Nassau New York Comprehensive Commercial Deed of Trust and Security Agreement

Description

How to fill out Comprehensive Commercial Deed Of Trust And Security Agreement?

Whether you intend to launch your enterprise, enter into a contract, request an update to your identification, or address family-related legal matters, you need to prepare specific documentation in accordance with your local statutes and regulations.

Locating the appropriate documents may require significant time and effort unless you utilize the US Legal Forms library.

The service offers individuals over 85,000 professionally crafted and verified legal templates for various personal or business situations. All documents are categorized by state and area of application, making it simple and swift to select a form like the Nassau Comprehensive Commercial Deed of Trust and Security Agreement.

The documents available through our platform are reusable. By maintaining an active subscription, you can access all your previously acquired paperwork whenever needed in the My documents section of your profile. Stop expending time on a continual search for current formal documents. Join the US Legal Forms community and organize your paperwork with the most comprehensive online form library!

- Ensure the template meets your specific requirements and complies with state law.

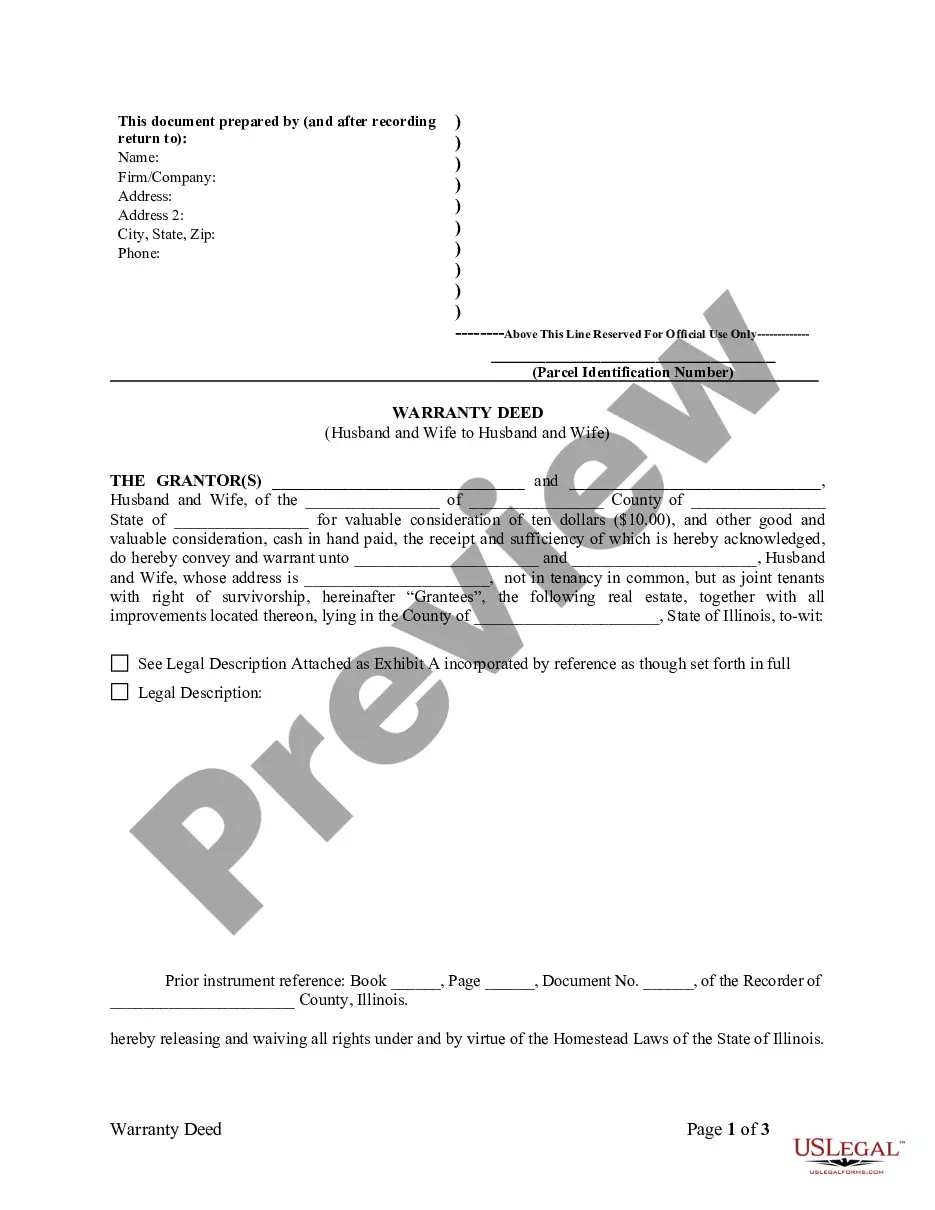

- Examine the form description and review the Preview if available on the site.

- Utilize the search bar specifying your state above to discover additional templates.

- Click Buy Now to acquire the document once you identify the correct one.

- Select the subscription plan that best meets your needs to proceed.

- Log in to your account and settle the payment with a credit card or PayPal.

- Download the Nassau Comprehensive Commercial Deed of Trust and Security Agreement in your preferred file format.

- Print the document or complete it and sign it electronically through an online editor to save time.

Form popularity

FAQ

A UCC, or Uniform Commercial Code filing, serves as a public notice that a lender has a security interest in a property. This is particularly relevant when you have a Nassau New York Comprehensive Commercial Deed of Trust and Security Agreement in place. Understanding how UCC filings work can help you manage your property financing with greater confidence.

A deed of trust, like a mortgage, pledges real property to secure a loan. This document is used instead of a mortgage in some states. While a mortgage involves two parties, a deed of trust involves three: the trustor (the borrower)

A deed of trust is a legal agreement that's similar to a mortgage, which is used in real estate transactions. Whereas a mortgage only involves the lender and a borrower, a deed of trust adds a neutral third party that holds rights to the real estate until the loan is paid or the borrower defaults.

A deed of trust is a legal agreement that's similar to a mortgage, which is used in real estate transactions. Whereas a mortgage only involves the lender and a borrower, a deed of trust adds a neutral third party that holds rights to the real estate until the loan is paid or the borrower defaults.

This is a standard form security trust deed. It creates a single security trust specifically for use in syndicated finance or other finance transactions where security is held on trust by a security trustee for the benefit of a group of secured finance parties (the beneficiaries).

For purpose of Article 9 of the Uniform Commercial Code in effect in the State of California, the Borrower is the Debtor, Lender is the Secured Party and this Deed of Trust constitutes a Financing Statement.

A deed of trust is an agreement between a home buyer and a lender at the closing of a property. It states that the home buyer will repay the loan and that the mortgage lender will hold the legal title to the property until the loan is fully paid.

Commercial Deed of Trust means that certain deed of trust made by the Mortgagor for the benefit of the Commercial Tract Lender, which prior to the Transfer Date, will encumber both the Residential Tract and the Commercial Tract, and after the Transfer Date will encumber only the Commercial Tract.

A mortgage is a legal arrangement in which a property owner gives someone else his property to hold as security until he pays off a debt. A deed acts as the legal evidence of any sort of property transfer from one party to another.

The beneficiary of the deed of trust in a real estate transaction is the person or entity whose investment interest is being protected. In most cases, this is a lender, but it could also be a person if you have a land contract with an individual to eventually own a property outright.