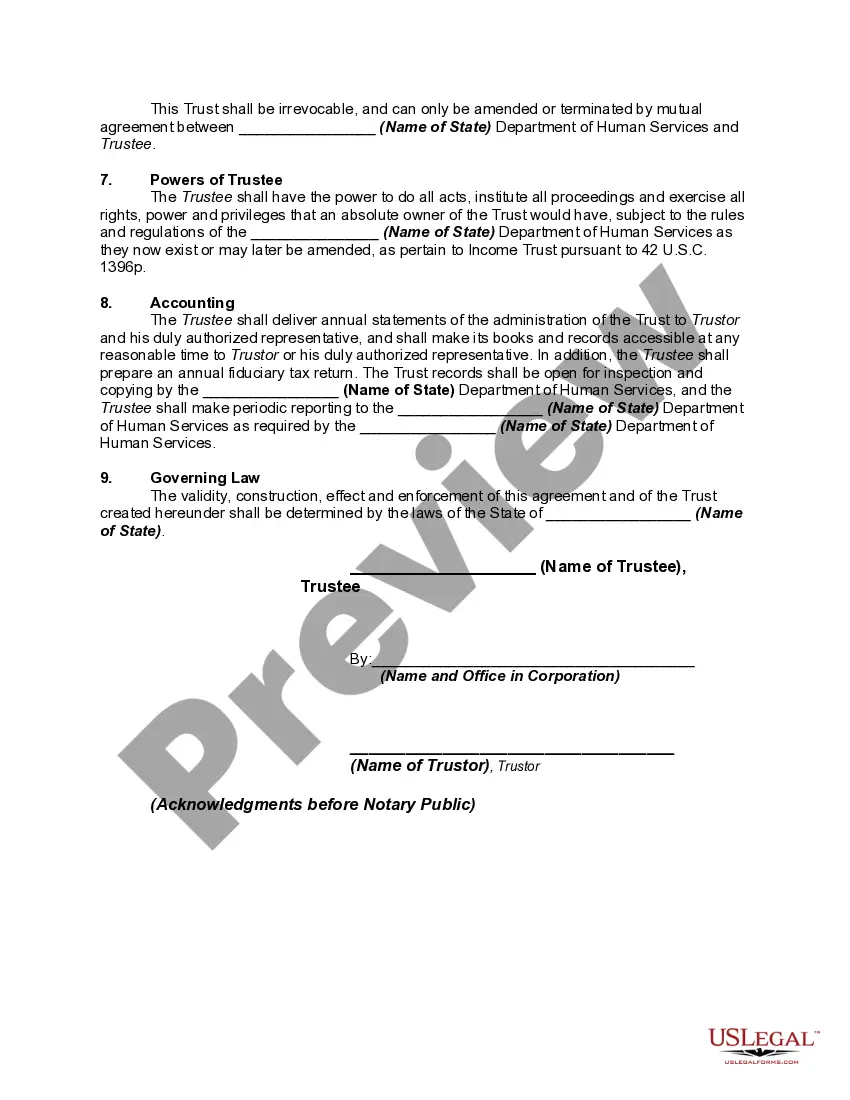

Wayne Michigan Miller Trust Forms for Medicaid are legal documents designed to help individuals who need long-term medical care but have incomes that exceed the maximum allowed to qualify for Medicaid. These forms are specific to Wayne County, Michigan, and are known as Miller Trust Documents or Qualified Income Trust (QIT) Documents. A Wayne Michigan Miller Trust Form is meant to establish a trust account, which allows the excess income of an individual to be placed into the trust, making them eligible for Medicaid. It is important to note that Miller Trusts are only available to individuals who have incomes that exceed the Medicaid income limits set by the state. There are primarily two types of Wayne Michigan Miller Trust Forms for Medicaid: 1. Individual Miller Trust: — This form is used when an individual's income exceeds the Medicaid income limits. — It is appropriate for single Medicaid applicants who are seeking eligibility for long-term care services. — The individual's excess income is deposited into the trust account, which then becomes a permissible expense for qualifying purposes. 2. Spousal Miller Trust: — This form is applicable when the income of a married individual exceeds the Medicaid income limits, but their spouse requires Medicaid-funded long-term care. — The excess income goes into the trust, allowing the spouse in need of care to meet the income threshold for Medicaid eligibility. — It helps prevent the healthy spouse from experiencing financial hardship due to the high cost of medical care. Applying for Medicaid and establishing a Wayne Michigan Miller Trust Form requires careful consideration of state-specific rules and regulations. It is recommended to consult with an elder law attorney or a Medicaid expert to ensure the correct completion of the appropriate Miller Trust Document, as well as compliance with all legal requirements. In conclusion, Wayne Michigan Miller Trust Forms for Medicaid provide a solution for individuals whose income exceeds Medicaid eligibility limits. These forms include Individual Miller Trusts and Spousal Miller Trusts, catering to single Medicaid applicants and married individuals, respectively. Seeking professional assistance is crucial to create the trust correctly and adhere to the necessary legal procedures.

Wayne Michigan Miller Trust Forms for Medicaid

Description

How to fill out Wayne Michigan Miller Trust Forms For Medicaid?

Preparing papers for the business or personal demands is always a huge responsibility. When creating a contract, a public service request, or a power of attorney, it's crucial to take into account all federal and state laws of the specific area. Nevertheless, small counties and even cities also have legislative provisions that you need to consider. All these aspects make it burdensome and time-consuming to draft Wayne Miller Trust Forms for Medicaid without expert help.

It's easy to avoid spending money on lawyers drafting your documentation and create a legally valid Wayne Miller Trust Forms for Medicaid on your own, using the US Legal Forms online library. It is the largest online catalog of state-specific legal documents that are professionally verified, so you can be certain of their validity when picking a sample for your county. Earlier subscribed users only need to log in to their accounts to download the necessary document.

If you still don't have a subscription, adhere to the step-by-step instruction below to get the Wayne Miller Trust Forms for Medicaid:

- Look through the page you've opened and check if it has the sample you require.

- To achieve this, use the form description and preview if these options are presented.

- To locate the one that satisfies your requirements, utilize the search tab in the page header.

- Double-check that the sample complies with juridical criteria and click Buy Now.

- Pick the subscription plan, then log in or register for an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the chosen document in the preferred format, print it, or complete it electronically.

The great thing about the US Legal Forms library is that all the documentation you've ever acquired never gets lost - you can get it in your profile within the My Forms tab at any time. Join the platform and quickly obtain verified legal templates for any situation with just a couple of clicks!