Generally, a contract to employ a certified public accountant need not be in writing.

However, such contracts often call for services of a highly complex and technical nature, and hence they should be explicit in their terms, and they should be in writing. In particular, a written employment contract is necessary in order to avoid misunderstanding with the employer regarding the amount of the accountant's fee or compensation and the nature of its computation. As most commonly used in legal settings, an audit is an examination of financial records and documents and other evidence by a trained accountant. Audits are conducted of records of a business or governmental entity, with the aim of ensuring proper accounting practices, recommendations for improvements, and a balancing of the books.

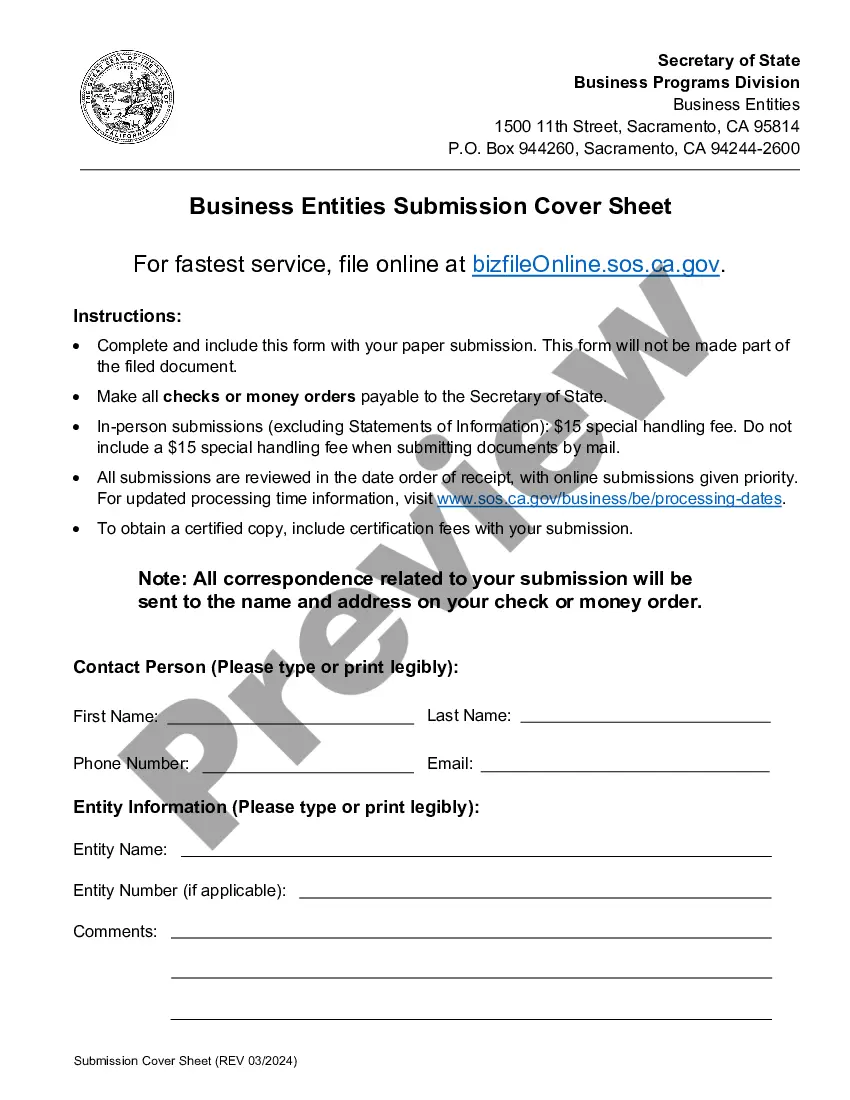

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Suffolk County, New York, known for its beautiful beaches, vibrant communities, and rich history, is home to numerous businesses and organizations that require professional accounting services. When engaging an accounting firm to perform an audit, a Suffolk New York Engagement Letter becomes a vital document that outlines the terms and agreement between the firm and its client. The Suffolk New York Engagement Letter serves as a binding agreement that specifies the scope, objectives, and responsibilities of both the accounting firm and the client. It establishes a clear understanding of the audit services to be provided and the expectations regarding the reporting and communication between the parties involved. There are several types of specific engagement letters used in Suffolk, New York, depending on the purpose of the audit services required: 1. Financial Statement Audit Engagement Letter: This letter is commonly used when an accounting firm is engaged to audit the financial statements of a client. It outlines the firm's responsibilities to express an opinion on the fairness and accuracy of the financial statements in accordance with Generally Accepted Accounting Principles (GAAP). 2. Compliance Audit Engagement Letter: If the client needs an audit to ensure compliance with specific regulations or laws, such as tax laws or industry-specific regulations, a compliance audit engagement letter is employed. It details the accounting firm's responsibilities to evaluate the client's compliance and report any findings or non-compliance. 3. Internal Audit Engagement Letter: In cases where an accounting firm is engaged to perform an internal audit, the internal audit engagement letter is utilized. This letter defines the scope of the internal audit, including identifying risks, evaluating internal controls, and making recommendations for process improvements. Each type of engagement letter includes key elements such as the audit's objectives, financial period to be reviewed, the responsibilities of the accounting firm and the client, confidentiality terms, and the fee structure. Additionally, it addresses the terms of access to the client's financial records, communication protocols, and the expected timeline for completing the audit. By signing the Suffolk New York Engagement Letter, both the accounting firm and the client demonstrate their agreement to adhere to the document's terms. This legally binding agreement serves to protect both parties' interests and ensures a transparent and efficient audit process. In conclusion, the Suffolk New York Engagement Letter plays a crucial role in establishing a clear understanding between an accounting firm and its client. The different types of engagement letters used in Suffolk, New York, cater to various audit requirements such as financial statement audits, compliance audits, and internal audits. These letters define the scope, responsibilities, and objectives of the audit services while safeguarding the interests of both parties involved.