The Maricopa Arizona Comprehensive Commercial Deed of Trust and Security Agreement is a legal document that serves as a binding contract between a borrower and a lender in a commercial real estate transaction. This agreement outlines the terms and conditions under which the lender provides a loan to the borrower, using the commercial property as security. Keywords: Maricopa Arizona, Comprehensive Commercial Deed of Trust, Security Agreement, legal document, borrower, lender, commercial real estate transaction, terms and conditions, loan, commercial property, security. There are various types of Maricopa Arizona Comprehensive Commercial Deed of Trust and Security Agreements, each with its own specific purpose. Some of these different types include: 1. Purchase Money Deed of Trust: This type of agreement is used when the borrower is obtaining financing from the lender for the purchase of a commercial property. The lender will secure the loan with a deed of trust on the property, providing security for the loan. 2. Refinancing Deed of Trust: In cases where a borrower wants to refinance an existing commercial property loan, a refinancing deed of trust may be used. This agreement outlines the terms and conditions of the new loan, including the repayment terms, interest rates, and any additional fees. 3. Construction Deed of Trust: When a borrower needs financing for the construction of a new commercial property, a construction deed of trust is employed. This agreement allows the lender to secure the loan with a deed of trust on the property being constructed, providing security for the loan until the project is completed. 4. Leasehold Deed of Trust: In situations where the borrower holds a lease on a commercial property instead of owning it, a leasehold deed of trust may be utilized. This agreement allows the lender to secure the loan using the borrower's leasehold interest in the property as collateral. 5. Subordination Agreement: In cases where there are multiple loans or liens on a commercial property, a subordination agreement may be required. This agreement establishes the priority of the different loans or liens, ensuring the lender's position in case of default or foreclosure. The Maricopa Arizona Comprehensive Commercial Deed of Trust and Security Agreement plays a crucial role in securing the interests of both borrowers and lenders in commercial real estate transactions. It provides the necessary legal framework and protections for all parties involved, ensuring that the loan is repaid as agreed upon and the commercial property serves as security for the loan.

Maricopa Arizona Comprehensive Commercial Deed of Trust and Security Agreement

Description

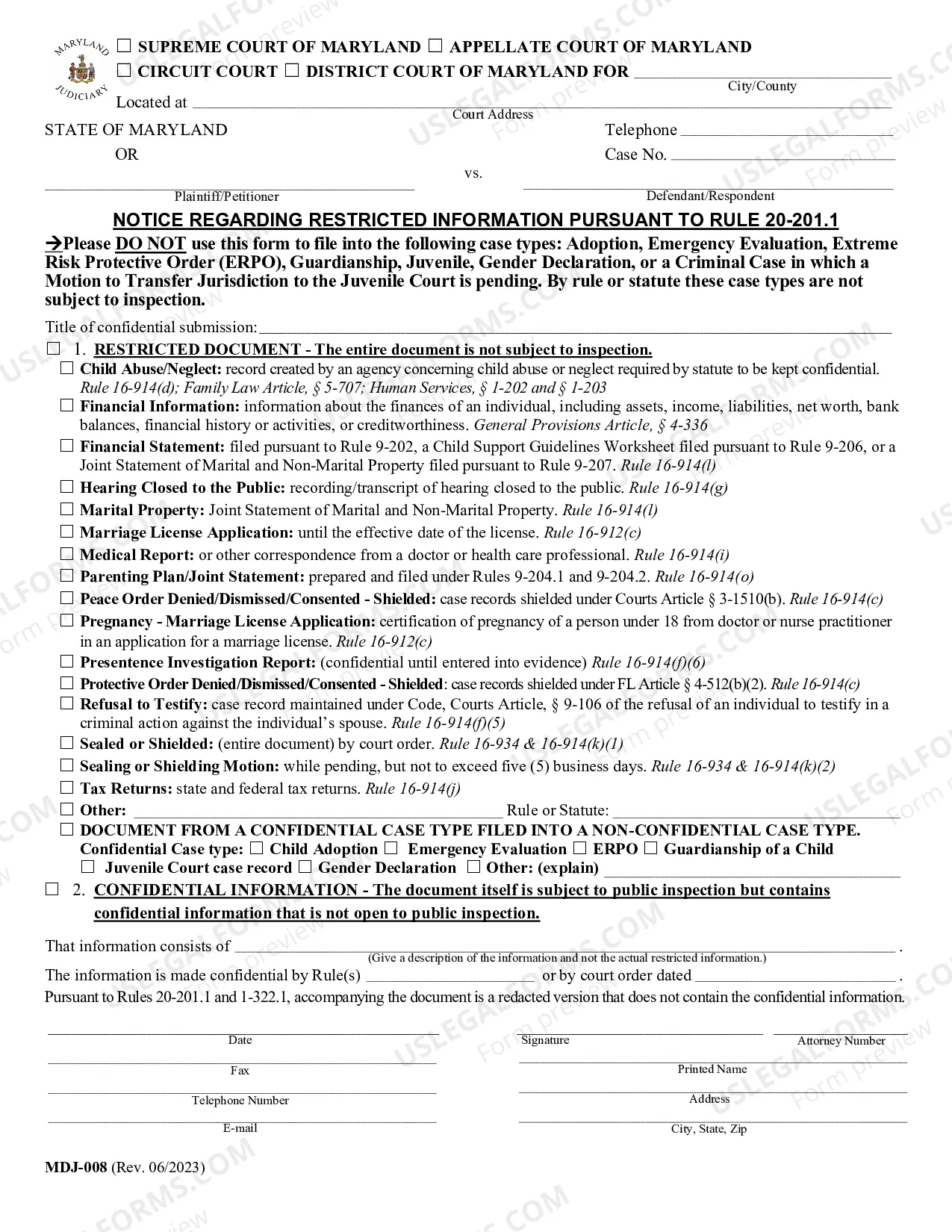

How to fill out Maricopa Arizona Comprehensive Commercial Deed Of Trust And Security Agreement?

How much time does it typically take you to create a legal document? Because every state has its laws and regulations for every life sphere, locating a Maricopa Comprehensive Commercial Deed of Trust and Security Agreement suiting all local requirements can be stressful, and ordering it from a professional attorney is often expensive. Many online services offer the most common state-specific templates for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most extensive online collection of templates, collected by states and areas of use. Apart from the Maricopa Comprehensive Commercial Deed of Trust and Security Agreement, here you can find any specific form to run your business or personal deeds, complying with your county requirements. Professionals check all samples for their validity, so you can be certain to prepare your paperwork correctly.

Using the service is fairly simple. If you already have an account on the platform and your subscription is valid, you only need to log in, select the needed form, and download it. You can retain the document in your profile anytime later on. Otherwise, if you are new to the platform, there will be a few more steps to complete before you get your Maricopa Comprehensive Commercial Deed of Trust and Security Agreement:

- Examine the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Look for another form using the related option in the header.

- Click Buy Now when you’re certain in the selected document.

- Select the subscription plan that suits you most.

- Create an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Change the file format if necessary.

- Click Download to save the Maricopa Comprehensive Commercial Deed of Trust and Security Agreement.

- Print the doc or use any preferred online editor to complete it electronically.

No matter how many times you need to use the acquired template, you can find all the files you’ve ever saved in your profile by opening the My Forms tab. Try it out!

Form popularity

FAQ

The Maricopa County Sheriff's Office does not yet allow bonds to be posted over the phone or online, so someone must physically go to the jail located at 201 S 4th Ave, Phoenix, AZ 85003. There is a door on the corner of 4th Ave and Madison St.

You also need to have your completed beneficiary deed notarized, then record it in the county where the property is located. Once you're finished, the website of the Maricopa County Recorder's Office (recorder.maricopa.gov), and those for various other counties, will list your deed, which you can look up at no cost.

The fee to record a document in County Recorder offices throughout Arizona will become $30.00 for each complete document. Documents received on or after July 1st will be returned if accompanied by insufficient payment. Postmarked recordings submitted without the $30.00 flat recording fee will be rejected.

The owner or owners must sign the deed in front of a notary and file the completed form with the land records for the county where the property is situated. After the owner's death, the remaining interest in land transfers to the beneficiary outside of the probate process.

Requirements for Arizona Beneficiary Deed Forms The deed must be recorded in the office of the county recorder of the county where the property is located before the death of the owner (or, with multiple owners, before the death of the last surviving owner).

How to Transfer Arizona Real Estate Locate the Prior Deed to the Property.Get a New Deed to the Property.Sign and Notarize the New Deed.Record the New Deed in the Land Records.

If your bond is not cash-only you may use cash, Postal Money Order, Western Union Money Order, or Cashier's Check made out to the Maricopa County Sheriff's Office for the exact amount of the bond. Go to the Fourth Ave Jail (201 S. 4th Ave, Phoenix, AZ 85003). Take a number at the bond out window.

Arizona Revised Statutes § 33-401 lays out the formal requirements for conveyance of property. All transfers of property in Arizona must be in writing. The deed must be signed by the grantor and notarized by an authority granted those duties in the state.

Arizona allows for the transfer of real estate by affidavit if the equity of all the real property in the estate is not greater than $100,000. The use of a beneficiary deed to transfer real property will avoid the need for a probate proceeding in cases where the equity in the property is in excess of $100,000.

You can eRecord your documents online through Simplifile right now in Maricopa County. You don't have to leave the office, use the mail, or stand in line saving you time and money. If you have a PC, high-speed internet access, and a scanner, you have what you need to start eRecording in Maricopa County.