Generally, a contract to employ a certified public accountant need not be in writing. However, such contracts often call for services of a highly complex and technical nature, and hence they should be explicit in their terms, and they should be in writing. In particular, a written employment contract is necessary in order to avoid misunderstanding with the employer regarding the amount of the accountant's fee or compensation and the nature of its computation.

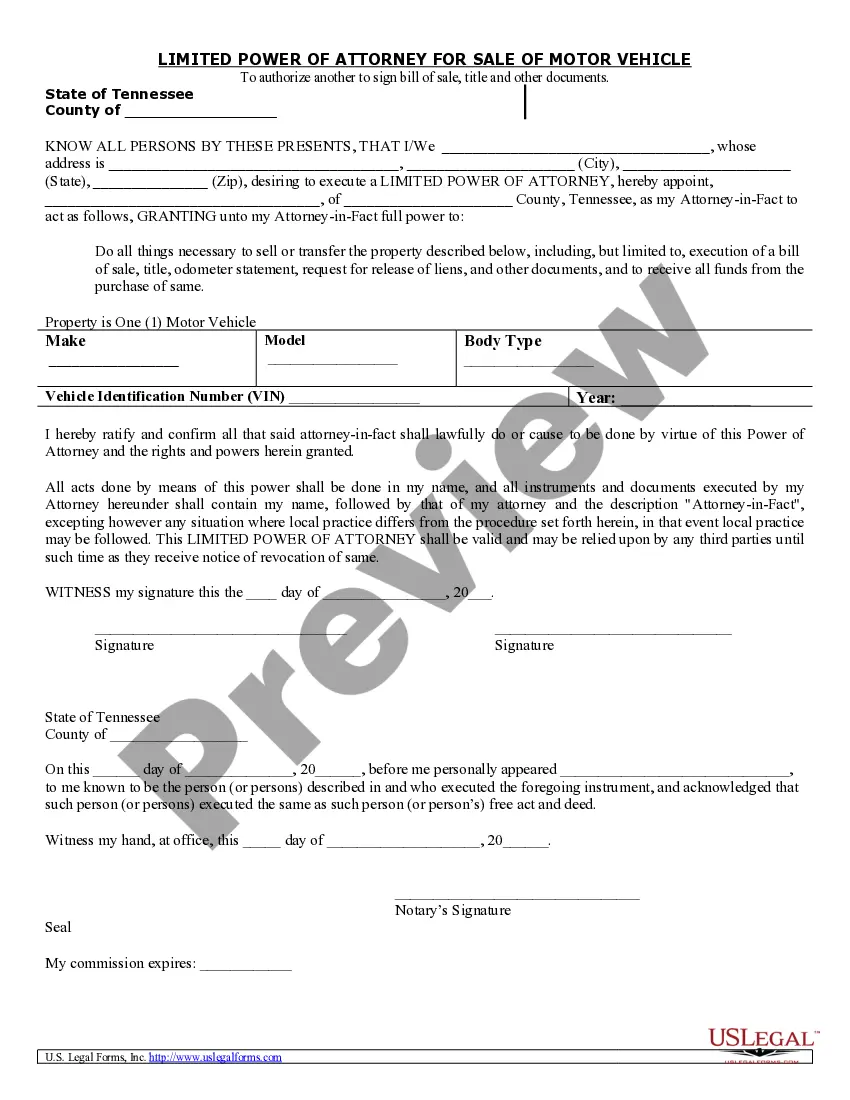

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

A Suffolk New York Fiduciary — Estatothersus— - Tax Return Engagement Letter is a legal document that outlines the terms and conditions of a professional agreement between a fiduciary (an individual or organization responsible for managing a trust or estate) and a tax professional for the preparation and filing of tax returns. This engagement letter ensures clarity and understanding of the services to be provided, as well as the responsibilities and expectations of both parties. Keywords: Suffolk New York, Fiduciary, Estate, Trust, Tax Return, Engagement Letter Types of Suffolk New York Fiduciary — Estatothersus— - Tax Return Engagement Letters: 1. Standard Engagement Letter: A standard engagement letter specifies the general terms and conditions of the engagement, such as the scope of work, fees, responsibilities, deadlines, and confidentiality. It is a comprehensive agreement that applies to most fiduciary tax return services. 2. Personalized Engagement Letter: In some cases, a fiduciary may require special considerations or specific services tailored to their unique situation. A personalized engagement letter allows for customization based on the specific needs and circumstances of the client. 3. Annual Engagement Letter: As fiduciary tax returns are typically filed annually, an annual engagement letter ensures continuity and provides a framework for ongoing services. It eliminates the need to create a new engagement letter every tax year and serves as a reference for the upcoming years. 4. Limited Scope Engagement Letter: In situations where a fiduciary only requires specific tax services, a limited scope engagement letter may be appropriate. It clearly defines the restricted scope of work, such as only preparing and filing tax returns, without additional services like tax planning or audit representation. 5. Amendment Engagement Letter: If modifications or changes to an existing Suffolk New York Fiduciary — Estatothersus— - Tax Return Engagement Letter are necessary, an amendment engagement letter can be used. This document helps to clearly communicate and record any changes to the original terms and conditions. Remember, each engagement letter should be carefully reviewed and customized to fulfill the unique requirements and preferences of both the fiduciary and the tax professional. It is essential for both parties to understand and agree upon the terms outlined in the engagement letter before commencing any tax-related services.A Suffolk New York Fiduciary — Estatothersus— - Tax Return Engagement Letter is a legal document that outlines the terms and conditions of a professional agreement between a fiduciary (an individual or organization responsible for managing a trust or estate) and a tax professional for the preparation and filing of tax returns. This engagement letter ensures clarity and understanding of the services to be provided, as well as the responsibilities and expectations of both parties. Keywords: Suffolk New York, Fiduciary, Estate, Trust, Tax Return, Engagement Letter Types of Suffolk New York Fiduciary — Estatothersus— - Tax Return Engagement Letters: 1. Standard Engagement Letter: A standard engagement letter specifies the general terms and conditions of the engagement, such as the scope of work, fees, responsibilities, deadlines, and confidentiality. It is a comprehensive agreement that applies to most fiduciary tax return services. 2. Personalized Engagement Letter: In some cases, a fiduciary may require special considerations or specific services tailored to their unique situation. A personalized engagement letter allows for customization based on the specific needs and circumstances of the client. 3. Annual Engagement Letter: As fiduciary tax returns are typically filed annually, an annual engagement letter ensures continuity and provides a framework for ongoing services. It eliminates the need to create a new engagement letter every tax year and serves as a reference for the upcoming years. 4. Limited Scope Engagement Letter: In situations where a fiduciary only requires specific tax services, a limited scope engagement letter may be appropriate. It clearly defines the restricted scope of work, such as only preparing and filing tax returns, without additional services like tax planning or audit representation. 5. Amendment Engagement Letter: If modifications or changes to an existing Suffolk New York Fiduciary — Estatothersus— - Tax Return Engagement Letter are necessary, an amendment engagement letter can be used. This document helps to clearly communicate and record any changes to the original terms and conditions. Remember, each engagement letter should be carefully reviewed and customized to fulfill the unique requirements and preferences of both the fiduciary and the tax professional. It is essential for both parties to understand and agree upon the terms outlined in the engagement letter before commencing any tax-related services.