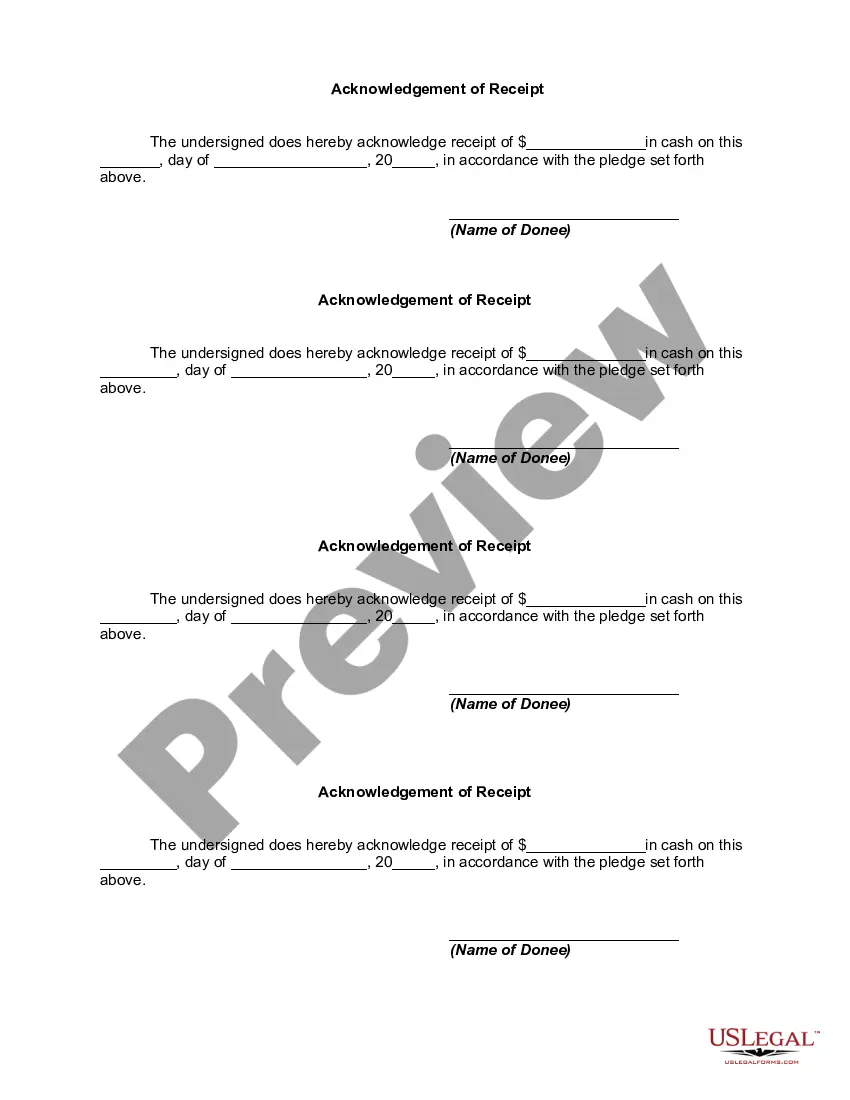

Although a written instrument is not usually essential to the validity of a gift inter vivos, to ensure compliance with the delivery requirement, and to avoid misunderstanding, a gift transfer should be made by a delivered written instrument. The language of the instrument must express a present intention to pass title to the property. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

The Lima Arizona Declaration of Gift Over Several Year periods is a legal document that outlines the transfer of assets or property from one individual or entity to another over a specified period of time. This declaration is commonly used in estate planning and gifting strategies to mitigate potential tax implications and ensure a smooth transfer of assets. Keywords: Lima Arizona, declaration of gift, several year periods, legal document, transfer of assets, property, estate planning, gifting strategies, tax implications. There are two main types of Lima Arizona Declaration of Gift Over Several Year periods: 1. Lima Arizona Declaration of Annual Exclusion Gifts: This type of declaration allows individuals to gift assets or property up to a certain annual exclusion limit without incurring any gift tax liabilities. The annual exclusion limit is determined by the Internal Revenue Service (IRS) and may change each year. By utilizing this declaration, individuals can gift assets or property over several years while remaining within the annual exclusion limit and avoiding gift tax obligations. 2. Lima Arizona Declaration of Gift Under Unified Tax Credit: This type of declaration is utilized when individuals wish to gift assets or property that exceed the annual exclusion limit. In such cases, the unified tax credit comes into play, which allows individuals to gift a certain amount over their lifetime without incurring gift taxes. The unified tax credit limit is also set by the IRS and can change each year. By using this declaration, individuals can spread their gifts over several years, taking advantage of the unified tax credit and minimizing potential tax implications. It's important to note that the specifics of the Lima Arizona Declaration of Gift Over Several Year periods may vary depending on individual circumstances and preferences. Consulting with a qualified attorney or tax professional is recommended to ensure compliance with applicable laws and regulations while making use of this declaration.The Lima Arizona Declaration of Gift Over Several Year periods is a legal document that outlines the transfer of assets or property from one individual or entity to another over a specified period of time. This declaration is commonly used in estate planning and gifting strategies to mitigate potential tax implications and ensure a smooth transfer of assets. Keywords: Lima Arizona, declaration of gift, several year periods, legal document, transfer of assets, property, estate planning, gifting strategies, tax implications. There are two main types of Lima Arizona Declaration of Gift Over Several Year periods: 1. Lima Arizona Declaration of Annual Exclusion Gifts: This type of declaration allows individuals to gift assets or property up to a certain annual exclusion limit without incurring any gift tax liabilities. The annual exclusion limit is determined by the Internal Revenue Service (IRS) and may change each year. By utilizing this declaration, individuals can gift assets or property over several years while remaining within the annual exclusion limit and avoiding gift tax obligations. 2. Lima Arizona Declaration of Gift Under Unified Tax Credit: This type of declaration is utilized when individuals wish to gift assets or property that exceed the annual exclusion limit. In such cases, the unified tax credit comes into play, which allows individuals to gift a certain amount over their lifetime without incurring gift taxes. The unified tax credit limit is also set by the IRS and can change each year. By using this declaration, individuals can spread their gifts over several years, taking advantage of the unified tax credit and minimizing potential tax implications. It's important to note that the specifics of the Lima Arizona Declaration of Gift Over Several Year periods may vary depending on individual circumstances and preferences. Consulting with a qualified attorney or tax professional is recommended to ensure compliance with applicable laws and regulations while making use of this declaration.