Compiled financial statements represent the most basic level of service that certified public accountants provide with respect to financial statements. In a compilation, the CPA must comply with certain basic requirements of professional standards, such as having a knowledge of the client's industry and applicable accounting principles, having a clear understanding with the client as to the services to be provided, and reading the financial statements to determine whether there are any obvious departures from generally accepted accounting principles (or, in some cases, another comprehensive basis of accounting used by the entity). It may be necessary for the CPA to perform "other accounting services" (such as creating a general ledger for the client, or assisting the client with adjusting entries for the books of the client (before the financial statements can be prepared). Upon completion, a report on the financial statements is issued that states a compilation was performed in accordance with AICPA professional standards, but no assurance is expressed that the statements are in conformity with generally accepted accounting principles. This is known as the expression of "no assurance." Compiled financial statements are often prepared for privately-held entities that do not need a higher level of assurance expressed by the CPA.

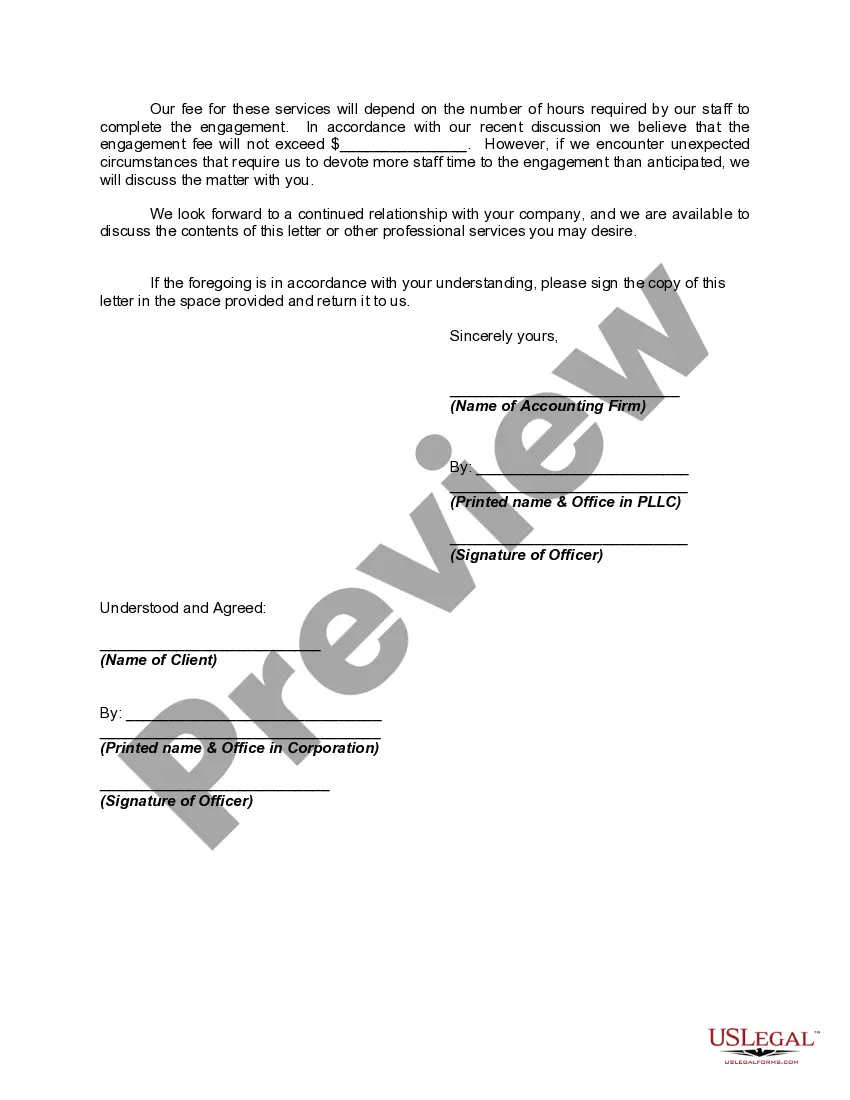

Middlesex Massachusetts Engagement Letter for Review of Financial Statements and Compilation by Accounting Firm: An engagement letter is a crucial document that outlines the terms and conditions of an agreement between an accounting firm and its client. In the Middlesex Massachusetts area, various types of engagement letters are required for review of financial statements and compilation services. The engagement letter for the review of financial statements is designed to ensure accuracy, compliance, and transparency in the financial reporting process. This letter is applicable to businesses, corporations, nonprofit organizations, and other entities operating in Middlesex County, Massachusetts. It signifies the intent of an accounting firm to perform an objective examination of the client's financial statements and provide an independent opinion on their fairness and reliability. The review engagement letter typically includes important details such as: 1. Objective: Clearly stating the purpose of the review engagement, which is to express limited assurance on the financial statements to enable users to make informed decisions. 2. Scope of Work: Describing the nature and extent of services to be provided, including procedures to be performed during the review process, and any restrictions or limitations. 3. Responsibility: Defining the responsibilities of both the accounting firm and the client, including providing access to relevant financial data, supporting documents, and timely completion of necessary information. 4. Reporting: Outlining the format and content of the final review report, which usually includes a description of procedures performed, significant findings, and the accountant's conclusion. 5. Fees and Payment Terms: Clearly specifying the fees for the review services, including any additional charges for extra work or specialized services, and the terms of payment. 6. Professional Conduct: Stating the accounting firm's commitment to maintaining ethical standards, confidentiality, and compliance with applicable laws and regulations. Furthermore, the engagement letter for compilation services, another vital financial statement-related document, is used when an accounting firm is engaged to assist clients in the preparation of financial statements without providing any assurance on their accuracy. This letter outlines the responsibilities of both parties, the scope of work, and the fees involved. In summary, Middlesex Massachusetts Engagement Letters for Review of Financial Statements and Compilation highlight the comprehensive services offered by accounting firms to ensure accurate financial reporting. These legally binding documents establish a professional relationship and set clear expectations between the firm and the client, safeguarding the interests of all parties involved.Middlesex Massachusetts Engagement Letter for Review of Financial Statements and Compilation by Accounting Firm: An engagement letter is a crucial document that outlines the terms and conditions of an agreement between an accounting firm and its client. In the Middlesex Massachusetts area, various types of engagement letters are required for review of financial statements and compilation services. The engagement letter for the review of financial statements is designed to ensure accuracy, compliance, and transparency in the financial reporting process. This letter is applicable to businesses, corporations, nonprofit organizations, and other entities operating in Middlesex County, Massachusetts. It signifies the intent of an accounting firm to perform an objective examination of the client's financial statements and provide an independent opinion on their fairness and reliability. The review engagement letter typically includes important details such as: 1. Objective: Clearly stating the purpose of the review engagement, which is to express limited assurance on the financial statements to enable users to make informed decisions. 2. Scope of Work: Describing the nature and extent of services to be provided, including procedures to be performed during the review process, and any restrictions or limitations. 3. Responsibility: Defining the responsibilities of both the accounting firm and the client, including providing access to relevant financial data, supporting documents, and timely completion of necessary information. 4. Reporting: Outlining the format and content of the final review report, which usually includes a description of procedures performed, significant findings, and the accountant's conclusion. 5. Fees and Payment Terms: Clearly specifying the fees for the review services, including any additional charges for extra work or specialized services, and the terms of payment. 6. Professional Conduct: Stating the accounting firm's commitment to maintaining ethical standards, confidentiality, and compliance with applicable laws and regulations. Furthermore, the engagement letter for compilation services, another vital financial statement-related document, is used when an accounting firm is engaged to assist clients in the preparation of financial statements without providing any assurance on their accuracy. This letter outlines the responsibilities of both parties, the scope of work, and the fees involved. In summary, Middlesex Massachusetts Engagement Letters for Review of Financial Statements and Compilation highlight the comprehensive services offered by accounting firms to ensure accurate financial reporting. These legally binding documents establish a professional relationship and set clear expectations between the firm and the client, safeguarding the interests of all parties involved.