Keywords: Franklin Ohio, indemnification, buyer, seller, business Title: Understanding Franklin Ohio Indemnification of Buyer and Seller of Business Introduction: Franklin Ohio indemnification laws play a crucial role in protecting the interests of both buyers and sellers in business transactions. This detailed description will explore the concept of indemnification, its importance, and the different types applicable to buyers and sellers in Franklin, Ohio. 1. Definition of Indemnification: Indemnification refers to the legal protection offered to party involved in a business transaction, ensuring that they will be financially compensated for any losses, damages, or liabilities incurred during the course of the deal. 2. Importance of Indemnification: In the context of business transactions, indemnification protects the buyer and seller from potential risks and uncertainties that may arise after the deal is closed. It provides a safety net, ensuring that the financial burden resulting from unforeseen liabilities, such as legal disputes, environmental issues, or undisclosed debts, is appropriately allocated. 3. Indemnification of Buyers: a. Representations and Warranties Indemnification: This type of indemnification primarily focuses on protecting the buyer from breaches of representations and warranties made by the seller during the negotiation and due diligence process. If any misrepresentations occur, the buyer can seek financial compensation for resulting losses. b. Tax Indemnification: In some cases, a buyer may require indemnification related to potential tax liabilities, such as unpaid taxes or underreported income, associated with the business being acquired. 4. Indemnification of Sellers: a. Successor Liability Indemnification: Sellers may seek indemnification for potential liabilities arising after the completion of the business sale, ensuring they are not held responsible for any debts, legal actions, or environmental issues concerning the business they have sold. b. Financial Statement Indemnification: Sellers may request indemnification for any inaccuracies or misrepresentations in the financial statements they provide to the buyer. This protects them from being held liable for losses resulting from financial discrepancies. Conclusion: When engaging in a business sale or acquisition in Franklin, Ohio, understanding the intricacies of indemnification is crucial for both buyers and sellers. By utilizing different types of indemnification, such as representations and warranties indemnification, tax indemnification, successor liability indemnification, or financial statement indemnification, parties can safeguard their financial interests and mitigate potential risks. Comprehending the various indemnification options will help ensure a smoother and more secure transaction for all parties involved.

Franklin Ohio Indemnification of Buyer and Seller of Business

Description

How to fill out Franklin Ohio Indemnification Of Buyer And Seller Of Business?

A document routine always goes along with any legal activity you make. Creating a company, applying or accepting a job offer, transferring property, and many other life situations require you prepare official documentation that varies throughout the country. That's why having it all collected in one place is so helpful.

US Legal Forms is the largest online library of up-to-date federal and state-specific legal templates. Here, you can easily locate and download a document for any individual or business purpose utilized in your region, including the Franklin Indemnification of Buyer and Seller of Business.

Locating forms on the platform is extremely simple. If you already have a subscription to our service, log in to your account, find the sample using the search field, and click Download to save it on your device. Following that, the Franklin Indemnification of Buyer and Seller of Business will be available for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, follow this simple guideline to get the Franklin Indemnification of Buyer and Seller of Business:

- Make sure you have opened the correct page with your localised form.

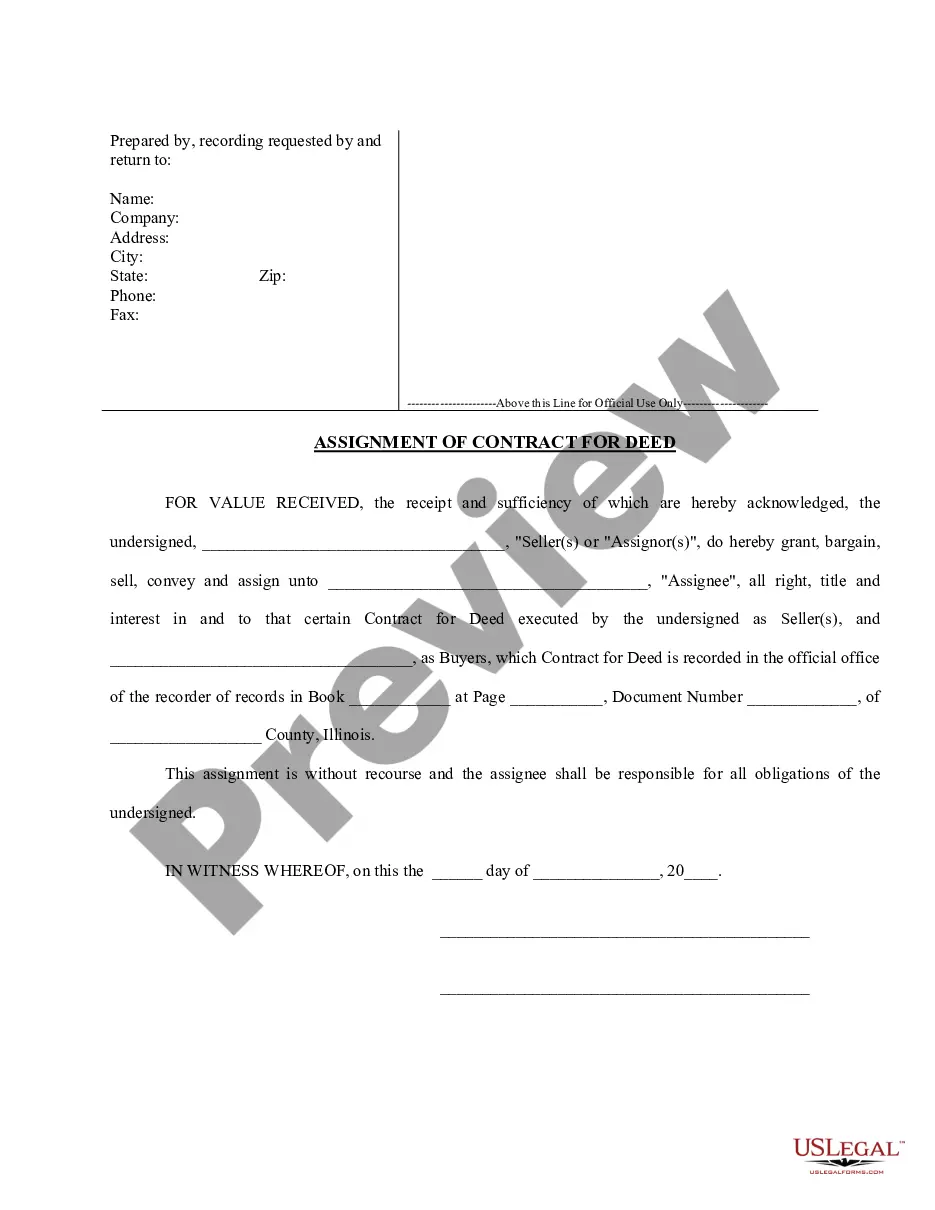

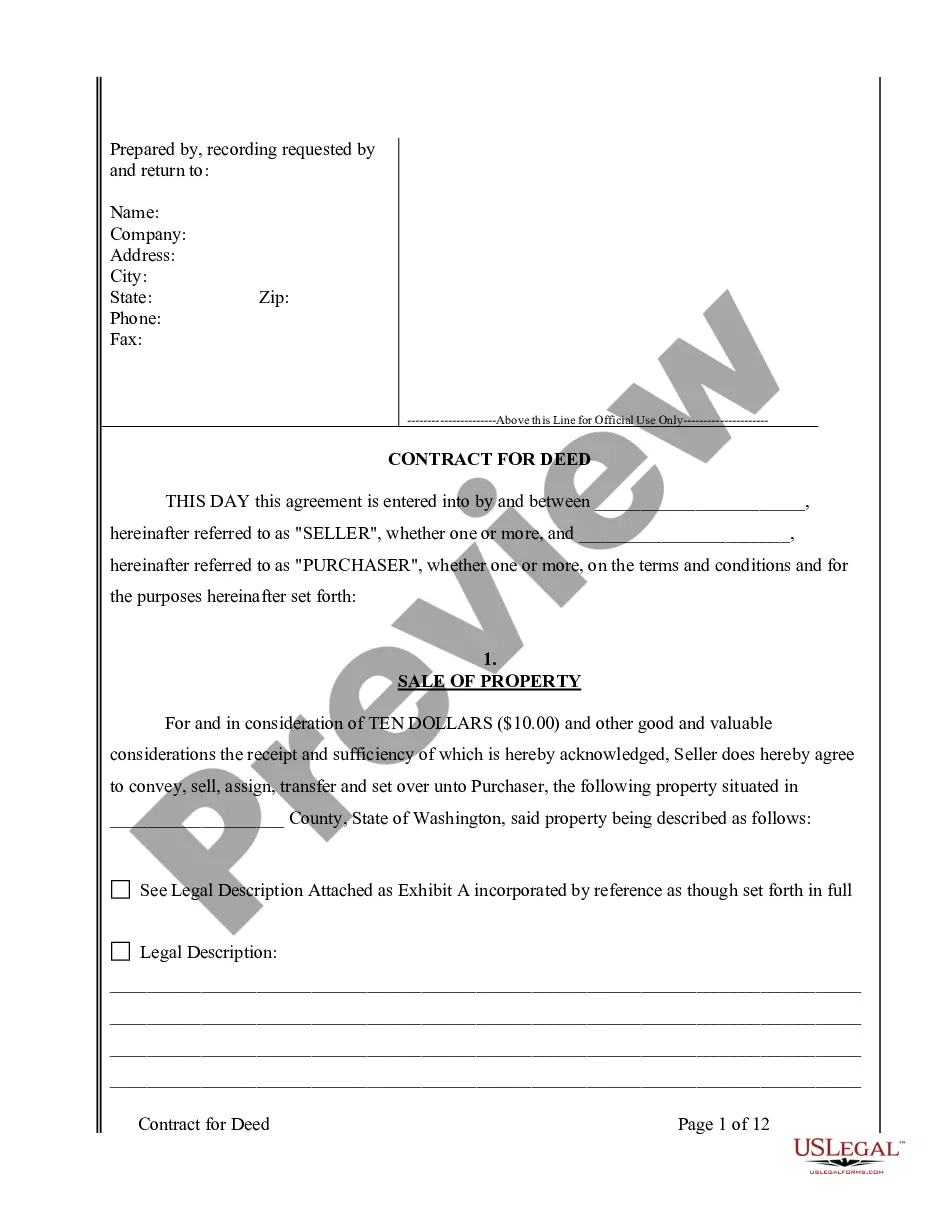

- Utilize the Preview mode (if available) and scroll through the sample.

- Read the description (if any) to ensure the template satisfies your needs.

- Search for another document via the search tab if the sample doesn't fit you.

- Click Buy Now once you locate the necessary template.

- Decide on the appropriate subscription plan, then sign in or create an account.

- Select the preferred payment method (with credit card or PayPal) to continue.

- Opt for file format and save the Franklin Indemnification of Buyer and Seller of Business on your device.

- Use it as needed: print it or fill it out electronically, sign it, and send where requested.

This is the simplest and most trustworthy way to obtain legal documents. All the samples provided by our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs properly with the US Legal Forms!