A Fulton Georgia Comprehensive Commercial Deed of Trust and Security Agreement is a legal and binding document that outlines the terms and conditions of a loan agreement for commercial properties in Fulton, Georgia. This agreement serves as a security measure to protect the lender's interests and ensure repayment of the loan amount. The Fulton Georgia Comprehensive Commercial Deed of Trust and Security Agreement includes detailed information about the property being used as collateral for the loan. It outlines the legal description of the property, including its location and boundaries, as well as any improvements or structures on the land. The agreement also mentions the property's fair market value and the loan amount that is being secured by it. One key aspect of this agreement is the provision regarding default. It outlines the circumstances under which the borrower will be considered in default, such as failure to make timely loan payments or violating any terms of the agreement. If the borrower defaults, the lender has the right to take possession of the property and sell it to recover their investment. Additionally, the Fulton Georgia Comprehensive Commercial Deed of Trust and Security Agreement may include clauses related to insurance requirements for the property. The borrower is usually required to maintain adequate property insurance and provide proof of coverage to the lender. Different types of Fulton Georgia Comprehensive Commercial Deed of Trust and Security Agreements may exist depending on the specific purpose of the loan or the unique requirements of the lender. For example, there might be variations for loans involving the purchase of commercial real estate, construction loans, or refinancing agreements. In conclusion, the Fulton Georgia Comprehensive Commercial Deed of Trust and Security Agreement plays a crucial role in documenting the loan terms and securing the lender's investment in commercial properties in Fulton, Georgia. It provides a framework for protecting the rights of both parties and ensures that the loan repayment process is conducted according to agreed-upon conditions.

Fulton Georgia Comprehensive Commercial Deed of Trust and Security Agreement

Description

How to fill out Fulton Georgia Comprehensive Commercial Deed Of Trust And Security Agreement?

Laws and regulations in every area vary throughout the country. If you're not an attorney, it's easy to get lost in various norms when it comes to drafting legal documents. To avoid high priced legal assistance when preparing the Fulton Comprehensive Commercial Deed of Trust and Security Agreement, you need a verified template legitimate for your region. That's when using the US Legal Forms platform is so helpful.

US Legal Forms is a trusted by millions web catalog of more than 85,000 state-specific legal forms. It's an excellent solution for specialists and individuals looking for do-it-yourself templates for different life and business scenarios. All the forms can be used multiple times: once you pick a sample, it remains accessible in your profile for further use. Therefore, if you have an account with a valid subscription, you can just log in and re-download the Fulton Comprehensive Commercial Deed of Trust and Security Agreement from the My Forms tab.

For new users, it's necessary to make a couple of more steps to obtain the Fulton Comprehensive Commercial Deed of Trust and Security Agreement:

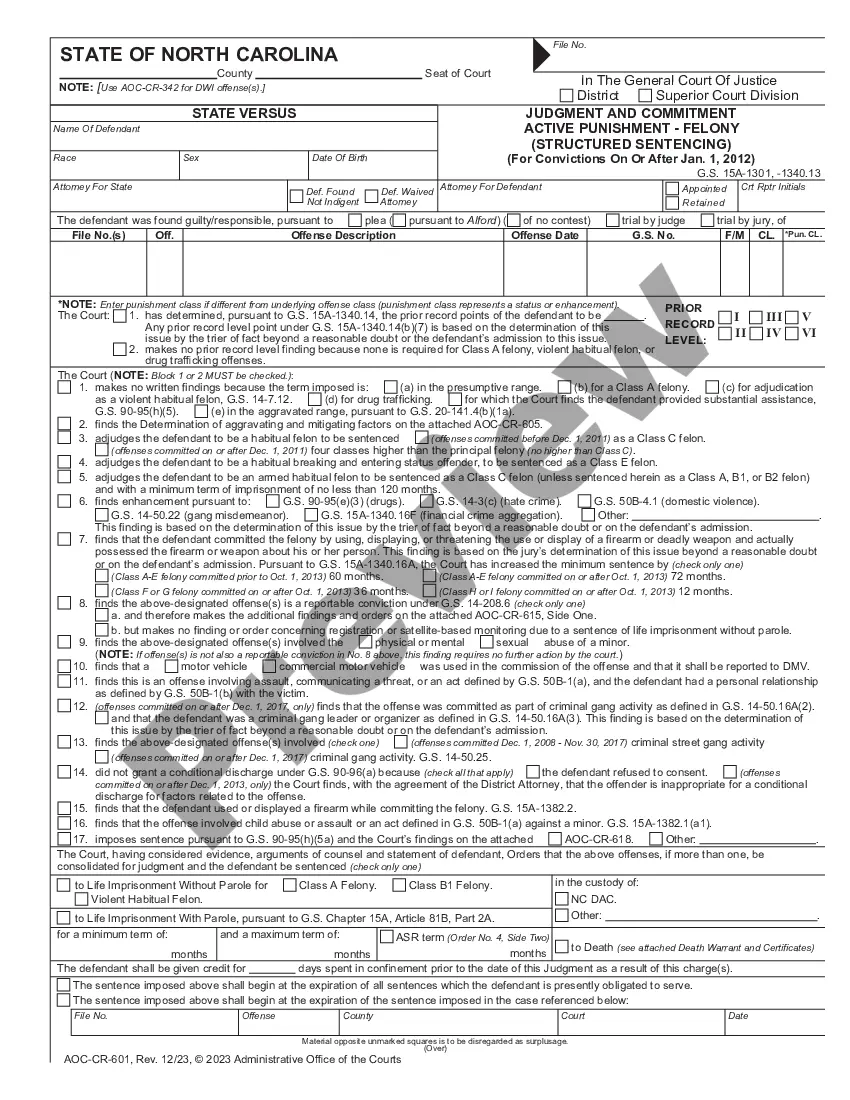

- Take a look at the page content to make sure you found the correct sample.

- Utilize the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your requirements.

- Use the Buy Now button to obtain the document when you find the correct one.

- Opt for one of the subscription plans and log in or create an account.

- Select how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the document in and click Download.

- Complete and sign the document on paper after printing it or do it all electronically.

That's the simplest and most economical way to get up-to-date templates for any legal scenarios. Locate them all in clicks and keep your documentation in order with the US Legal Forms!