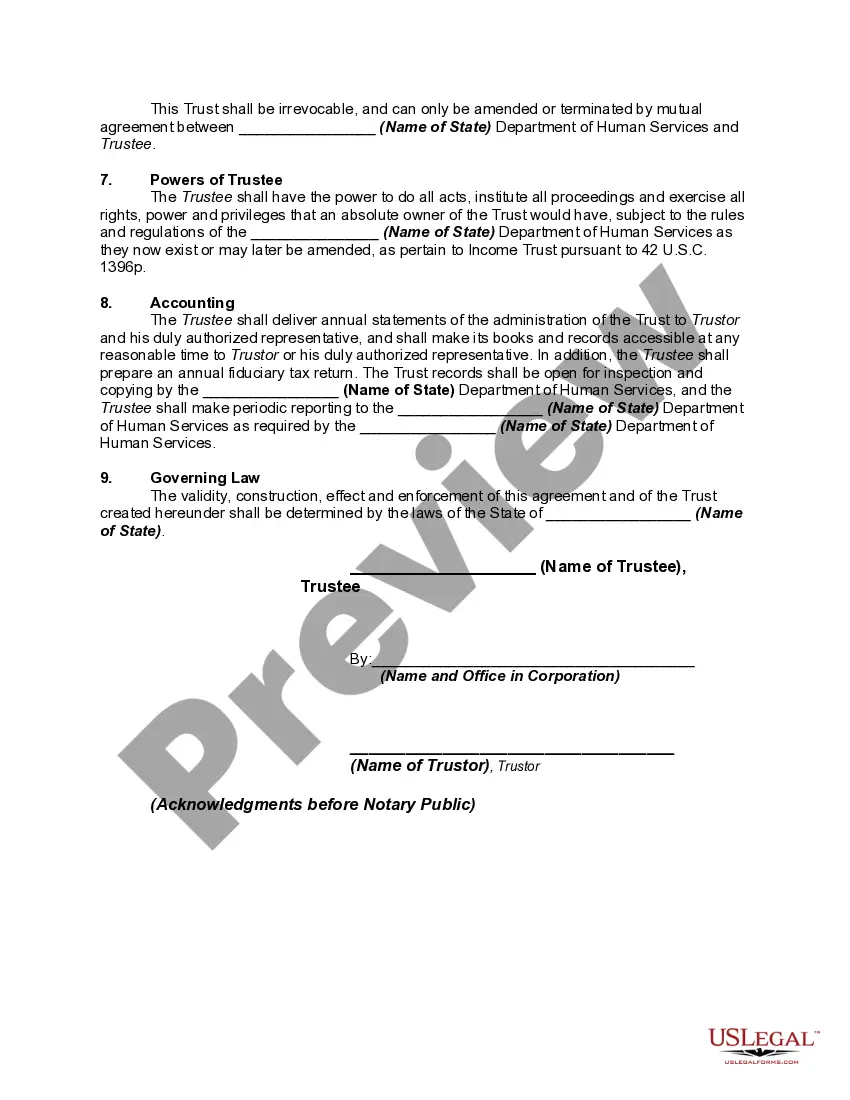

Maricopa Arizona Miller Trust Forms for Medicaid are crucial legal documents designed to help individuals qualify for long-term care assistance through Medicaid while preserving their income. Miller trusts, also known as Qualified Income Trusts (Its), are a specific type of trust that allows individuals with excess income to become eligible for Medicaid benefits. In Maricopa, Arizona, there are several types of Miller Trust Forms tailored to specific needs and requirements: 1. Irrevocable Miller Trust Form: This is the most common form of Miller Trust used in Maricopa, Arizona, where the trust creator transfers their excess income into an irrevocable trust. The funds in this trust are used to pay for long-term care expenses, ensuring Medicaid eligibility. 2. Sole Beneficiary Miller Trust Form: In certain cases, the individual may have a spouse or dependent child who is the sole beneficiary of the trust. This ensures that the income is used for the well-being and support of the designated beneficiary while making the granter eligible for Medicaid. 3. Medicaid Pooled Income Trust Form: Some individuals may opt for a pooled income trust, where the excess income is deposited along with other Medicaid applicants' income. The trust administrator manages the pooled funds and uses them for the benefit of the granter while maintaining Medicaid eligibility. 4. Miller Trust Amendment Form: As circumstances change or need adjustments, individuals can utilize a Miller Trust Amendment Form to modify or update their existing trust. This form allows individuals to make necessary changes while adhering to Maricopa, Arizona's specific Medicaid rules and regulations. Maricopa Arizona Miller Trust Forms for Medicaid typically require detailed information, including the granter's personal details, income sources, and list of expenses related to healthcare and long-term care. By utilizing these Miller Trust Forms, individuals in Maricopa, Arizona can effectively navigate Medicaid requirements, preserve their income, and receive vital long-term care assistance. It is essential to consult with an experienced attorney specializing in elder law or Medicaid planning to ensure the accurate completion and adherence to all legal requirements when preparing these forms.

Maricopa Arizona Miller Trust Forms for Medicaid

Description

How to fill out Maricopa Arizona Miller Trust Forms For Medicaid?

Laws and regulations in every sphere differ around the country. If you're not an attorney, it's easy to get lost in countless norms when it comes to drafting legal documents. To avoid expensive legal assistance when preparing the Maricopa Miller Trust Forms for Medicaid, you need a verified template valid for your county. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions online collection of more than 85,000 state-specific legal templates. It's a great solution for specialists and individuals looking for do-it-yourself templates for different life and business scenarios. All the documents can be used many times: once you obtain a sample, it remains accessible in your profile for subsequent use. Thus, when you have an account with a valid subscription, you can just log in and re-download the Maricopa Miller Trust Forms for Medicaid from the My Forms tab.

For new users, it's necessary to make some more steps to get the Maricopa Miller Trust Forms for Medicaid:

- Take a look at the page content to make sure you found the correct sample.

- Utilize the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your criteria.

- Utilize the Buy Now button to obtain the document once you find the proper one.

- Choose one of the subscription plans and log in or create an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the document in and click Download.

- Fill out and sign the document on paper after printing it or do it all electronically.

That's the simplest and most economical way to get up-to-date templates for any legal reasons. Locate them all in clicks and keep your documentation in order with the US Legal Forms!