This form is a generic for filing an affidavit that is to be filed with a court. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

San Diego California Affidavit or Proof of Income and Property - Assets and Liabilities

Description

How to fill out Affidavit Or Proof Of Income And Property - Assets And Liabilities?

Legislation and guidelines in every area differ across the nation.

If you're not an attorney, it's simple to become confused by a range of standards when it comes to creating legal documents.

To prevent expensive legal fees when drafting the San Diego Affidavit or Proof of Income and Property - Assets and Liabilities, you require an authenticated template valid for your locality.

That's the easiest and most economical method to obtain current templates for any legal purposes. Locate them all within clicks and maintain your documentation orderly with the US Legal Forms!

- That's where utilizing the US Legal Forms platform proves to be beneficial.

- US Legal Forms is relied upon by millions and features a comprehensive web library of over 85,000 state-specific legal documents.

- It's a fantastic resource for professionals and individuals seeking DIY templates for various personal and business scenarios.

- All the documents can be reused: once you buy a template, it stays available in your account for repeated access.

- Therefore, when you possess an account with an active subscription, you can effortlessly Log In and retrieve the San Diego Affidavit or Proof of Income and Property - Assets and Liabilities from the My documents section.

- For newcomers, there are a few additional steps to acquire the San Diego Affidavit or Proof of Income and Property - Assets and Liabilities.

- Review the page content to ensure you have found the correct sample.

- Use the Preview feature or check the form description if one is provided.

Form popularity

FAQ

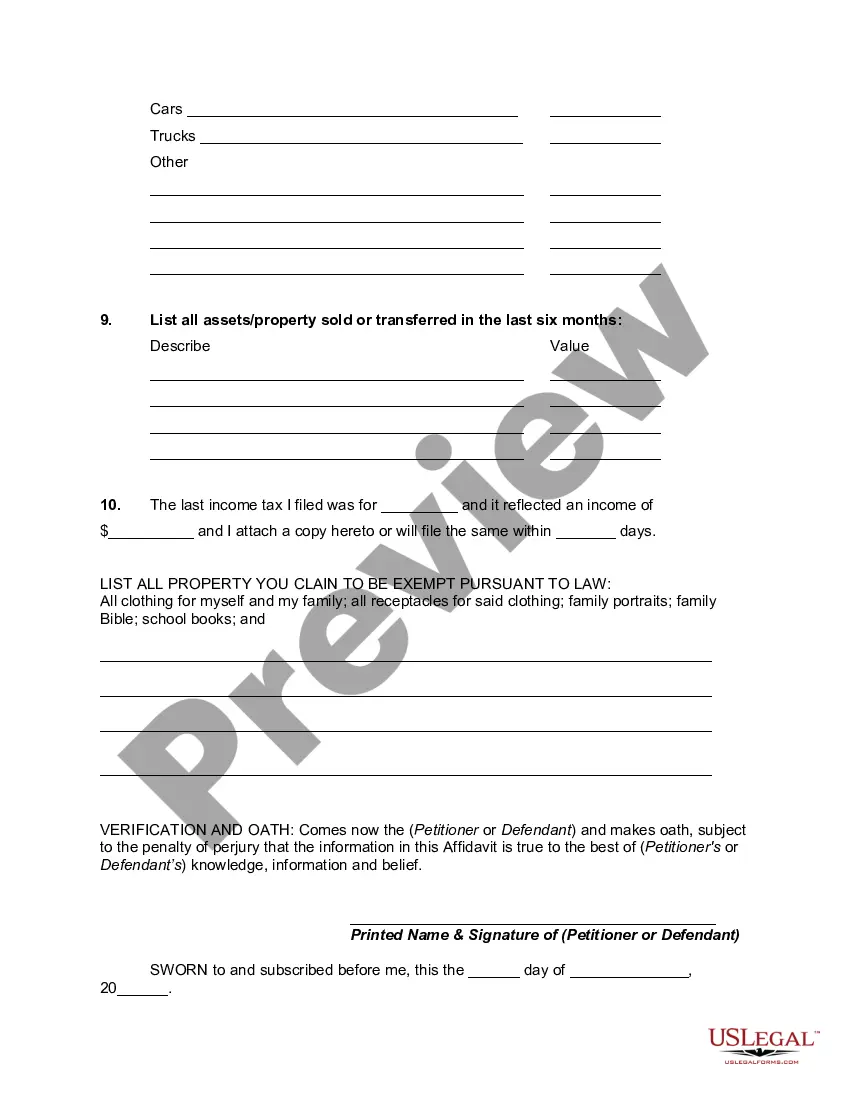

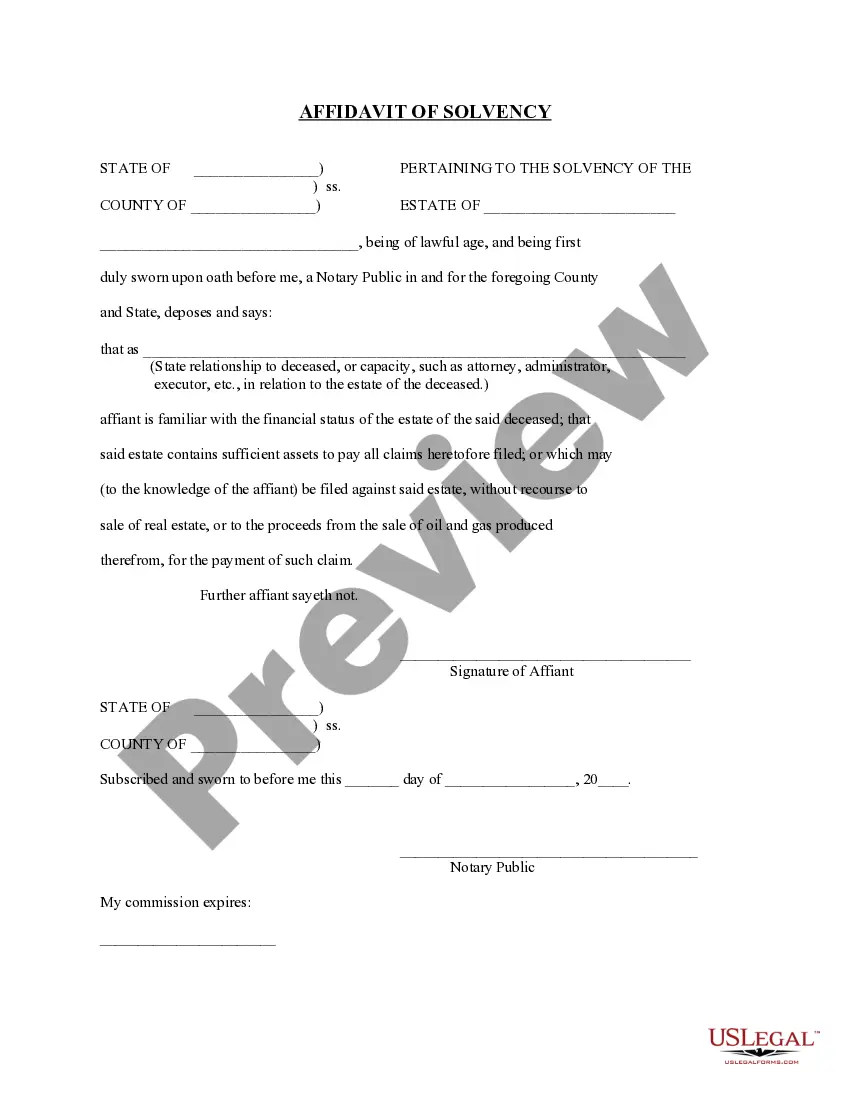

A financial affidavit is like getting on the stand and testifying. You are swearing to the court that you're telling the truth. If a lie is uncovered, it is technically perjury, so if it's a big enough lie or you're belligerent about it, you could be charged with perjury and face sanctions including criminal charges.

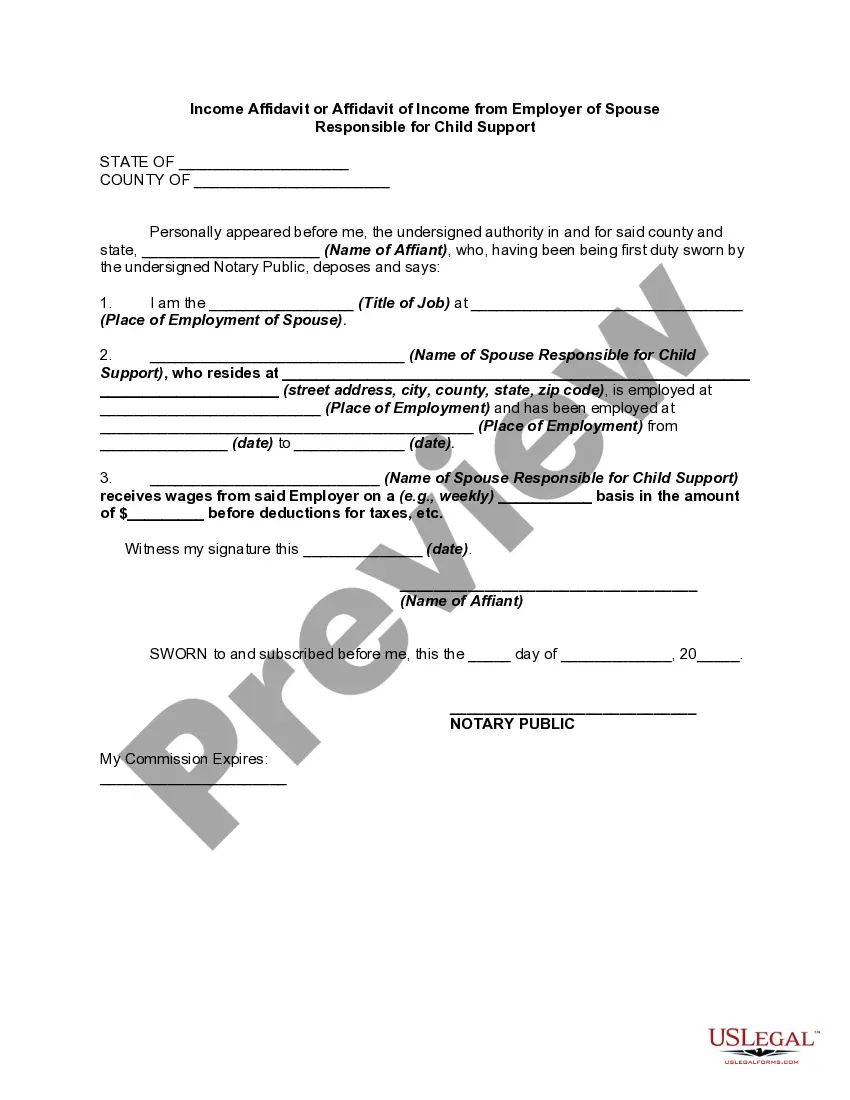

Income and Expenses Declarations (form FL-150) are probably the most important document filed in relation to child and spousal support proceedings. It is the parties' way to show the court their income. For this reason, it is vital that the Income and Expense Declarations are complete and properly filled out.

In concept, a financial affidavit is a simple document. It is a sworn statement of your income, expenses, assets and liabilities. The form for the affidavit is prescribed by the Florida Supreme Court. Both parties must file and serve a financial affidavit in a divorce case.

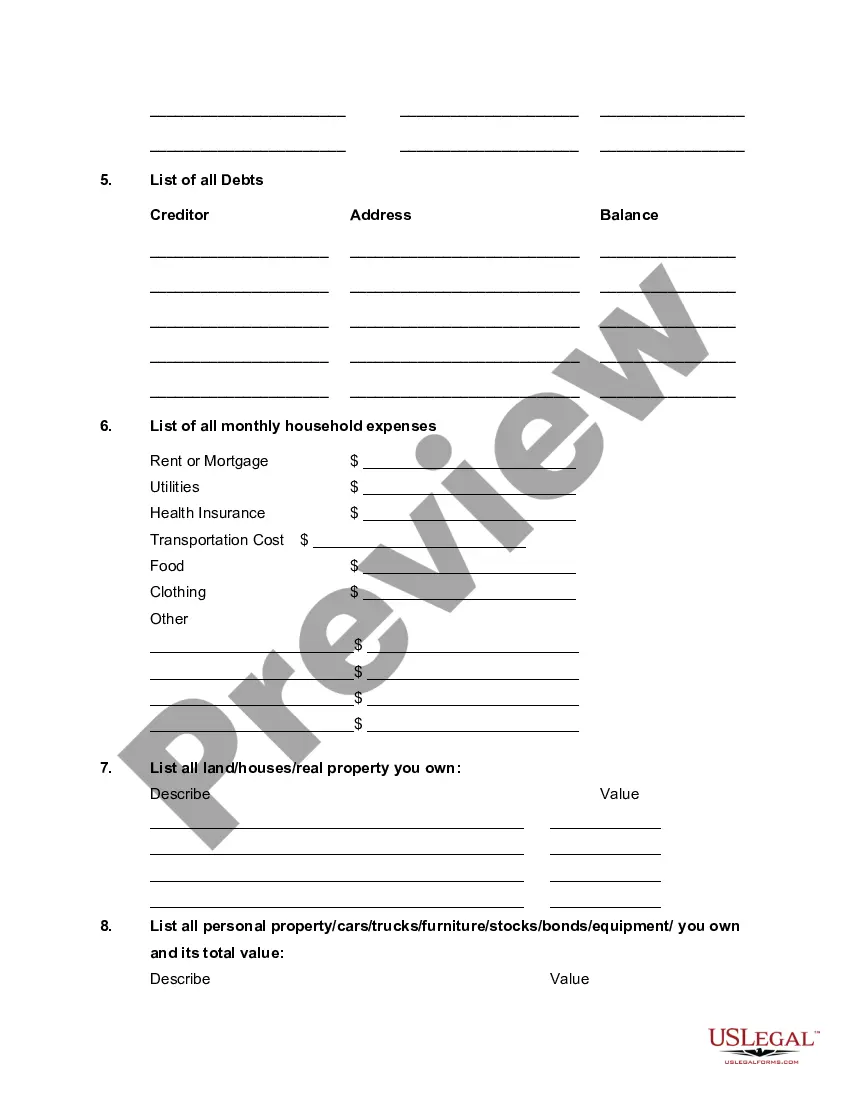

Filling Out and Filing a Financial Affidavit Short Form - YouTube YouTube Start of suggested clip End of suggested clip And child support the financial affidavit requires you to list your income expenses debts and assetsMoreAnd child support the financial affidavit requires you to list your income expenses debts and assets on a weekly basis. If your income or expenses are on some other basis. Such as monthly or yearly.

The Income and Expense Declaration (FL-150) is one of, if not the most important document during the pendency of a family law matter. The Income and Expense Declaration is important since it is used for a variety of financial issues in a family law case.

How to fill out the California Income and Expense Declaration FL-150 YouTube Start of suggested clip End of suggested clip Yourself down and once you've had the opportunity to review this video let's fill it out. Online.MoreYourself down and once you've had the opportunity to review this video let's fill it out. Online. Website is going to take you back to PDF filler once again you'll fill in your name.

A financial affidavit is a statement of a party's income, expenses, assets, and liabilities.

A majority of Florida family law courts require both litigants to complete a financial affidavit.

As with all divorce-related documents, it is important that you complete your Income and Expense Declaration (FL-150) as completely and as accurately as possible. These tips are designed to help you with the process. You'll want to make sure you have the necessary information at hand before you start.