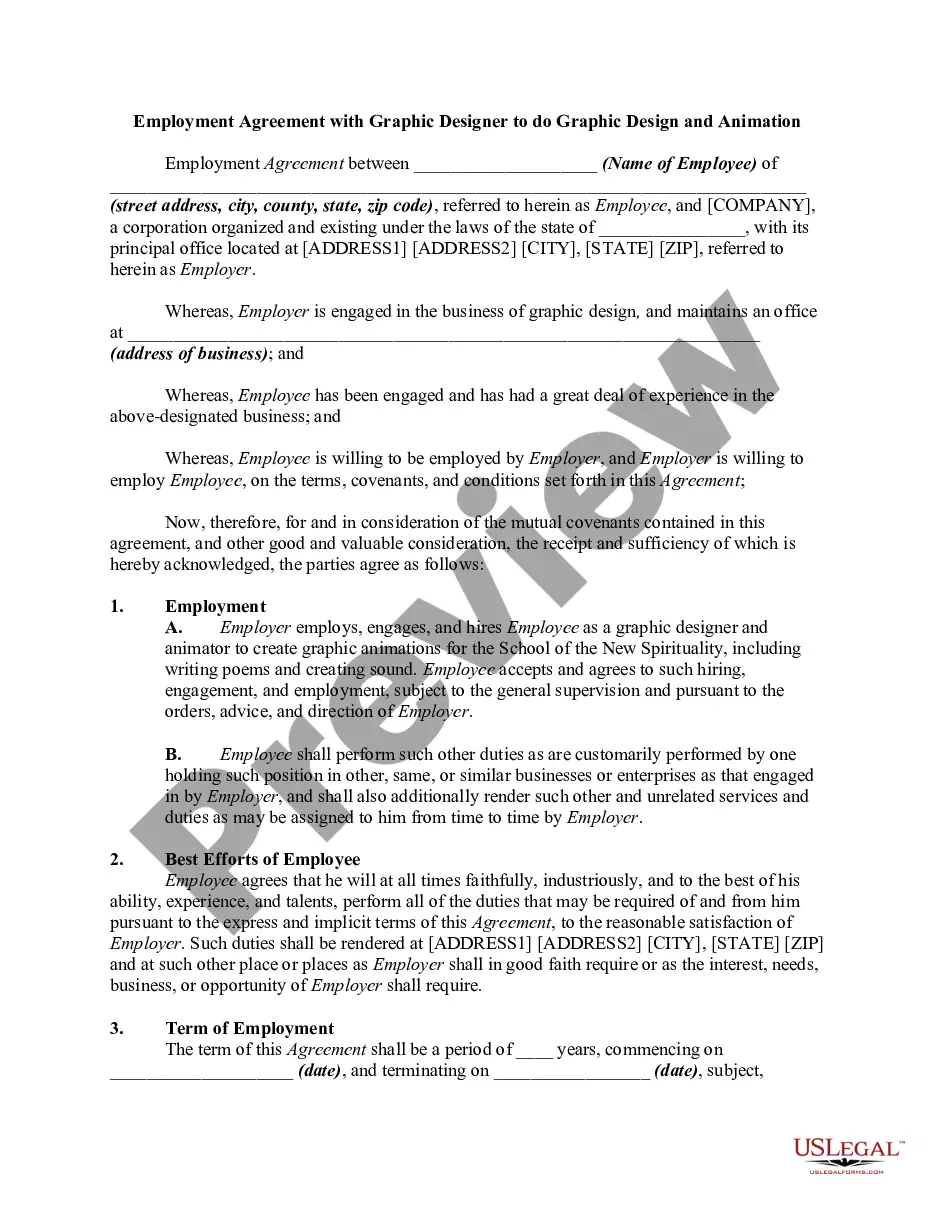

Generally, a contract to employ a certified public accountant need not be in writing. However, such contracts often call for services of a highly complex and technical nature, and hence they should be explicit in their terms, and they should be in writing. In particular, a written employment contract is necessary in order to avoid misunderstanding with the employer regarding the amount of the accountant's fee or compensation and the nature of its computation.

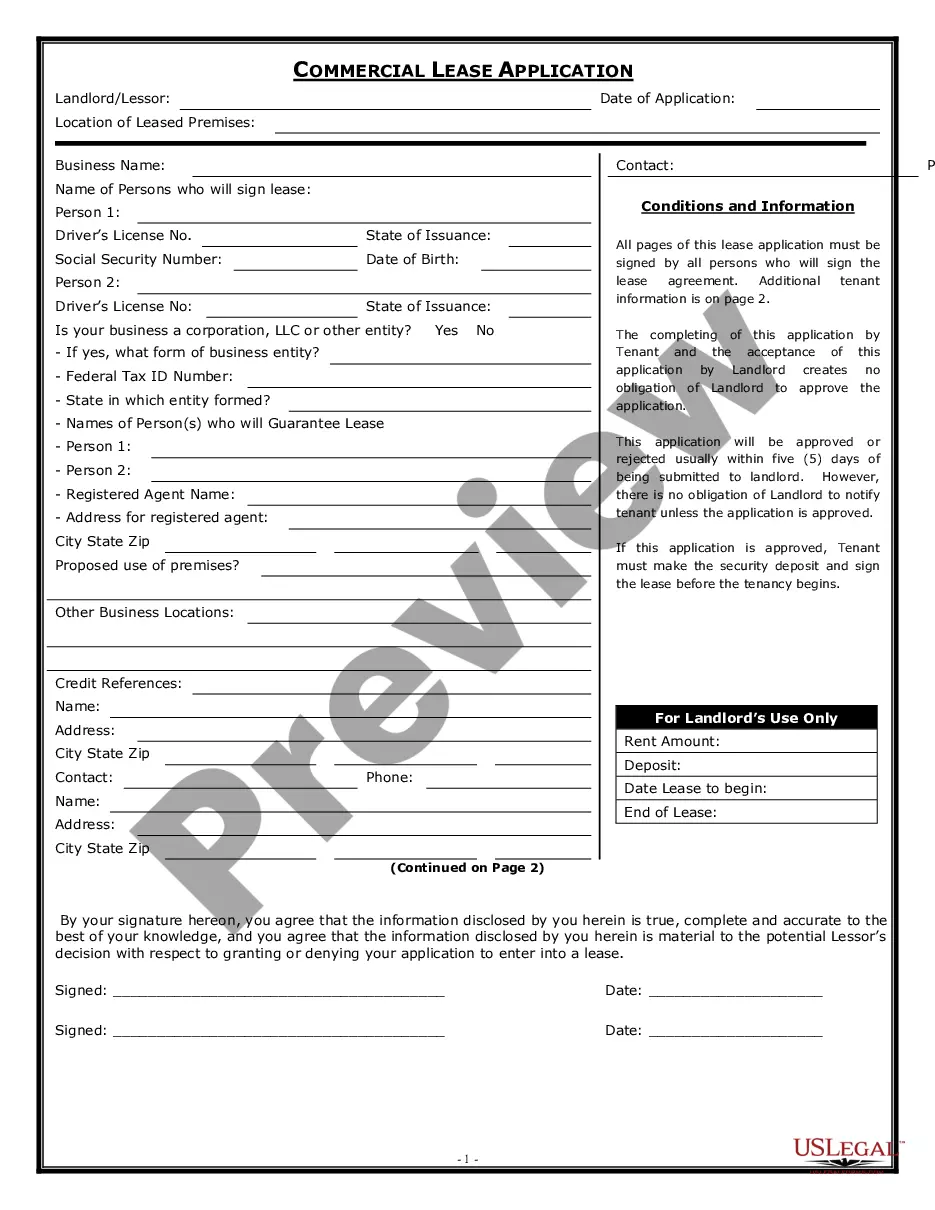

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

A Maricopa Arizona Fiduciary — Estatothersus— - Tax Return Engagement Letter is a legally binding document that outlines the responsibilities and expectations between a fiduciary (an individual or entity appointed to manage someone's assets) and their client in relation to the preparation and filing of tax returns for an estate or trust. This engagement letter serves as a crucial communication tool that establishes a clear understanding between the parties involved, ensuring a smooth and efficient tax filing process. It typically includes important details such as the scope of services, fees, timelines, and confidentiality provisions. By clearly defining these aspects, it helps to minimize potential misunderstandings, disputes, and legal issues. There are different types of Maricopa Arizona Fiduciary — Estatothersus— - Tax Return Engagement Letters that can be tailored to meet specific needs: 1. Basic Tax Return Engagement Letter: This type of engagement letter outlines the standard services provided by the fiduciary, such as the preparation and filing of federal and state tax returns for the estate or trust. It may also include provisions related to estimated tax payments, extensions, and any additional services required by the client. 2. Complex Tax Return Engagement Letter: In situations where the estate or trust has intricate holdings, business interests, or investment structures, a complex tax return engagement letter is necessary. This type of engagement letter will cover more detailed services, such as the preparation of multiple forms and schedules, identification of tax-saving opportunities, and analysis of complex tax issues specific to the estate or trust. 3. Amended Tax Return Engagement Letter: If the estate or trust needs to amend a previously filed tax return, an amended tax return engagement letter comes into play. This document would outline the additional services required to prepare and file the necessary amended tax returns, taking into account any changes in income, deductions, or other relevant information. 4. Tax Planning Engagement Letter: Apart from tax return preparation, some fiduciaries may offer tax planning services specifically tailored for estates or trusts. This engagement letter will outline the specialized tax planning services to mitigate tax liabilities and maximize tax-saving opportunities for the estate or trust. It may include advice on structuring the estate or trust to optimize tax efficiency, identifying tax-efficient investment strategies, and other proactive tax planning measures. In conclusion, a Maricopa Arizona Fiduciary — Estatothersus— - Tax Return Engagement Letter is a critical document that clearly defines the scope of services, responsibilities, and expectations between a fiduciary and their client regarding the preparation and filing of tax returns for an estate or trust. Different types of engagement letters can be customized to meet specific requirements, including basic tax return engagement letter, complex tax return engagement letter, amended tax return engagement letter, and tax planning engagement letter.A Maricopa Arizona Fiduciary — Estatothersus— - Tax Return Engagement Letter is a legally binding document that outlines the responsibilities and expectations between a fiduciary (an individual or entity appointed to manage someone's assets) and their client in relation to the preparation and filing of tax returns for an estate or trust. This engagement letter serves as a crucial communication tool that establishes a clear understanding between the parties involved, ensuring a smooth and efficient tax filing process. It typically includes important details such as the scope of services, fees, timelines, and confidentiality provisions. By clearly defining these aspects, it helps to minimize potential misunderstandings, disputes, and legal issues. There are different types of Maricopa Arizona Fiduciary — Estatothersus— - Tax Return Engagement Letters that can be tailored to meet specific needs: 1. Basic Tax Return Engagement Letter: This type of engagement letter outlines the standard services provided by the fiduciary, such as the preparation and filing of federal and state tax returns for the estate or trust. It may also include provisions related to estimated tax payments, extensions, and any additional services required by the client. 2. Complex Tax Return Engagement Letter: In situations where the estate or trust has intricate holdings, business interests, or investment structures, a complex tax return engagement letter is necessary. This type of engagement letter will cover more detailed services, such as the preparation of multiple forms and schedules, identification of tax-saving opportunities, and analysis of complex tax issues specific to the estate or trust. 3. Amended Tax Return Engagement Letter: If the estate or trust needs to amend a previously filed tax return, an amended tax return engagement letter comes into play. This document would outline the additional services required to prepare and file the necessary amended tax returns, taking into account any changes in income, deductions, or other relevant information. 4. Tax Planning Engagement Letter: Apart from tax return preparation, some fiduciaries may offer tax planning services specifically tailored for estates or trusts. This engagement letter will outline the specialized tax planning services to mitigate tax liabilities and maximize tax-saving opportunities for the estate or trust. It may include advice on structuring the estate or trust to optimize tax efficiency, identifying tax-efficient investment strategies, and other proactive tax planning measures. In conclusion, a Maricopa Arizona Fiduciary — Estatothersus— - Tax Return Engagement Letter is a critical document that clearly defines the scope of services, responsibilities, and expectations between a fiduciary and their client regarding the preparation and filing of tax returns for an estate or trust. Different types of engagement letters can be customized to meet specific requirements, including basic tax return engagement letter, complex tax return engagement letter, amended tax return engagement letter, and tax planning engagement letter.