There will come a time when a current tenant may fall seriously behind or owe you for something due under the lease, such as an accumulated water bill, a bounced security deposit check or some damages they did to the premises. A promissory note is simply an agreement when one party agrees to pay another party a particular past due sum or currently due sum on a particular date or dates.

Some recommend that a promissory note should be used only with a past or departing tenant owes you money and desires to pay you on a certain date or dates according to the payment arrangement spelled out on the promissory note. These people also recommend never using such an arrangement with a current tenant. The tenant may vacate owing you past due rent, late charges, unpaid utility bills or anything owed under the terms of the lease This Note will memorialize the debt in writing and can be used later if the past tenant defaults, and you wish to pursue the debt.

These same people recommend that a promissory note should not be used with a current tenant who owes you money. They point out that unless the promissory note clearly states that the amount is rent due under the terms of the lease, the landlord may have unwittingly converted past due rent into simply a monetary obligation for which he will not be able to evict the tenant using a Statutory Notice Period. Also suppose the tenant fails to make a payment, what is owed: the full balance all at once; or only that missed payment? This matter may be clarified by an acceleration clause in both the lease and the Note.

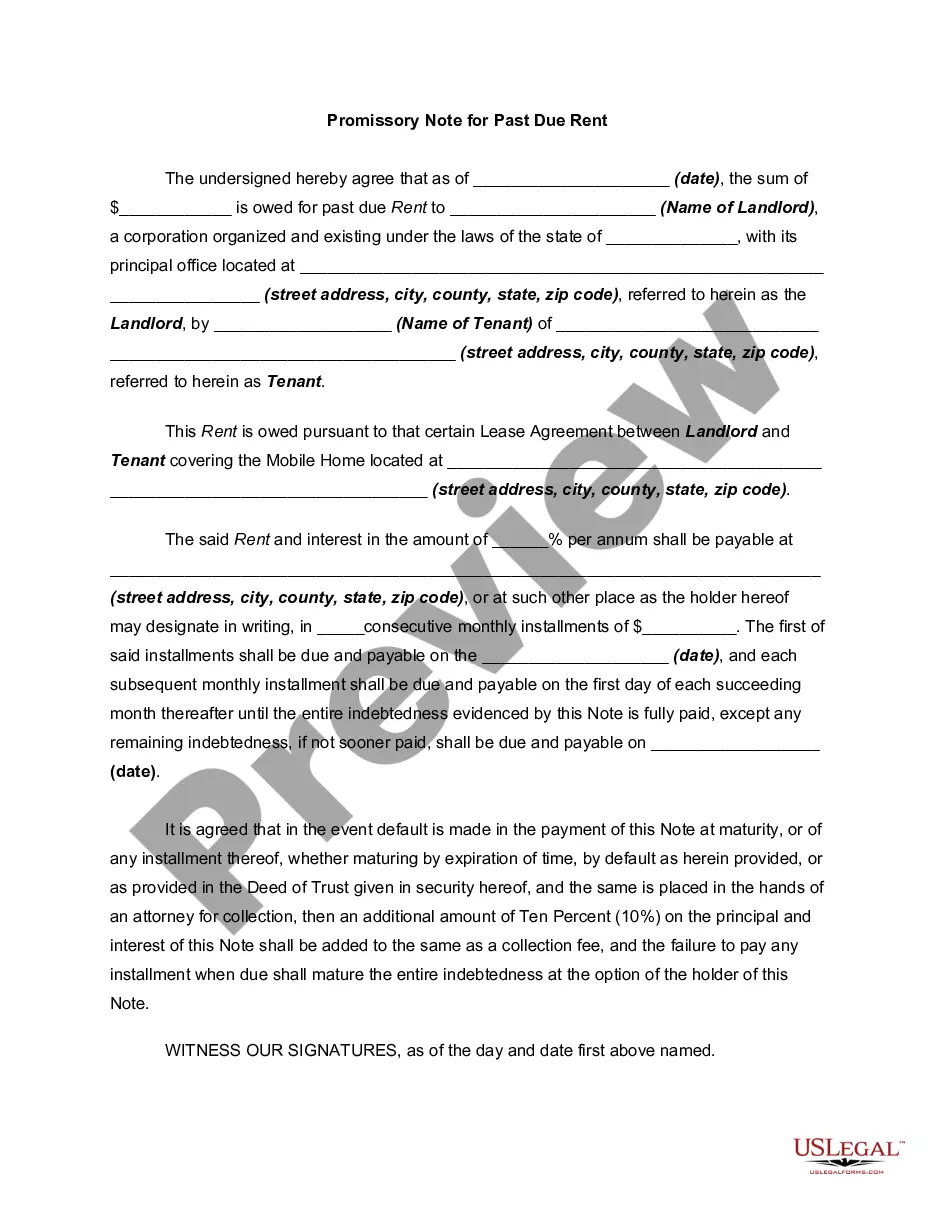

A Fulton Georgia Promissory Note for Past Due Rent is a legally binding document that outlines an agreement between a landlord and a tenant regarding the repayment of overdue rental payments. It serves as a formal acknowledgment of the tenant's debt and specifies the terms and conditions for repayment. The Fulton Georgia Promissory Note for Past Due Rent is typically used when a tenant has fallen behind on their rental payments and needs a formal arrangement to repay the landlord. This can be crucial in maintaining a good tenant-landlord relationship and avoiding eviction proceedings. The key elements included in a Fulton Georgia Promissory Note for Past Due Rent are as follows: 1. Parties involved: The names and contact information of both the landlord (lender) and the tenant (borrower) are clearly stated. 2. Amount owed: The total amount of past-due rent is specified, including any late fees or penalties. 3. Repayment terms: The repayment plan is detailed, stating the preferred method of payment, installment amounts, due dates, and the duration of the repayment period. 4. Interest rate: If applicable, the interest rate charged on the outstanding balance is mentioned to ensure compliance with Georgia laws. 5. Late payment provisions: Late payment penalties or charges for missed payments can be agreed upon and documented to incentivize timely repayments. 6. Security provisions: To secure the repayment, both parties may agree to add collateral or a security deposit to the promissory note. 7. Legal consequences: The document may outline the repercussions for non-compliance, such as eviction proceedings or legal action by the landlord. Several types of Fulton Georgia Promissory Notes for Past Due Rent may exist depending on specific circumstances: 1. Lump-sum repayment plan: The tenant pays the entire overdue amount as a single payment within a specified time period. 2. Installment repayment plan: The tenant repays the overdue rent in equal monthly installments over an agreed-upon period, including any additional interest or fees. 3. Tenant-initiated repayment plan: The tenant proposes a repayment plan to the landlord, which both parties negotiate and agree upon. 4. Court-ordered promissory note: In the case of a legal dispute, the court may issue a promissory note with specific terms and conditions for overdue rent repayment. Overall, a Fulton Georgia Promissory Note for Past Due Rent plays a crucial role in establishing a clear framework for debt repayment, maintaining a positive tenant-landlord relationship, and avoiding the need for legal intervention.A Fulton Georgia Promissory Note for Past Due Rent is a legally binding document that outlines an agreement between a landlord and a tenant regarding the repayment of overdue rental payments. It serves as a formal acknowledgment of the tenant's debt and specifies the terms and conditions for repayment. The Fulton Georgia Promissory Note for Past Due Rent is typically used when a tenant has fallen behind on their rental payments and needs a formal arrangement to repay the landlord. This can be crucial in maintaining a good tenant-landlord relationship and avoiding eviction proceedings. The key elements included in a Fulton Georgia Promissory Note for Past Due Rent are as follows: 1. Parties involved: The names and contact information of both the landlord (lender) and the tenant (borrower) are clearly stated. 2. Amount owed: The total amount of past-due rent is specified, including any late fees or penalties. 3. Repayment terms: The repayment plan is detailed, stating the preferred method of payment, installment amounts, due dates, and the duration of the repayment period. 4. Interest rate: If applicable, the interest rate charged on the outstanding balance is mentioned to ensure compliance with Georgia laws. 5. Late payment provisions: Late payment penalties or charges for missed payments can be agreed upon and documented to incentivize timely repayments. 6. Security provisions: To secure the repayment, both parties may agree to add collateral or a security deposit to the promissory note. 7. Legal consequences: The document may outline the repercussions for non-compliance, such as eviction proceedings or legal action by the landlord. Several types of Fulton Georgia Promissory Notes for Past Due Rent may exist depending on specific circumstances: 1. Lump-sum repayment plan: The tenant pays the entire overdue amount as a single payment within a specified time period. 2. Installment repayment plan: The tenant repays the overdue rent in equal monthly installments over an agreed-upon period, including any additional interest or fees. 3. Tenant-initiated repayment plan: The tenant proposes a repayment plan to the landlord, which both parties negotiate and agree upon. 4. Court-ordered promissory note: In the case of a legal dispute, the court may issue a promissory note with specific terms and conditions for overdue rent repayment. Overall, a Fulton Georgia Promissory Note for Past Due Rent plays a crucial role in establishing a clear framework for debt repayment, maintaining a positive tenant-landlord relationship, and avoiding the need for legal intervention.