Although a written instrument is not usually essential to the validity of a gift inter vivos, to ensure compliance with the delivery requirement, and to avoid misunderstanding, a gift transfer should be made by a delivered written instrument. The language of the instrument must express a present intention to pass title to the property. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

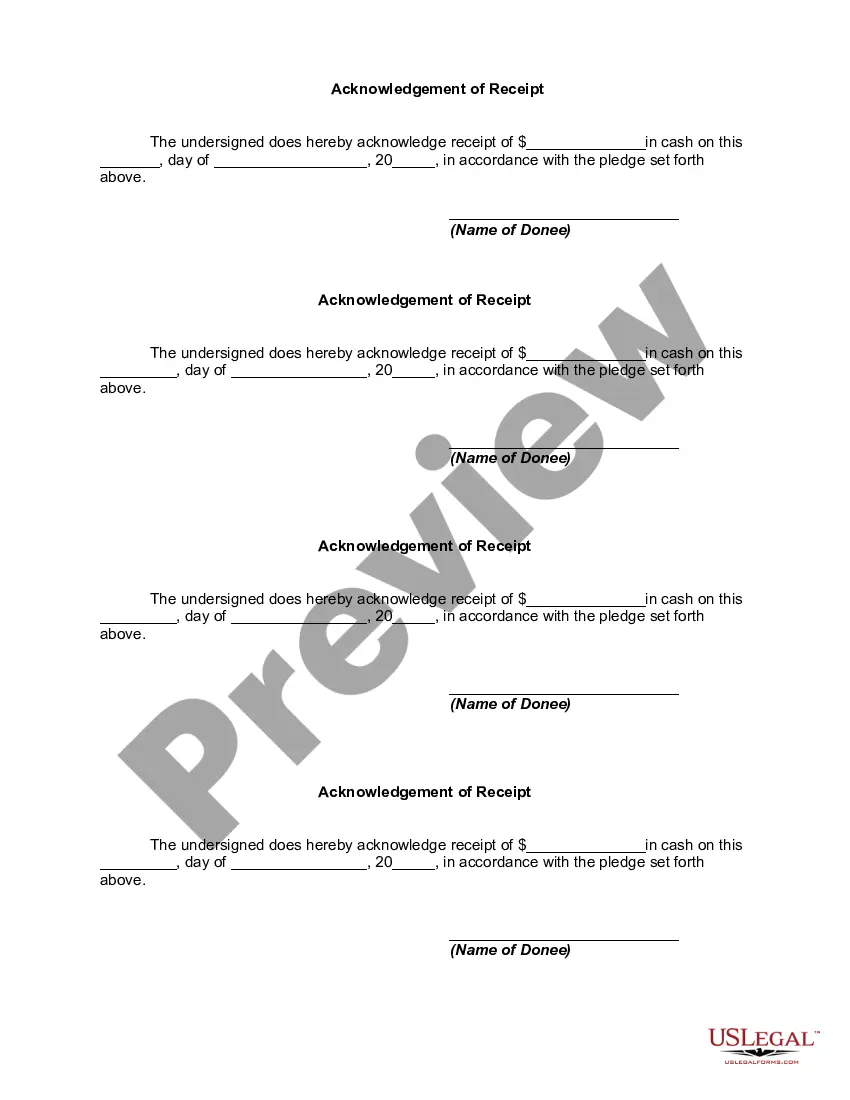

The Clark Nevada Declaration of Gift Over Several Year periods is a legal document that allows an individual to make a series of gifts over a span of multiple years. This unique declaration enables the donor to distribute their assets gradually, rather than in a lump sum, while ensuring the gifts are properly documented and compliant with Nevada laws. One type of the Clark Nevada Declaration of Gift Over Several Year periods is the Annual Gift Declaration. This declaration allows the donor to gift a certain amount of assets each year, taking advantage of the annual gift tax exclusion provided by the Internal Revenue Service (IRS). By spreading out the gifts over several years, the donor can minimize potential gift tax liabilities and maximize the benefits for both the donor and the recipient. Another type of the Clark Nevada Declaration of Gift Over Several Year periods is the Graduated Gift Declaration. This type of declaration follows a predetermined schedule where the value of the gift increases over time. It is commonly used when the donor wants to provide ongoing financial support to the recipient, such as funding a child's education or assisting a family member in need. The gradual increase in gift value allows the donor to manage their assets effectively while ensuring the recipient receives consistent assistance. The Clark Nevada Declaration of Gift Over Several Year Period offers several advantages. First and foremost, it provides a legal framework for the donor to make gifts in compliance with Nevada state laws. The declaration ensures that all necessary paperwork and documentation are completed, protecting both the donor and the recipient's interests. Additionally, the declaration enables the donor to plan their estate and distribute assets strategically. By making gifts over a period of years, the donor can optimize their overall tax planning, potentially reducing estate tax liabilities. Careful consideration of the annual gift tax exclusion and other relevant tax laws can help the donor minimize potential tax burdens. Moreover, the Clark Nevada Declaration of Gift Over Several Year periods allows the donor to maintain control over their assets while providing ongoing financial support to loved ones. This type of declaration promotes responsible and structured asset management, ensuring that the gifts are given in a controlled and sustainable manner while considering the donor's financial circumstances. In conclusion, the Clark Nevada Declaration of Gift Over Several Year periods is a valuable legal document that facilitates the systematic distribution of assets over multiple years. By offering different types of declarations, including the Annual Gift Declaration and the Graduated Gift Declaration, individuals can plan their gifting strategies effectively while conforming to Nevada laws. This declaration provides numerous advantages, including tax planning opportunities, asset control, and legal compliance, making it an essential tool for individuals seeking to gift their assets over an extended period.The Clark Nevada Declaration of Gift Over Several Year periods is a legal document that allows an individual to make a series of gifts over a span of multiple years. This unique declaration enables the donor to distribute their assets gradually, rather than in a lump sum, while ensuring the gifts are properly documented and compliant with Nevada laws. One type of the Clark Nevada Declaration of Gift Over Several Year periods is the Annual Gift Declaration. This declaration allows the donor to gift a certain amount of assets each year, taking advantage of the annual gift tax exclusion provided by the Internal Revenue Service (IRS). By spreading out the gifts over several years, the donor can minimize potential gift tax liabilities and maximize the benefits for both the donor and the recipient. Another type of the Clark Nevada Declaration of Gift Over Several Year periods is the Graduated Gift Declaration. This type of declaration follows a predetermined schedule where the value of the gift increases over time. It is commonly used when the donor wants to provide ongoing financial support to the recipient, such as funding a child's education or assisting a family member in need. The gradual increase in gift value allows the donor to manage their assets effectively while ensuring the recipient receives consistent assistance. The Clark Nevada Declaration of Gift Over Several Year Period offers several advantages. First and foremost, it provides a legal framework for the donor to make gifts in compliance with Nevada state laws. The declaration ensures that all necessary paperwork and documentation are completed, protecting both the donor and the recipient's interests. Additionally, the declaration enables the donor to plan their estate and distribute assets strategically. By making gifts over a period of years, the donor can optimize their overall tax planning, potentially reducing estate tax liabilities. Careful consideration of the annual gift tax exclusion and other relevant tax laws can help the donor minimize potential tax burdens. Moreover, the Clark Nevada Declaration of Gift Over Several Year periods allows the donor to maintain control over their assets while providing ongoing financial support to loved ones. This type of declaration promotes responsible and structured asset management, ensuring that the gifts are given in a controlled and sustainable manner while considering the donor's financial circumstances. In conclusion, the Clark Nevada Declaration of Gift Over Several Year periods is a valuable legal document that facilitates the systematic distribution of assets over multiple years. By offering different types of declarations, including the Annual Gift Declaration and the Graduated Gift Declaration, individuals can plan their gifting strategies effectively while conforming to Nevada laws. This declaration provides numerous advantages, including tax planning opportunities, asset control, and legal compliance, making it an essential tool for individuals seeking to gift their assets over an extended period.