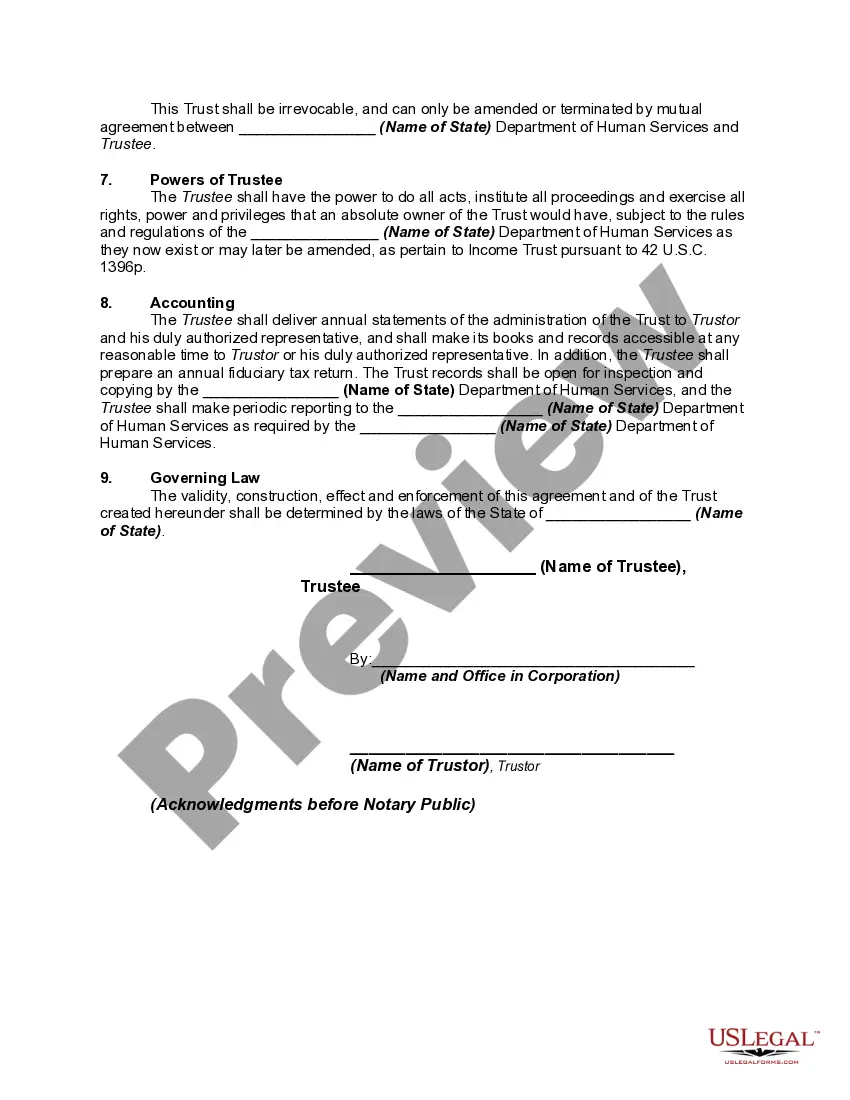

A Miller Trust, also known as a Qualified Income Trust, is a specialized type of trust that enables Medicaid applicants with income that exceeds the eligibility limit to qualify for long-term care benefits. Specifically focusing on Cuyahoga County, Ohio, the Cuyahoga Ohio Miller Trust Forms for Medicaid cater to individuals residing within this region who seek Medicaid assistance but have income above the threshold. These trust forms are essential because, under Ohio Medicaid guidelines, individuals with income above a certain level are typically not eligible for long-term care benefits. However, by establishing a Miller Trust, also referred to as an income-only trust, individuals can allocate their excess income into the trust, ultimately reducing their countable income to the eligible level for Medicaid qualification. The Cuyahoga Ohio Miller Trust Forms for Medicaid offer different variations designed to fit the specific needs and circumstances of the applicants. Some commonly known Miller Trust Forms specific to Cuyahoga, Ohio region include: 1. Cuyahoga Ohio Medicaid Income-Only Trust Form: This form is the primary document used to establish a Miller Trust for Medicaid eligibility. It outlines the essential details of the trust, including the beneficiary's personal information, the trustee appointed to manage the trust, and the terms and conditions governing the trust. 2. Cuyahoga Ohio Miller Trust Funding Instructions Form: This form provides instructions to the beneficiary on how to fund the Miller Trust. It includes guidance on redirecting income, such as paychecks or pension payments, into the trust account to ensure compliance with Medicaid income requirements. 3. Cuyahoga Ohio Miller Trust Disbursement Authorization Form: This form grants the appointed trustee the authority to make disbursements from the Miller Trust account. The trustee will be responsible for distributing funds to cover the beneficiary's medical expenses, long-term care costs, and other approved expenditures. 4. Cuyahoga Ohio Miller Trust Annual Reporting Form: As part of the ongoing management of the Miller Trust, this form requires the trustee to provide an annual report of the trust's financial activities. The report should detail the income received, disbursements made, and the remaining balance in the trust account. It is important to note that the specific names and formats of the Cuyahoga Ohio Miller Trust Forms for Medicaid may vary slightly based on individual circumstances and updates in state regulations. However, the underlying purpose remains constant — ensuring individuals with excess income can still access vital Medicaid benefits for their long-term care needs.

Cuyahoga Ohio Miller Trust Forms for Medicaid

Description

How to fill out Cuyahoga Ohio Miller Trust Forms For Medicaid?

If you need to get a reliable legal paperwork supplier to obtain the Cuyahoga Miller Trust Forms for Medicaid, look no further than US Legal Forms. Whether you need to start your LLC business or take care of your belongings distribution, we got you covered. You don't need to be well-versed in in law to find and download the needed template.

- You can select from more than 85,000 forms arranged by state/county and situation.

- The self-explanatory interface, number of learning materials, and dedicated support make it simple to get and complete various paperwork.

- US Legal Forms is a reliable service providing legal forms to millions of users since 1997.

Simply type to look for or browse Cuyahoga Miller Trust Forms for Medicaid, either by a keyword or by the state/county the form is created for. After locating needed template, you can log in and download it or retain it in the My Forms tab.

Don't have an account? It's effortless to start! Simply find the Cuyahoga Miller Trust Forms for Medicaid template and take a look at the form's preview and description (if available). If you're comfortable with the template’s language, go ahead and hit Buy now. Create an account and choose a subscription option. The template will be immediately ready for download once the payment is processed. Now you can complete the form.

Taking care of your legal matters doesn’t have to be pricey or time-consuming. US Legal Forms is here to demonstrate it. Our comprehensive collection of legal forms makes these tasks less pricey and more reasonably priced. Create your first business, arrange your advance care planning, create a real estate contract, or complete the Cuyahoga Miller Trust Forms for Medicaid - all from the comfort of your sofa.

Sign up for US Legal Forms now!