San Diego, California, is a vibrant city located on the Pacific coast of the United States. Known for its year-round sunny weather, beautiful beaches, and diverse cultural scene, San Diego is a popular tourist destination and a thriving economic center. When it comes to business transactions in San Diego, such as the buying and selling of businesses, indemnification plays a crucial role in protecting the interests of both the buyer and the seller. Indemnification refers to the process of compensating someone for any losses, damages, or liabilities that may arise from the transaction. In the context of buying a business in San Diego, the buyer may seek indemnification from the seller to ensure that they are protected in case of any undisclosed liabilities, legal claims, or financial burdens that the business may have. This is especially important as the buyer assumes responsibility for the business's operations and any potential legal or financial risks associated with it. On the other hand, the seller may also request indemnification from the buyer to protect themselves from any future claims, costs, or liabilities that may arise due to the buyer's actions or mismanagement of the business after the sale. This is particularly essential when the seller wants to ensure a clean break from the business and eliminate any potential legal entanglements. There are different types of indemnification agreements that can be used in San Diego when buying or selling a business. Some common types include: 1. General Indemnity Agreement: This is a broad agreement that covers a wide range of potential risks or liabilities that may arise from the transaction. It provides comprehensive protection for both the buyer and the seller. 2. Specific Indemnity Agreement: This agreement focuses on specific risks or liabilities that are identified during the due diligence process and requires the indemnifying party to cover any losses or damages related to those specific areas. 3. Contingent Indemnity Agreement: This type of agreement is triggered only if certain specified events or conditions occur in the future. It provides protection for the indemnity if those events or conditions come to pass. 4. Survival Indemnity Agreement: This agreement ensures that the indemnity provisions survive the closing of the sale for a specified period. It allows the buyer or seller to make a claim for indemnification even after the transaction is completed. In summary, indemnification of buyers and sellers of businesses in San Diego, California, is a crucial aspect of protecting parties from potential losses, liabilities, and risks associated with the transaction. By using different types of indemnification agreements, both parties can negotiate terms that provide adequate protection and ensure a smooth transition of ownership.

San Diego California Indemnification of Buyer and Seller of Business

Description

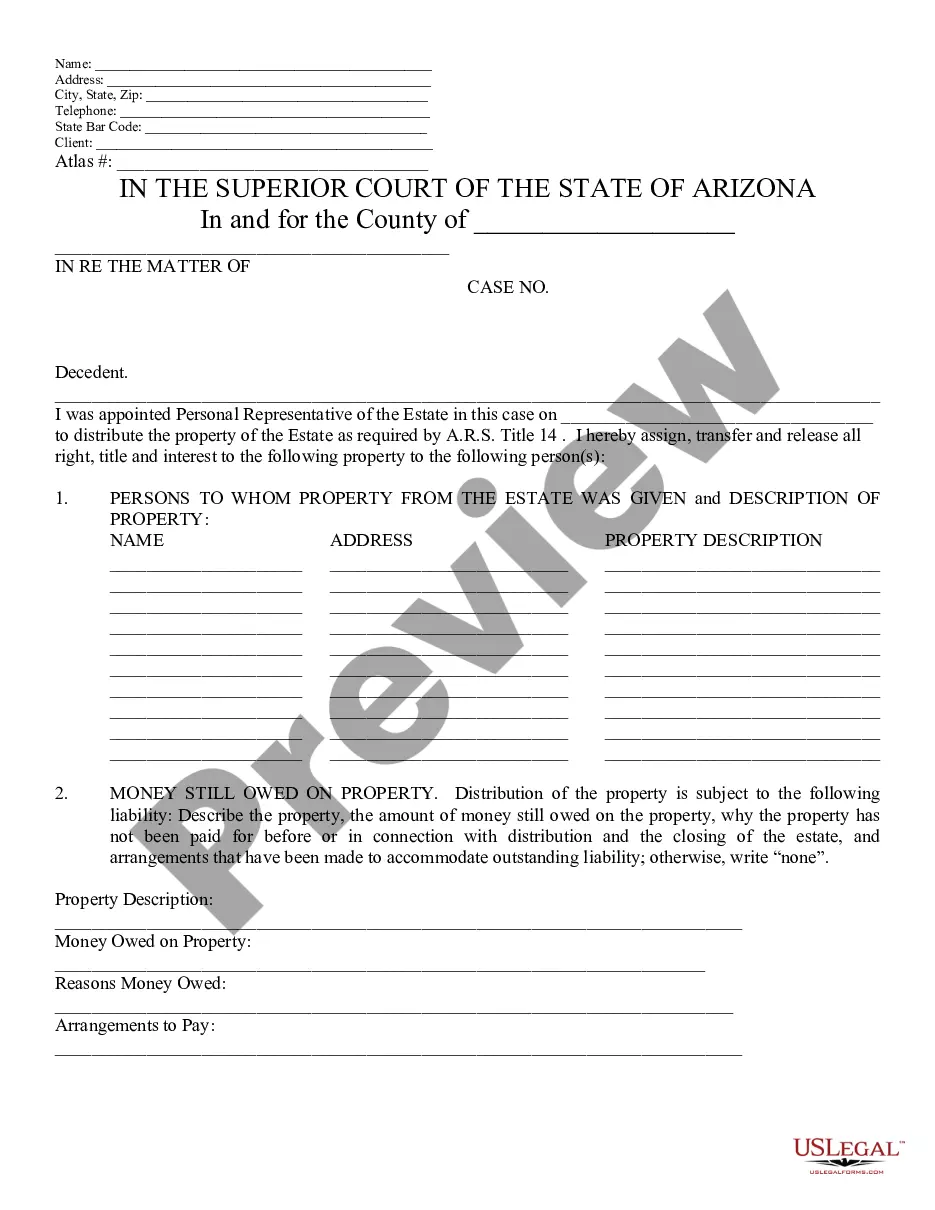

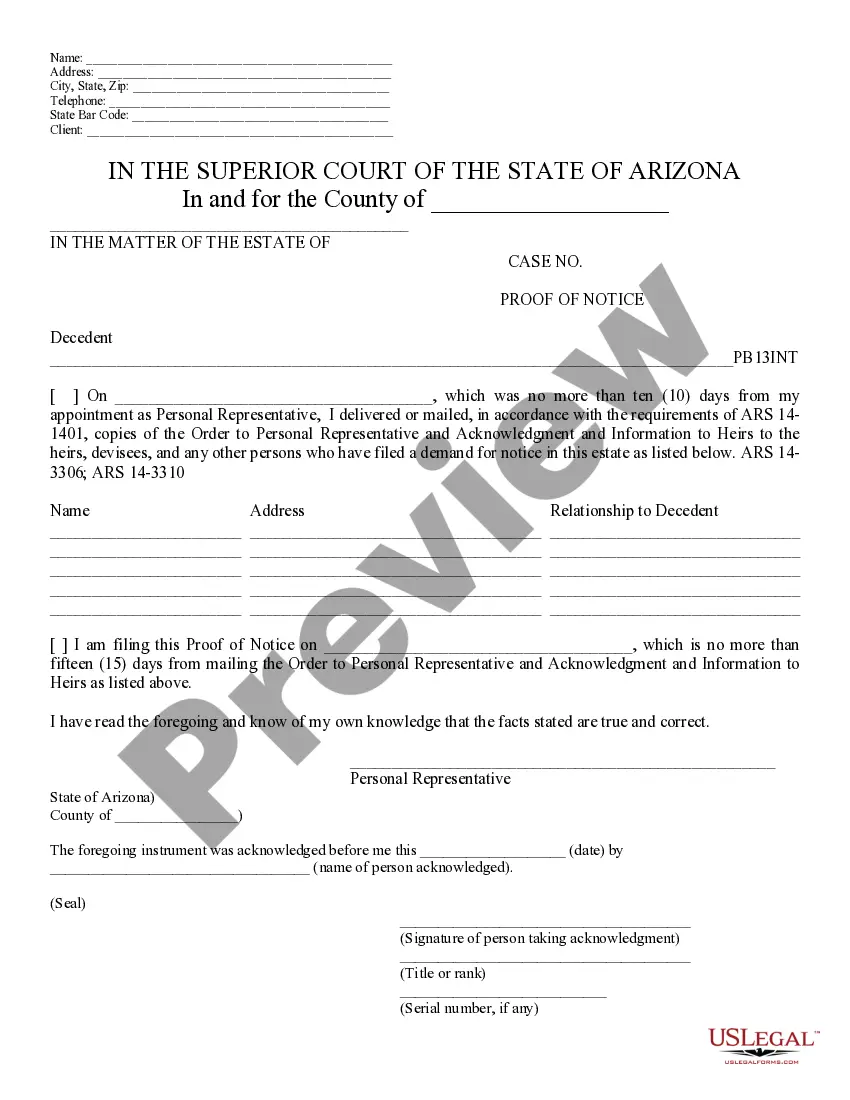

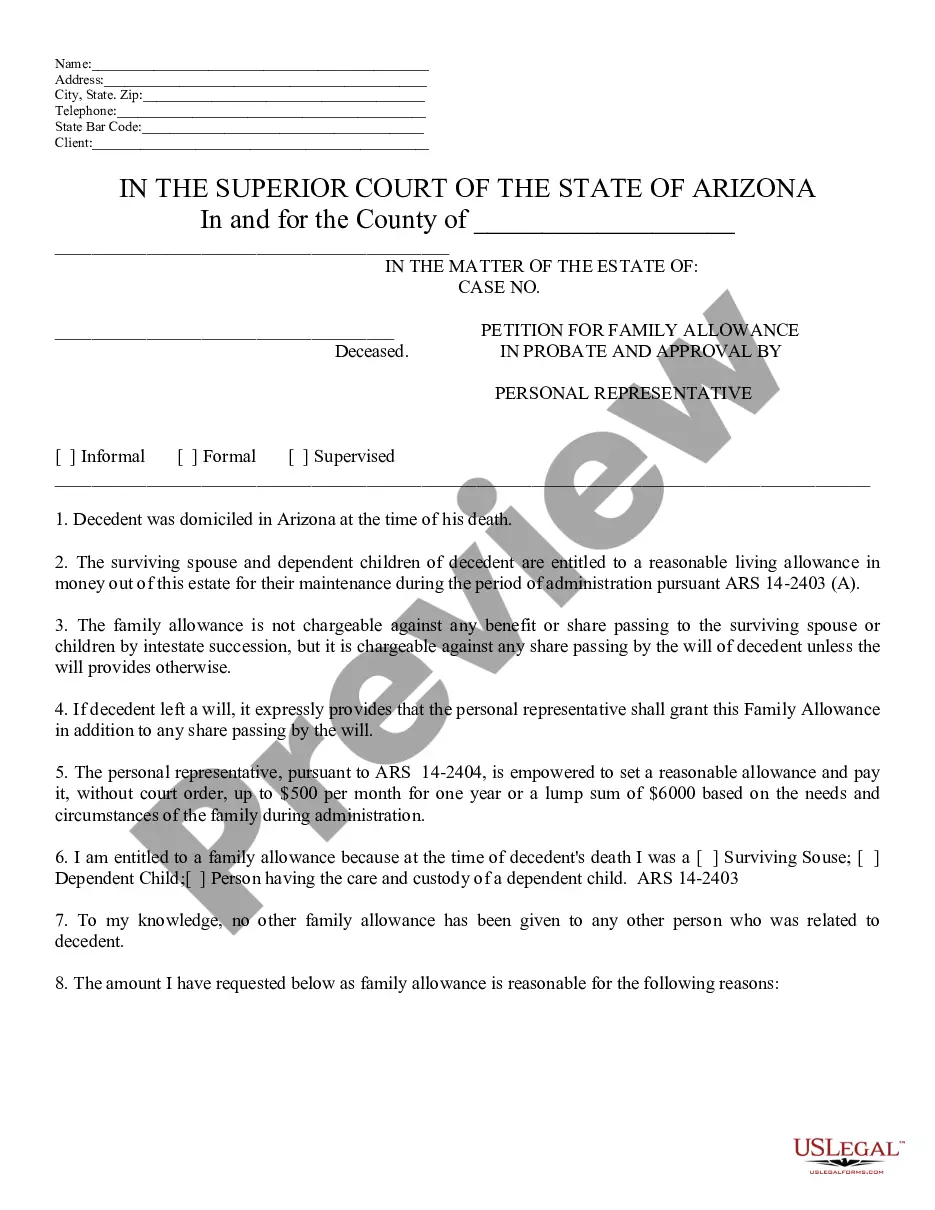

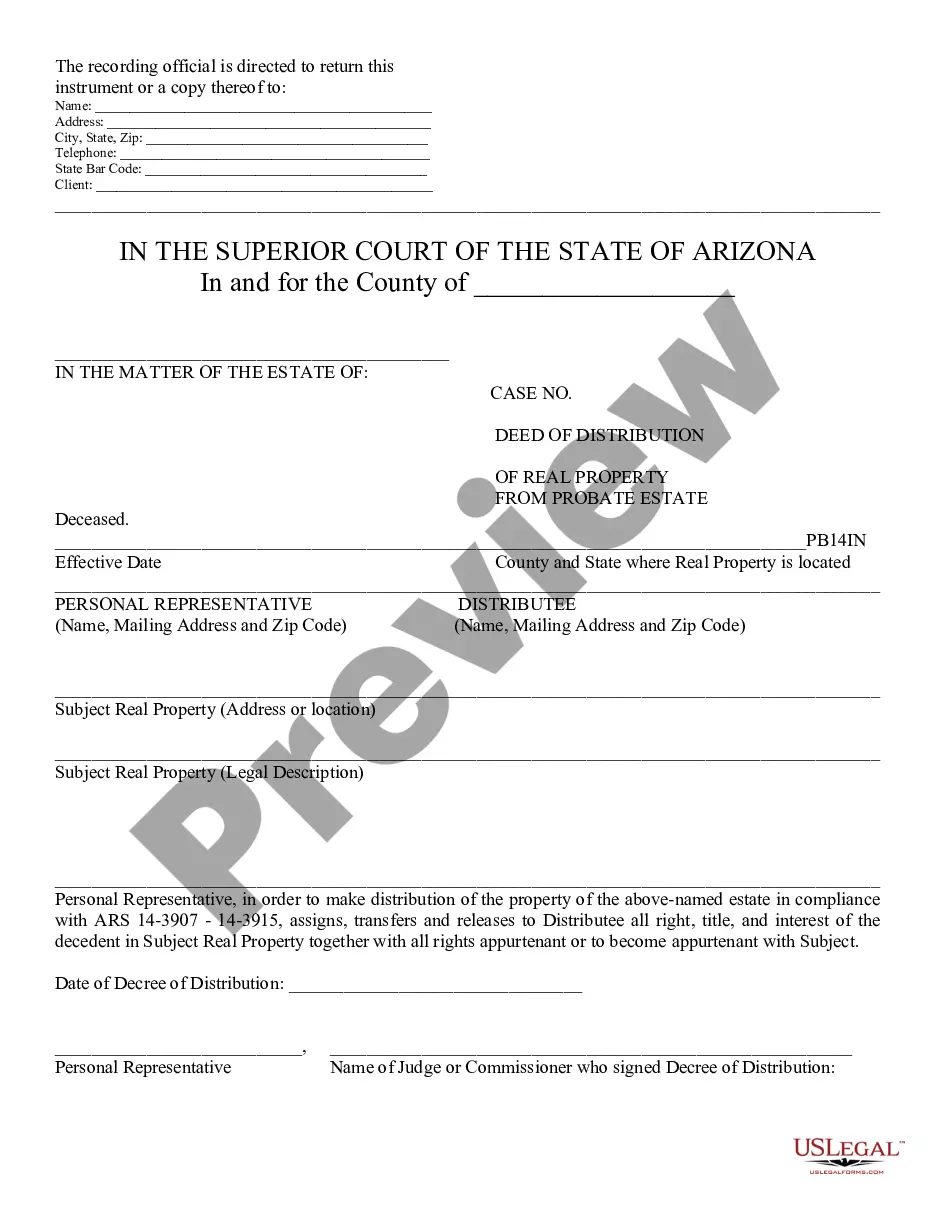

How to fill out San Diego California Indemnification Of Buyer And Seller Of Business?

How much time does it usually take you to create a legal document? Because every state has its laws and regulations for every life situation, finding a San Diego Indemnification of Buyer and Seller of Business suiting all local requirements can be tiring, and ordering it from a professional attorney is often costly. Many web services offer the most popular state-specific templates for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most extensive web catalog of templates, gathered by states and areas of use. In addition to the San Diego Indemnification of Buyer and Seller of Business, here you can find any specific document to run your business or individual affairs, complying with your county requirements. Experts verify all samples for their actuality, so you can be certain to prepare your paperwork correctly.

Using the service is fairly straightforward. If you already have an account on the platform and your subscription is valid, you only need to log in, opt for the required sample, and download it. You can get the file in your profile anytime in the future. Otherwise, if you are new to the website, there will be some extra steps to complete before you obtain your San Diego Indemnification of Buyer and Seller of Business:

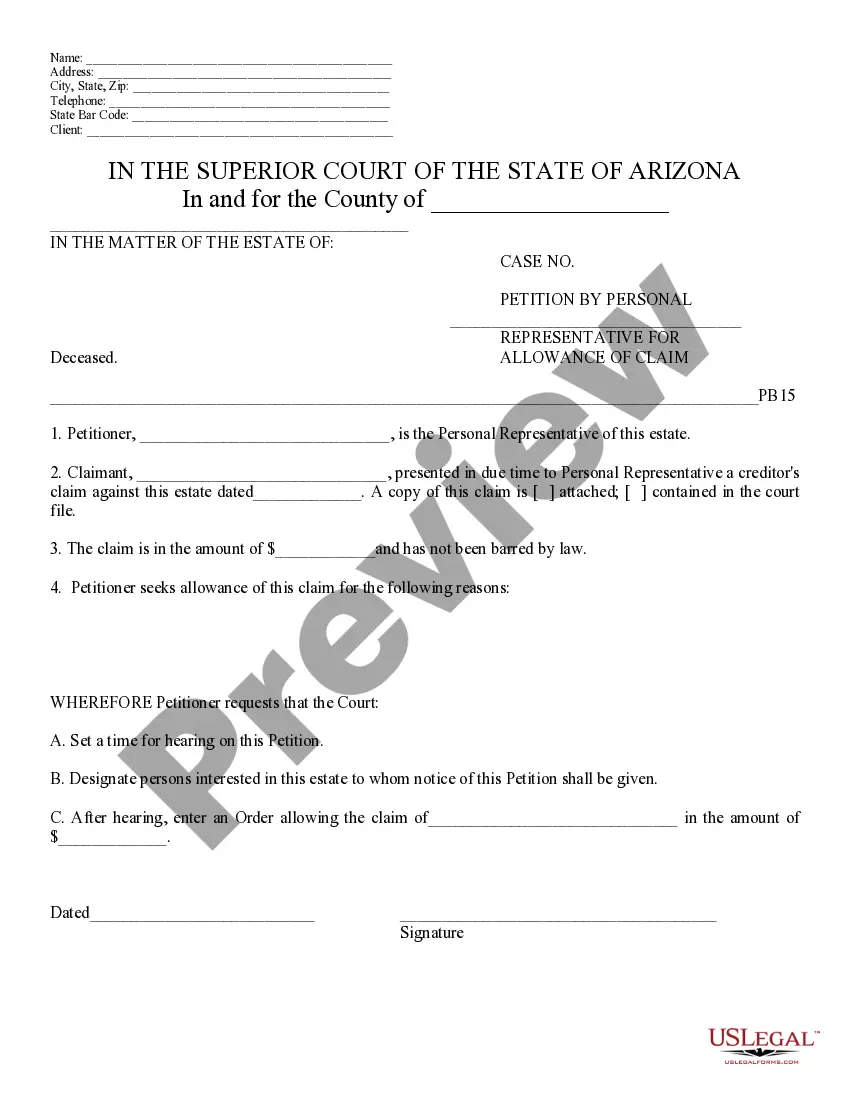

- Check the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Search for another document utilizing the corresponding option in the header.

- Click Buy Now once you’re certain in the chosen file.

- Choose the subscription plan that suits you most.

- Sign up for an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Switch the file format if needed.

- Click Download to save the San Diego Indemnification of Buyer and Seller of Business.

- Print the doc or use any preferred online editor to complete it electronically.

No matter how many times you need to use the acquired template, you can find all the samples you’ve ever saved in your profile by opening the My Forms tab. Give it a try!