A limited liability company (LLC) is a separate legal entity that can conduct business just like a corporation with many of the advantages of a partnership. It is taxed as a partnership. Its owners are called members and receive income from the LLC just as a partner would. There is no tax on the LLC entity itself. The members are not personally liable for the debts and obligations of the entity like partners would be. Basically, an LLC combines the tax advantages of a partnership with the limited liability feature of a corporation.

Montgomery Maryland Partnership or LLC Tax Return Engagement Letter

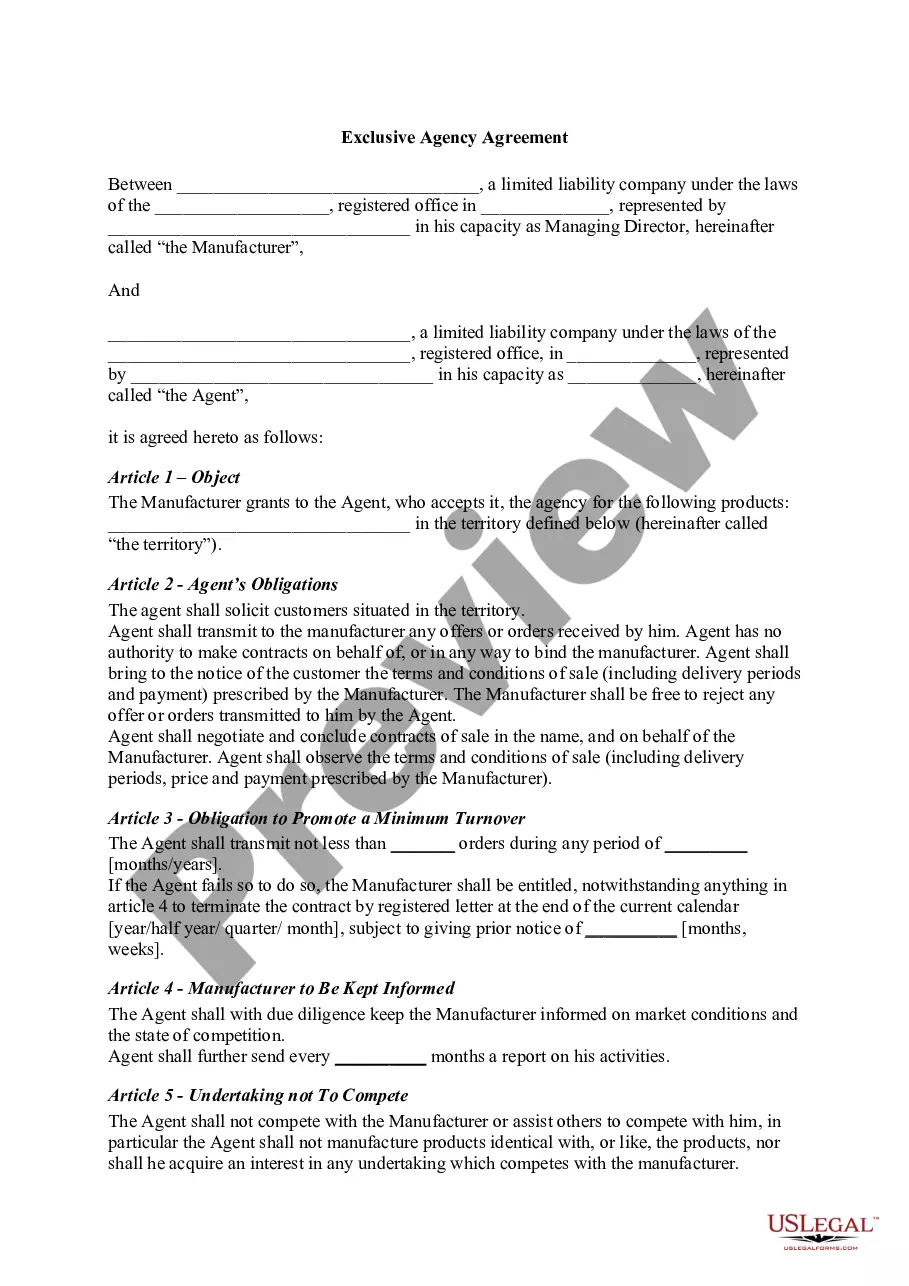

Description

How to fill out Montgomery Maryland Partnership Or LLC Tax Return Engagement Letter?

A document routine always goes along with any legal activity you make. Creating a company, applying or accepting a job offer, transferring ownership, and many other life situations require you prepare official paperwork that differs from state to state. That's why having it all accumulated in one place is so beneficial.

US Legal Forms is the largest online library of up-to-date federal and state-specific legal templates. On this platform, you can easily locate and download a document for any individual or business objective utilized in your county, including the Montgomery Partnership or LLC Tax Return Engagement Letter.

Locating samples on the platform is remarkably straightforward. If you already have a subscription to our library, log in to your account, find the sample using the search field, and click Download to save it on your device. Afterward, the Montgomery Partnership or LLC Tax Return Engagement Letter will be available for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, adhere to this quick guide to get the Montgomery Partnership or LLC Tax Return Engagement Letter:

- Make sure you have opened the correct page with your localised form.

- Use the Preview mode (if available) and scroll through the template.

- Read the description (if any) to ensure the template corresponds to your needs.

- Search for another document via the search tab in case the sample doesn't fit you.

- Click Buy Now once you locate the required template.

- Decide on the appropriate subscription plan, then log in or register for an account.

- Choose the preferred payment method (with credit card or PayPal) to continue.

- Opt for file format and save the Montgomery Partnership or LLC Tax Return Engagement Letter on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the simplest and most trustworthy way to obtain legal documents. All the samples available in our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs properly with the US Legal Forms!