Compiled financial statements represent the most basic level of service that certified public accountants provide with respect to financial statements. In a compilation, the CPA must comply with certain basic requirements of professional standards, such as having a knowledge of the client's industry and applicable accounting principles, having a clear understanding with the client as to the services to be provided, and reading the financial statements to determine whether there are any obvious departures from generally accepted accounting principles (or, in some cases, another comprehensive basis of accounting used by the entity). It may be necessary for the CPA to perform "other accounting services" (such as creating a general ledger for the client, or assisting the client with adjusting entries for the books of the client (before the financial statements can be prepared). Upon completion, a report on the financial statements is issued that states a compilation was performed in accordance with AICPA professional standards, but no assurance is expressed that the statements are in conformity with generally accepted accounting principles. This is known as the expression of "no assurance." Compiled financial statements are often prepared for privately-held entities that do not need a higher level of assurance expressed by the CPA.

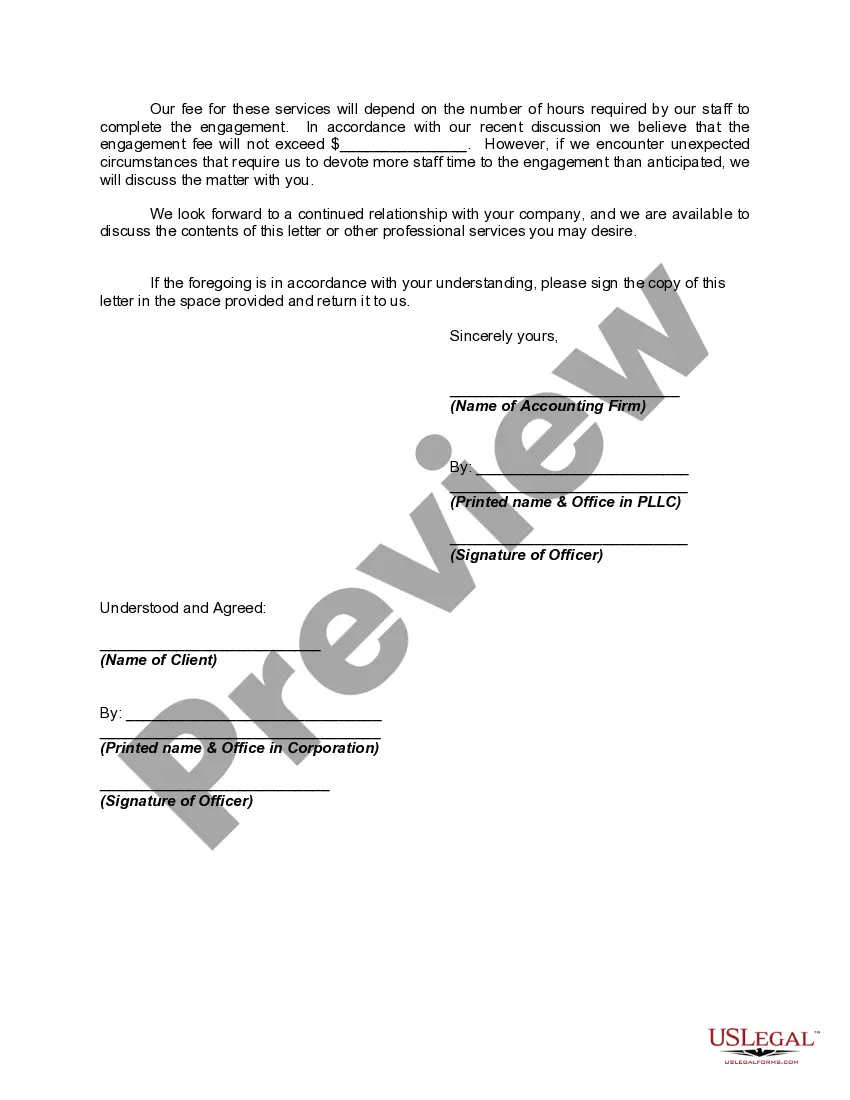

Miami-Dade Florida Engagement Letter for Review of Financial Statements and Compilation by Accounting Firm In Miami-Dade County, an engagement letter is a crucial document when engaging the services of an accounting firm for the review of financial statements and compilation. This letter serves as a formal agreement between the accounting firm and the client, outlining the scope, terms, and responsibilities of both parties involved. The purpose of an Engagement Letter for Review of Financial Statements is to provide assurance that the financial statements of an entity have been thoroughly examined by the accounting firm. This type of engagement is usually undertaken to assess the accuracy, completeness, and compliance of the financial statements with relevant accounting standards and regulatory guidelines. Keywords: Miami-Dade Florida, Engagement letter, Review of Financial Statements, Compilation, Accounting Firm, assurance, accuracy, completeness, compliance, accounting standards, regulatory guidelines. Different types of Miami-Dade Florida Engagement Letters for Review of Financial Statements and Compilation by Accounting Firm may include: 1. Review Engagement Letter: In this type of engagement, the accounting firm evaluates the financial statements by performing analytical procedures, making inquiries, and conducting discussions with management. The objective is to provide limited assurance that the financial statements are free from material misstatements. 2. Compilation Engagement Letter: This engagement involves the accounting firm assisting the entity in preparing financial statements based on information provided by management. The objective is to present the financial information in the form of financial statements without providing any assurance on their accuracy or compliance with accounting standards. 3. Special Purpose Engagement Letter: This type of engagement is specific to certain financial statements that are prepared for a particular purpose, such as for tax reporting, loan applications, or regulatory compliance. The scope and objectives of such engagements may differ based on the purpose specified in the engagement letter. 4. Agreed-Upon Procedures Engagement Letter: In this type of engagement, the accounting firm performs specified procedures on financial information or particular aspects of an entity's operations. The procedures are agreed upon by both the accounting firm and the client, and the resulting report provides findings based on the procedures performed. Remember, the content of the engagement letter may vary based on the specific requirements of the engagement and the accounting firm's policies. It is recommended to consult with an accounting professional or legal advisor to ensure the engagement letter is comprehensive, accurate, and tailored to the specific circumstances of your business in Miami-Dade, Florida.Miami-Dade Florida Engagement Letter for Review of Financial Statements and Compilation by Accounting Firm In Miami-Dade County, an engagement letter is a crucial document when engaging the services of an accounting firm for the review of financial statements and compilation. This letter serves as a formal agreement between the accounting firm and the client, outlining the scope, terms, and responsibilities of both parties involved. The purpose of an Engagement Letter for Review of Financial Statements is to provide assurance that the financial statements of an entity have been thoroughly examined by the accounting firm. This type of engagement is usually undertaken to assess the accuracy, completeness, and compliance of the financial statements with relevant accounting standards and regulatory guidelines. Keywords: Miami-Dade Florida, Engagement letter, Review of Financial Statements, Compilation, Accounting Firm, assurance, accuracy, completeness, compliance, accounting standards, regulatory guidelines. Different types of Miami-Dade Florida Engagement Letters for Review of Financial Statements and Compilation by Accounting Firm may include: 1. Review Engagement Letter: In this type of engagement, the accounting firm evaluates the financial statements by performing analytical procedures, making inquiries, and conducting discussions with management. The objective is to provide limited assurance that the financial statements are free from material misstatements. 2. Compilation Engagement Letter: This engagement involves the accounting firm assisting the entity in preparing financial statements based on information provided by management. The objective is to present the financial information in the form of financial statements without providing any assurance on their accuracy or compliance with accounting standards. 3. Special Purpose Engagement Letter: This type of engagement is specific to certain financial statements that are prepared for a particular purpose, such as for tax reporting, loan applications, or regulatory compliance. The scope and objectives of such engagements may differ based on the purpose specified in the engagement letter. 4. Agreed-Upon Procedures Engagement Letter: In this type of engagement, the accounting firm performs specified procedures on financial information or particular aspects of an entity's operations. The procedures are agreed upon by both the accounting firm and the client, and the resulting report provides findings based on the procedures performed. Remember, the content of the engagement letter may vary based on the specific requirements of the engagement and the accounting firm's policies. It is recommended to consult with an accounting professional or legal advisor to ensure the engagement letter is comprehensive, accurate, and tailored to the specific circumstances of your business in Miami-Dade, Florida.