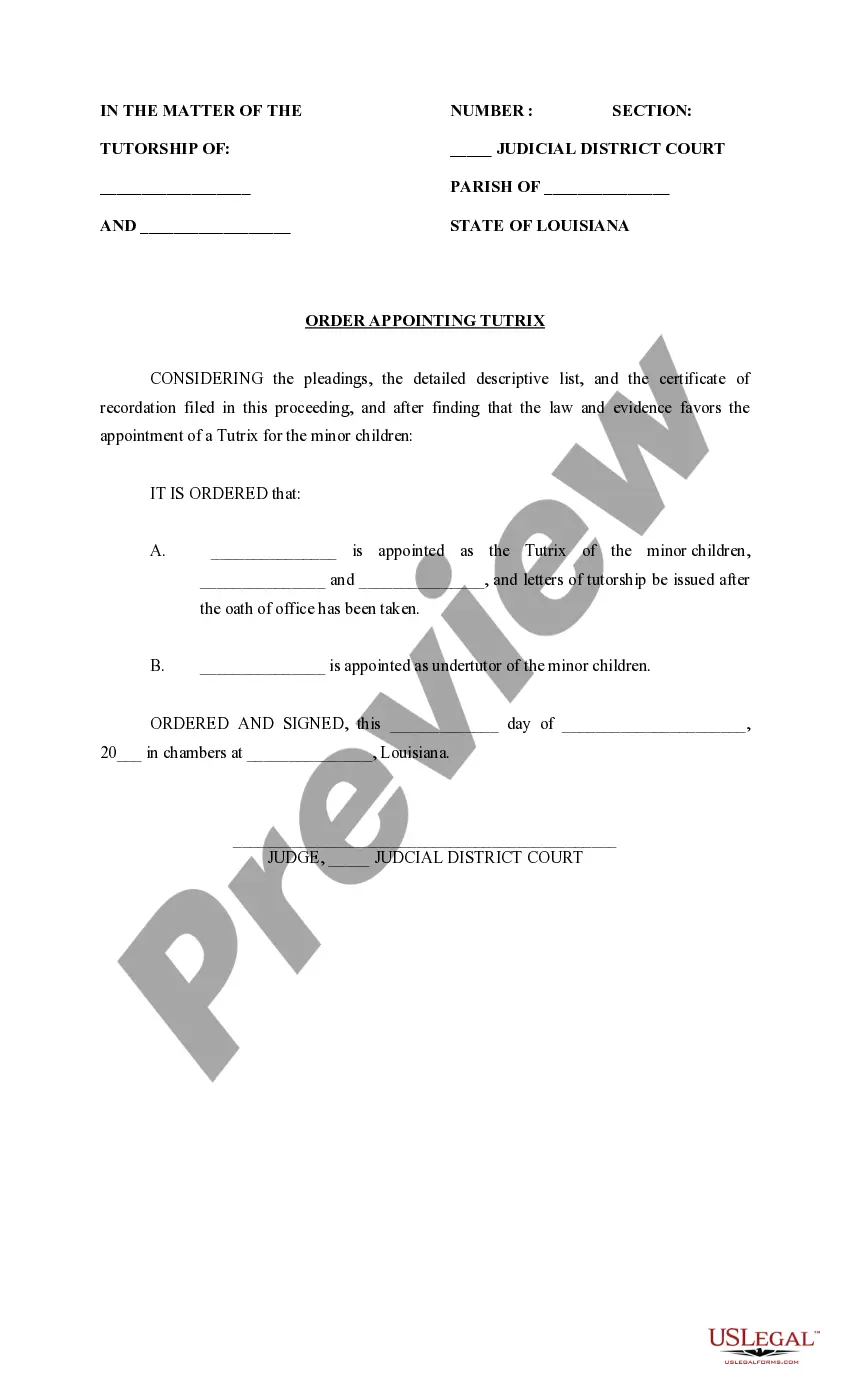

The Alameda California Comprehensive Commercial Deed of Trust and Security Agreement is a legal document that serves as a comprehensive agreement between a lender and borrower regarding a commercial property located in Alameda, California. This agreement establishes a deed of trust, which is a security interest in the property provided by the borrower to secure a loan or other financial obligation. This particular type of deed of trust and security agreement applies specifically to commercial properties within the Alameda, California area. It is designed to ensure that both parties' interests are protected and to provide a legal framework for the financing of commercial real estate transactions. The Alameda California Comprehensive Commercial Deed of Trust and Security Agreement typically includes several key components: 1. Property Details: The agreement will include detailed information about the commercial property, such as its legal description, address, and any associated zoning or land use restrictions. 2. Parties Involved: It will identify the lender, borrower, and any other relevant parties involved in the transaction, such as guarantors or trustees. 3. Loan Terms: The agreement will outline the terms and conditions of the loan, including the principal amount, interest rate, repayment schedule, and any late payment penalties or default provisions. 4. Security Interest: The deed of trust portion of the agreement establishes the lender's security interest in the property, allowing them to take legal action in the event of default. It typically includes a provision allowing the lender to initiate foreclosure proceedings if the borrower fails to meet their obligations. 5. Insurance and Taxes: The agreement will specify the borrower's obligations regarding property insurance and tax payments, ensuring that these are appropriately maintained throughout the loan term. 6. Prepayment and Acceleration: The document will outline the conditions under which the borrower may prepay the loan without penalty and clarify the circumstances under which the lender may accelerate the loan, demanding immediate repayment. 7. Default Remedies: The agreement will detail the remedies available to the lender in the event of default, such as the right to sell the property via foreclosure or to appoint a receiver to manage the property's affairs. While the Alameda California Comprehensive Commercial Deed of Trust and Security Agreement is a standard document used for commercial property transactions in Alameda, there may be variations or tailored versions depending on specific circumstances or additional agreements made between the parties involved. It is essential to consult with legal professionals familiar with California real estate law to ensure compliance and protect both parties' interests.

Alameda California Comprehensive Commercial Deed of Trust and Security Agreement

Description

How to fill out Alameda California Comprehensive Commercial Deed Of Trust And Security Agreement?

Dealing with legal forms is a necessity in today's world. Nevertheless, you don't always need to look for professional help to create some of them from scratch, including Alameda Comprehensive Commercial Deed of Trust and Security Agreement, with a platform like US Legal Forms.

US Legal Forms has over 85,000 templates to choose from in different categories varying from living wills to real estate papers to divorce documents. All forms are arranged based on their valid state, making the searching process less frustrating. You can also find information resources and tutorials on the website to make any activities associated with document completion straightforward.

Here's how to purchase and download Alameda Comprehensive Commercial Deed of Trust and Security Agreement.

- Go over the document's preview and description (if provided) to get a general information on what you’ll get after downloading the document.

- Ensure that the template of your choice is adapted to your state/county/area since state regulations can impact the validity of some records.

- Check the related forms or start the search over to find the appropriate document.

- Click Buy now and register your account. If you already have an existing one, choose to log in.

- Choose the option, then a suitable payment gateway, and purchase Alameda Comprehensive Commercial Deed of Trust and Security Agreement.

- Select to save the form template in any offered format.

- Go to the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can find the appropriate Alameda Comprehensive Commercial Deed of Trust and Security Agreement, log in to your account, and download it. Needless to say, our platform can’t replace a lawyer entirely. If you have to deal with an extremely complicated situation, we recommend using the services of a lawyer to review your document before executing and filing it.

With over 25 years on the market, US Legal Forms proved to be a go-to provider for various legal forms for millions of customers. Join them today and purchase your state-specific documents effortlessly!