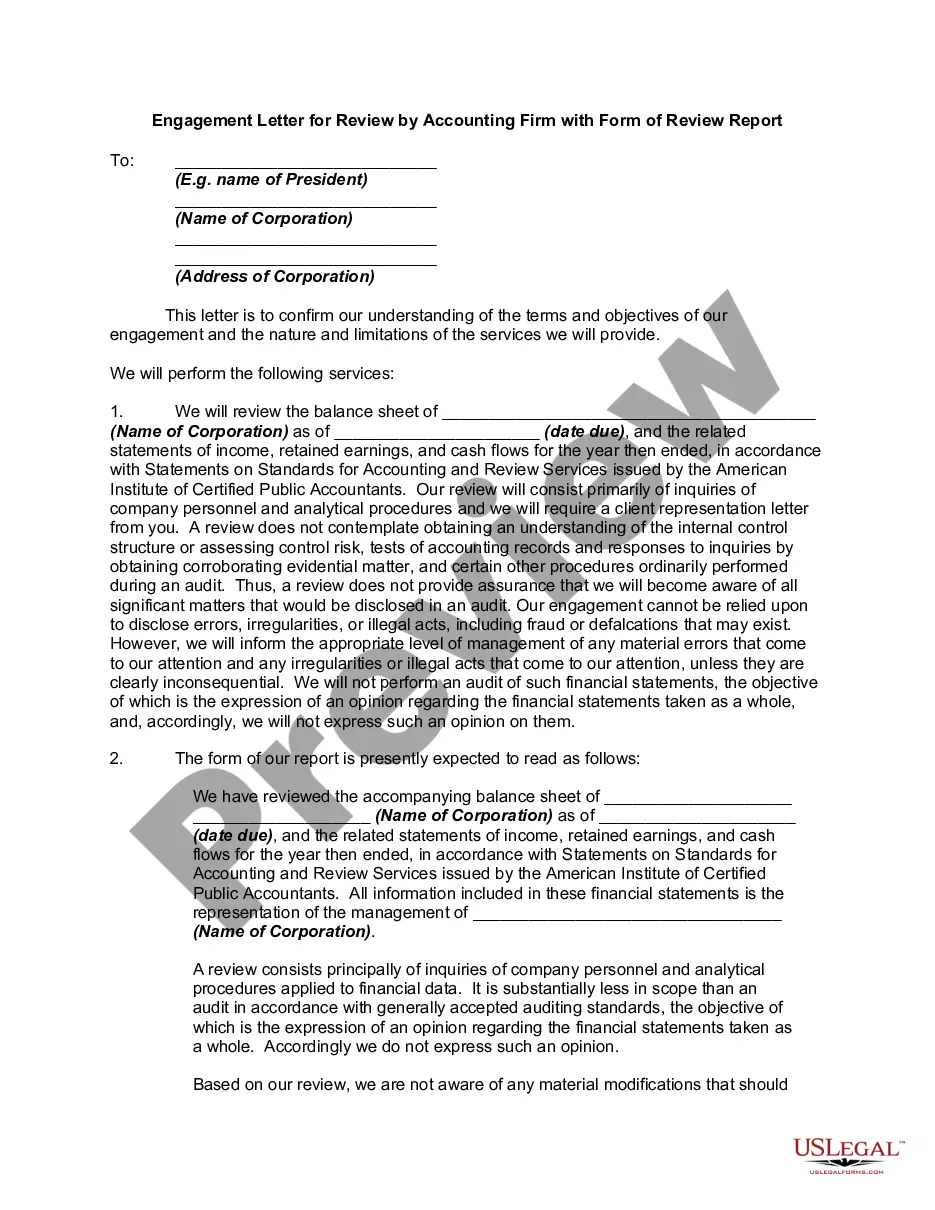

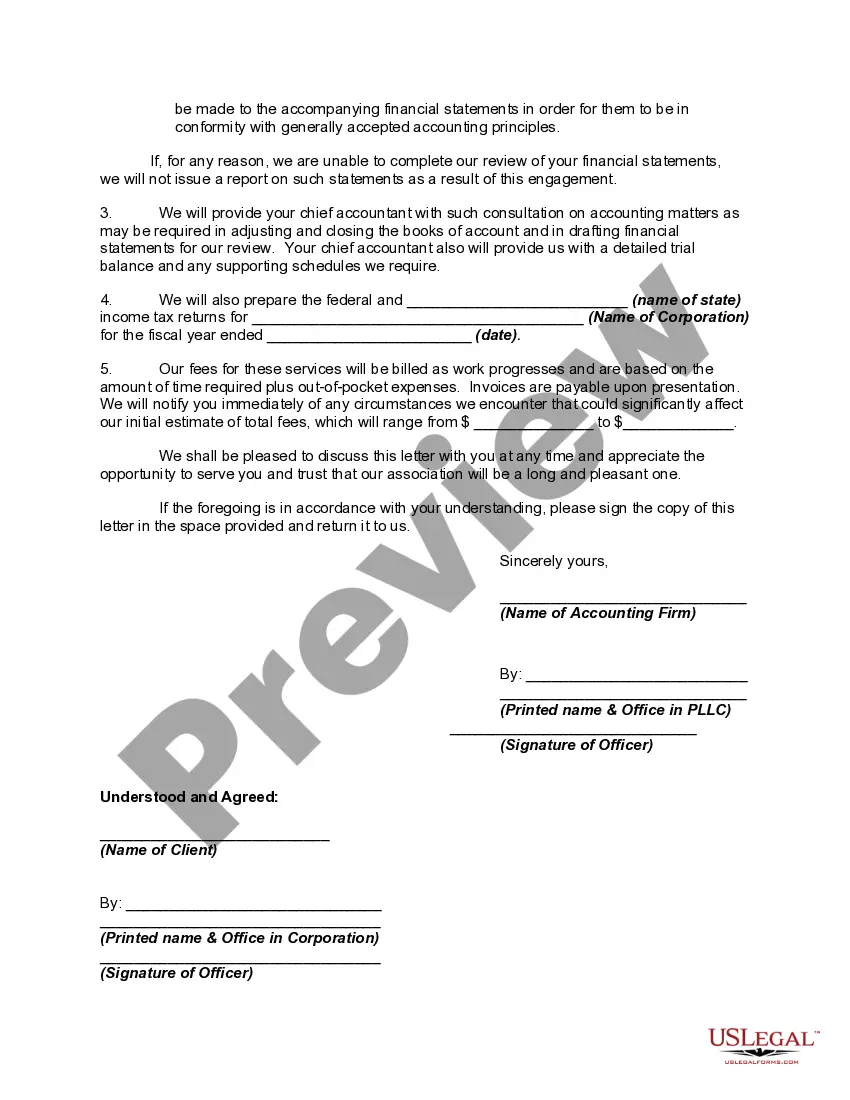

Generally, a contract to employ a certified public accountant need not be in writing. However, such contracts often call for services of a highly complex and technical nature, and hence they should be explicit in their terms, and they should be in writing. In particular, a written employment contract is necessary in order to avoid misunderstanding with the employer regarding the amount of the accountant's fee or compensation and the nature of its computation. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

In San Diego, California, an engagement letter for review by an accounting firm with a form of review report is a crucial document that formally outlines the scope and terms of the engagement between the accounting firm and their client. This letter serves as a binding agreement, providing a clear understanding of the expectations, responsibilities, and deliverables to be provided by both parties. The San Diego Engagement Letter for Review by Accounting Firm typically includes several key components. Firstly, it begins with a concise introduction, stating the purpose of the engagement, the identification of the accounting firm, and a summary of the client's information. The engagement letter will explicitly define the scope of the review, identifying the specific financial statements and related schedules that will be subjected to scrutiny. It may also specify any additional procedures or services to be performed, such as the review of internal controls or compliance with specific regulations. Furthermore, the letter will outline the responsibilities of both the accounting firm and the client. The accounting firm will commit to conducting the review in accordance with Generally Accepted Accounting Principles (GAAP), Generally Accepted Auditing Standards (GAS), and any other relevant regulations. The client will be responsible for providing accurate and complete financial records, as well as granting access to necessary information and personnel. The San Diego Engagement Letter for Review by Accounting Firm will also address confidentiality and ethical considerations. It will emphasize the accounting firm's obligation to maintain the privacy of the client's information and restrict its use solely to the engagement at hand. Moreover, the engagement letter will outline the timeframe for completion, the estimated fees, and the billing terms. The client may be required to provide a retainer or make agreed-upon payments throughout the engagement. Additionally, the letter will disclose the termination clauses and procedures, protecting both parties in case of unforeseen circumstances. Different types of San Diego Engagement Letters for Review by Accounting Firm with a Form of Review Report may include industry-specific variations or cater to unique engagement requirements. For instance, there may be separate engagement letters for nonprofit organizations, government entities, or specialized sectors such as healthcare or real estate. In conclusion, a San Diego Engagement Letter for Review by Accounting Firm with a Form of Review Report is a vital document that establishes the foundation for a successful and professional client-accountant relationship. It ensures transparency, sets clear expectations, and serves as a legal agreement that protects both parties throughout the engagement process.In San Diego, California, an engagement letter for review by an accounting firm with a form of review report is a crucial document that formally outlines the scope and terms of the engagement between the accounting firm and their client. This letter serves as a binding agreement, providing a clear understanding of the expectations, responsibilities, and deliverables to be provided by both parties. The San Diego Engagement Letter for Review by Accounting Firm typically includes several key components. Firstly, it begins with a concise introduction, stating the purpose of the engagement, the identification of the accounting firm, and a summary of the client's information. The engagement letter will explicitly define the scope of the review, identifying the specific financial statements and related schedules that will be subjected to scrutiny. It may also specify any additional procedures or services to be performed, such as the review of internal controls or compliance with specific regulations. Furthermore, the letter will outline the responsibilities of both the accounting firm and the client. The accounting firm will commit to conducting the review in accordance with Generally Accepted Accounting Principles (GAAP), Generally Accepted Auditing Standards (GAS), and any other relevant regulations. The client will be responsible for providing accurate and complete financial records, as well as granting access to necessary information and personnel. The San Diego Engagement Letter for Review by Accounting Firm will also address confidentiality and ethical considerations. It will emphasize the accounting firm's obligation to maintain the privacy of the client's information and restrict its use solely to the engagement at hand. Moreover, the engagement letter will outline the timeframe for completion, the estimated fees, and the billing terms. The client may be required to provide a retainer or make agreed-upon payments throughout the engagement. Additionally, the letter will disclose the termination clauses and procedures, protecting both parties in case of unforeseen circumstances. Different types of San Diego Engagement Letters for Review by Accounting Firm with a Form of Review Report may include industry-specific variations or cater to unique engagement requirements. For instance, there may be separate engagement letters for nonprofit organizations, government entities, or specialized sectors such as healthcare or real estate. In conclusion, a San Diego Engagement Letter for Review by Accounting Firm with a Form of Review Report is a vital document that establishes the foundation for a successful and professional client-accountant relationship. It ensures transparency, sets clear expectations, and serves as a legal agreement that protects both parties throughout the engagement process.