The number 706 refers to Form 706 which is used to file the United States Estate (and Generation-Skipping Transfer) Tax Return. Generally, a contract to employ a certified public accountant need not be in writing. However, such contracts often call for services of a highly complex and technical nature, and hence they should be explicit in their terms, and they should be in writing. In particular, a written employment contract is necessary in order to avoid misunderstanding with the employer regarding the amount of the accountant's fee or compensation and the nature of its computation.

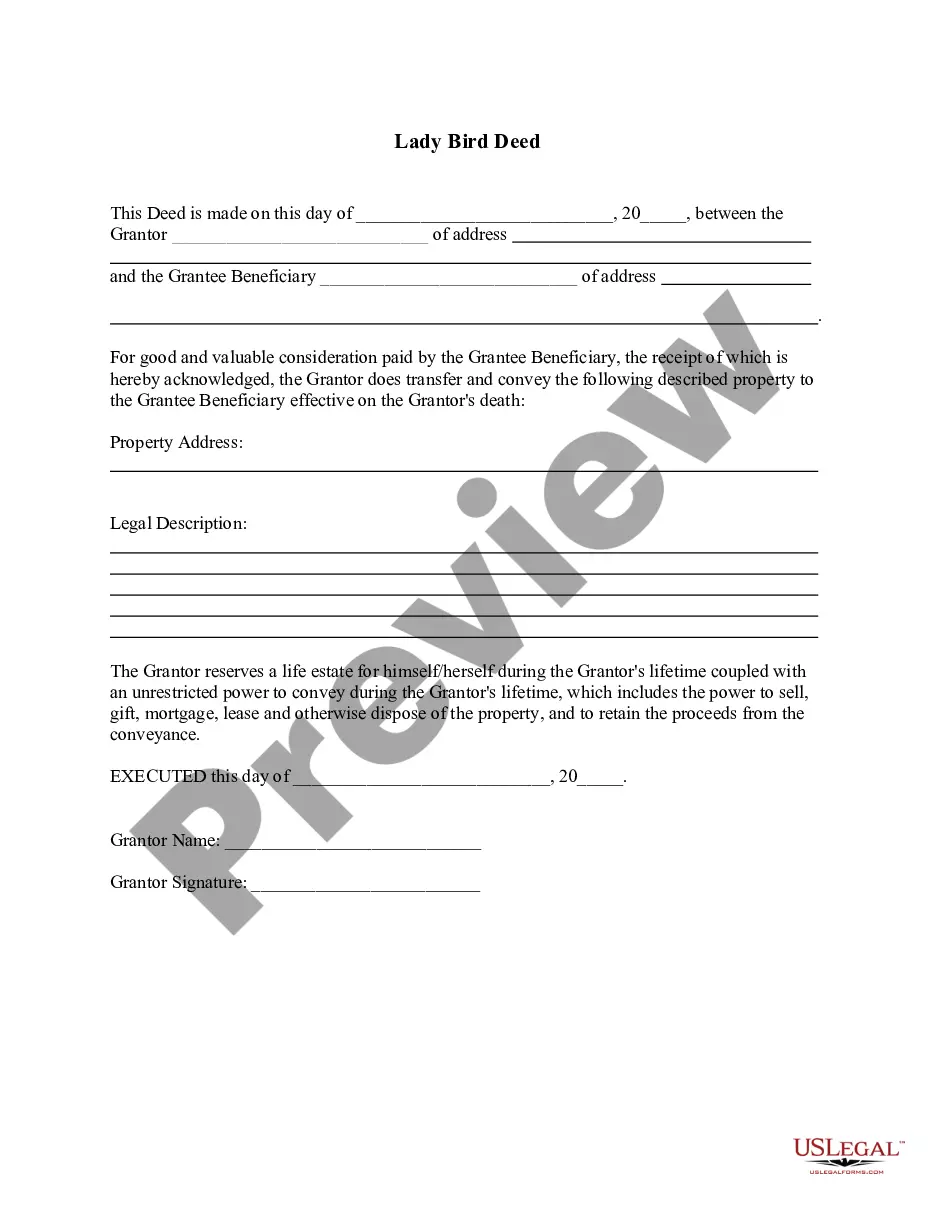

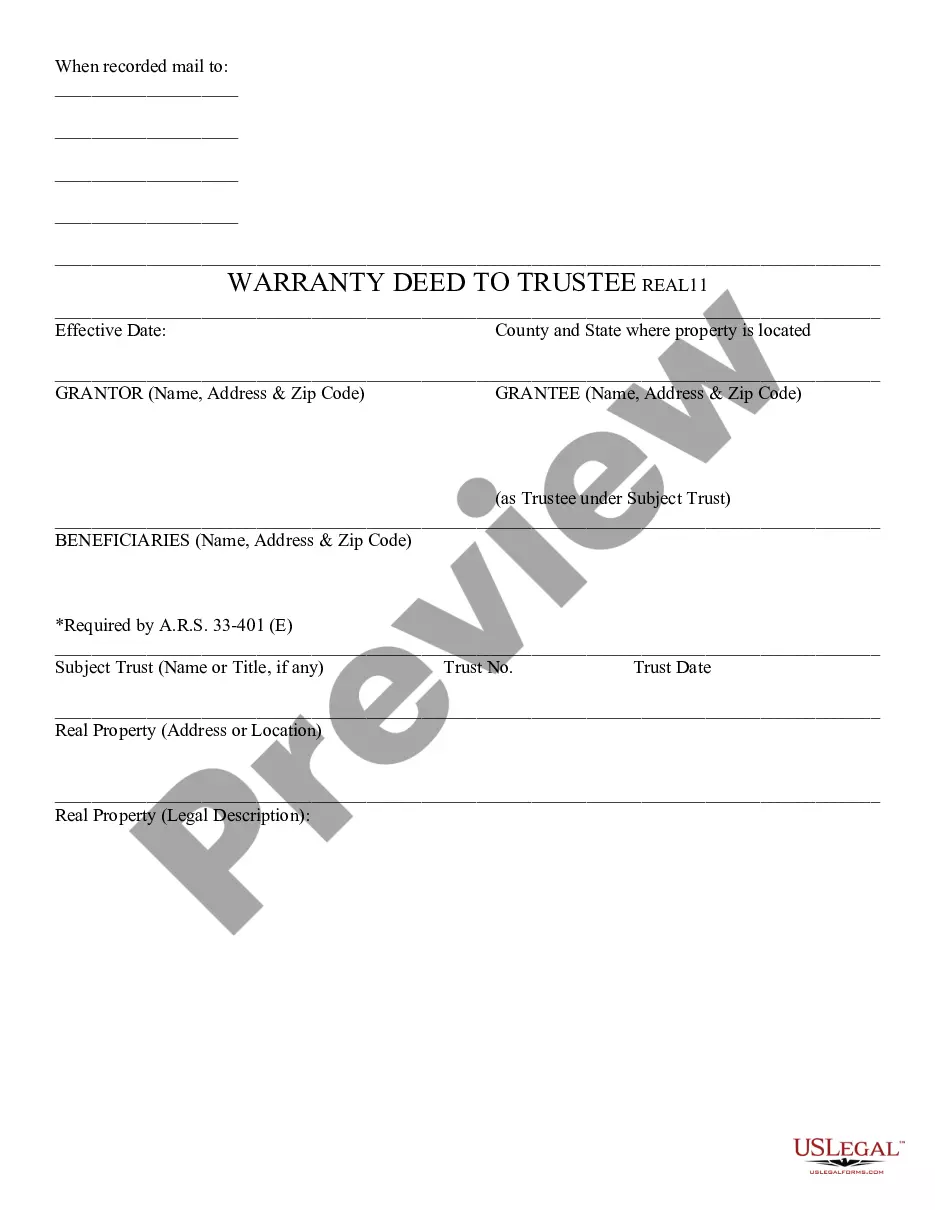

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

The Cuyahoga Ohio Estate and Inheritance Tax Return Engagement Letter — 706 is a crucial document used by estate planning attorneys, CPA's, and tax professionals when engaging with clients who require assistance with the preparation and filing of their estate and inheritance tax returns. This letter outlines the terms and conditions of the engagement, ensuring a clear understanding between the professional and the client. In Cuyahoga County, Ohio, the engagement letter for estate and inheritance tax return preparation provides a comprehensive description of the services to be rendered by the professional and the client's responsibilities throughout the process. This letter is tailored specifically for Form 706, the federal estate tax return, which is required for estates exceeding the federal estate tax exemption threshold. The contents of the Cuyahoga Ohio Estate and Inheritance Tax Return Engagement Letter — 706 may include: 1. Introduction: The engagement letter begins with a professional greeting, clearly stating the purpose of the document and identifying the parties involved. It defines the client as the estate owner, and the professional providing the services. 2. Scope of Services: This section outlines the tax-related services that the professional will undertake, such as completing the estate and inheritance tax return forms, analyzing financial statements, valuing assets, determining eligibility for any tax deductions or credits, and corresponding with tax authorities. 3. Responsibilities of the Client: The engagement letter specifies the obligations of the client, including providing accurate and complete financial and personal information, preserving relevant documents, responding promptly to requests for information, and reviewing the prepared tax returns for accuracy before filing. 4. Deadlines and Extensions: The letter explains the importance of adhering to tax filing deadlines and advises the client on the potential consequences of late filings or failure to submit required information. It may also mention the possibility of requesting extensions if necessary. 5. Fees and Billing: This section details the professional fees for services rendered, including any applicable hourly rates or fixed fees. It may also discuss the billing schedule, reimbursement for out-of-pocket expenses, and the payment terms. 6. Confidentiality: The engagement letter highlights the importance of maintaining client confidentiality and the professional's commitment to safeguarding sensitive information. 7. Termination or Changes: The letter may outline the circumstances under which either party can terminate the engagement or make changes to the agreed-upon terms. It may also clarify the process for resolving disputes or disagreements. Different types of Cuyahoga Ohio Estate and Inheritance Tax Return Engagement Letters — 706 may exist depending on factors such as the estate's complexity, the extent of the professional services required, or specific client preferences. However, these variations usually address the same core concepts and adhere to local and federal tax regulations.The Cuyahoga Ohio Estate and Inheritance Tax Return Engagement Letter — 706 is a crucial document used by estate planning attorneys, CPA's, and tax professionals when engaging with clients who require assistance with the preparation and filing of their estate and inheritance tax returns. This letter outlines the terms and conditions of the engagement, ensuring a clear understanding between the professional and the client. In Cuyahoga County, Ohio, the engagement letter for estate and inheritance tax return preparation provides a comprehensive description of the services to be rendered by the professional and the client's responsibilities throughout the process. This letter is tailored specifically for Form 706, the federal estate tax return, which is required for estates exceeding the federal estate tax exemption threshold. The contents of the Cuyahoga Ohio Estate and Inheritance Tax Return Engagement Letter — 706 may include: 1. Introduction: The engagement letter begins with a professional greeting, clearly stating the purpose of the document and identifying the parties involved. It defines the client as the estate owner, and the professional providing the services. 2. Scope of Services: This section outlines the tax-related services that the professional will undertake, such as completing the estate and inheritance tax return forms, analyzing financial statements, valuing assets, determining eligibility for any tax deductions or credits, and corresponding with tax authorities. 3. Responsibilities of the Client: The engagement letter specifies the obligations of the client, including providing accurate and complete financial and personal information, preserving relevant documents, responding promptly to requests for information, and reviewing the prepared tax returns for accuracy before filing. 4. Deadlines and Extensions: The letter explains the importance of adhering to tax filing deadlines and advises the client on the potential consequences of late filings or failure to submit required information. It may also mention the possibility of requesting extensions if necessary. 5. Fees and Billing: This section details the professional fees for services rendered, including any applicable hourly rates or fixed fees. It may also discuss the billing schedule, reimbursement for out-of-pocket expenses, and the payment terms. 6. Confidentiality: The engagement letter highlights the importance of maintaining client confidentiality and the professional's commitment to safeguarding sensitive information. 7. Termination or Changes: The letter may outline the circumstances under which either party can terminate the engagement or make changes to the agreed-upon terms. It may also clarify the process for resolving disputes or disagreements. Different types of Cuyahoga Ohio Estate and Inheritance Tax Return Engagement Letters — 706 may exist depending on factors such as the estate's complexity, the extent of the professional services required, or specific client preferences. However, these variations usually address the same core concepts and adhere to local and federal tax regulations.