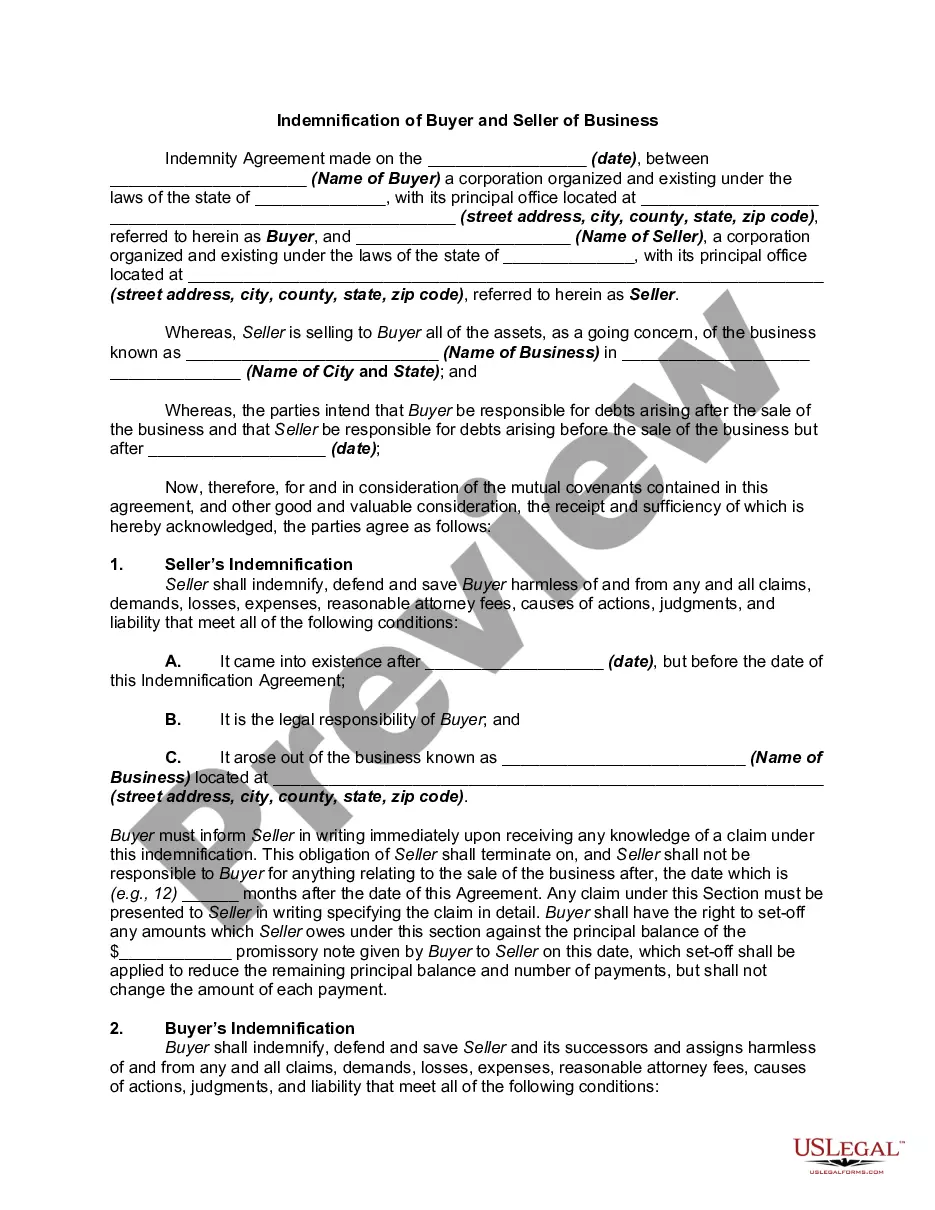

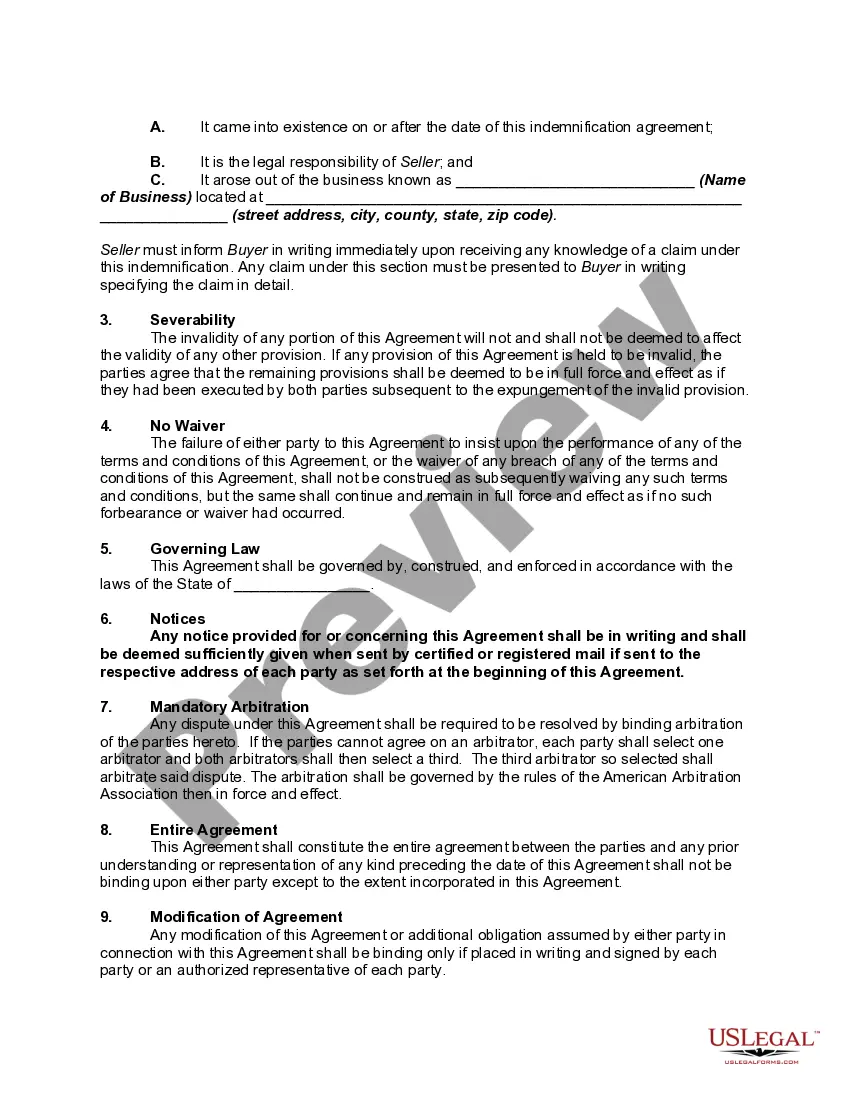

Cook Illinois Indemnification of Buyer and Seller of Business is a legal provision that aims to protect both parties involved in a business acquisition or sale. It establishes certain rights and responsibilities regarding financial compensation for any potential losses, damages, or liabilities that may arise from the transaction. Under the Cook Illinois Indemnification of Buyer and Seller of Business, there are primarily two types of indemnification: 1. Buyer Indemnification: This type of indemnification provides protection to the buyer of a business. It ensures that the buyer is compensated if any undisclosed liabilities, claims, or legal issues associated with the acquired business arise after the completion of the transaction. The buyer may seek indemnification from the seller in such cases. 2. Seller Indemnification: Conversely, seller indemnification protects the seller of a business. It ensures that the seller is not liable for any losses, claims, or liabilities that might arise after the sale of the business. The buyer may seek indemnification from the seller if any undisclosed issues emerge, especially if they were unknown or concealed at the time of the sale. To fully understand the Cook Illinois Indemnification of Buyer and Seller of Business, it's crucial to be familiar with its key components and implications: 1. Indemnification Agreement: Both the buyer and seller need to enter into an indemnification agreement that outlines the terms and conditions of indemnification. The agreement should clearly state the scope of indemnification, time limits for pursuing claims, and the procedures for resolving disputes. 2. Financial Compensation: Indemnification typically involves the reimbursement of financial losses. The agreement should specify the criteria for determining the amount of compensation, such as the valuation method used or the maximum liability of the indemnifying party. 3. Disclosures and Representations: The indemnification provision often relies on the accuracy and completeness of the information provided by the seller during the due diligence process. Sellers are usually required to disclose all known liabilities or risks associated with the business, while buyers are expected to thoroughly review and verify these disclosures. 4. Survival Period: The indemnification clause should specify a survival period, which indicates the duration for which the buyer may seek indemnification after the transaction's completion. Typically, this period ranges from several months to a few years. 5. Legal Remedies and Dispute Resolution: In case of disputes regarding indemnification claims, the agreement should outline the preferred method for resolving disagreements. It may require mediation or arbitration before resorting to litigation. Cook Illinois Indemnification of Buyer and Seller of Business is critical for mitigating risks associated with business acquisitions and sales. It provides a legal framework to protect both parties and ensure a fair transfer of ownership. Careful consideration should be given to drafting the indemnification provisions appropriately to safeguard the interests of all parties involved.

Cook Illinois Indemnification of Buyer and Seller of Business

Description

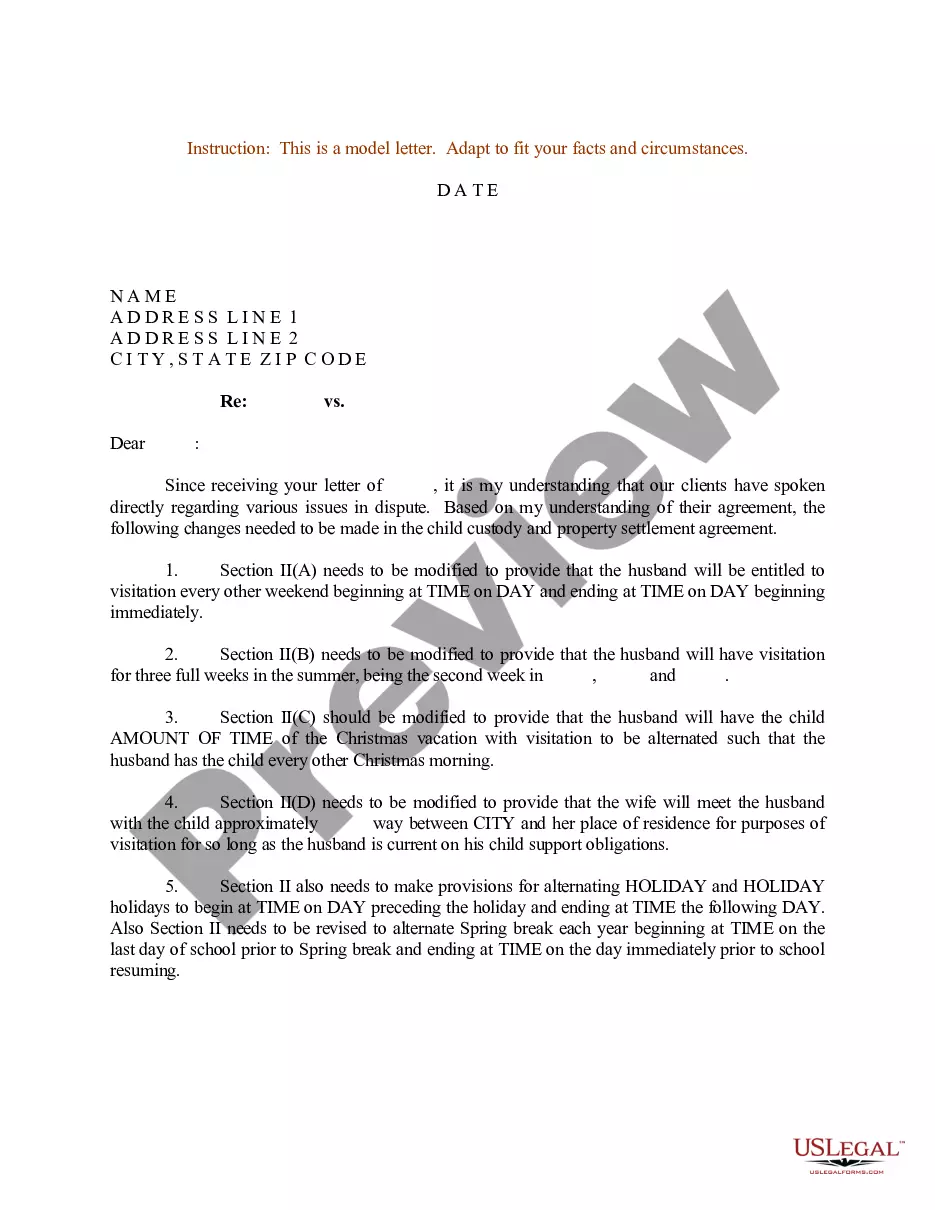

How to fill out Cook Illinois Indemnification Of Buyer And Seller Of Business?

Preparing legal documentation can be burdensome. In addition, if you decide to ask a legal professional to draft a commercial contract, papers for proprietorship transfer, pre-marital agreement, divorce paperwork, or the Cook Indemnification of Buyer and Seller of Business, it may cost you a fortune. So what is the best way to save time and money and create legitimate forms in total compliance with your state and local regulations? US Legal Forms is a perfect solution, whether you're searching for templates for your personal or business needs.

US Legal Forms is biggest online library of state-specific legal documents, providing users with the up-to-date and professionally verified forms for any scenario collected all in one place. Therefore, if you need the recent version of the Cook Indemnification of Buyer and Seller of Business, you can easily find it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample with the Download button. If you haven't subscribed yet, here's how you can get the Cook Indemnification of Buyer and Seller of Business:

- Look through the page and verify there is a sample for your region.

- Check the form description and use the Preview option, if available, to ensure it's the template you need.

- Don't worry if the form doesn't suit your requirements - search for the right one in the header.

- Click Buy Now when you find the needed sample and choose the best suitable subscription.

- Log in or register for an account to purchase your subscription.

- Make a transaction with a credit card or through PayPal.

- Opt for the file format for your Cook Indemnification of Buyer and Seller of Business and download it.

When finished, you can print it out and complete it on paper or upload the samples to an online editor for a faster and more practical fill-out. US Legal Forms allows you to use all the documents ever obtained many times - you can find your templates in the My Forms tab in your profile. Give it a try now!