The main function of a financial advisor is to evaluate the economic performance of certain companies and industries for business firms and other organizations that have the money to make valuable investments.

Other tasks financial advisors have include:

" Compiling data for financial reports

" Analyzing social and economic data

" Examining market conditions

" Working with detailed financial records

" Creating statistical diagrams and charts

" Advising clients on financial matters

" Making investment presentations

Advisers use Form ADV to register as an investment adviser with the SEC. Form ADV also is used for state registration. Generally, an investment adviser that manages $25 million or more in client assets must register with the SEC. Advisers that manage less than $25 million must register with the state securities regulator where the adviser's principal place of business is located.

Form ADV has two parts. Part 1 contains information about the adviser's education, business and disciplinary history within the last ten years. Part 1 is filed electronically with the SEC. Part 2 includes information on an adviser's services, fees, and investment strategies. Currently, the SEC does not require advisers to file Part 2 electronically.

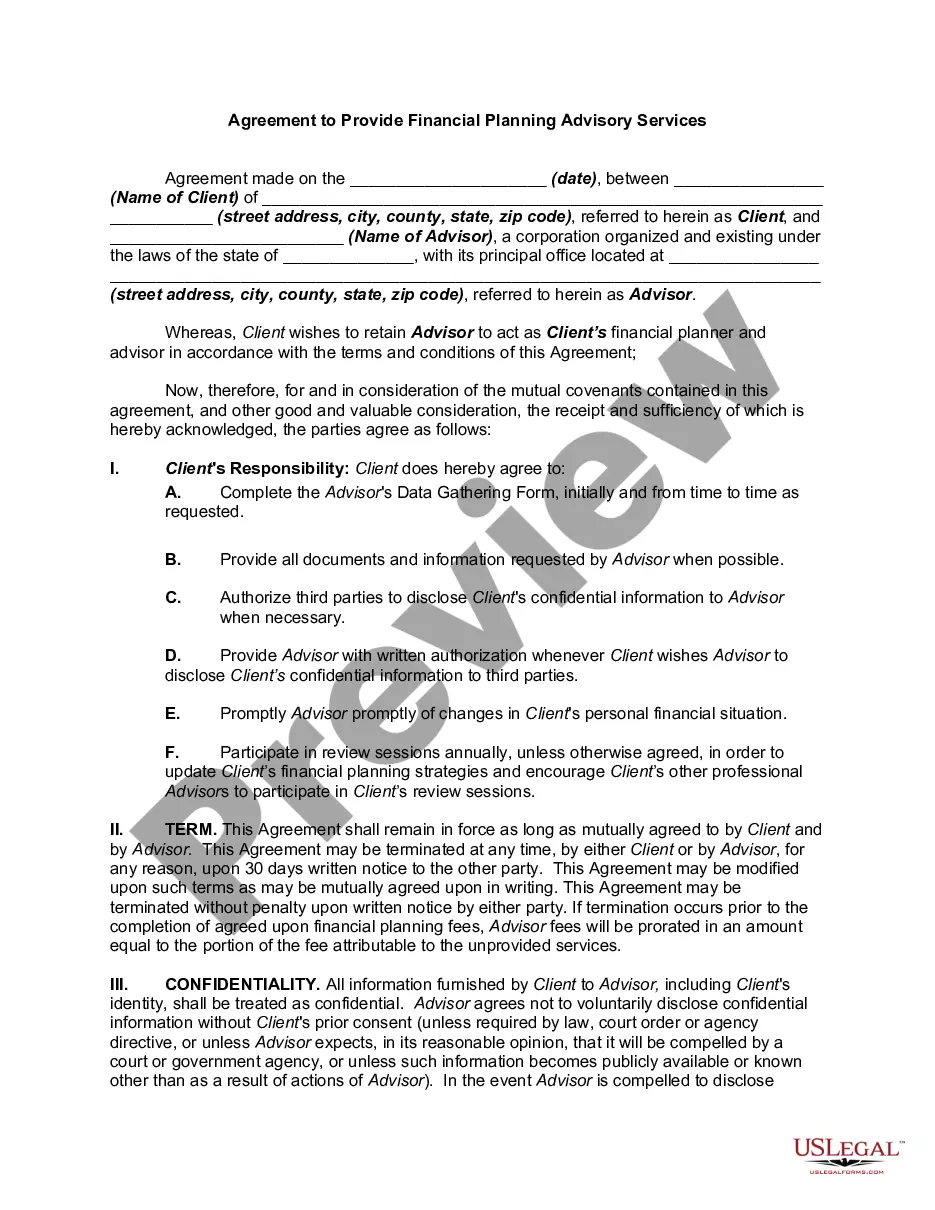

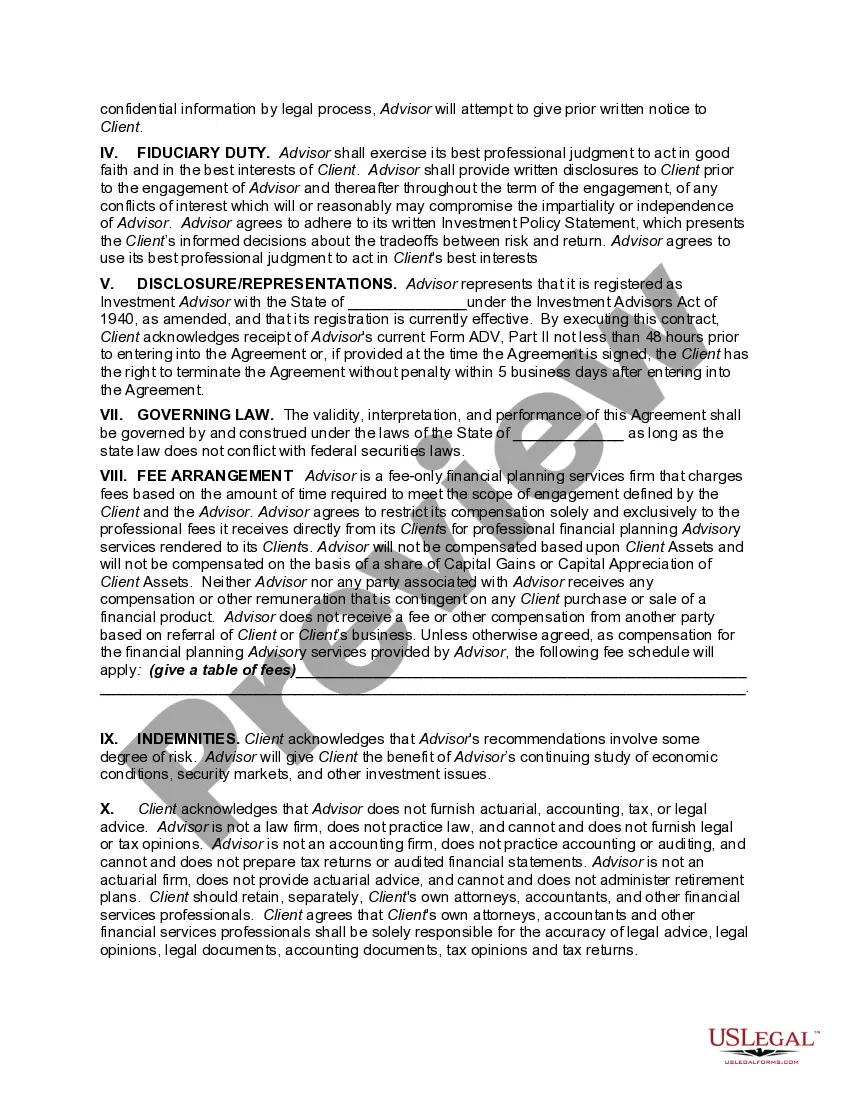

The Middlesex Massachusetts Agreement to Provide Financial Planning Advisory Services is a comprehensive and legally binding document that outlines the terms and conditions of the financial planning services offered by a financial planner or advisory firm in Middlesex County, Massachusetts. This agreement serves as a crucial tool to establish a professional relationship between the financial planner and their clients, ensuring transparency, clarity, and the protection of both parties' rights. The Middlesex Massachusetts Agreement to Provide Financial Planning Advisory Services covers various aspects related to the financial planning services provided. These may include investment management, retirement planning, estate planning, tax planning, risk management, college savings planning, and other relevant financial services. The agreement clearly delineates the scope of services provided and defines the responsibilities and obligations of both the financial planner and the client. To ensure compliance with regulatory requirements and best practices in the financial planning industry, the agreement will typically include a section outlining the advisor's certifications, licenses, and credentials. It may require the financial planner to disclose any potential conflicts of interest that may arise during the course of providing services, thus ensuring that the client receives unbiased and objective financial advice. The agreement also provides detailed information regarding the fees and compensation structure, including initial charges, ongoing management fees, performance-based fees, and any other expenses associated with the financial planning services. It may specify the payment schedule, method of payment, and procedures for termination or modification of the agreement. When it comes to different types of Middlesex Massachusetts Agreements to Provide Financial Planning Advisory Services, they can vary depending on the specific needs and requirements of the client or the financial planner's specialization. This might include agreements tailored for individuals, couples, families, or businesses seeking professional financial planning services. Furthermore, the agreement may also distinguish between different levels of service provided by the financial advisor, such as basic financial planning, comprehensive financial planning, or investment management services. Each of these services may come with varying fees, responsibilities, and deliverables, which are outlined in the agreement to ensure mutual understanding and satisfaction. In summary, the Middlesex Massachusetts Agreement to Provide Financial Planning Advisory Services is a crucial document that establishes a professional relationship between a financial planner and their clients in Middlesex County, Massachusetts. It outlines the scope of services, fees, responsibilities, and obligations of both parties, ensuring transparency and protecting the rights and interests of the clients.The Middlesex Massachusetts Agreement to Provide Financial Planning Advisory Services is a comprehensive and legally binding document that outlines the terms and conditions of the financial planning services offered by a financial planner or advisory firm in Middlesex County, Massachusetts. This agreement serves as a crucial tool to establish a professional relationship between the financial planner and their clients, ensuring transparency, clarity, and the protection of both parties' rights. The Middlesex Massachusetts Agreement to Provide Financial Planning Advisory Services covers various aspects related to the financial planning services provided. These may include investment management, retirement planning, estate planning, tax planning, risk management, college savings planning, and other relevant financial services. The agreement clearly delineates the scope of services provided and defines the responsibilities and obligations of both the financial planner and the client. To ensure compliance with regulatory requirements and best practices in the financial planning industry, the agreement will typically include a section outlining the advisor's certifications, licenses, and credentials. It may require the financial planner to disclose any potential conflicts of interest that may arise during the course of providing services, thus ensuring that the client receives unbiased and objective financial advice. The agreement also provides detailed information regarding the fees and compensation structure, including initial charges, ongoing management fees, performance-based fees, and any other expenses associated with the financial planning services. It may specify the payment schedule, method of payment, and procedures for termination or modification of the agreement. When it comes to different types of Middlesex Massachusetts Agreements to Provide Financial Planning Advisory Services, they can vary depending on the specific needs and requirements of the client or the financial planner's specialization. This might include agreements tailored for individuals, couples, families, or businesses seeking professional financial planning services. Furthermore, the agreement may also distinguish between different levels of service provided by the financial advisor, such as basic financial planning, comprehensive financial planning, or investment management services. Each of these services may come with varying fees, responsibilities, and deliverables, which are outlined in the agreement to ensure mutual understanding and satisfaction. In summary, the Middlesex Massachusetts Agreement to Provide Financial Planning Advisory Services is a crucial document that establishes a professional relationship between a financial planner and their clients in Middlesex County, Massachusetts. It outlines the scope of services, fees, responsibilities, and obligations of both parties, ensuring transparency and protecting the rights and interests of the clients.