The main function of a financial advisor is to evaluate the economic performance of certain companies and industries for business firms and other organizations that have the money to make valuable investments.

Other tasks financial advisors have include:

" Compiling data for financial reports

" Analyzing social and economic data

" Examining market conditions

" Working with detailed financial records

" Creating statistical diagrams and charts

" Advising clients on financial matters

" Making investment presentations

Advisers use Form ADV to register as an investment adviser with the SEC. Form ADV also is used for state registration. Generally, an investment adviser that manages $25 million or more in client assets must register with the SEC. Advisers that manage less than $25 million must register with the state securities regulator where the adviser's principal place of business is located.

Form ADV has two parts. Part 1 contains information about the adviser's education, business and disciplinary history within the last ten years. Part 1 is filed electronically with the SEC. Part 2 includes information on an adviser's services, fees, and investment strategies. Currently, the SEC does not require advisers to file Part 2 electronically.

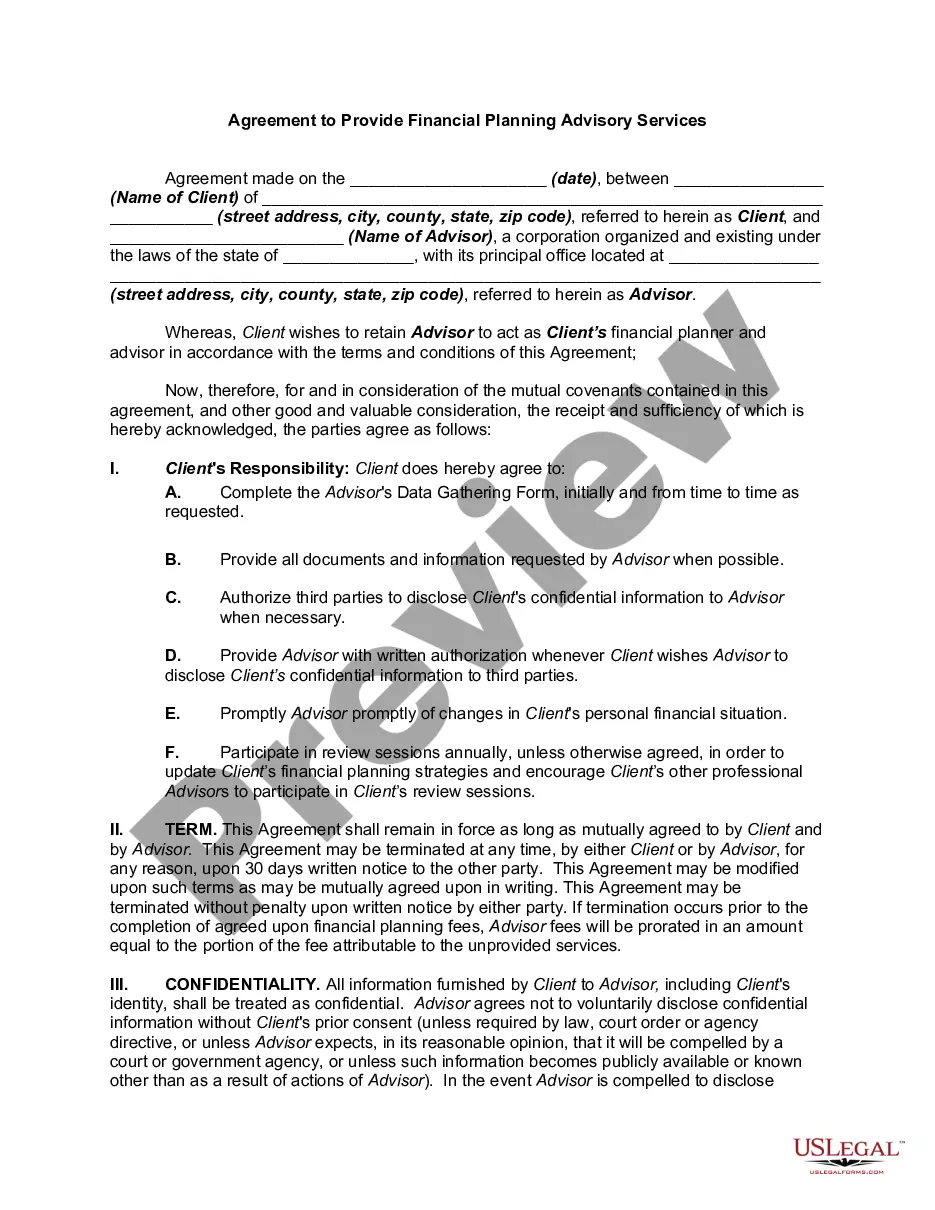

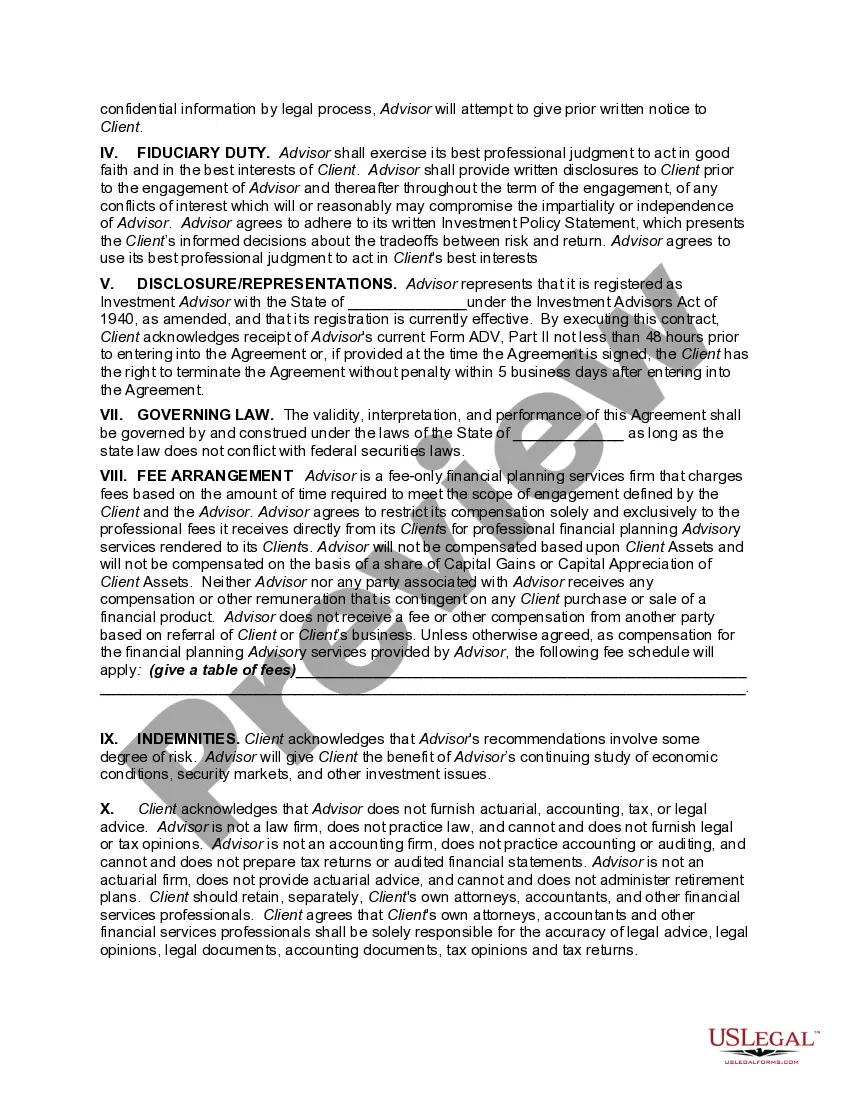

Palm Beach, Florida Agreement to Provide Financial Planning Advisory Services is a formal and legally binding contract between a financial planner or firm and a client in Palm Beach, Florida. This agreement outlines the terms and conditions under which the financial planner will provide their services to their clients. Financial Planning Advisory Services refers to the professional assistance provided by financial planners or advisory firms to help individuals or businesses effectively manage their personal or corporate finances. These services encompass a wide range of areas, including but not limited to investment planning, retirement planning, tax planning, estate planning, risk management, and wealth management. The Palm Beach, Florida Agreement to Provide Financial Planning Advisory Services typically includes the following key elements: 1. Parties involved: This section identifies the client seeking financial advisory services and the financial planner or advisory firm providing the services. It includes their full legal names, contact information, and addresses. 2. Scope of services: This section outlines the specific services the financial planner will provide. These may include developing a comprehensive financial plan, assessing the client's financial goals, analyzing their current financial situation, recommending investment strategies, creating retirement plans, and providing ongoing financial guidance. 3. Compensation: This portion of the agreement stipulates how the financial planner will be compensated for their services. It may include a percentage-based fee, hourly rate, fixed fee, or a combination thereof. The agreement should also disclose any additional charges or expenses the client may be responsible for, such as transaction fees or administrative costs. 4. Duration and termination: This section specifies the duration of the agreement, including the start and end dates. It may also describe the circumstances under which either party can terminate the agreement, such as breach of contract or mutual agreement. 5. Confidentiality: Financial information shared between the client and financial planner is highly sensitive, so this section ensures the confidentiality and non-disclosure of such information. It may include provisions preventing the financial planner from sharing or using the client's information for personal gain or other purposes not related to the provision of financial planning services. 6. Standard of care: This section outlines the standard of care and fiduciary duty the financial planner owes to the client. It clarifies that the financial planner must act in the client's best interest, exercise due diligence, and provide advice that is suitable and appropriate for the client's financial goals and risk tolerance. 7. Dispute resolution: In the event of a dispute between the client and financial planner, this section describes the preferred method of resolution, which might include negotiation, mediation, or arbitration. It may also specify the jurisdiction and governing law applicable to the agreement. Different types of Palm Beach, Florida Agreements to Provide Financial Planning Advisory Services can vary based on client requirements or the specific areas of financial planning they wish to address. Some specialized types of financial planning agreements that may be mentioned in Palm Beach include retirement planning agreements, investment planning agreements, estate planning agreements, tax planning agreements, and business financial planning agreements. In conclusion, a Palm Beach, Florida Agreement to Provide Financial Planning Advisory Services is a contractual arrangement that establishes the rights and obligations of financial planners and their clients. The agreement outlines the scope of services, compensation terms, confidentiality, termination conditions, and sets the standard of care to ensure a professional and trustworthy relationship that prioritizes the client's financial well-being.Palm Beach, Florida Agreement to Provide Financial Planning Advisory Services is a formal and legally binding contract between a financial planner or firm and a client in Palm Beach, Florida. This agreement outlines the terms and conditions under which the financial planner will provide their services to their clients. Financial Planning Advisory Services refers to the professional assistance provided by financial planners or advisory firms to help individuals or businesses effectively manage their personal or corporate finances. These services encompass a wide range of areas, including but not limited to investment planning, retirement planning, tax planning, estate planning, risk management, and wealth management. The Palm Beach, Florida Agreement to Provide Financial Planning Advisory Services typically includes the following key elements: 1. Parties involved: This section identifies the client seeking financial advisory services and the financial planner or advisory firm providing the services. It includes their full legal names, contact information, and addresses. 2. Scope of services: This section outlines the specific services the financial planner will provide. These may include developing a comprehensive financial plan, assessing the client's financial goals, analyzing their current financial situation, recommending investment strategies, creating retirement plans, and providing ongoing financial guidance. 3. Compensation: This portion of the agreement stipulates how the financial planner will be compensated for their services. It may include a percentage-based fee, hourly rate, fixed fee, or a combination thereof. The agreement should also disclose any additional charges or expenses the client may be responsible for, such as transaction fees or administrative costs. 4. Duration and termination: This section specifies the duration of the agreement, including the start and end dates. It may also describe the circumstances under which either party can terminate the agreement, such as breach of contract or mutual agreement. 5. Confidentiality: Financial information shared between the client and financial planner is highly sensitive, so this section ensures the confidentiality and non-disclosure of such information. It may include provisions preventing the financial planner from sharing or using the client's information for personal gain or other purposes not related to the provision of financial planning services. 6. Standard of care: This section outlines the standard of care and fiduciary duty the financial planner owes to the client. It clarifies that the financial planner must act in the client's best interest, exercise due diligence, and provide advice that is suitable and appropriate for the client's financial goals and risk tolerance. 7. Dispute resolution: In the event of a dispute between the client and financial planner, this section describes the preferred method of resolution, which might include negotiation, mediation, or arbitration. It may also specify the jurisdiction and governing law applicable to the agreement. Different types of Palm Beach, Florida Agreements to Provide Financial Planning Advisory Services can vary based on client requirements or the specific areas of financial planning they wish to address. Some specialized types of financial planning agreements that may be mentioned in Palm Beach include retirement planning agreements, investment planning agreements, estate planning agreements, tax planning agreements, and business financial planning agreements. In conclusion, a Palm Beach, Florida Agreement to Provide Financial Planning Advisory Services is a contractual arrangement that establishes the rights and obligations of financial planners and their clients. The agreement outlines the scope of services, compensation terms, confidentiality, termination conditions, and sets the standard of care to ensure a professional and trustworthy relationship that prioritizes the client's financial well-being.