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Nassau, New York Engagement Letter Between Accounting Firm and Client For Audit Services: A Comprehensive Overview Introduction: An engagement letter between an accounting firm and a client is a vital document that establishes the terms and conditions of an audit engagement. This letter outlines the scope of services, responsibilities of both the accounting firm and the client, the fee structure, and other crucial details. In Nassau, New York, various types of engagement letters exist, catering to different audit needs and requirements. In this article, we will delve into the details of what Nassau New York Engagement Letter Between Accounting Firm and Client For Audit Services entails. Types of Nassau New York Engagement Letters for Audit Services: 1. Standard Engagement Letter: The standard engagement letter is the most commonly used document between an accounting firm and a client for audit services in Nassau, New York. It defines the overall scope of the audit engagement, including financial statements, internal controls, and compliance matters. Additionally, it outlines the responsibilities of both parties, confidentiality requirements, and timelines for the audit process. 2. Limited Scope Engagement Letter: In some cases, clients may require a limited scope engagement due to specific requirements or budget constraints. This engagement letter specifies the services which will be performed within the defined limitations. The accounting firm clarifies what areas of the audit engagement will not be covered, allowing the client to make an informed decision based on their needs. 3. Agreed-Upon Procedures Engagement Letter: Certain clients may seek an engagement letter for agreed-upon procedures where the accounting firm performs specific procedures, reviews findings, and presents the results to the client. This type of engagement letter is more focused and targeted, enabling the client to address specific concerns or comply with regulatory requirements. Components of a Nassau New York Engagement Letter Between Accounting Firm and Client For Audit Services: 1. Introduction: This section lays the foundation for the engagement letter, introducing both parties involved, their respective roles, and the purpose of the agreement. State the effective date of the engagement letter and any relevant reference numbers or project codes. 2. Scope of Services: Clearly define the scope of the audit engagement. Include specifics such as the financial statements to be audited, the auditing standards to be followed (e.g., Generally Accepted Auditing Standards), and any additional areas of focus like internal controls, compliance, or fraud detection. 3. Responsibilities of the Accounting Firm: Outline the responsibilities that the accounting firm undertakes during the audit engagement. This includes conducting the audit in accordance with applicable standards, maintenance of professional independence, and delivering the audit report within a specified timeframe. 4. Responsibilities of the Client: Specify the client's responsibilities, such as providing accurate and complete financial records, granting access to relevant personnel, and cooperating with the accounting firm during the audit process. 5. Confidentiality and Data Security: Address the confidentiality requirements, emphasizing the handling and protection of sensitive information in compliance with relevant laws and regulations. 6. Fee Structure and Payment Terms: Detail the fee structure for the audit engagement, including the basis for billing (e.g., hourly rate, fixed fee, or percentage of revenues). Mention payment terms, any associated expenses, and the consequences of delayed payments. 7. Amendments and Termination: Explicitly state the conditions under which the engagement letter may be amended or terminated by either party. Conclusion: A Nassau, New York Engagement Letter Between Accounting Firm and Client For Audit Services lays the groundwork for a successful audit engagement. By defining the scope, responsibilities, confidentiality, fee structure, and other essential elements, it ensures clear communication and mutual understanding between the accounting firm and the client. Different types of engagement letters, such as standard, limited scope, and agreed-upon procedures, cater to specific audit requirements.Nassau, New York Engagement Letter Between Accounting Firm and Client For Audit Services: A Comprehensive Overview Introduction: An engagement letter between an accounting firm and a client is a vital document that establishes the terms and conditions of an audit engagement. This letter outlines the scope of services, responsibilities of both the accounting firm and the client, the fee structure, and other crucial details. In Nassau, New York, various types of engagement letters exist, catering to different audit needs and requirements. In this article, we will delve into the details of what Nassau New York Engagement Letter Between Accounting Firm and Client For Audit Services entails. Types of Nassau New York Engagement Letters for Audit Services: 1. Standard Engagement Letter: The standard engagement letter is the most commonly used document between an accounting firm and a client for audit services in Nassau, New York. It defines the overall scope of the audit engagement, including financial statements, internal controls, and compliance matters. Additionally, it outlines the responsibilities of both parties, confidentiality requirements, and timelines for the audit process. 2. Limited Scope Engagement Letter: In some cases, clients may require a limited scope engagement due to specific requirements or budget constraints. This engagement letter specifies the services which will be performed within the defined limitations. The accounting firm clarifies what areas of the audit engagement will not be covered, allowing the client to make an informed decision based on their needs. 3. Agreed-Upon Procedures Engagement Letter: Certain clients may seek an engagement letter for agreed-upon procedures where the accounting firm performs specific procedures, reviews findings, and presents the results to the client. This type of engagement letter is more focused and targeted, enabling the client to address specific concerns or comply with regulatory requirements. Components of a Nassau New York Engagement Letter Between Accounting Firm and Client For Audit Services: 1. Introduction: This section lays the foundation for the engagement letter, introducing both parties involved, their respective roles, and the purpose of the agreement. State the effective date of the engagement letter and any relevant reference numbers or project codes. 2. Scope of Services: Clearly define the scope of the audit engagement. Include specifics such as the financial statements to be audited, the auditing standards to be followed (e.g., Generally Accepted Auditing Standards), and any additional areas of focus like internal controls, compliance, or fraud detection. 3. Responsibilities of the Accounting Firm: Outline the responsibilities that the accounting firm undertakes during the audit engagement. This includes conducting the audit in accordance with applicable standards, maintenance of professional independence, and delivering the audit report within a specified timeframe. 4. Responsibilities of the Client: Specify the client's responsibilities, such as providing accurate and complete financial records, granting access to relevant personnel, and cooperating with the accounting firm during the audit process. 5. Confidentiality and Data Security: Address the confidentiality requirements, emphasizing the handling and protection of sensitive information in compliance with relevant laws and regulations. 6. Fee Structure and Payment Terms: Detail the fee structure for the audit engagement, including the basis for billing (e.g., hourly rate, fixed fee, or percentage of revenues). Mention payment terms, any associated expenses, and the consequences of delayed payments. 7. Amendments and Termination: Explicitly state the conditions under which the engagement letter may be amended or terminated by either party. Conclusion: A Nassau, New York Engagement Letter Between Accounting Firm and Client For Audit Services lays the groundwork for a successful audit engagement. By defining the scope, responsibilities, confidentiality, fee structure, and other essential elements, it ensures clear communication and mutual understanding between the accounting firm and the client. Different types of engagement letters, such as standard, limited scope, and agreed-upon procedures, cater to specific audit requirements.