Generally, a contract to employ a certified public accountant need not be in writing. However, such contracts often call for services of a highly complex and technical nature, and hence they should be explicit in their terms, and they should be in writing. In particular, a written employment contract is necessary in order to avoid misunderstanding with the employer regarding the amount of the accountant's fee or compensation and the nature of its computation. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Santa Clara California Engagement Letter Between Accounting Firm and Client For Tax Return Preparation

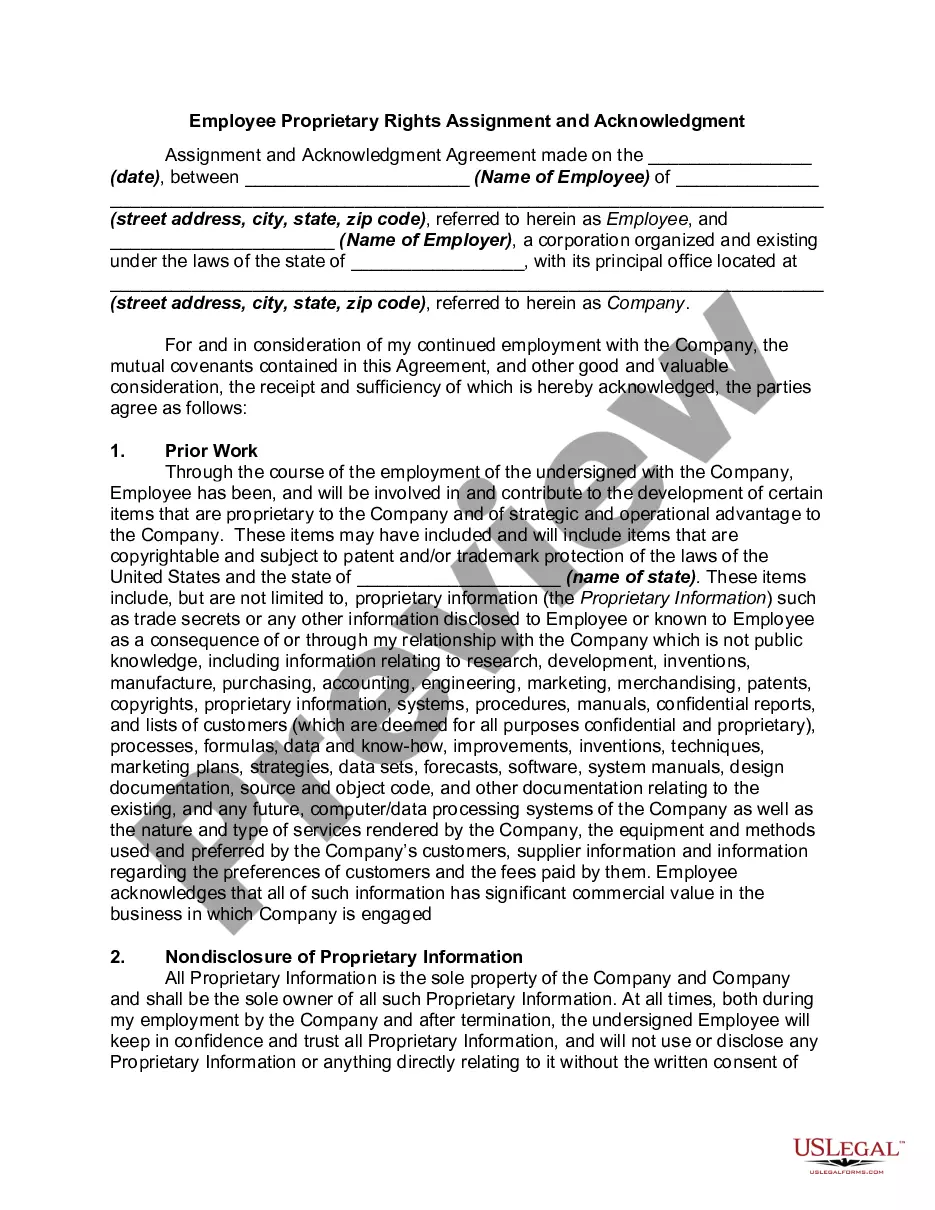

Description

How to fill out Santa Clara California Engagement Letter Between Accounting Firm And Client For Tax Return Preparation?

How much time does it normally take you to draft a legal document? Considering that every state has its laws and regulations for every life situation, finding a Santa Clara Engagement Letter Between Accounting Firm and Client For Tax Return Preparation suiting all regional requirements can be tiring, and ordering it from a professional attorney is often expensive. Numerous web services offer the most common state-specific templates for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most comprehensive web catalog of templates, grouped by states and areas of use. Aside from the Santa Clara Engagement Letter Between Accounting Firm and Client For Tax Return Preparation, here you can get any specific form to run your business or personal affairs, complying with your county requirements. Professionals verify all samples for their actuality, so you can be certain to prepare your paperwork correctly.

Using the service is remarkably straightforward. If you already have an account on the platform and your subscription is valid, you only need to log in, pick the needed form, and download it. You can pick the file in your profile anytime later on. Otherwise, if you are new to the website, there will be some extra steps to complete before you get your Santa Clara Engagement Letter Between Accounting Firm and Client For Tax Return Preparation:

- Examine the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Search for another form using the corresponding option in the header.

- Click Buy Now once you’re certain in the selected file.

- Select the subscription plan that suits you most.

- Create an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Change the file format if needed.

- Click Download to save the Santa Clara Engagement Letter Between Accounting Firm and Client For Tax Return Preparation.

- Print the sample or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the acquired template, you can find all the samples you’ve ever saved in your profile by opening the My Forms tab. Give it a try!