A virtual assistant is like a personal secretary. They provide customer support, write, answer calls, transcribe, do research, etc. They basically work at home and communicate with their employer through the Internet or through phone.

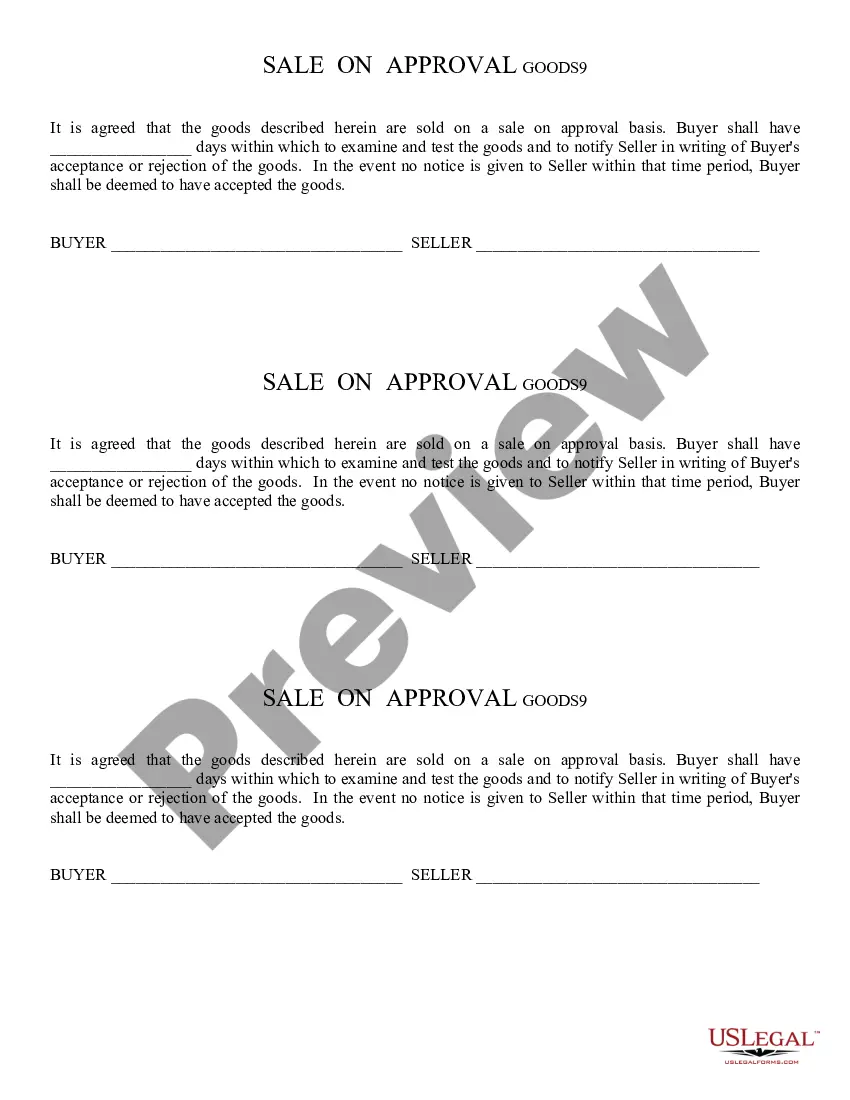

Some of the most common rate schedules used in the virtual industry are hourly, retainer, and per project. Hourly rates are said to work well for those who require routine assistance but are unsure how much of their workflow will be delegated at any given time. Retainer rates secure a predetermined number of hours within a preset time period at a discounted rate. This has been recommended as an excellent way to go if you want to work with someone on a regular basis. Per project is recommended if you have small projects that are either one time or recurring.

The San Diego California Hourly Payment Agreement for Virtual Assistant Services — Bookkeeping is a detailed contract that outlines the terms and conditions for hiring a virtual assistant specifically for bookkeeping tasks in the vibrant city of San Diego, California. This agreement ensures a smooth and fair working relationship between the client and the virtual assistant, while focusing on the hourly payment structure. Keywords: San Diego California, hourly payment agreement, virtual assistant services, bookkeeping In San Diego, hiring a virtual assistant for bookkeeping tasks can greatly benefit individuals and businesses alike. With its thriving economy and diverse industries, San Diego has a high demand for skilled professionals who can efficiently manage financial records and transactions. The hourly payment agreement is designed to establish the payment structure for virtual assistant services in line with the bookkeeping tasks. By utilizing an hourly payment model, clients have the flexibility to pay based on the actual time spent on specific bookkeeping assignments, ensuring a fair and accurate compensation arrangement. Different types of San Diego California Hourly Payment Agreement for Virtual Assistant Services — Bookkeeping may include the following: 1. Basic Hourly Payment Agreement: This agreement sets a standard hourly rate for bookkeeping services performed by the virtual assistant. It outlines the scope of work, expectations, and rates for various bookkeeping tasks. 2. Project-Based Hourly Payment Agreement: In some cases, clients may require bookkeeping assistance for specific projects such as tax preparation or financial audit. This agreement outlines the project duration, tasks involved, and the hourly rate for the virtual assistant's services. 3. Retainer Hourly Payment Agreement: For ongoing bookkeeping support, clients can enter into a retainer agreement with a virtual assistant. This agreement specifies a set number of hours per week or month that the virtual assistant will dedicate to bookkeeping tasks, ensuring consistent support at an agreed-upon hourly rate. 4. Consulting Hourly Payment Agreement: Occasionally, clients may need expert advice or consulting services in addition to bookkeeping tasks. This agreement outlines the hourly rate for both bookkeeping services and consulting time, encompassing a broader range of financial support. Whether clients require assistance with budgeting, payroll, accounts receivable, accounts payable, or any other bookkeeping tasks, the San Diego California Hourly Payment Agreement for Virtual Assistant Services — Bookkeeping offers a transparent and professional framework to meet their needs. With an emphasis on fair compensation, clear expectations, and adherence to California labor laws, this agreement ensures a successful virtual assistant-client relationship focused on efficient bookkeeping practices.The San Diego California Hourly Payment Agreement for Virtual Assistant Services — Bookkeeping is a detailed contract that outlines the terms and conditions for hiring a virtual assistant specifically for bookkeeping tasks in the vibrant city of San Diego, California. This agreement ensures a smooth and fair working relationship between the client and the virtual assistant, while focusing on the hourly payment structure. Keywords: San Diego California, hourly payment agreement, virtual assistant services, bookkeeping In San Diego, hiring a virtual assistant for bookkeeping tasks can greatly benefit individuals and businesses alike. With its thriving economy and diverse industries, San Diego has a high demand for skilled professionals who can efficiently manage financial records and transactions. The hourly payment agreement is designed to establish the payment structure for virtual assistant services in line with the bookkeeping tasks. By utilizing an hourly payment model, clients have the flexibility to pay based on the actual time spent on specific bookkeeping assignments, ensuring a fair and accurate compensation arrangement. Different types of San Diego California Hourly Payment Agreement for Virtual Assistant Services — Bookkeeping may include the following: 1. Basic Hourly Payment Agreement: This agreement sets a standard hourly rate for bookkeeping services performed by the virtual assistant. It outlines the scope of work, expectations, and rates for various bookkeeping tasks. 2. Project-Based Hourly Payment Agreement: In some cases, clients may require bookkeeping assistance for specific projects such as tax preparation or financial audit. This agreement outlines the project duration, tasks involved, and the hourly rate for the virtual assistant's services. 3. Retainer Hourly Payment Agreement: For ongoing bookkeeping support, clients can enter into a retainer agreement with a virtual assistant. This agreement specifies a set number of hours per week or month that the virtual assistant will dedicate to bookkeeping tasks, ensuring consistent support at an agreed-upon hourly rate. 4. Consulting Hourly Payment Agreement: Occasionally, clients may need expert advice or consulting services in addition to bookkeeping tasks. This agreement outlines the hourly rate for both bookkeeping services and consulting time, encompassing a broader range of financial support. Whether clients require assistance with budgeting, payroll, accounts receivable, accounts payable, or any other bookkeeping tasks, the San Diego California Hourly Payment Agreement for Virtual Assistant Services — Bookkeeping offers a transparent and professional framework to meet their needs. With an emphasis on fair compensation, clear expectations, and adherence to California labor laws, this agreement ensures a successful virtual assistant-client relationship focused on efficient bookkeeping practices.