Dallas Texas Miller Trust Forms for Medicaid are legal documents that are specifically designed to help individuals living in Dallas, Texas, meet the income eligibility criteria for Medicaid long-term care benefits. These forms are created to establish a specialized type of trust known as a Miller Trust or Qualified Income Trust (QIT). A Miller Trust is primarily utilized when an individual's income exceeds the limit set by Medicaid. It allows them to restructure their income and redirect a portion of it into a trust, thereby bringing their income within the permissible limit. By doing so, individuals can still qualify for Medicaid assistance, particularly for nursing home care, even if their income is higher than the allowable threshold. There are a few different types of Miller Trust Forms available in Dallas, Texas, depending on the specific needs of the individual. These include: 1. Standard Miller Trust Form: This is the most common type of Miller Trust form used to redirect excess income. It outlines the terms and conditions of the trust, such as how the income will be distributed and managed. 2. Irrevocable Miller Trust Form: This form establishes a trust that cannot be easily modified, amended, or terminated. It provides more control over the trust's assets and protects them from being counted as income for Medicaid eligibility. 3. Revocable Miller Trust Form: Unlike the irrevocable form, this type of Miller Trust allows the granter to modify or revoke it during their lifetime. It provides more flexibility but may have some limitations when it comes to Medicaid eligibility. 4. Supplemental Services Miller Trust Form: This form is designed specifically for individuals who require Medicaid to cover additional services beyond nursing home care. It allows the individual to allocate a certain portion of their income specifically for these supplemental services. When individuals need to create a Dallas Texas Miller Trust Form for Medicaid, it is crucial to consult an attorney or a professional well-versed in Medicaid laws and regulations. These experts can provide personalized guidance by assessing individual financial circumstances and drafting the appropriate Miller Trust form that conforms to the specific requirements set forth by the Texas Medicaid program. Navigating the complexities of Medicaid eligibility can be challenging, especially for those living in Dallas, Texas. Miller Trust forms offer a legal solution to meet the income requirements while still receiving essential Medicaid benefits. By understanding the different types of Miller Trust forms available and seeking expert guidance, individuals can successfully establish a trust that optimizes their chances of qualifying for Medicaid assistance.

Dallas Texas Miller Trust Forms for Medicaid

Description

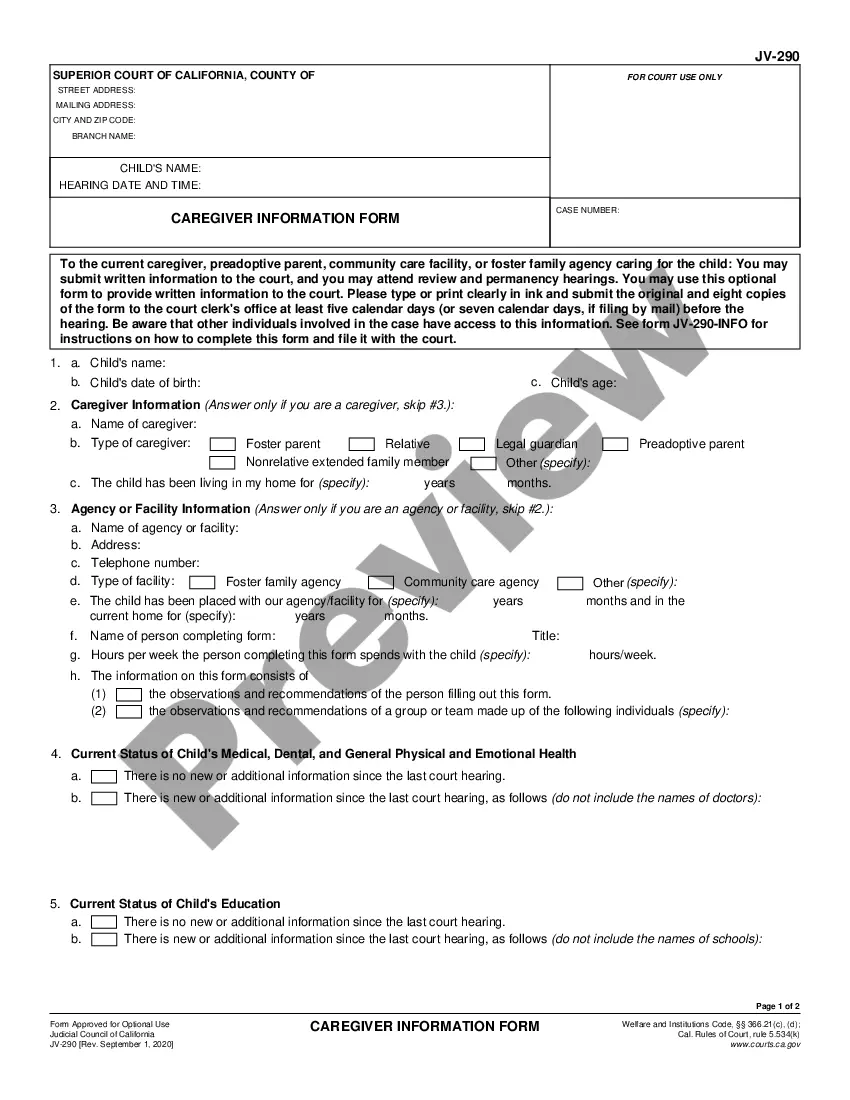

How to fill out Dallas Texas Miller Trust Forms For Medicaid?

Creating legal forms is a must in today's world. However, you don't always need to seek professional help to draft some of them from the ground up, including Dallas Miller Trust Forms for Medicaid, with a service like US Legal Forms.

US Legal Forms has more than 85,000 templates to select from in various types ranging from living wills to real estate papers to divorce documents. All forms are arranged according to their valid state, making the searching experience less frustrating. You can also find information materials and guides on the website to make any activities related to paperwork execution simple.

Here's how you can purchase and download Dallas Miller Trust Forms for Medicaid.

- Take a look at the document's preview and description (if available) to get a general idea of what you’ll get after getting the document.

- Ensure that the template of your choosing is adapted to your state/county/area since state laws can impact the validity of some records.

- Check the similar forms or start the search over to find the right file.

- Hit Buy now and create your account. If you already have an existing one, choose to log in.

- Pick the option, then a suitable payment method, and buy Dallas Miller Trust Forms for Medicaid.

- Select to save the form template in any available format.

- Go to the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can find the appropriate Dallas Miller Trust Forms for Medicaid, log in to your account, and download it. Of course, our platform can’t replace a lawyer entirely. If you need to deal with an extremely challenging case, we advise using the services of a lawyer to check your form before executing and filing it.

With more than 25 years on the market, US Legal Forms proved to be a go-to provider for various legal forms for millions of users. Join them today and purchase your state-specific paperwork effortlessly!

Form popularity

FAQ

The first step is to hire an attorney to create a Medicaid qualified income trust. You then deposit the Social Security check into the account. This drops the amount of income the state counts against his eligibility. His Social Security income will pay part of his care.

Miller Trusts can be used to pay for a small monthly allowance, Medicare premiums and medical expenses that are not covered by Medicaid. Unlike other types of trusts, there are very few restrictions on who can establish a Miller Trust to qualify for government benefits.

A Qualified Income Trust (QIT), also known as a Miller Trust, is a special legal arrangement for holding a person's income. A QIT is a written trust agreement for which the trustee establishes a dedicated bank account.

Miller Trusts, also called Qualified Income Trusts, provide a way for Medicaid applicants who have income over Medicaid's limit to become eligible for Medicaid long term care. In short, income over Medicaid's limit, is put into a trust and therefore not counted as income, thus allowing the applicant to become eligible.

A Miller Trust is specifically designed to qualify an individual for Medicaid benefits by diverting all income into the trust. Income diverted to the trust is not counted as income for purposes of Medicaid eligibility when attempting to qualify for nursing home care. A Miller Trust can only hold the applicant's income.

A basic limitation of Miller Trusts is that only income of the person needing care can go into it. Medicaid's income limit for 2019 is $2,313 per month. If a person has income over the threshold, the only way to become eligible is to set up a Texas Miller Trust.

Upon Death, Assets in a QIT Will be Given to the State Any funds that remain after the state has been reimbursed will be paid to other trust beneficiaries. Normally, all deposited income is spent each month, so most QITs are usually empty at the time of the applicant's death.