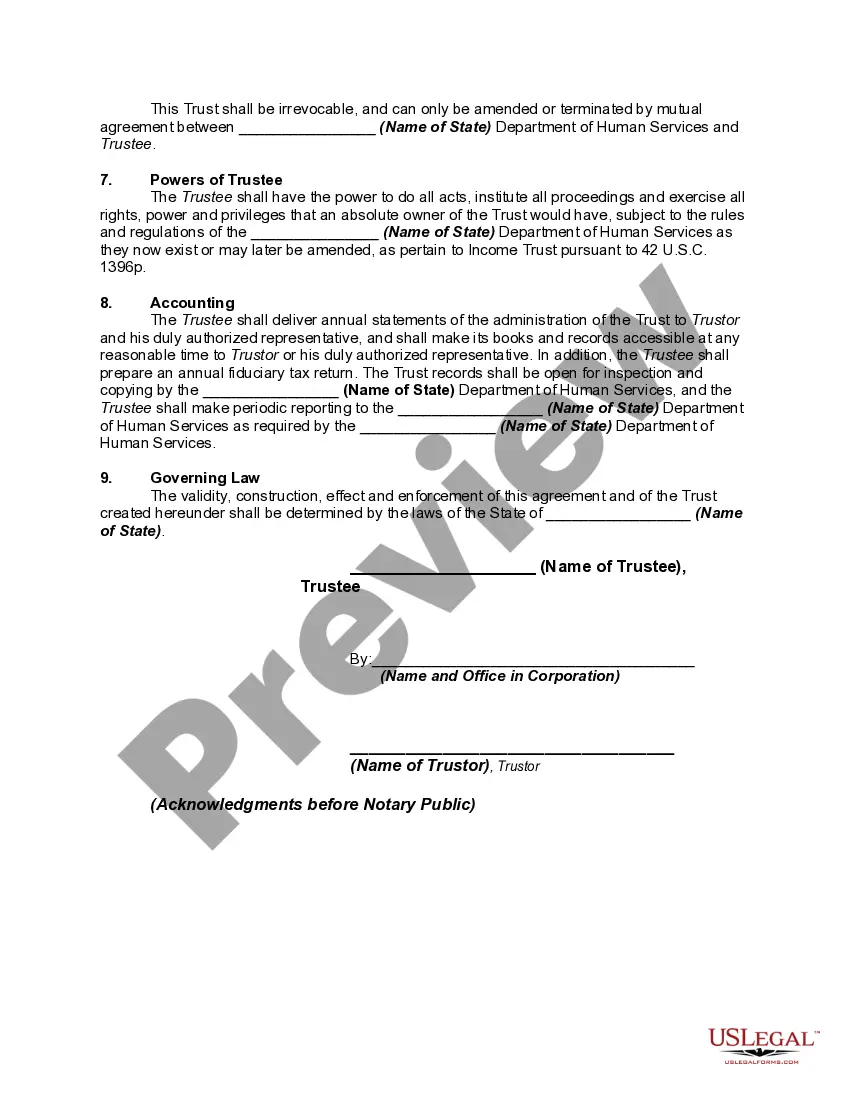

Allegheny Pennsylvania Miller Trust Forms for Assisted Living are legal documents specific to the state that help individuals residing in assisted living facilities manage their income and assets in order to qualify for Medicaid benefits. These forms are crucial for elderly or disabled individuals who want to receive financial assistance for their long-term care needs. A Miller Trust, also known as a Qualified Income Trust (QIT), is designed to assist individuals who have income above the Medicaid eligibility limit but still require financial assistance for their assisted living costs. By creating and utilizing a Miller Trust, individuals can contribute their excess income into the trust and use it to pay for their care expenses, allowing them to qualify for Medicaid coverage. In Allegheny Pennsylvania, there are various types of Miller Trust Forms available to cater to different circumstances and requirements of assisted living residents. Some commonly used Miller Trust Forms specific to Allegheny Pennsylvania include: 1. Allegheny Pennsylvania Miller Trust Form for Assisted Living: This general form covers the basic requirements and provisions for creating a Miller Trust in Allegheny County specifically for assisted living expenses. 2. Allegheny Pennsylvania Miller Trust Form for Medicaid Eligibility: This form focuses on the documentation needed to determine Medicaid eligibility and outlines the process of establishing a Miller Trust to meet the requisite income limit. 3. Allegheny Pennsylvania Miller Trust Form for Income Allocation: This particular form provides a detailed breakdown of how income should be allocated and deposited into the Miller Trust to comply with Medicaid regulations. 4. Allegheny Pennsylvania Miller Trust Form for Asset Protection: This form emphasizes strategies for protecting certain assets while establishing and utilizing a Miller Trust for assisted living expenses. 5. Allegheny Pennsylvania Miller Trust Form for Trustee Appointment: This form is used to designate a trustee responsible for managing the Miller Trust and making financial decisions on behalf of the assisted living resident. It is important to note that these forms must be completed accurately and in accordance with the guidelines set by the Pennsylvania Department of Human Services and the Medicaid program. Consulting with an elder law attorney or a qualified professional who specializes in Medicaid planning is recommended to ensure compliance with all legal requirements and maximize the benefits of utilizing a Miller Trust for assisted living residents in Allegheny Pennsylvania.

Allegheny Pennsylvania Miller Trust Forms for Assisted Living

Description

How to fill out Allegheny Pennsylvania Miller Trust Forms For Assisted Living?

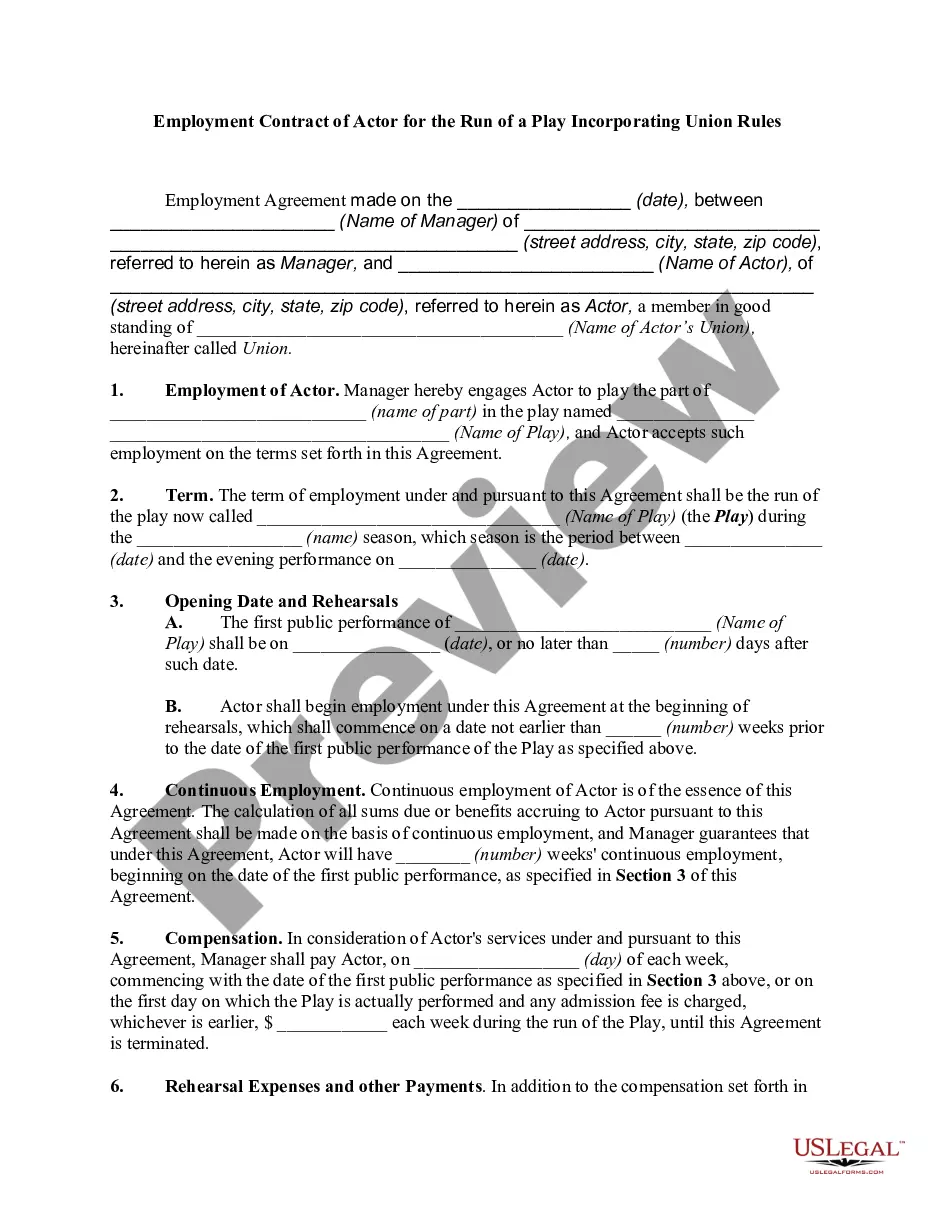

Whether you intend to open your company, enter into a deal, apply for your ID renewal, or resolve family-related legal concerns, you need to prepare specific documentation meeting your local laws and regulations. Finding the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 professionally drafted and verified legal templates for any personal or business case. All files are grouped by state and area of use, so picking a copy like Allegheny Miller Trust Forms for Assisted Living is fast and straightforward.

The US Legal Forms library users only need to log in to their account and click the Download button next to the required template. If you are new to the service, it will take you a couple of additional steps to get the Allegheny Miller Trust Forms for Assisted Living. Follow the instructions below:

- Make sure the sample meets your individual needs and state law regulations.

- Look through the form description and check the Preview if available on the page.

- Use the search tab specifying your state above to find another template.

- Click Buy Now to obtain the file when you find the right one.

- Choose the subscription plan that suits you most to continue.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the Allegheny Miller Trust Forms for Assisted Living in the file format you need.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Documents provided by our library are multi-usable. Having an active subscription, you are able to access all of your previously acquired paperwork at any time in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date official documentation. Sign up for the US Legal Forms platform and keep your paperwork in order with the most extensive online form library!

Form popularity

FAQ

To do so, you must set up a special kind of trust known as a "Miller Trust." Miller Trusts are also called "Medical Assistance Income Trusts" in state and federal statutes or regulations....To apply for help from Iowa Legal Aid: Call 800-532-1275. Iowans age 60 and over, call 800-992-8161. Apply online at iowalegalaid.org.

How do I open a QIT bank account? A QIT bank account is set up at a bank. The DMAHS website provides guidance to the individuals going to the bank and a bank memo to provide to the bank officer. You can bring the memo to the bank to help establish these accounts.

Miller Trusts can be used to pay for a small monthly allowance, Medicare premiums and medical expenses that are not covered by Medicaid. Unlike other types of trusts, there are very few restrictions on who can establish a Miller Trust to qualify for government benefits.

Miller Trusts are basically agreements where one person (called the trustee) agrees to hold and manage money for another person who needs long term care (called the beneficiary), and promises to spend the money only in ways approved by Idaho Dept. of Health & Welfare (primarily paying long term care costs).

In 2022, this is $2,523 / month for an individual. A portion, or all of one's income, can be directly deposited into a Miller trust and it is not counted towards Medicaid's income limit. Therefore, this option allows an applicant to become income eligible.

Miller Trusts, also called Qualified Income Trusts, provide a way for Medicaid applicants who have income over Medicaid's limit to become eligible for Medicaid long term care. In short, income over Medicaid's limit, is put into a trust and therefore not counted as income, thus allowing the applicant to become eligible.

A Miller Trust is specifically designed to qualify an individual for Medicaid benefits by diverting all income into the trust. Income diverted to the trust is not counted as income for purposes of Medicaid eligibility when attempting to qualify for nursing home care. A Miller Trust can only hold the applicant's income.

The trust account will be used to pay the Medicaid income spend down and any other medical expenses not covered by Medicaid or other insurance. For example, payment of a health insurance premium, such as a Medicare supplemental insurance premium, is allowed.

More info

A weekly series of reading groups for LGBTQ adults. It's like a book club for your Instagram feeds (though still fun if you're the type who loves social media). There are a lot of other good and good-looking organizations scattered across the county that have websites, and they'll most likely be able to help you with your questions. But don't wait for a hotline — call and get assistance.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.