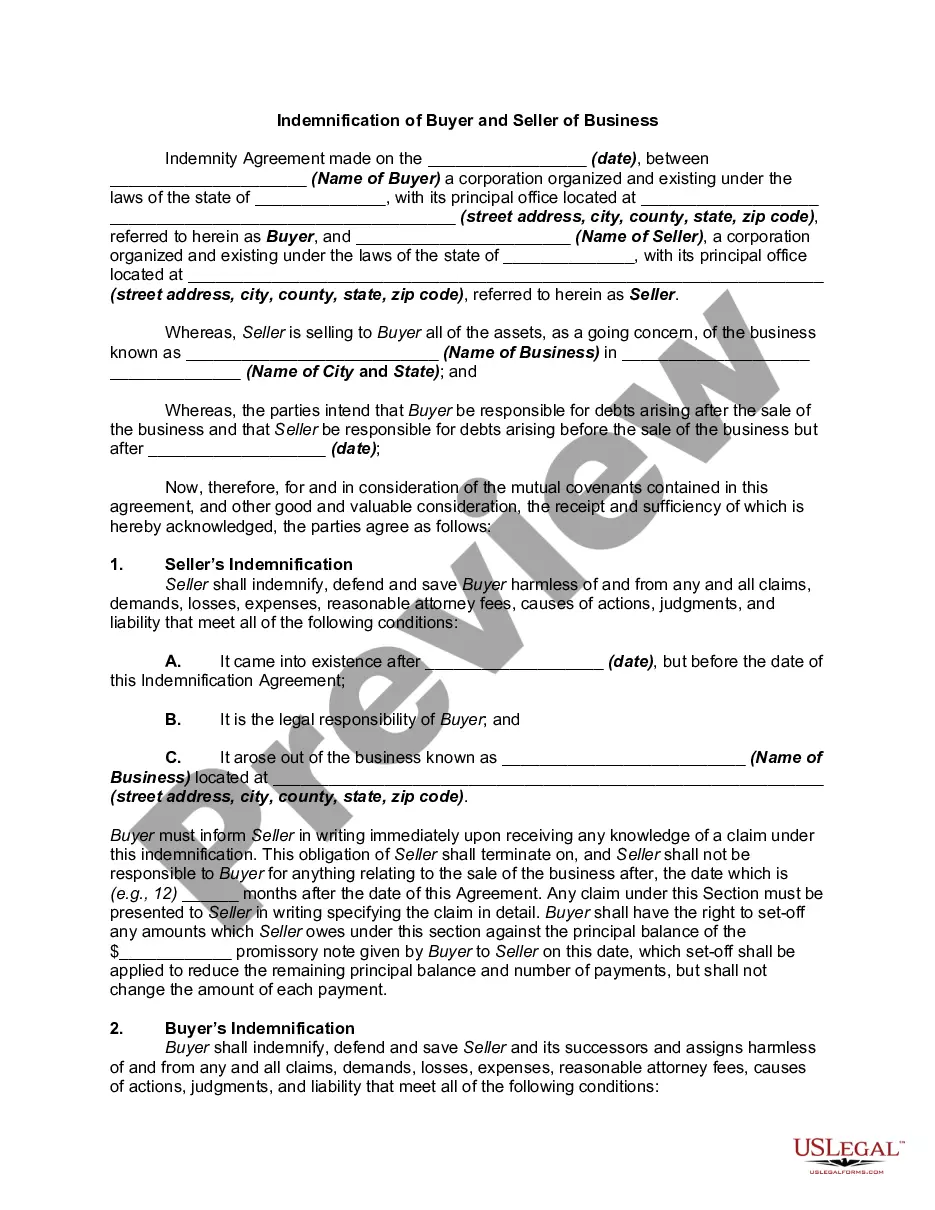

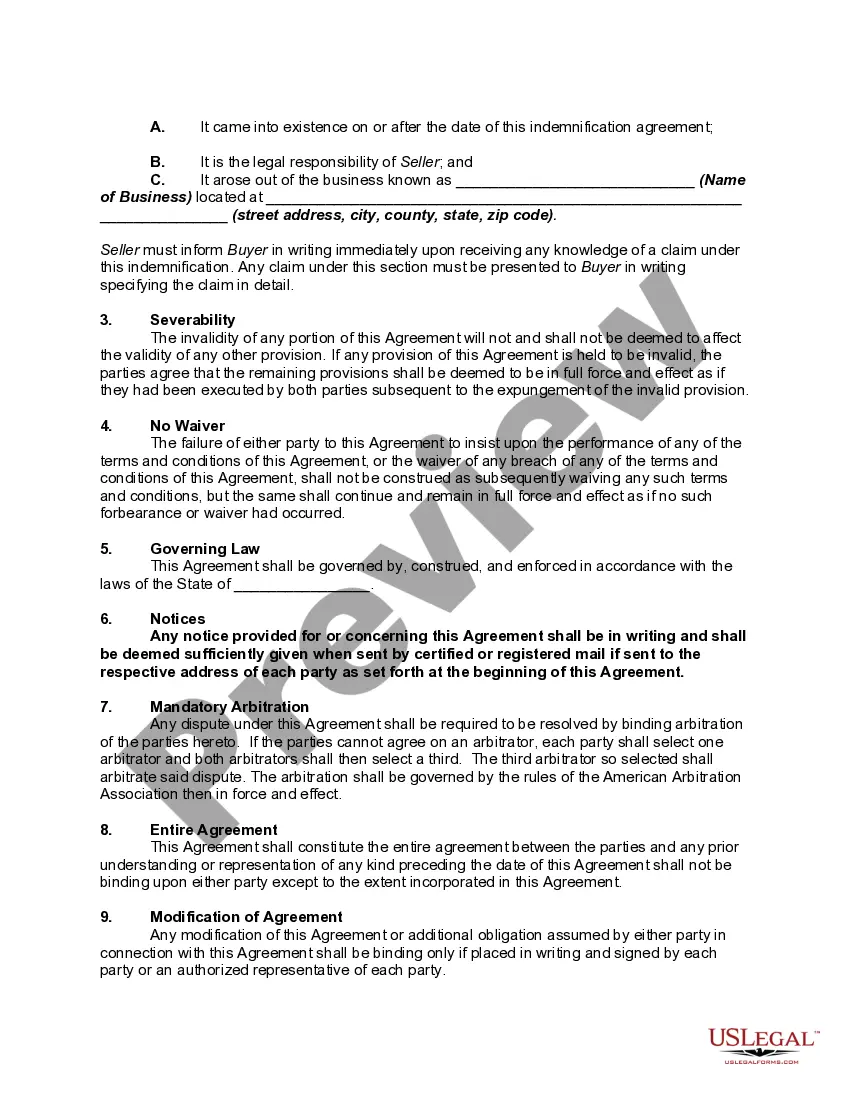

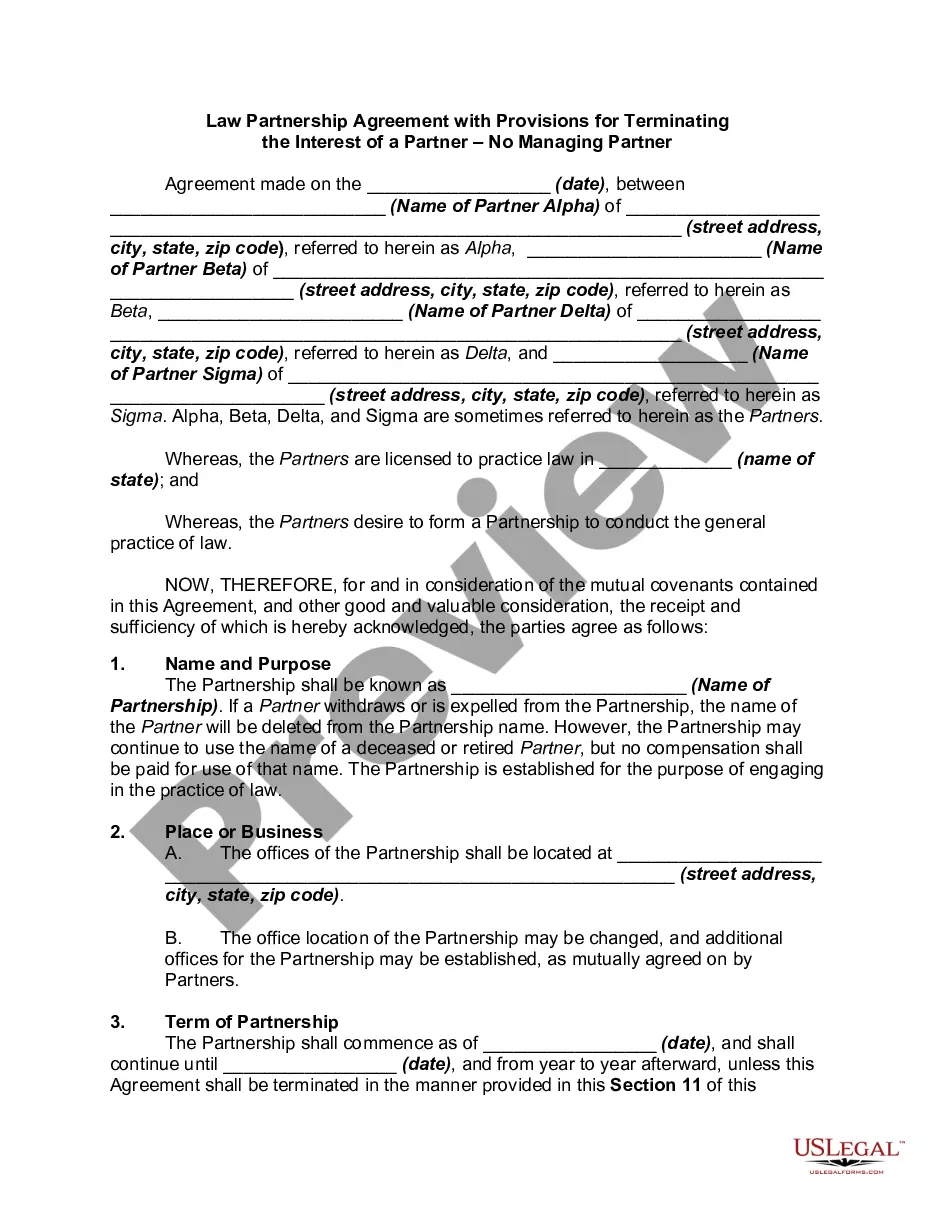

Phoenix, Arizona Indemnification of Buyer and Seller of Business: A Comprehensive Guide Indemnification plays a crucial role in protecting the interests of both buyers and sellers when it comes to business transactions in Phoenix, Arizona. In this detailed description, we will delve into what Phoenix, Arizona indemnification entails, its significance in business deals, and explore different types of indemnification available to parties involved. What are Phoenix, Arizona Indemnification? Indemnification, in the context of buying and selling businesses in Phoenix, Arizona, refers to a legal mechanism used to shift potential liabilities or risks between the buyer and seller. It is a contractual provision aimed at safeguarding against losses, damages, claims, and legal expenses that may arise during or after the transaction. Significance of Indemnification in Business Deals Indemnification provisions are vital components of business sale agreements in Phoenix, Arizona, as they provide clarity on who is responsible for which contingencies and protect both the buyer and seller from unforeseen liabilities. By outlining the scope of indemnification, these agreements ensure that any losses, damages, or legal issues are appropriately addressed. Different Types of Phoenix, Arizona Indemnification: 1. General Indemnification: This is the most common form of indemnification and typically covers losses that occur due to breach of representations and warranties made by the seller regarding the business being sold. It ensures that the buyer is compensated for inaccuracies or undisclosed information. 2. Specific Indemnification: Specific indemnification defines obligations related to specific risks that may be unique to the business being sold. It is often used when the seller retains certain assets or liabilities, and both parties agree on the level of protection required. 3. Time-Limited Indemnification: In some cases, indemnification may have a specific duration, typically post-closing. This ensures that the buyer has a limited period to discover and claim breaches or liabilities, after which the seller is relieved of such obligations. 4. Caps and Baskets: Indemnification provisions may include caps and baskets to limit liability and ensure a fair distribution of financial responsibility. Caps establish a maximum amount that the indemnifying party will be liable for, while baskets establish thresholds that must be exceeded before claims can be made. 5. Escrow Accounts: To provide additional security, parties may agree to set up escrow accounts where a portion of the purchase price is held to cover potential indemnification claims. Funds in these accounts are released according to predetermined conditions or as disputes are settled. It is important to note that the specific types and terms of indemnification may vary depending on the nature and complexity of the transaction, as well as the negotiated agreements between the buyer and seller. In conclusion, Phoenix, Arizona indemnification of buyers and sellers of businesses is a critical aspect of any business transaction. By clearly defining the parties' responsibilities and potential liabilities, indemnification provisions ensure a fair and secure agreement. Understanding the various types of indemnification available allows parties to tailor the terms to their unique needs and protect their interests effectively.

Phoenix Arizona Indemnification of Buyer and Seller of Business

Description

How to fill out Phoenix Arizona Indemnification Of Buyer And Seller Of Business?

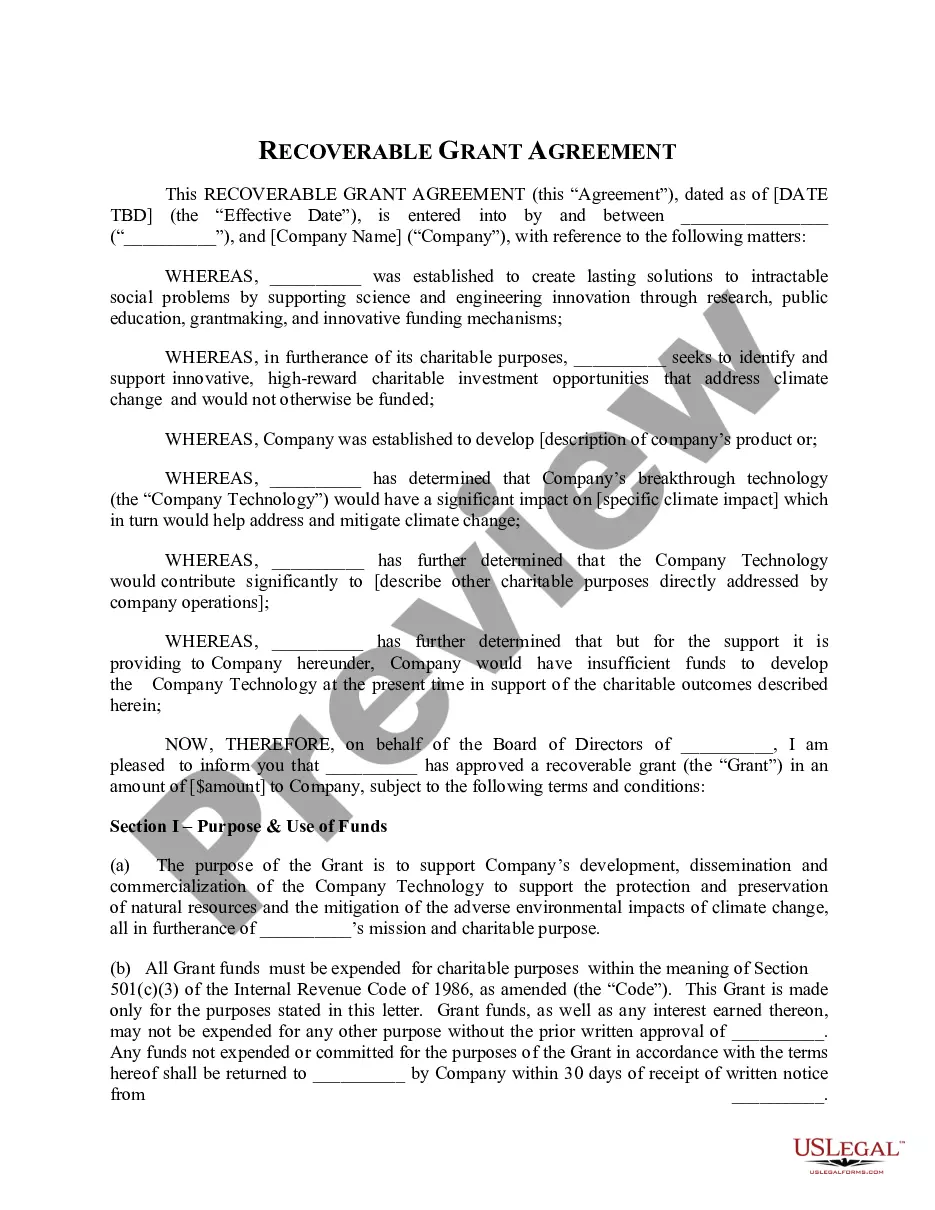

Preparing legal documentation can be burdensome. Besides, if you decide to ask an attorney to draft a commercial contract, documents for ownership transfer, pre-marital agreement, divorce paperwork, or the Phoenix Indemnification of Buyer and Seller of Business, it may cost you a fortune. So what is the best way to save time and money and create legitimate forms in total compliance with your state and local laws? US Legal Forms is a perfect solution, whether you're looking for templates for your individual or business needs.

US Legal Forms is biggest online collection of state-specific legal documents, providing users with the up-to-date and professionally verified templates for any use case accumulated all in one place. Consequently, if you need the latest version of the Phoenix Indemnification of Buyer and Seller of Business, you can easily find it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample by clicking on the Download button. If you haven't subscribed yet, here's how you can get the Phoenix Indemnification of Buyer and Seller of Business:

- Look through the page and verify there is a sample for your region.

- Examine the form description and use the Preview option, if available, to make sure it's the sample you need.

- Don't worry if the form doesn't suit your requirements - look for the correct one in the header.

- Click Buy Now once you find the required sample and pick the best suitable subscription.

- Log in or register for an account to purchase your subscription.

- Make a transaction with a credit card or through PayPal.

- Choose the document format for your Phoenix Indemnification of Buyer and Seller of Business and save it.

When done, you can print it out and complete it on paper or import the samples to an online editor for a faster and more convenient fill-out. US Legal Forms allows you to use all the paperwork ever purchased multiple times - you can find your templates in the My Forms tab in your profile. Give it a try now!

Form popularity

FAQ

?To indemnify? means to compensate someone for his/her harm or loss. In most contracts, an indemnification clause serves to compensate a party for harm or loss arising in connection with the other party's actions or failure to act. The intent is to shift liability away from one party, and on to the indemnifying party.

Indemnification in real estate defines the buyer taking full responsibility for what should be the seller's fault otherwise. For example, you agree to purchase a property with minor flaws caused by the seller. The previous owner might have felled a tree which crashed into the roof.

To indemnify another party is to compensate that party for losses that that party has incurred or will incur as related to a specified incident.

To indemnify means that the seller will reimburse the buyer for a loss or liability. To defend means that the seller will pay the buyer's legal fees for suits that arise from specific risks articulated in the contract.

It basically releases the seller from any liability that may arise due to the buyer's failure to provide true and accurate reps and warranties.

In property insurance, the amount of the indemnity is typically based on the actual cash value of the loss at the time of the loss....Solution: Depreciation = $120,000 × 10/40 = $30,000. Actual Cash Value = $120,000 - $30,000 = $90,000. Amount of Indemnification = $90,000 × 50% = $45,000.

To pay or promise to pay someone an amount of money if they suffer damage or loss: In return for a premium, the underwriter agrees to indemnify the insured against losses covered by the insurance.

An indemnity agreement is a contract that protects one party of a transaction from the risks or liabilities created by the other party of the transaction. Hold harmless agreement, no-fault agreement, release of liability, or waiver of liability are other terms for an indemnity agreement.?

Indemnification is a legal agreement by one party to hold another party blameless ? not liable ? for potential losses or damages. It is similar to a liability waiver but is usually more specific, applicable only to particular items, circumstances, or situations, or in regard to a particular contract.

Indemnification obligations are negotiated to spread risk between the buyer and the seller in a sale transaction. They are commonly used to make the seller responsible for matters that occurred prior to closing and which the buyer does not expressly assume, but they can cover any matter and benefit either party.