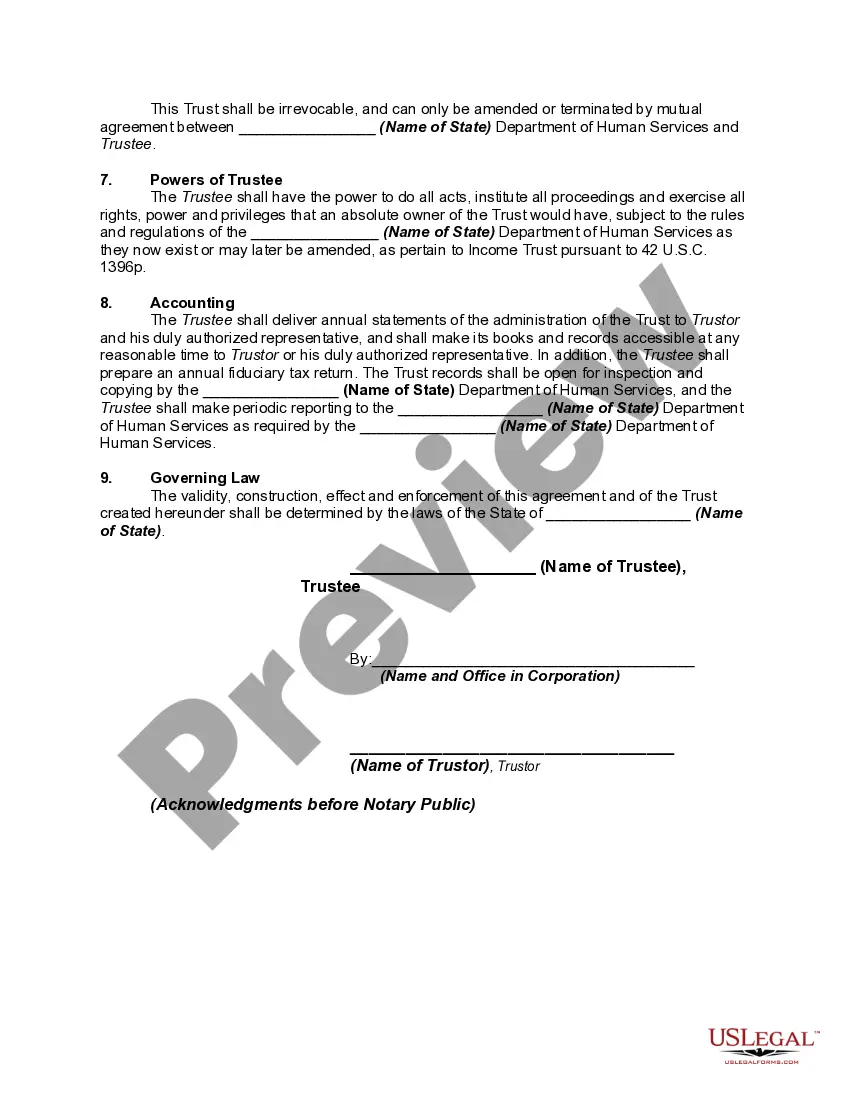

Fulton Georgia Miller Trust Forms for Assisted Living are legal documents specifically designed for individuals residing in Fulton County, Georgia, who require Medicaid assistance to cover the costs of their assisted living expenses. These forms are crucial for establishing a Miller Trust, also known as a Qualified Income Trust, which allows individuals with incomes exceeding the predetermined Medicaid thresholds to still qualify for Medicaid assistance. The Miller Trust Forms for Assisted Living in Fulton, Georgia, serve as a means of managing excess income that would otherwise disqualify an individual from receiving Medicaid benefits. By setting up a Miller Trust, individuals can redirect their surplus income into the trust, which is then used to pay for their assisted living expenses. This arrangement enables them to meet the income requirements imposed by Medicaid while still receiving much-needed financial support for their assisted living needs. Specific types of Fulton Georgia Miller Trust Forms for Assisted Living may include: 1. Fulton Georgia Miller Trust Establishment Form: This form is used to create the Miller Trust and outline specific terms, conditions, and beneficiaries. It captures essential information such as the granter's name, trustee appointment, trust funding details, and guidelines for disbursements. 2. Fulton Georgia Miller Trust Funding Form: This form serves to transfer the granter's excess income into the Miller Trust. It documents the specific income sources and amounts being deposited into the trust each month, ensuring compliance with Medicaid regulations. 3. Fulton Georgia Miller Trust Disbursement Form: This form details the specific expenses paid directly from the Miller Trust for assisted living services. It captures information about the assisted living facility or provider, outlines the type of care received, amount disbursed, and other relevant details for proper record-keeping. 4. Fulton Georgia Miller Trust Reporting Form: This form plays a critical role in compliance with Medicaid requirements by documenting the trust's financial activities regularly. It includes income sources, expenditures, and balance information, ensuring that all transactions are accurately recorded and reported to Medicaid for ongoing eligibility. It is important to consult with an experienced elder law attorney or a legal professional specializing in Miller Trusts when completing these Fulton Georgia Miller Trust Forms for Assisted Living. This ensures that all necessary information is accurately recorded, and the legal requirements are met, increasing the chances of a successful Medicaid application.

Fulton Georgia Miller Trust Forms for Assisted Living

Description

How to fill out Fulton Georgia Miller Trust Forms For Assisted Living?

Draftwing forms, like Fulton Miller Trust Forms for Assisted Living, to take care of your legal affairs is a tough and time-consumming task. Many situations require an attorney’s participation, which also makes this task not really affordable. Nevertheless, you can take your legal issues into your own hands and take care of them yourself. US Legal Forms is here to save the day. Our website comes with over 85,000 legal forms created for various cases and life circumstances. We make sure each form is in adherence with the regulations of each state, so you don’t have to be concerned about potential legal problems associated with compliance.

If you're already aware of our services and have a subscription with US, you know how straightforward it is to get the Fulton Miller Trust Forms for Assisted Living form. Go ahead and log in to your account, download the template, and personalize it to your requirements. Have you lost your form? Don’t worry. You can get it in the My Forms tab in your account - on desktop or mobile.

The onboarding flow of new customers is just as easy! Here’s what you need to do before getting Fulton Miller Trust Forms for Assisted Living:

- Make sure that your template is specific to your state/county since the rules for writing legal papers may differ from one state another.

- Learn more about the form by previewing it or going through a quick intro. If the Fulton Miller Trust Forms for Assisted Living isn’t something you were looking for, then take advantage of the search bar in the header to find another one.

- Log in or register an account to begin utilizing our website and download the form.

- Everything looks great on your side? Click the Buy now button and choose the subscription option.

- Select the payment gateway and enter your payment details.

- Your template is good to go. You can go ahead and download it.

It’s easy to locate and buy the needed document with US Legal Forms. Thousands of businesses and individuals are already benefiting from our extensive collection. Subscribe to it now if you want to check what other perks you can get with US Legal Forms!