A limited liability company (LLC) is a separate legal entity that can conduct business just like a corporation with many of the advantages of a partnership. It is taxed as a partnership. Its owners are called members and receive income from the LLC just as a partner would. There is no tax on the LLC entity itself. The members are not personally liable for the debts and obligations of the entity like partners would be. Basically, an LLC combines the tax advantages of a partnership with the limited liability feature of a corporation.

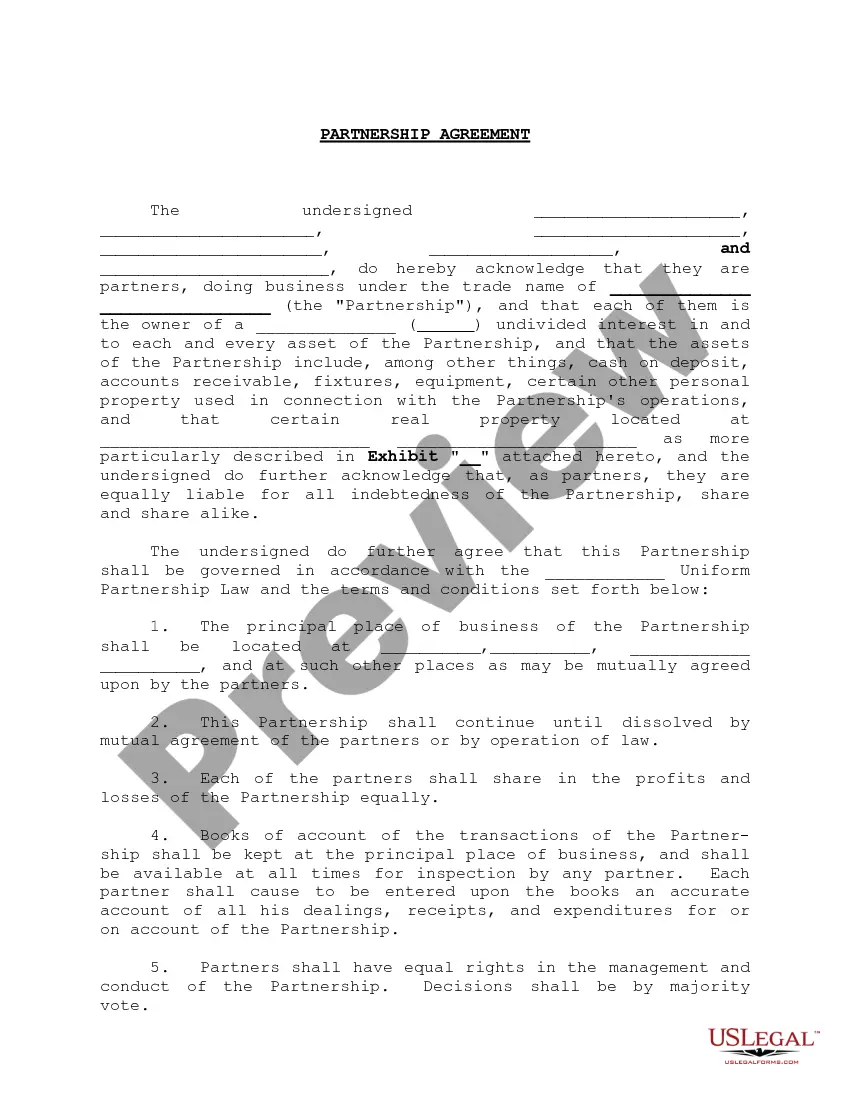

The Allegheny Pennsylvania Partnership or LLC Tax Return Engagement Letter is a comprehensive document that outlines the terms and conditions between a tax professional or firm and a partnership or LLC operating in Allegheny County, Pennsylvania. This engagement letter serves as an agreement for the tax preparation services to be provided by the tax professional. The main purpose of the Allegheny Pennsylvania Partnership or LLC Tax Return Engagement Letter is to establish clear expectations, responsibility, and understanding of the engagement between the tax professional and the partnership or LLC. It ensures transparency, compliance, and a smooth tax return preparation process. The engagement letter typically includes the following key information: 1. Contact Information: It includes the name, address, and contact details of the tax professional or firm and the partnership or LLC involved in the engagement. 2. Services to be provided: The engagement letter specifies the services to be provided by the tax professional, such as preparation of federal, state, and local tax returns, tax planning, and consultations. 3. Responsibilities: It outlines the responsibilities of both parties, including the exchange of necessary information, cooperation, and any other obligations related to the tax return preparation process. 4. Timeline and Fees: The engagement letter includes the estimated timeline for completing the tax returns and processing the engagement. It also outlines the fees and payment terms for the services rendered. 5. Confidentiality and Data Security: This section establishes the confidentiality obligations of the tax professional regarding the partnership or LLC's financial and personal information. It may also address data security measures to ensure the secure handling of sensitive data. 6. Limitations of Engagement: The engagement letter may specify any restrictions or limitations on the services provided by the tax professional, such as no representation in disputes or audits. 7. Termination Clause: This section outlines the conditions under which either party can terminate the engagement, along with any applicable fees or penalties. Types of Allegheny Pennsylvania Partnership or LLC Tax Return Engagement Letters: 1. Allegheny Pennsylvania Partnership Tax Return Engagement Letter: This engagement letter specifically caters to partnerships operating in Allegheny County, Pennsylvania. It focuses on the unique tax considerations and compliance requirements for this business entity. 2. Allegheny Pennsylvania LLC Tax Return Engagement Letter: This engagement letter caters to Limited Liability Companies (LCS) operating in Allegheny County, Pennsylvania. It addresses the tax treatment, reporting obligations, and compliance requirements specific to LCS in the county. In summary, the Allegheny Pennsylvania Partnership or LLC Tax Return Engagement Letters are essential documents that define the terms and conditions of tax preparation services between a tax professional or firm and a partnership or LLC operating in Allegheny County. These engagement letters ensure clear communication, mutual understanding, and compliance with relevant tax laws and regulations.The Allegheny Pennsylvania Partnership or LLC Tax Return Engagement Letter is a comprehensive document that outlines the terms and conditions between a tax professional or firm and a partnership or LLC operating in Allegheny County, Pennsylvania. This engagement letter serves as an agreement for the tax preparation services to be provided by the tax professional. The main purpose of the Allegheny Pennsylvania Partnership or LLC Tax Return Engagement Letter is to establish clear expectations, responsibility, and understanding of the engagement between the tax professional and the partnership or LLC. It ensures transparency, compliance, and a smooth tax return preparation process. The engagement letter typically includes the following key information: 1. Contact Information: It includes the name, address, and contact details of the tax professional or firm and the partnership or LLC involved in the engagement. 2. Services to be provided: The engagement letter specifies the services to be provided by the tax professional, such as preparation of federal, state, and local tax returns, tax planning, and consultations. 3. Responsibilities: It outlines the responsibilities of both parties, including the exchange of necessary information, cooperation, and any other obligations related to the tax return preparation process. 4. Timeline and Fees: The engagement letter includes the estimated timeline for completing the tax returns and processing the engagement. It also outlines the fees and payment terms for the services rendered. 5. Confidentiality and Data Security: This section establishes the confidentiality obligations of the tax professional regarding the partnership or LLC's financial and personal information. It may also address data security measures to ensure the secure handling of sensitive data. 6. Limitations of Engagement: The engagement letter may specify any restrictions or limitations on the services provided by the tax professional, such as no representation in disputes or audits. 7. Termination Clause: This section outlines the conditions under which either party can terminate the engagement, along with any applicable fees or penalties. Types of Allegheny Pennsylvania Partnership or LLC Tax Return Engagement Letters: 1. Allegheny Pennsylvania Partnership Tax Return Engagement Letter: This engagement letter specifically caters to partnerships operating in Allegheny County, Pennsylvania. It focuses on the unique tax considerations and compliance requirements for this business entity. 2. Allegheny Pennsylvania LLC Tax Return Engagement Letter: This engagement letter caters to Limited Liability Companies (LCS) operating in Allegheny County, Pennsylvania. It addresses the tax treatment, reporting obligations, and compliance requirements specific to LCS in the county. In summary, the Allegheny Pennsylvania Partnership or LLC Tax Return Engagement Letters are essential documents that define the terms and conditions of tax preparation services between a tax professional or firm and a partnership or LLC operating in Allegheny County. These engagement letters ensure clear communication, mutual understanding, and compliance with relevant tax laws and regulations.