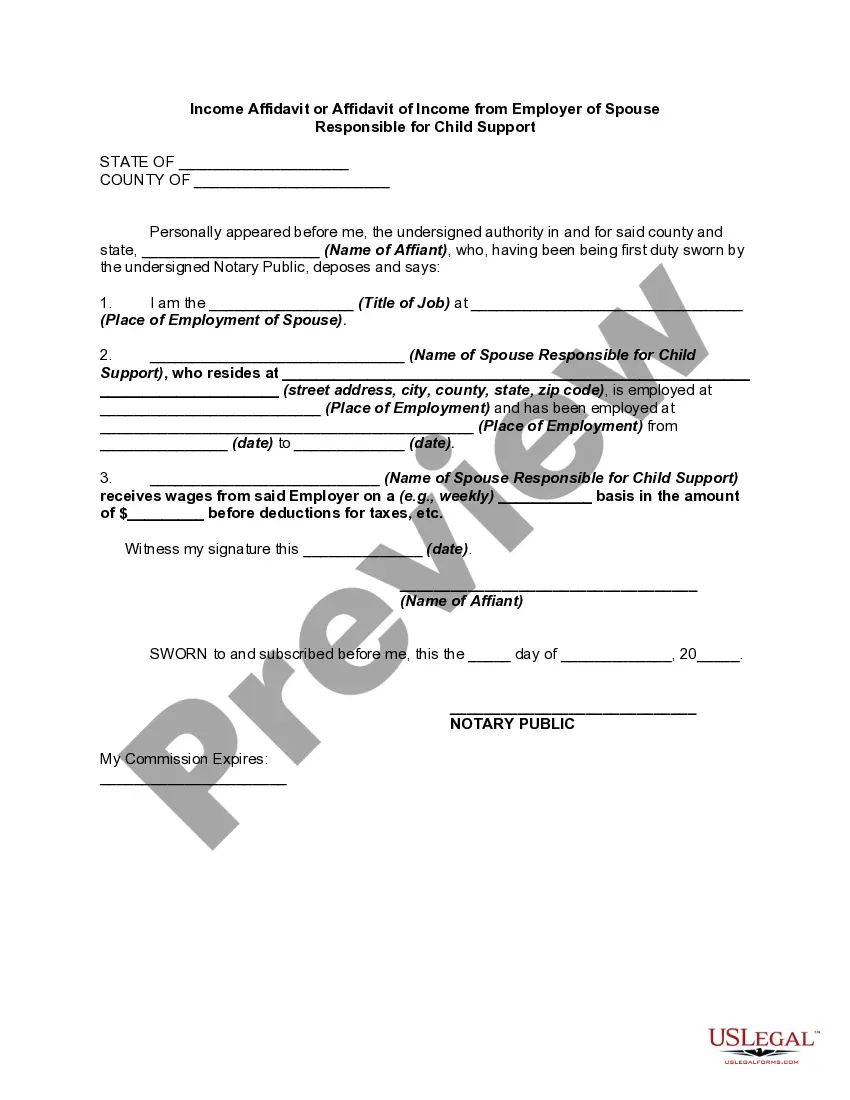

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Cook Illinois Income Affidavit is a legal document used in the state of Illinois to provide an accurate representation of an individual's income and financial situation. It specifically applies to cases involving child support, where a spouse is responsible for providing financial support for their child. This affidavit serves as a means for the court to determine the appropriate amount of child support that should be paid based on the income and assets of the responsible spouse. It requires detailed information regarding the individual's earnings, sources of income, assets, and liabilities. The Cook Illinois Income Affidavit typically consists of several sections: 1. Personal Information: This section includes the individual's name, address, contact information, and relevant identification details. 2. Employment Information: Here, the individual must disclose their current employment status, including the name and address of the employer, job title, work hours, and any other relevant details. 3. Income Details: This part requires a comprehensive breakdown of the individual's income, including wages, salary, bonuses, commissions, tips, rental income, and income from any other sources. It is crucial to provide accurate and up-to-date information in this section. 4. Assets: The affidavit requires a thorough declaration of the individual's assets, such as real estate properties, vehicles, bank accounts, investments, retirement accounts, and any other valuable assets they own. 5. Liabilities: This section requires the individual to disclose their outstanding debts and financial obligations, including mortgages, loans, credit card debts, child support or alimony payments, and any other liabilities. It is essential to note that the Cook Illinois Income Affidavit may have variations or additional sections depending on the specific requirements of the court or jurisdiction involved. Different courts may have slightly different versions of the affidavit, but the core purpose and content generally remain consistent. Compliance with the Cook Illinois Income Affidavit is vital to ensure a fair determination of child support obligations. Providing accurate and complete information is essential, as any misrepresentation or omission can have legal consequences and negatively impact the outcome of the child support proceedings. In conclusion, the Cook Illinois Income Affidavit is a comprehensive document that enables the court to evaluate the income, assets, and liabilities of a spouse responsible for child support. By diligently completing this affidavit with precise and relevant information, individuals can contribute to a fair assessment of child support obligations.Cook Illinois Income Affidavit is a legal document used in the state of Illinois to provide an accurate representation of an individual's income and financial situation. It specifically applies to cases involving child support, where a spouse is responsible for providing financial support for their child. This affidavit serves as a means for the court to determine the appropriate amount of child support that should be paid based on the income and assets of the responsible spouse. It requires detailed information regarding the individual's earnings, sources of income, assets, and liabilities. The Cook Illinois Income Affidavit typically consists of several sections: 1. Personal Information: This section includes the individual's name, address, contact information, and relevant identification details. 2. Employment Information: Here, the individual must disclose their current employment status, including the name and address of the employer, job title, work hours, and any other relevant details. 3. Income Details: This part requires a comprehensive breakdown of the individual's income, including wages, salary, bonuses, commissions, tips, rental income, and income from any other sources. It is crucial to provide accurate and up-to-date information in this section. 4. Assets: The affidavit requires a thorough declaration of the individual's assets, such as real estate properties, vehicles, bank accounts, investments, retirement accounts, and any other valuable assets they own. 5. Liabilities: This section requires the individual to disclose their outstanding debts and financial obligations, including mortgages, loans, credit card debts, child support or alimony payments, and any other liabilities. It is essential to note that the Cook Illinois Income Affidavit may have variations or additional sections depending on the specific requirements of the court or jurisdiction involved. Different courts may have slightly different versions of the affidavit, but the core purpose and content generally remain consistent. Compliance with the Cook Illinois Income Affidavit is vital to ensure a fair determination of child support obligations. Providing accurate and complete information is essential, as any misrepresentation or omission can have legal consequences and negatively impact the outcome of the child support proceedings. In conclusion, the Cook Illinois Income Affidavit is a comprehensive document that enables the court to evaluate the income, assets, and liabilities of a spouse responsible for child support. By diligently completing this affidavit with precise and relevant information, individuals can contribute to a fair assessment of child support obligations.