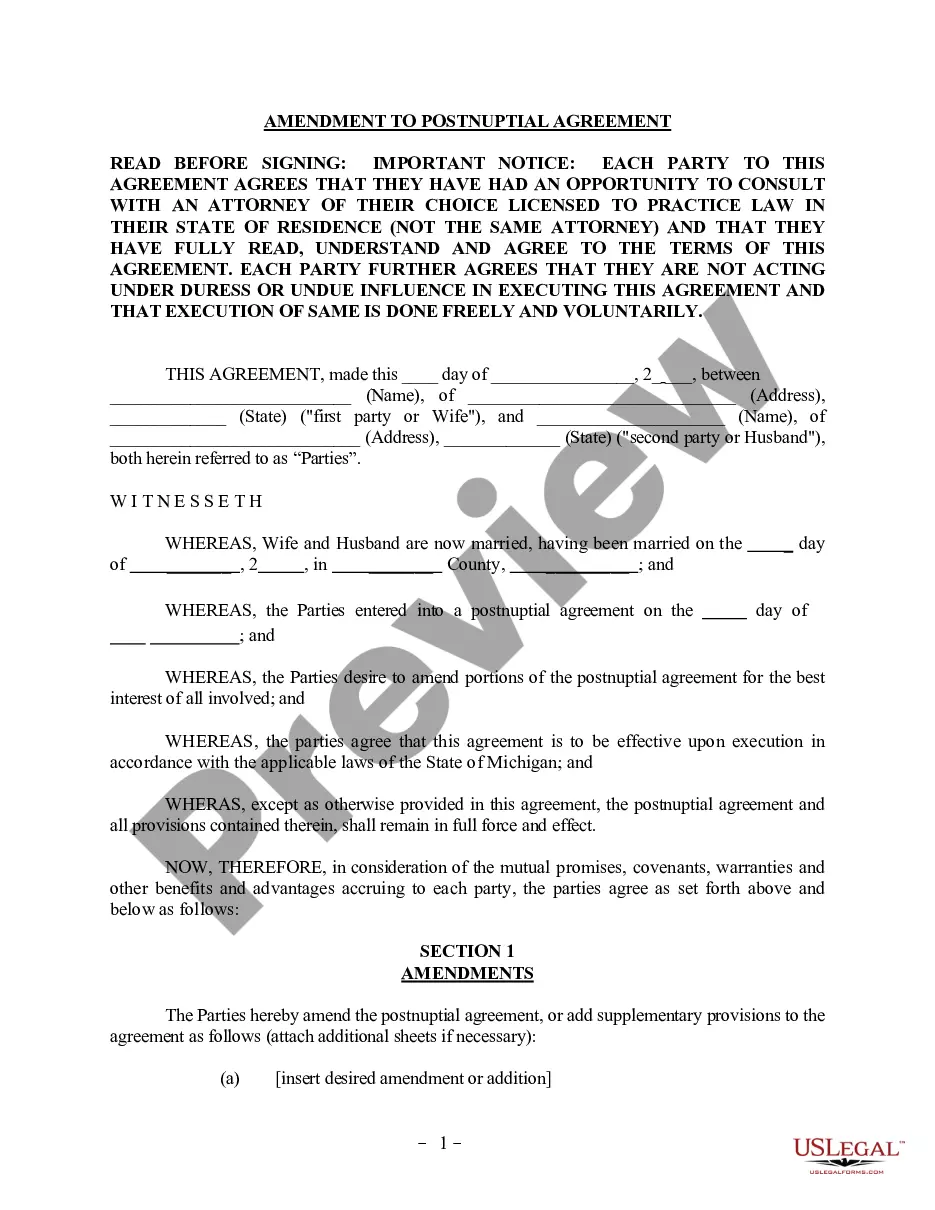

Fulton Georgia Miller Trust Forms for Medicaid are legal documents used to establish and manage a Miller Trust, also known as a Qualified Income Trust (QIT), in Fulton County, Georgia. This trust is specifically designed to help individuals who have excess income qualify for Medicaid benefits. The primary purpose of a Miller Trust is to provide a way for individuals with income above the Medicaid eligibility limit (often referred to as the income cap) to still receive Medicaid coverage for long-term care services. In Fulton County, Georgia, individuals must have a monthly income below a certain level to be eligible for Medicaid long-term care programs, such as nursing home care or home and community-based services. However, if their income exceeds this limit, establishing a Miller Trust can be a viable solution. There are different types of Fulton Georgia Miller Trust Forms for Medicaid, depending on the specific circumstances of the individual. These typically include: 1. Fulton Georgia Miller Trust Application Form: This form is used to start the process of establishing a Miller Trust for Medicaid purposes. It requires detailed information about the applicant's income, assets, and other financial details. 2. Fulton Georgia Miller Trust Agreement Form: Once approved, this form outlines the terms and conditions of the Miller Trust. It establishes the trust as a separate legal entity and specifies how the income will be deposited, managed, and used to pay for the individual's medical expenses. 3. Fulton Georgia Miller Trust Beneficiary Information Form: This form collects personal details about the individual who will benefit from the Miller Trust, such as their name, Social Security number, and Medicaid eligibility information. 4. Fulton Georgia Miller Trust Reporting Forms: These forms are used to report the income deposited into the Miller Trust and document the expenditures made to cover the individual's medical expenses. Regular reporting is necessary to ensure compliance with Medicaid rules and regulations. It is important to consult with an experienced attorney or Medicaid planner when dealing with Fulton Georgia Miller Trust Forms. Medicaid eligibility rules and requirements can be complex, and proper completion of these forms is crucial for a successful Miller Trust arrangement.

Fulton Georgia Miller Trust Forms for Medicaid

Description

How to fill out Fulton Georgia Miller Trust Forms For Medicaid?

Do you need to quickly create a legally-binding Fulton Miller Trust Forms for Medicaid or probably any other document to take control of your personal or corporate matters? You can select one of the two options: hire a professional to draft a legal paper for you or draft it entirely on your own. The good news is, there's an alternative option - US Legal Forms. It will help you get professionally written legal paperwork without having to pay sky-high prices for legal services.

US Legal Forms offers a huge collection of over 85,000 state-specific document templates, including Fulton Miller Trust Forms for Medicaid and form packages. We provide documents for a myriad of life circumstances: from divorce paperwork to real estate documents. We've been on the market for more than 25 years and got a spotless reputation among our customers. Here's how you can become one of them and obtain the needed document without extra hassles.

- First and foremost, double-check if the Fulton Miller Trust Forms for Medicaid is adapted to your state's or county's regulations.

- If the form includes a desciption, make sure to check what it's suitable for.

- Start the search over if the template isn’t what you were hoping to find by using the search bar in the header.

- Choose the subscription that best suits your needs and proceed to the payment.

- Choose the file format you would like to get your form in and download it.

- Print it out, fill it out, and sign on the dotted line.

If you've already set up an account, you can simply log in to it, locate the Fulton Miller Trust Forms for Medicaid template, and download it. To re-download the form, just head to the My Forms tab.

It's effortless to find and download legal forms if you use our services. In addition, the paperwork we provide are reviewed by law professionals, which gives you greater confidence when dealing with legal affairs. Try US Legal Forms now and see for yourself!