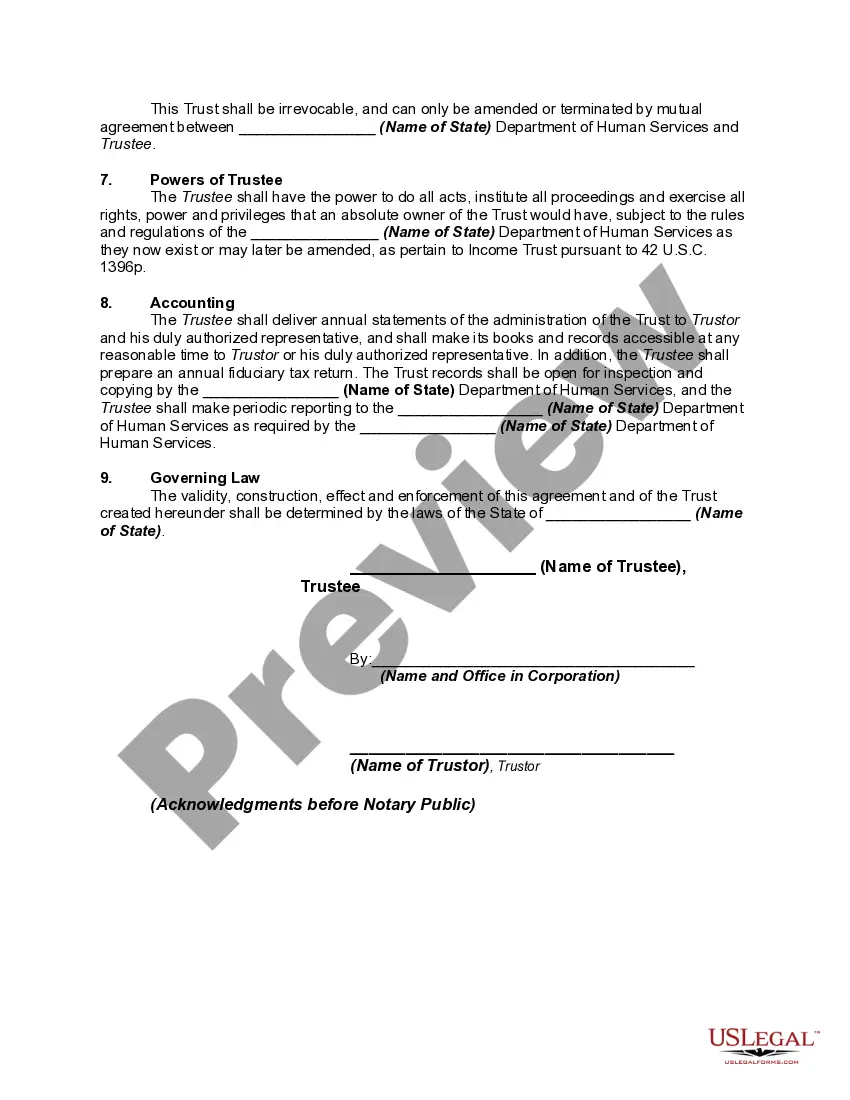

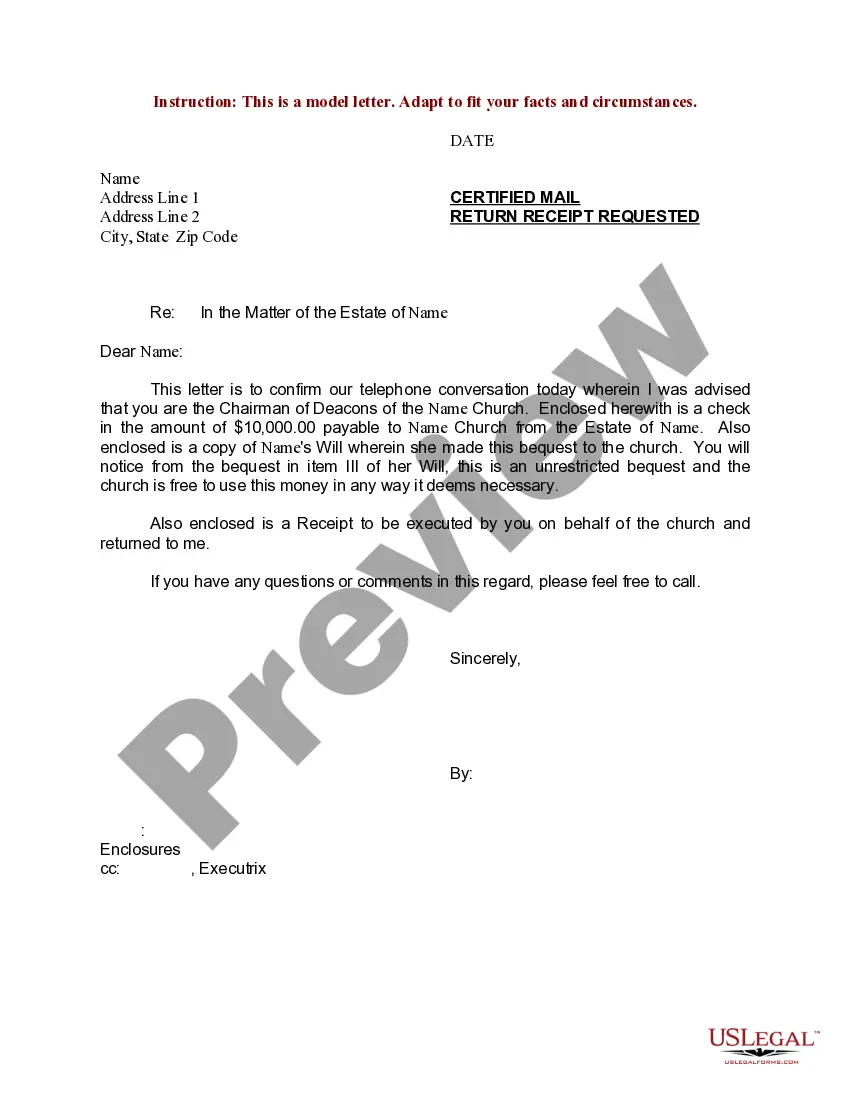

Allegheny Pennsylvania Miller Trust Forms for Medicaid are legal instruments specifically designed to assist individuals who are attempting to qualify for Medicaid benefits in Pennsylvania while having income that exceeds the program's limits. The Miller Trust, also known as a Qualified Income Trust (QIT), is a trust created by individuals who need Medicaid's long-term care benefits but have income that exceeds the program's eligibility levels. These trust forms are crucial for Pennsylvanians in situations where their income surpasses the allowable threshold, making them ineligible for Medicaid initially. These trust forms essentially function as a specialized bank account, allowing individuals to transfer their excess income into the trust, which is then disregarded when determining eligibility for Medicaid benefits. By utilizing these forms, individuals can "spend down" their income to meet the program's requirements. In Allegheny County, Pennsylvania, there are two main types of Miller Trust Forms for Medicaid: 1. Miller Trust Agreement: This form outlines the terms and conditions of the trust, including the details of the trustee, beneficiary, and the income being transferred into the trust. It specifies how the income within the trust will be managed and distributed to cover the individual's medical expenses. 2. Miller Trust Bank Account Form: This form is used to open a dedicated bank account solely for the Miller Trust. It includes all required banking information and ensures that the trust's funds are kept separate from any other personal accounts. Both forms are necessary for establishing and maintaining a Miller Trust compliant with Pennsylvania's Medicaid program rules. They need to be completed accurately and filed with the appropriate state agencies to ensure eligibility for Medicaid. In conclusion, Allegheny Pennsylvania Miller Trust Forms for Medicaid are essential documents that allow individuals with excessive income to qualify for Medicaid benefits. By utilizing these specialized trust forms, individuals can effectively manage their income and ensure they receive the vital long-term care assistance they require.

Allegheny Pennsylvania Miller Trust Forms for Medicaid

Description

How to fill out Allegheny Pennsylvania Miller Trust Forms For Medicaid?

How much time does it typically take you to draw up a legal document? Given that every state has its laws and regulations for every life situation, locating a Allegheny Miller Trust Forms for Medicaid meeting all local requirements can be tiring, and ordering it from a professional attorney is often pricey. Many online services offer the most popular state-specific documents for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most comprehensive online catalog of templates, collected by states and areas of use. Apart from the Allegheny Miller Trust Forms for Medicaid, here you can find any specific document to run your business or personal deeds, complying with your county requirements. Experts check all samples for their validity, so you can be certain to prepare your paperwork correctly.

Using the service is fairly simple. If you already have an account on the platform and your subscription is valid, you only need to log in, opt for the required sample, and download it. You can retain the document in your profile anytime later on. Otherwise, if you are new to the platform, there will be a few more steps to complete before you obtain your Allegheny Miller Trust Forms for Medicaid:

- Check the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Search for another document using the corresponding option in the header.

- Click Buy Now when you’re certain in the selected document.

- Choose the subscription plan that suits you most.

- Create an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Switch the file format if needed.

- Click Download to save the Allegheny Miller Trust Forms for Medicaid.

- Print the sample or use any preferred online editor to complete it electronically.

No matter how many times you need to use the purchased template, you can find all the samples you’ve ever saved in your profile by opening the My Forms tab. Try it out!