Compiled financial statements represent the most basic level of service that certified public accountants provide with respect to financial statements. In a compilation, the CPA must comply with certain basic requirements of professional standards, such as having a knowledge of the client's industry and applicable accounting principles, having a clear understanding with the client as to the services to be provided, and reading the financial statements to determine whether there are any obvious departures from generally accepted accounting principles (or, in some cases, another comprehensive basis of accounting used by the entity). It may be necessary for the CPA to perform "other accounting services" (such as creating a general ledger for the client, or assisting the client with adjusting entries for the books of the client (before the financial statements can be prepared). Upon completion, a report on the financial statements is issued that states a compilation was performed in accordance with AICPA professional standards, but no assurance is expressed that the statements are in conformity with generally accepted accounting principles. This is known as the expression of "no assurance." Compiled financial statements are often prepared for privately-held entities that do not need a higher level of assurance expressed by the CPA.

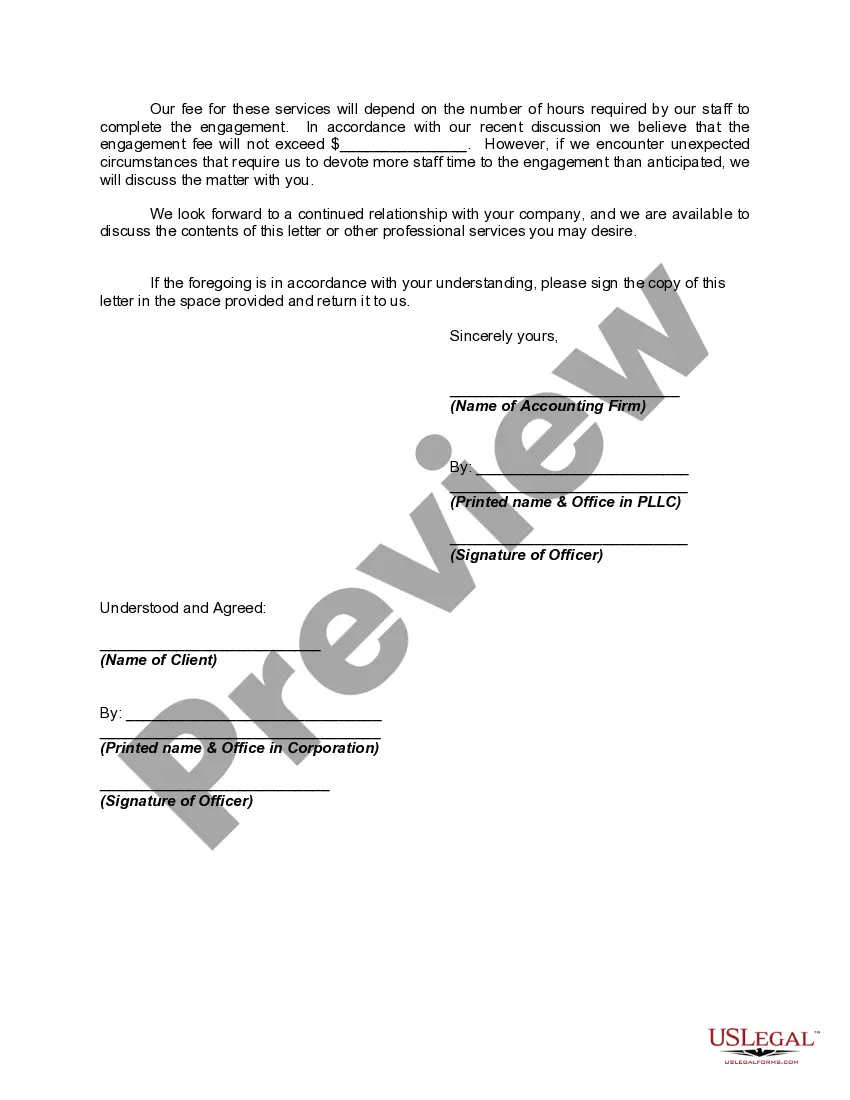

Allegheny Pennsylvania Engagement Letter for Review of Financial Statements and Compilation by Accounting Firm is a formal document that outlines the terms and conditions of the engagement between an accounting firm and a client in Allegheny, Pennsylvania, for reviewing financial statements and compiling financial data. This engagement letter ensures clear communication between the accounting firm and the client, establishing the scope of work, responsibilities, and fees associated with the engagement. The engagement letter for the review of financial statements involves a comprehensive examination of the financial records, analysis of financial data, and providing limited assurance on the accuracy and completeness of the financial statements. The accounting firm will perform necessary procedures to evaluate the reasonableness of the financial statements, identify any material misstatements, and issue a review report based on their findings. On the other hand, the engagement letter for compilation services outlines the accounting firm's role in assisting the client in preparing financial statements without offering any assurance or opinion on the accuracy or completeness of the financial information. The compiled financial statements provide an organized presentation of the client's financial data based on information provided by the management. In both types of engagement letters, confidentiality and professional independence clauses ensure that the accounting firm maintains discretion oversensitive client information and operates without any conflicts of interest. The engagement letter specifically defines the responsibilities of both the accounting firm and the client, including the client's duty to provide complete and accurate information necessary for the engagement. The engagement letter also addresses the fees and payment terms associated with the services provided. The accounting firm may charge based on billable hours, flat fees, or a combination of the two, depending on the complexity and extent of the engagement. By utilizing keywords such as "Allegheny Pennsylvania," "engagement letter," "review of financial statements," "compilation," and "accounting firm," this content creates a detailed description of what an Allegheny Pennsylvania Engagement Letter for Review of Financial Statements and Compilation by an Accounting Firm entails.Allegheny Pennsylvania Engagement Letter for Review of Financial Statements and Compilation by Accounting Firm is a formal document that outlines the terms and conditions of the engagement between an accounting firm and a client in Allegheny, Pennsylvania, for reviewing financial statements and compiling financial data. This engagement letter ensures clear communication between the accounting firm and the client, establishing the scope of work, responsibilities, and fees associated with the engagement. The engagement letter for the review of financial statements involves a comprehensive examination of the financial records, analysis of financial data, and providing limited assurance on the accuracy and completeness of the financial statements. The accounting firm will perform necessary procedures to evaluate the reasonableness of the financial statements, identify any material misstatements, and issue a review report based on their findings. On the other hand, the engagement letter for compilation services outlines the accounting firm's role in assisting the client in preparing financial statements without offering any assurance or opinion on the accuracy or completeness of the financial information. The compiled financial statements provide an organized presentation of the client's financial data based on information provided by the management. In both types of engagement letters, confidentiality and professional independence clauses ensure that the accounting firm maintains discretion oversensitive client information and operates without any conflicts of interest. The engagement letter specifically defines the responsibilities of both the accounting firm and the client, including the client's duty to provide complete and accurate information necessary for the engagement. The engagement letter also addresses the fees and payment terms associated with the services provided. The accounting firm may charge based on billable hours, flat fees, or a combination of the two, depending on the complexity and extent of the engagement. By utilizing keywords such as "Allegheny Pennsylvania," "engagement letter," "review of financial statements," "compilation," and "accounting firm," this content creates a detailed description of what an Allegheny Pennsylvania Engagement Letter for Review of Financial Statements and Compilation by an Accounting Firm entails.