A sale of goods is a present transfer of title to movable property for a price. This price may be a payment of money, an exchange of other property, or the performance of services. The parties to a sale are the person who owns the goods and the person to whom the title is transferred. The transferor is the seller or vendor, and the transferee is the buyer or vendee.

Most goods are tangible and solid, such as an automobile or a chair. But goods may also be fluid, such as oil or gasoline. Goods may also be intangible, such as natural gas and electricity. The UCC is applicable to both new and used goods.

Goods that are physically existing and owned by the seller at the time of the transaction are called existing goods. All other goods are called future goods. Future goods include both goods that are physically existing but not owned by the seller and goods that have not yet been produced .

Before an interest in goods can pass from seller to buyer, the goods must exist, and they must be identified to the contract. For passage of title, goods must be identified in a way that will distinguish them from all similar goods. Identification gives a buyer the right to obtain insurance on goods and the right to recover from third parties who damage goods. Sometimes, identification allows the buyer to take goods from the seller. Regarding future goods, occurs when they are shipped, marked, or otherwise designated as the contract goods.

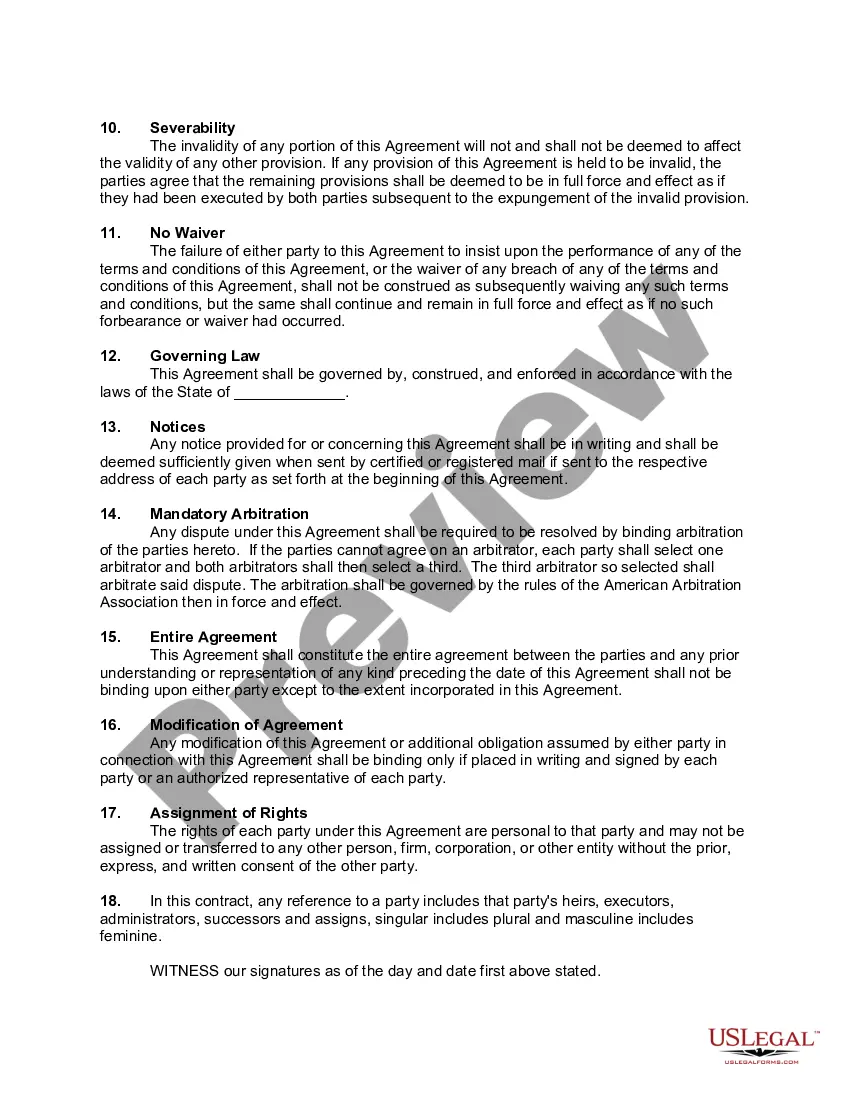

The Harris Texas General Form of Agreement for the Sale of Goods is a legally binding document used in the state of Texas to outline the terms and conditions of a transaction involving the sale of goods between a buyer and a seller. This agreement ensures that both parties are clear on their obligations and rights regarding the sale. Keywords: Harris Texas, general form, agreement, sale of goods, buyer, seller, terms and conditions, transaction. The Harris Texas General Form of Agreement for the Sale of Goods can be categorized into different types based on the specific requirements of the parties involved or the nature of the goods being sold. These types may include: 1. Standard Sale Agreement: This is a comprehensive and versatile agreement used for the sale of common goods, including products, merchandise, equipment, or materials. It covers essential details such as the description of goods, quantity, price, delivery terms, and payment terms. 2. Wholesale Agreement: Specifically designed for businesses engaged in wholesale trade, this agreement addresses larger quantities of goods and establishes terms related to bulk purchasing, delivery schedules, pricing models, and potential discounts. 3. Consignment Agreement: This type of agreement is applicable when goods are provided on consignment. It outlines the terms and conditions for the consignor (seller) to deliver goods to the consignee (buyer) for sale, with arrangements for payment typically based on a percentage of the sale proceeds. 4. Trade-In Agreement: In cases where a buyer intends to trade in their existing goods as partial payment or credit towards a new purchase, this agreement establishes the terms for the evaluation of the trade-in item's value and its application towards the purchase price of the new goods. 5. Installment Sale Agreement: When the seller agrees to sell goods to the buyer on installment payments rather than a lump sum, this agreement delineates the amount, timing, and conditions of each installment payment, including any applicable interest or penalties for late payments. 6. International Sale Agreement: This type of agreement is tailored for transactions involving the sale of goods between parties located in different countries. It incorporates additional clauses related to import/export regulations, customs duties, currency exchange, and dispute resolution mechanisms. Remember that the specific terms and provisions of these agreements can vary depending on the particular circumstances and negotiations between the parties involved. Consulting with a legal professional or using reputable online legal resources is crucial to ensure that the agreement properly reflects the intended arrangement and is in compliance with relevant Harris Texas laws.The Harris Texas General Form of Agreement for the Sale of Goods is a legally binding document used in the state of Texas to outline the terms and conditions of a transaction involving the sale of goods between a buyer and a seller. This agreement ensures that both parties are clear on their obligations and rights regarding the sale. Keywords: Harris Texas, general form, agreement, sale of goods, buyer, seller, terms and conditions, transaction. The Harris Texas General Form of Agreement for the Sale of Goods can be categorized into different types based on the specific requirements of the parties involved or the nature of the goods being sold. These types may include: 1. Standard Sale Agreement: This is a comprehensive and versatile agreement used for the sale of common goods, including products, merchandise, equipment, or materials. It covers essential details such as the description of goods, quantity, price, delivery terms, and payment terms. 2. Wholesale Agreement: Specifically designed for businesses engaged in wholesale trade, this agreement addresses larger quantities of goods and establishes terms related to bulk purchasing, delivery schedules, pricing models, and potential discounts. 3. Consignment Agreement: This type of agreement is applicable when goods are provided on consignment. It outlines the terms and conditions for the consignor (seller) to deliver goods to the consignee (buyer) for sale, with arrangements for payment typically based on a percentage of the sale proceeds. 4. Trade-In Agreement: In cases where a buyer intends to trade in their existing goods as partial payment or credit towards a new purchase, this agreement establishes the terms for the evaluation of the trade-in item's value and its application towards the purchase price of the new goods. 5. Installment Sale Agreement: When the seller agrees to sell goods to the buyer on installment payments rather than a lump sum, this agreement delineates the amount, timing, and conditions of each installment payment, including any applicable interest or penalties for late payments. 6. International Sale Agreement: This type of agreement is tailored for transactions involving the sale of goods between parties located in different countries. It incorporates additional clauses related to import/export regulations, customs duties, currency exchange, and dispute resolution mechanisms. Remember that the specific terms and provisions of these agreements can vary depending on the particular circumstances and negotiations between the parties involved. Consulting with a legal professional or using reputable online legal resources is crucial to ensure that the agreement properly reflects the intended arrangement and is in compliance with relevant Harris Texas laws.