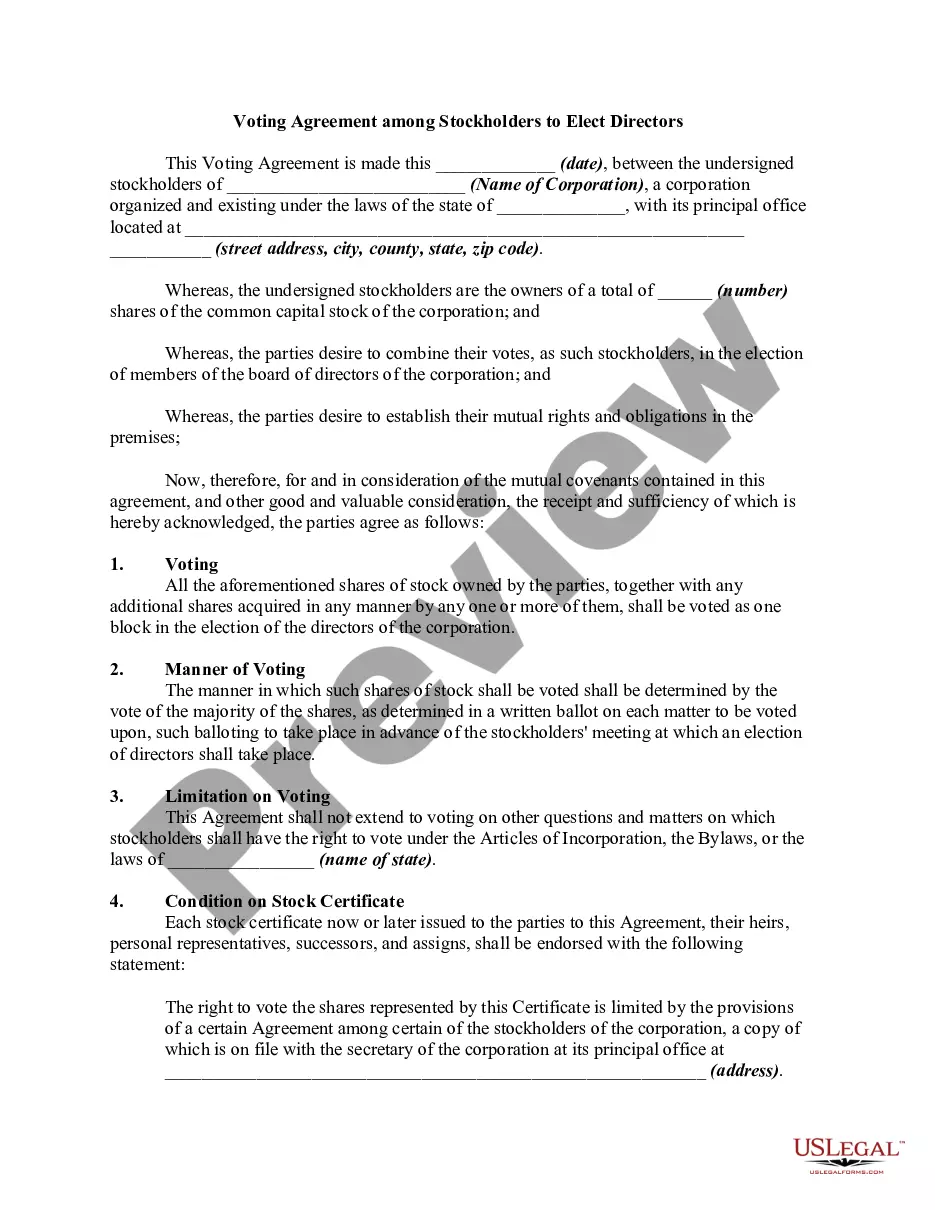

Philadelphia, Pennsylvania Voting Agreement Among Stockholders to Elect Directors is a legally binding document that outlines the terms and conditions by which stockholders in a Philadelphia-based company agree to vote for a specific slate of directors during annual board elections. This agreement ensures that stockholders collectively wield their voting power to endorse director candidates who will represent their interests and steer the company in the desired direction. By entering into this voting agreement, stockholders commit to voting their shares in a unified manner, thereby amplifying their influence and increasing the likelihood of electing the desired directors. Through this agreement, stockholders align their votes and strategy, ensuring that the board of directors comprises individuals who possess the necessary skills, experience, and vision to advance the company's objectives. Key elements covered in a Philadelphia Pennsylvania Voting Agreement Among Stockholders to Elect Directors may include, but are not limited to: 1. Purpose: Clearly articulates the purpose of the agreement, such as promoting stability, long-term growth, or safeguarding stockholder rights. 2. Stockholder Identification: Specifies the parties involved in the agreement, including their names, contact details, and number of shares held. 3. Director Nomination: Outlines the process by which stockholders collectively select a slate of directors to be voted upon during board elections. This may involve establishing a nominating committee or utilizing a proxy voting system. 4. Voting Commitments: Enforces stockholders' commitment to cast their votes for the nominated directors during board elections. This is typically based on a predetermined voting ratio, ensuring that each stockholder's voting power is proportionate to their respective shareholdings. 5. Duration and Termination: Defines the agreement's duration and outlines the conditions under which it may be terminated, such as a specified date, achievement of certain milestones, or consent from a majority of stockholders. Variations of the Philadelphia Pennsylvania Voting Agreement Among Stockholders to Elect Directors can exist depending on specific circumstances and preferences, such as: 1. Majority Veto Voting Agreement: In this type of agreement, stockholders collectively agree to vote against particular candidates or in favor of certain thresholds, granting veto power to a majority of stockholders. 2. Cumulative Voting Agreement: This agreement allows stockholders to consolidate their votes and allocate them across multiple directors, potentially enabling minority stockholders to secure board representation. 3. Director Compensation Agreement: A supplementary agreement that outlines the compensation terms and benefits for elected directors. This ensures transparency and prevents conflicts of interest related to compensation matters. In conclusion, a Philadelphia Pennsylvania Voting Agreement Among Stockholders to Elect Directors is a crucial method employed by stockholders to consolidate their voting power and elect directors who will represent their best interests. By aligning their votes, stockholders can collectively influence the composition of the board, enabling effective governance and strategic decision-making within Philadelphia-based companies.

Philadelphia Pennsylvania Voting Agreement Among Stockholders to Elect Directors

Description

How to fill out Philadelphia Pennsylvania Voting Agreement Among Stockholders To Elect Directors?

Are you looking to quickly draft a legally-binding Philadelphia Voting Agreement Among Stockholders to Elect Directors or maybe any other document to take control of your own or business matters? You can go with two options: hire a professional to draft a legal paper for you or draft it completely on your own. Thankfully, there's an alternative option - US Legal Forms. It will help you get neatly written legal papers without having to pay unreasonable fees for legal services.

US Legal Forms offers a huge catalog of more than 85,000 state-specific document templates, including Philadelphia Voting Agreement Among Stockholders to Elect Directors and form packages. We offer documents for a myriad of life circumstances: from divorce papers to real estate document templates. We've been on the market for over 25 years and got a rock-solid reputation among our customers. Here's how you can become one of them and obtain the necessary document without extra hassles.

- To start with, carefully verify if the Philadelphia Voting Agreement Among Stockholders to Elect Directors is tailored to your state's or county's laws.

- In case the document has a desciption, make sure to check what it's intended for.

- Start the searching process again if the document isn’t what you were looking for by using the search box in the header.

- Choose the plan that is best suited for your needs and move forward to the payment.

- Select the file format you would like to get your document in and download it.

- Print it out, complete it, and sign on the dotted line.

If you've already registered an account, you can simply log in to it, locate the Philadelphia Voting Agreement Among Stockholders to Elect Directors template, and download it. To re-download the form, simply go to the My Forms tab.

It's effortless to buy and download legal forms if you use our services. In addition, the templates we offer are updated by industry experts, which gives you greater confidence when dealing with legal matters. Try US Legal Forms now and see for yourself!