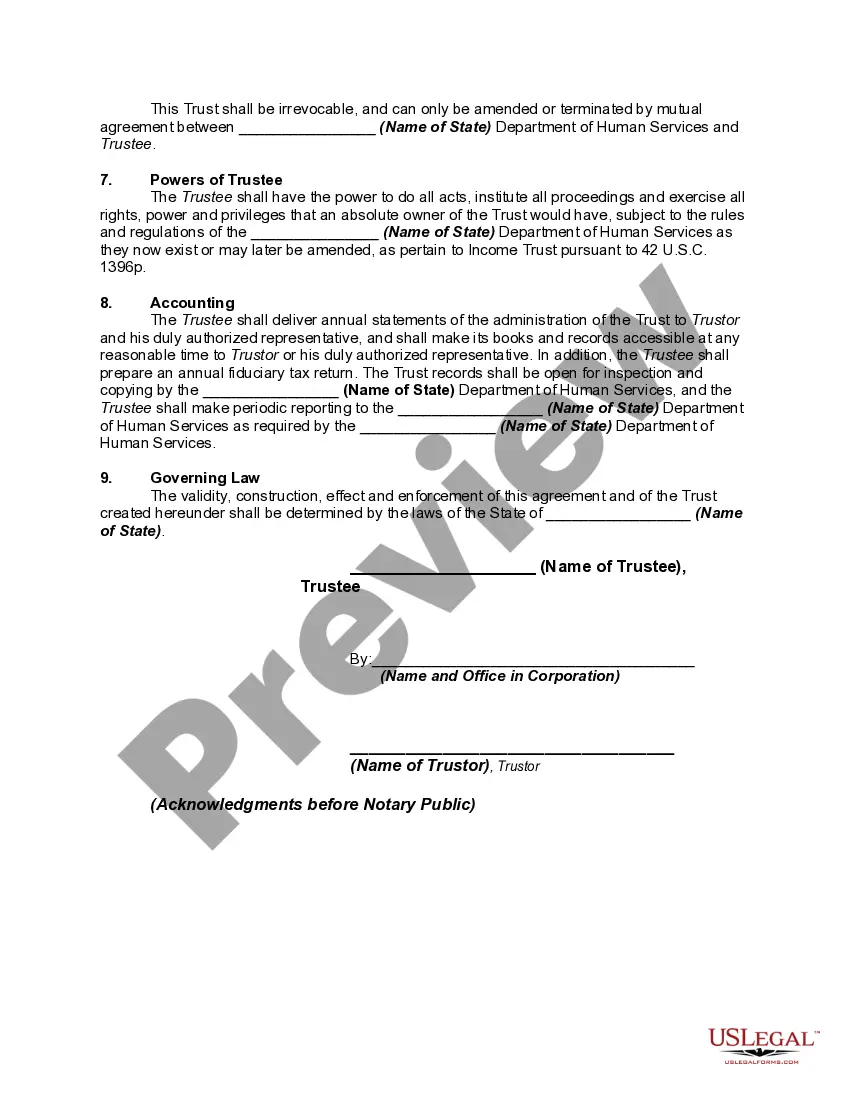

Nassau New York Miller Trust Forms for Assisted Living provide individuals with an important financial tool to qualify for Medicaid benefits while residing in assisted living communities. These trust forms are specifically designed to meet the requirements of the New York State Medicaid program, enabling individuals to utilize their income to cover their living expenses while still meeting the eligibility criteria. There are two main types of Miller Trust Forms available in Nassau County, New York. The first is the Income-Only Miller Trust, also known as a Qualified Income Trust (QIT). This type of trust allows individuals with income exceeding the Medicaid threshold to "spend down" their excess income by depositing it into the trust. The funds held in the trust can then be used to pay for the individual's assisted living expenses, such as room and board, personal care services, and medical needs, while still qualifying for Medicaid. The second type of Miller Trust Form in Nassau County is the Pooled Income Trust. This trust option is beneficial for individuals who are over the Medicaid income limit, as it allows them to deposit their excess income into a pooled trust account. The funds in the account are managed by a nonprofit organization, which combines the income of multiple beneficiaries for investment purposes. Participants in a pooled income trust can use the funds in their account to cover assisted living expenses, while still maintaining Medicaid eligibility. To establish either type of Miller Trust, individuals must follow a detailed process that involves completing the necessary forms and obtaining approval from the New York State Department of Health. It is crucial to consult with an experienced attorney or financial advisor specializing in Medicaid planning to ensure compliance with all state regulations and accurately complete the required forms. In conclusion, Nassau New York Miller Trust Forms for Assisted Living offer a valuable solution for individuals seeking Medicaid eligibility while residing in assisted living facilities. By utilizing these trust forms, individuals can effectively manage their income and continue receiving the necessary support and care in their chosen assisted living community. Proper guidance from professionals familiar with Medicaid regulations is essential for a smooth and successful application process.

Nassau New York Miller Trust Forms for Assisted Living

Description

How to fill out Nassau New York Miller Trust Forms For Assisted Living?

Do you need to quickly draft a legally-binding Nassau Miller Trust Forms for Assisted Living or probably any other document to take control of your own or business matters? You can go with two options: hire a professional to write a legal paper for you or draft it entirely on your own. The good news is, there's a third option - US Legal Forms. It will help you receive professionally written legal documents without paying sky-high prices for legal services.

US Legal Forms provides a huge catalog of more than 85,000 state-specific document templates, including Nassau Miller Trust Forms for Assisted Living and form packages. We offer templates for an array of use cases: from divorce papers to real estate documents. We've been out there for over 25 years and got a spotless reputation among our customers. Here's how you can become one of them and obtain the needed template without extra hassles.

- To start with, double-check if the Nassau Miller Trust Forms for Assisted Living is adapted to your state's or county's regulations.

- In case the form has a desciption, make sure to verify what it's intended for.

- Start the search over if the template isn’t what you were hoping to find by using the search box in the header.

- Select the plan that best suits your needs and move forward to the payment.

- Select the file format you would like to get your form in and download it.

- Print it out, fill it out, and sign on the dotted line.

If you've already set up an account, you can easily log in to it, locate the Nassau Miller Trust Forms for Assisted Living template, and download it. To re-download the form, simply go to the My Forms tab.

It's easy to find and download legal forms if you use our services. Additionally, the paperwork we offer are updated by law professionals, which gives you greater confidence when dealing with legal matters. Try US Legal Forms now and see for yourself!