The Nassau New York Voting Trust Agreement is a legal document that outlines the terms and conditions for the establishment and operation of a voting trust in Nassau County, New York. This agreement is crucial in safeguarding the voting rights and interests of shareholders in various corporations or organizations operating within the jurisdiction of Nassau County. A Nassau New York Voting Trust Agreement serves as a mechanism to consolidate the voting rights of shareholders into a single entity, known as the voting trustee. This trustee is appointed to act on behalf of the shareholders and exercise their voting rights at corporate meetings or any other relevant decision-making processes. There are different types of Nassau New York Voting Trust Agreements, each with its own specific purpose and provisions. These types include: 1. General Voting Trust Agreement: This is the most common type of voting trust agreement and covers a wide range of corporations and organizations. It specifies the duration of the agreement, the powers and responsibilities of the voting trustee, as well as the voting rights and limitations of the shareholders involved. 2. Statutory Voting Trust Agreement: This type of agreement is designed to comply with specific statutes or regulations enforced in Nassau County, New York. It takes into account any legal requirements and ensures that the agreement adheres to the prevailing laws and regulations. 3. Restrictive Voting Trust Agreement: This agreement places certain restrictions or conditions on the exercise of voting rights by the voting trustee. It may impose limitations on specific matters, such as major corporate decisions or changes in ownership. 4. Block Voting Trust Agreement: In this type of agreement, the shareholders transfer their voting rights to the voting trustee in proportion to their ownership interest. It allows the trustee to vote as a block, presenting a unified front on behalf of the shareholders involved. The Nassau New York Voting Trust Agreement is a critical legal tool that provides clarity and protection for shareholders and ensures their voting rights are properly represented. It offers transparency, stability, and accountability in corporate decision-making processes within Nassau County, New York.

Nassau New York Voting Trust Agreement

Description

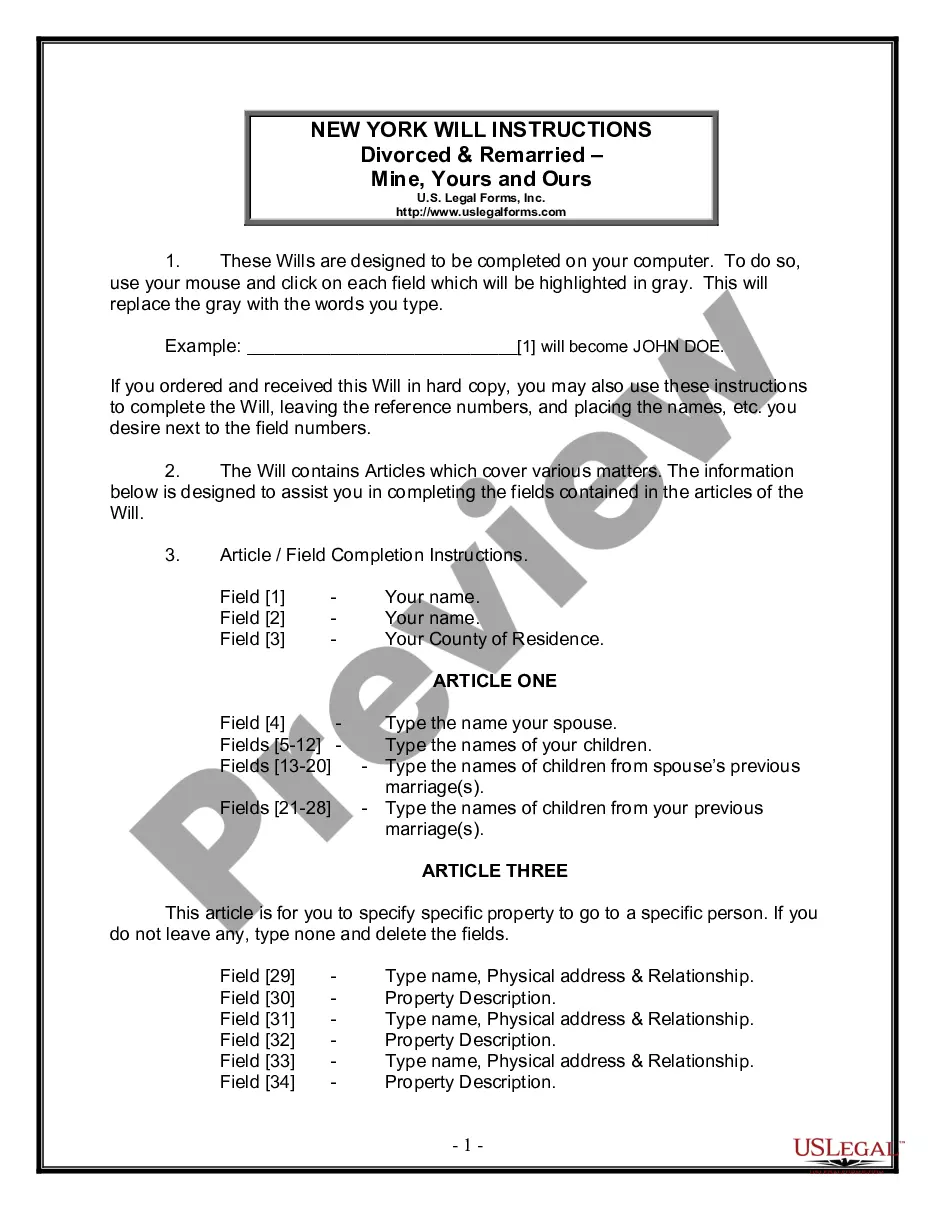

How to fill out Nassau New York Voting Trust Agreement?

Laws and regulations in every area differ from state to state. If you're not an attorney, it's easy to get lost in a variety of norms when it comes to drafting legal paperwork. To avoid pricey legal assistance when preparing the Nassau Voting Trust Agreement, you need a verified template legitimate for your region. That's when using the US Legal Forms platform is so advantageous.

US Legal Forms is a trusted by millions online collection of more than 85,000 state-specific legal forms. It's an excellent solution for professionals and individuals looking for do-it-yourself templates for different life and business scenarios. All the forms can be used many times: once you purchase a sample, it remains available in your profile for subsequent use. Thus, if you have an account with a valid subscription, you can just log in and re-download the Nassau Voting Trust Agreement from the My Forms tab.

For new users, it's necessary to make a couple of more steps to get the Nassau Voting Trust Agreement:

- Analyze the page content to make sure you found the correct sample.

- Utilize the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your criteria.

- Utilize the Buy Now button to get the template when you find the appropriate one.

- Choose one of the subscription plans and log in or sign up for an account.

- Select how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the document in and click Download.

- Complete and sign the template in writing after printing it or do it all electronically.

That's the easiest and most affordable way to get up-to-date templates for any legal scenarios. Find them all in clicks and keep your documentation in order with the US Legal Forms!

Form popularity

FAQ

A trust formed when individual shareholders transfer both the legal title and voting rights in their shares to a trustee. The trustee then controls a unified voting block - with a stronger voice on matters of corporate governance than the individual shareholders could have on their own.

While the proxy may be a temporary or one-time arrangement, often created for a specific vote, the voting trust is usually more permanent, intended to give a bloc of voters increased power as a groupor indeed, control of the company, which is not necessarily the case with proxy voting.

Shareholders can use voting trusts to help resolve conflicts of interest in some functions of the company. Ordinarily, such shareholders would transfer their shares to a trustee who would then vote on their behalf at arms-length to mitigate against conflicts of interest.

issued certificate that evidences stock ownership but reserves voting rights for the trust. Voting trust certificates are exchanged for stock when voting power must be consolidated. Thus, holders of certificates have all the usual rights of stockholders with the exception of voting rights.

Definition. A trust formed when individual shareholders transfer both the legal title and voting rights in their shares to a trustee. The trustee then controls a unified voting block - with a stronger voice on matters of corporate governance than the individual shareholders could have on their own.

A voting trust is a legal trust created to combine the voting power of shareholders by temporarily transferring their shares to the trustee.

The Voting Trust shall either be treated as a grantor trust under subpart E, part I of subchapter J of the Internal Revenue Code of 1986, as amended, or shall be treated as merely a custodial arrangement that is not an entity recognized for U.S. federal tax purposes, and the provisions of this Agreement shall be

Voting trusts normally pay no taxes and file no tax returns, as it holds only the right to vote and if it receives any dividends, it does so merely as an agent of the shareholders.