Dear [Recipient's Name], I hope this letter finds you well. I am writing to provide you with a detailed description of Maricopa, Arizona, and share an article relating to tax sales in this area. Maricopa is a vibrant city located in Pinal County, Arizona, approximately 35 miles south of downtown Phoenix. Known for its warm climate, stunning desert landscapes, and friendly community, Maricopa offers a myriad of opportunities for residents and visitors alike. Maricopa, Arizona, is a growing city with a population of over 50,000 residents. Despite its rapid expansion, Maricopa has managed to maintain a strong sense of community and small-town charm. The city boasts an array of amenities, including parks, recreational facilities, shopping centers, and numerous dining options. Residents enjoy a high quality of life, affordable housing, and a variety of educational opportunities through the Maricopa Unified School District and Central Arizona College. Investing in Maricopa can be a wise decision, and one lucrative avenue is through tax sales. Tax sales occur when a property owner fails to pay property taxes, resulting in the property being auctioned off to the highest bidder. These tax sales provide an opportunity for individuals to acquire properties at a potentially discounted price. However, it is crucial to understand the intricacies of tax sales and the legal requirements involved before participating in such auctions. To guide you through the process of tax sales in Maricopa, I have included an informative article titled "Navigating Tax Sales in Maricopa, Arizona: A Comprehensive Guide". This article delves into the legal aspects of tax sales, outlines the steps involved, and provides tips for successful bidding. It also highlights the potential risks and challenges that prospective buyers should be aware of. In addition to the general guide, there are various types of Maricopa Arizona Sample Letters available that cater to specific aspects of tax sales. Some of these letters include: 1. Invitation Letter to Tax Sale: This letter serves as an invitation to potential bidders, providing details about upcoming tax sales, including date, time, and location. It also includes instructions on how to register for the auction and any prerequisites or qualifications necessary for participation. 2. Redemption Letter: This letter is sent to property owners who have unpaid taxes and informs them of their opportunity to redeem their property by paying off the outstanding balance before the tax sale auction date. It outlines the redemption process and provides a deadline for payment. 3. Letter of Intent to Purchase Tax Delinquent Property: This letter is written by a prospective buyer to express their intention to purchase a specific tax delinquent property. It includes details such as the property address, the buyer's contact information, and an offer to negotiate terms and conditions. These sample letters serve as valuable resources to help individuals navigate the tax sale process in Maricopa effectively. Whether you are considering investing in properties, seeking redemption opportunities, or expressing your intent to purchase, these letters can be customized to meet your specific needs. I hope the article and sample letters provided prove to be insightful and assist you in your endeavors related to tax sales in Maricopa, Arizona. For any further inquiries or assistance, please do not hesitate to contact me. Warm regards, [Your Name]

Maricopa Arizona Sample Letter to Include Article Relating to Tax Sales

Description

How to fill out Maricopa Arizona Sample Letter To Include Article Relating To Tax Sales?

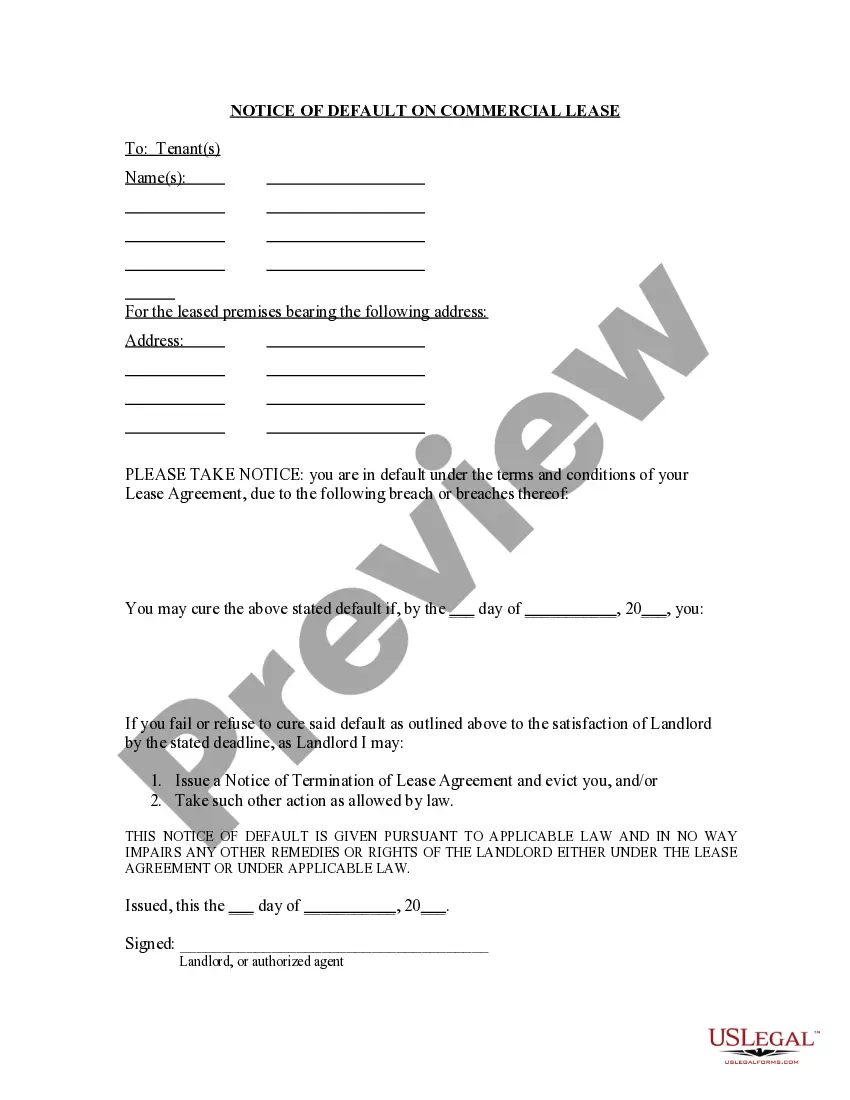

Preparing legal documentation can be difficult. In addition, if you decide to ask a legal professional to draft a commercial agreement, papers for proprietorship transfer, pre-marital agreement, divorce papers, or the Maricopa Sample Letter to Include Article Relating to Tax Sales, it may cost you a lot of money. So what is the most reasonable way to save time and money and draft legitimate forms in total compliance with your state and local regulations? US Legal Forms is a perfect solution, whether you're looking for templates for your individual or business needs.

US Legal Forms is largest online catalog of state-specific legal documents, providing users with the up-to-date and professionally checked forms for any use case gathered all in one place. Therefore, if you need the recent version of the Maricopa Sample Letter to Include Article Relating to Tax Sales, you can easily find it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample using the Download button. If you haven't subscribed yet, here's how you can get the Maricopa Sample Letter to Include Article Relating to Tax Sales:

- Look through the page and verify there is a sample for your region.

- Check the form description and use the Preview option, if available, to ensure it's the sample you need.

- Don't worry if the form doesn't satisfy your requirements - search for the right one in the header.

- Click Buy Now once you find the required sample and choose the best suitable subscription.

- Log in or register for an account to purchase your subscription.

- Make a transaction with a credit card or via PayPal.

- Choose the document format for your Maricopa Sample Letter to Include Article Relating to Tax Sales and save it.

Once finished, you can print it out and complete it on paper or import the template to an online editor for a faster and more practical fill-out. US Legal Forms enables you to use all the paperwork ever acquired multiple times - you can find your templates in the My Forms tab in your profile. Try it out now!