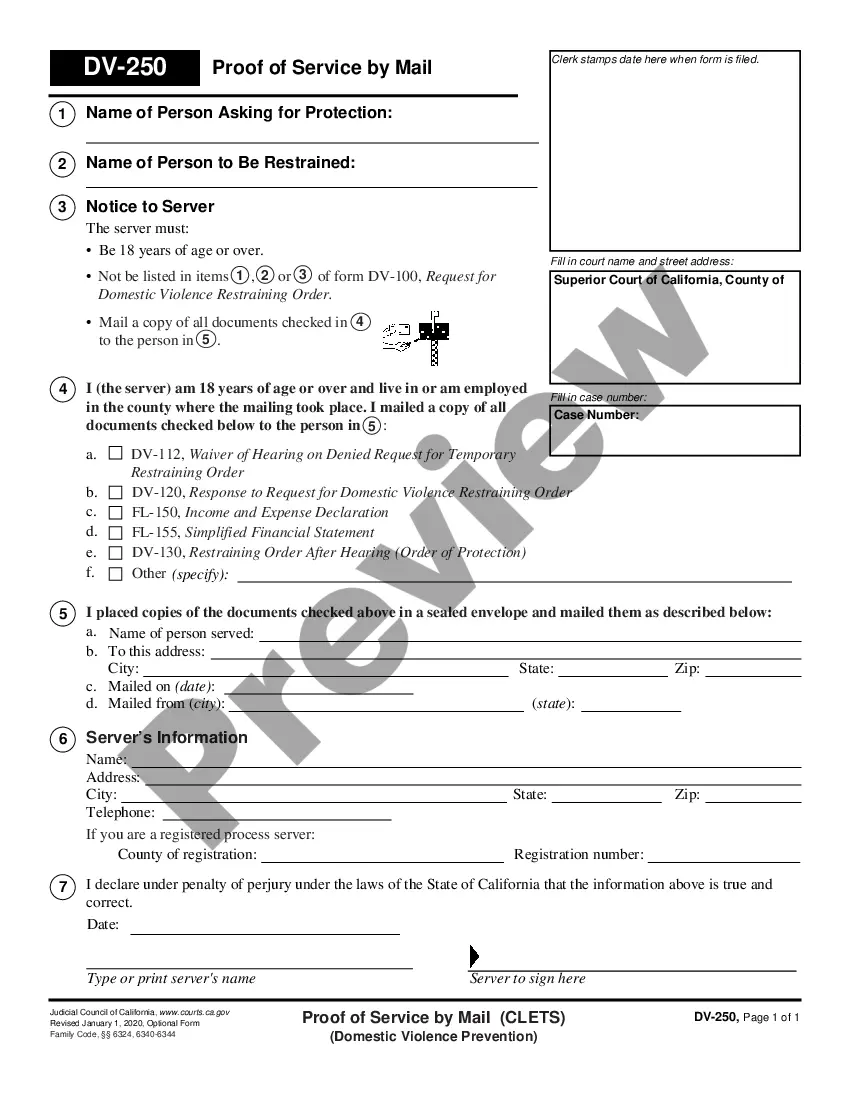

HUD gathers information on employees, individuals applying for HUD programs, business partners, contractors and clients. The Privacy Act of 1974 established controls over what personal information is collected by the federal government and how it is used.

The Act grants rights to United States citizens and legal permanent residents. Under the Privacy Act you:

" Have the right to see records about yourself; and

" Can correct a record that is inaccurate, irrelevant, untimely, or incomplete.

The Act mandates that the Government:

" Informs you why information is being collected and how it is going to be used;

" Assures that information is accurate, relevant, complete and up-to-date before disclosing it to others;

" Allows you to find out about disclosures of your records to other agencies or persons; and

" Provides you with the opportunity to correct inaccuracies in your records.

The Privacy Act applies only to records about individuals maintained by agencies in the executive branch of the government. It applies to these records only if they are kept in a "system of records." A "system of records" is a group of records from which the information was retrieved by an individual's name, social security number, date of birth or some other personal identifier.