Sacramento California Bylaws of Nonprofit Corporation are legal documents that outline the rules and regulations governing the internal operations of a nonprofit organization in the city of Sacramento, California. These bylaws serve as a guide to the organization's board of directors, officers, and members, ensuring that the corporation operates in a transparent and accountable manner. The bylaws typically cover various areas, including the purpose and mission of the organization, the composition and responsibilities of the board of directors, the procedures for electing officers and directors, the rules for conducting meetings, and the guidelines for financial administration. Additionally, they may address membership eligibility, voting rights, conflict of interest policies, and the process for amending the bylaws. In Sacramento, there are various types of nonprofit corporations, each with its own distinct set of bylaws tailored to its specific purpose. Some examples include: 1. Charitable Nonprofit Corporation: Bylaws for charitable nonprofit corporations focus on promoting a specific cause or providing services to the community. They outline how the organization will operate, fundraise, and distribute resources to accomplish its charitable goals. 2. Educational Nonprofit Corporation: Bylaws for educational nonprofit corporations are designed for organizations that aim to provide education or promote specific educational activities. These bylaws may contain provisions regarding teaching methods, curriculum development, student enrollment, and faculty governance. 3. Religious Nonprofit Corporation: Religious nonprofit corporations have unique bylaws that reflect the beliefs and practices of the religious group. These bylaws may include provisions for worship services, religious ceremonies, leadership structures, and guidelines for religious teachings. 4. Environmental Nonprofit Corporation: Bylaws for environmental nonprofit corporations focus on preserving and protecting the environment. They may contain provisions related to organizing community initiatives, conservation efforts, public awareness campaigns, and advocating for environmental policies. 5. Health and Wellness Nonprofit Corporation: Bylaws for health and wellness nonprofit corporations typically address issues related to promoting physical and mental wellness, providing healthcare services, or supporting the needs of specific patient populations. They may cover areas such as health program delivery, patient advocacy, and fundraising for medical research. It's important for nonprofit corporations in Sacramento to ensure their bylaws comply with state laws and regulations, as well as any applicable federal laws related to nonprofit organizations. Organizations often consult legal professionals or use templates provided by the state to create their bylaws, ensuring they accurately reflect the organization's activities and goals. Properly drafted and regularly reviewed bylaws can guarantee a nonprofit's compliance and help it function efficiently.

Sacramento California Bylaws of Nonprofit Corporation

Description

How to fill out Sacramento California Bylaws Of Nonprofit Corporation?

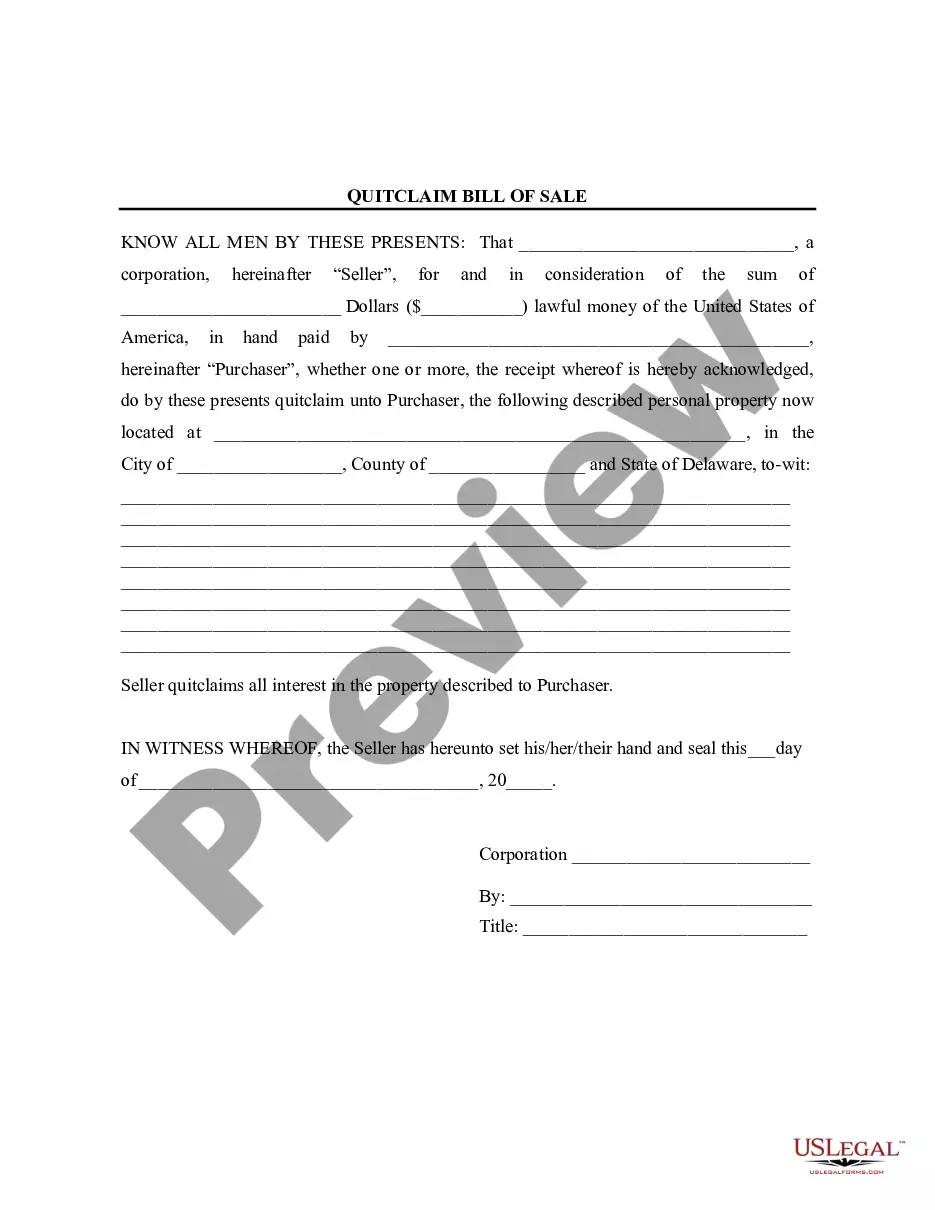

Whether you plan to open your business, enter into a deal, apply for your ID update, or resolve family-related legal concerns, you need to prepare certain documentation corresponding to your local laws and regulations. Finding the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 expertly drafted and verified legal documents for any personal or business occasion. All files are grouped by state and area of use, so picking a copy like Sacramento Bylaws of Nonprofit Corporation is quick and easy.

The US Legal Forms library users only need to log in to their account and click the Download key next to the required template. If you are new to the service, it will take you a few more steps to obtain the Sacramento Bylaws of Nonprofit Corporation. Follow the guidelines below:

- Make certain the sample fulfills your personal needs and state law requirements.

- Look through the form description and check the Preview if there’s one on the page.

- Utilize the search tab specifying your state above to find another template.

- Click Buy Now to obtain the file when you find the proper one.

- Opt for the subscription plan that suits you most to proceed.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the Sacramento Bylaws of Nonprofit Corporation in the file format you need.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Documents provided by our library are reusable. Having an active subscription, you are able to access all of your previously acquired paperwork whenever you need in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date official documentation. Sign up for the US Legal Forms platform and keep your paperwork in order with the most extensive online form collection!

Form popularity

FAQ

For CCPA specifically, nonprofits are exempt. Therefore, the responsibility is on businesses that are covered by the law, including all vendors, providers and agencies.

The corporation is the most common, and usually best, form for a nonprofit organization. Some of the benefits follow. There is a small price to pay for these benefits: the organization must register with a state and must make periodic filings and disclosures. There are also filing fees, but these are usually small.

Top Ten Policies and Practices for Nonprofit Organizations ONE: Conflict of interest policy. TWO: Code of ethics/whistle-blower policies. THREE: Document retention. FOUR: Compensation setting procedure. FIVE: Charity care/debt collection. SIX: Spending policy. SEVEN: Investment policy.EIGHT: Gift acceptance.

The California Corporations Code does not explicitly state that corporations must have corporate bylaws. However, the necessity of bylaws is implied in several places, including CA Corp Code § 213, which requires corporations to keep a copy of their bylaws on file at their principal executive office.

Types of Nonprofits TypeDescription501(c)(4)Civic Leagues, Social Welfare Organizations, and Local Associations of Employees501(c)(5)Labor, Agricultural, and Horticultural Organizations501(c)(6)Business Leagues, Chambers of Commerce, Real Estate Boards, etc.501(c)(7)Social and Recreational Clubs23 more rows ?

As per IRS, 501(c)3 is a nonprofit organization for religious, charitable, scientific, and educational purposes. Donations to 501(c)3 are tax-deductible. Whereas on the other hand, 501(c)4 is a social welfare group, and donations to 501(c)4 are not tax-deductible.

California laws regarding nonprofits relate to organizations that fundraise or operate in California. California law requires nonprofit organizations to have bylaws, or rules by which the organizations operate as part of their corporate records. Requirements for bylaws are stated in the California Corporations Code.

IRS 557 provides details on the different categories of nonprofit organizations. Public charities, foundations, social advocacy groups, and trade organizations are common types of nonprofit organization.

There Are Three Main Types of Charitable Organizations The IRS designates eight categories of organizations that may be allowed to operate as 501(c)(3) entities. Most organizations are eligible to become one of the three main categories, including public charities, private foundations and private operating foundations.

The state of California requires a minimum of one board member for each organization. It is recommended that your organization have at least three since the IRS will most likely not give 501(c)(3) status to an organization with less. 3-25 directors are recommended based on the size and purpose of your nonprofit.