Compiled financial statements represent the most basic level of service that certified public accountants provide with respect to financial statements. In a compilation, the CPA must comply with certain basic requirements of professional standards, such as having a knowledge of the client's industry and applicable accounting principles, having a clear understanding with the client as to the services to be provided, and reading the financial statements to determine whether there are any obvious departures from generally accepted accounting principles (or, in some cases, another comprehensive basis of accounting used by the entity). It may be necessary for the CPA to perform "other accounting services" (such as creating a general ledger for the client, or assisting the client with adjusting entries for the books of the client (before the financial statements can be prepared). Upon completion, a report on the financial statements is issued that states a compilation was performed in accordance with AICPA professional standards, but no assurance is expressed that the statements are in conformity with generally accepted accounting principles. This is known as the expression of "no assurance." Compiled financial statements are often prepared for privately-held entities that do not need a higher level of assurance expressed by the CPA.

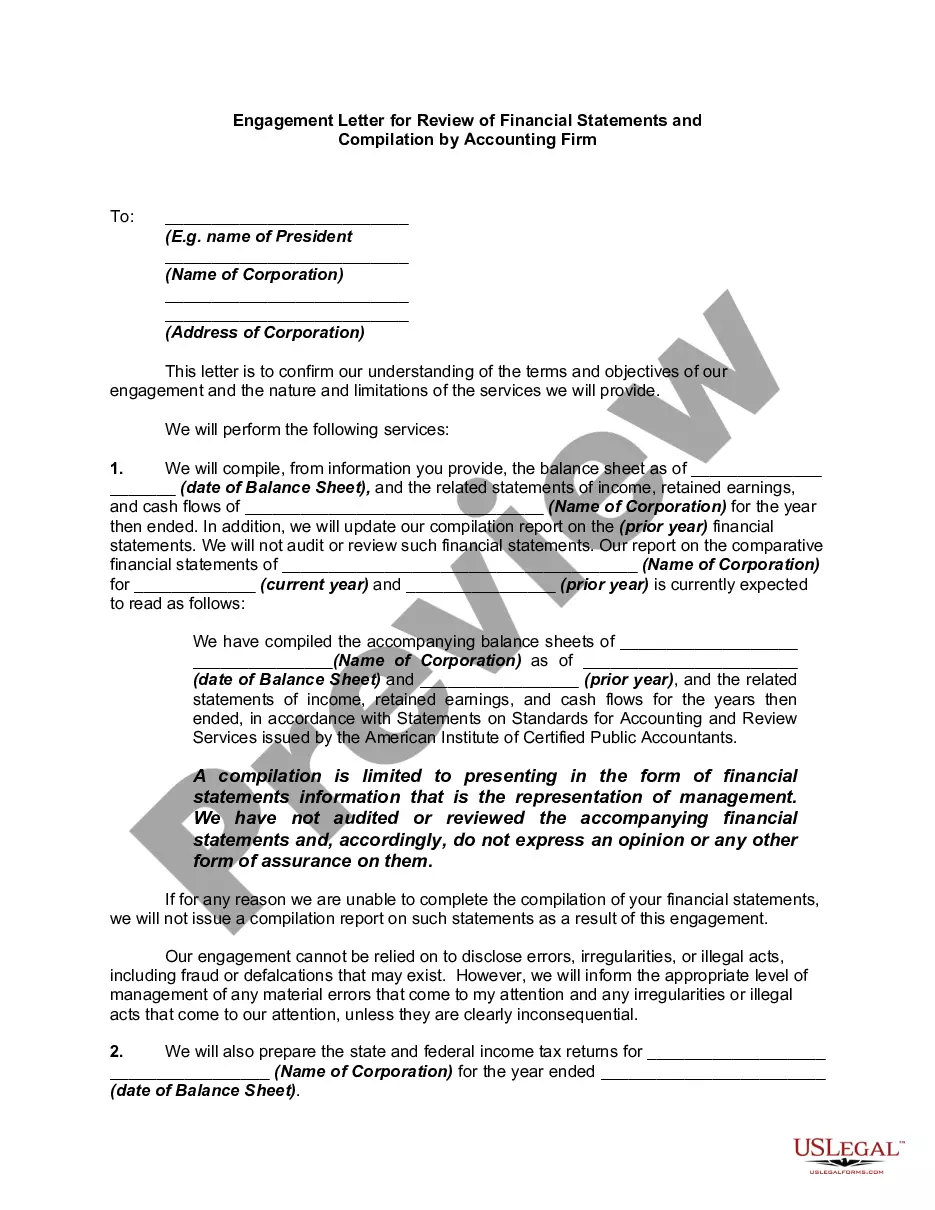

Tarrant Texas Engagement Letter for Review of Financial Statements and Compilation by Accounting Firm is a legal document that outlines the agreed-upon terms and conditions between an accounting firm and their client for the provision of review and compilation services for financial statements. This engagement letter ensures transparency and helps establish a clear understanding of the services to be provided, the responsibilities of both parties, and the fee structure involved. Engagement letters are crucial in establishing the scope of work and expectations between the accounting firm and their client, ensuring a smooth and efficient collaboration. In Tarrant Texas, there may be different types of Engagement Letters for Review of Financial Statements and Compilation by Accounting Firm, each serving a specific purpose. These different types might include: 1. Review Engagement Letter: A review engagement letter is used when the accounting firm is engaged to perform a limited review of the client's financial statements. This engagement type provides a moderate level of assurance to stakeholders, indicating that the financial statements are plausible and have been reviewed in accordance with generally accepted accounting principles (GAAP). 2. Compilation Engagement Letter: A compilation engagement letter is used when the accounting firm is engaged to prepare financial statements based on information provided by the client. In this engagement type, the accounting firm does not provide any assurance on the accuracy or completeness of the financial statements. Instead, they ensure that the financial statements conform to the appropriate accounting framework. 3. Special Purpose Engagement Letter: A special purpose engagement letter may be utilized when the accounting firm is engaged for a particular purpose or industry-specific requirements. This type of engagement letter outlines the specific objectives, assumptions, and related procedures to be followed when conducting the review or compilation services. Regardless of the type of engagement letter used, it is essential for both the accounting firm and the client to review the letter carefully, seeking professional advice if necessary, to ensure that all the terms, responsibilities, and limitations are clearly understood and agreed upon before commencing any work. In conclusion, the Tarrant Texas Engagement Letter for Review of Financial Statements and Compilation by Accounting Firm is a vital legal document that sets out the agreement between an accounting firm and their client. It provides clarity on the scope of work, responsibilities, and fees, helping establish a professional relationship to deliver review and compilation services efficiently.Tarrant Texas Engagement Letter for Review of Financial Statements and Compilation by Accounting Firm is a legal document that outlines the agreed-upon terms and conditions between an accounting firm and their client for the provision of review and compilation services for financial statements. This engagement letter ensures transparency and helps establish a clear understanding of the services to be provided, the responsibilities of both parties, and the fee structure involved. Engagement letters are crucial in establishing the scope of work and expectations between the accounting firm and their client, ensuring a smooth and efficient collaboration. In Tarrant Texas, there may be different types of Engagement Letters for Review of Financial Statements and Compilation by Accounting Firm, each serving a specific purpose. These different types might include: 1. Review Engagement Letter: A review engagement letter is used when the accounting firm is engaged to perform a limited review of the client's financial statements. This engagement type provides a moderate level of assurance to stakeholders, indicating that the financial statements are plausible and have been reviewed in accordance with generally accepted accounting principles (GAAP). 2. Compilation Engagement Letter: A compilation engagement letter is used when the accounting firm is engaged to prepare financial statements based on information provided by the client. In this engagement type, the accounting firm does not provide any assurance on the accuracy or completeness of the financial statements. Instead, they ensure that the financial statements conform to the appropriate accounting framework. 3. Special Purpose Engagement Letter: A special purpose engagement letter may be utilized when the accounting firm is engaged for a particular purpose or industry-specific requirements. This type of engagement letter outlines the specific objectives, assumptions, and related procedures to be followed when conducting the review or compilation services. Regardless of the type of engagement letter used, it is essential for both the accounting firm and the client to review the letter carefully, seeking professional advice if necessary, to ensure that all the terms, responsibilities, and limitations are clearly understood and agreed upon before commencing any work. In conclusion, the Tarrant Texas Engagement Letter for Review of Financial Statements and Compilation by Accounting Firm is a vital legal document that sets out the agreement between an accounting firm and their client. It provides clarity on the scope of work, responsibilities, and fees, helping establish a professional relationship to deliver review and compilation services efficiently.