Middlesex Massachusetts Sample Letter to Include Article Relating to Tax Sales

Description

How to fill out Middlesex Massachusetts Sample Letter To Include Article Relating To Tax Sales?

Drafting papers for the business or personal needs is always a big responsibility. When creating an agreement, a public service request, or a power of attorney, it's crucial to consider all federal and state laws of the specific area. However, small counties and even cities also have legislative provisions that you need to consider. All these details make it burdensome and time-consuming to generate Middlesex Sample Letter to Include Article Relating to Tax Sales without expert help.

It's possible to avoid spending money on attorneys drafting your documentation and create a legally valid Middlesex Sample Letter to Include Article Relating to Tax Sales on your own, using the US Legal Forms online library. It is the largest online collection of state-specific legal documents that are professionally cheched, so you can be certain of their validity when selecting a sample for your county. Earlier subscribed users only need to log in to their accounts to save the required document.

If you still don't have a subscription, adhere to the step-by-step instruction below to get the Middlesex Sample Letter to Include Article Relating to Tax Sales:

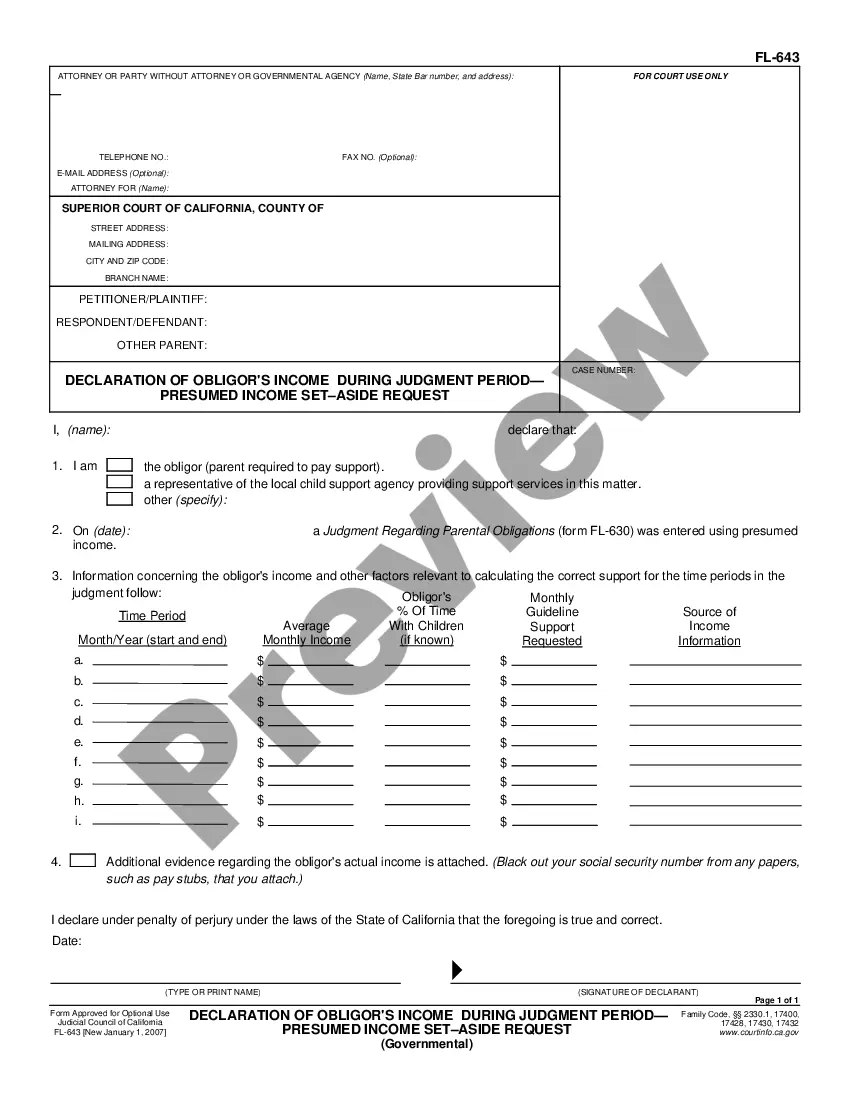

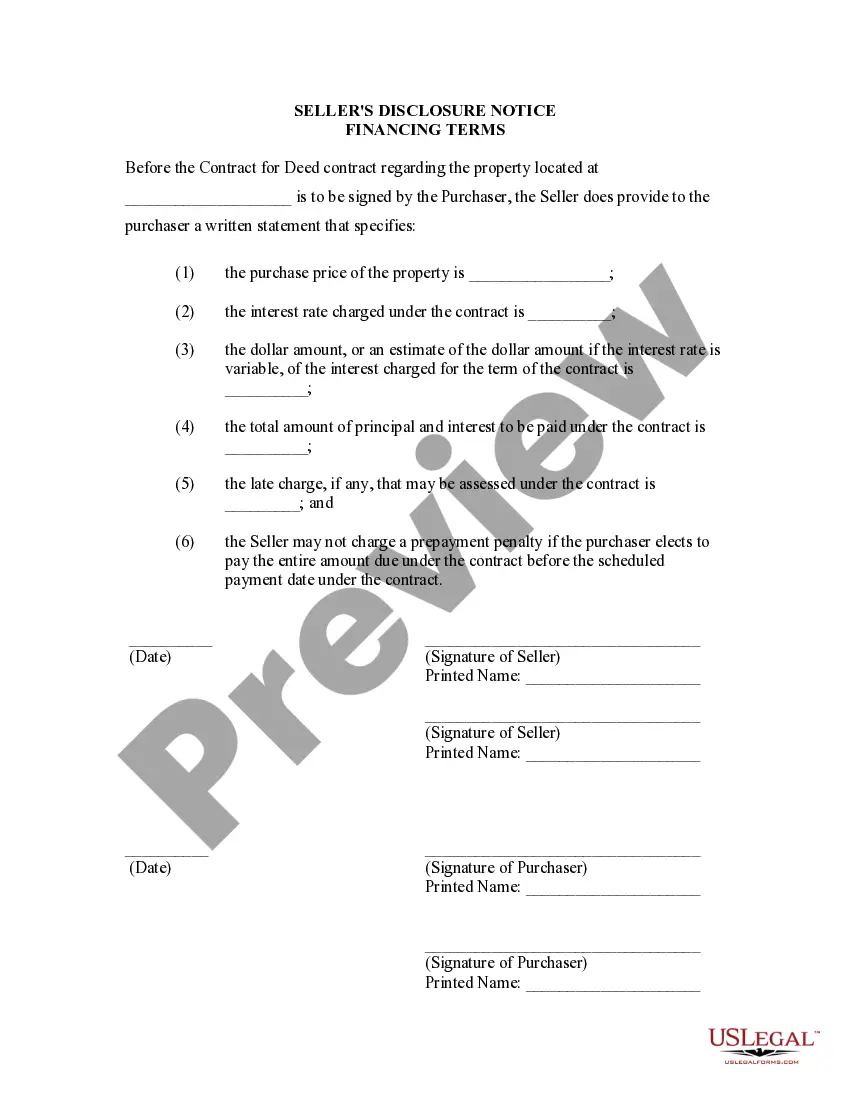

- Examine the page you've opened and check if it has the sample you need.

- To achieve this, use the form description and preview if these options are available.

- To find the one that fits your requirements, use the search tab in the page header.

- Double-check that the sample complies with juridical standards and click Buy Now.

- Opt for the subscription plan, then sign in or register for an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the selected file in the preferred format, print it, or fill it out electronically.

The great thing about the US Legal Forms library is that all the documentation you've ever acquired never gets lost - you can access it in your profile within the My Forms tab at any moment. Join the platform and quickly obtain verified legal templates for any scenario with just a few clicks!

Form popularity

FAQ

To appeal your property's assessment, File Form A-1 and Form A-1 Comp. Sale with the County Board of Taxation. Occasionally, property owners make changes or additions to real property after October 1, when municipalities set the value of property for tax purposes for the following tax year.

A letter of authority is a legal document that authorises a third party to act on behalf of your business.

Filing Compliance Agreement Program Franchise Tax Board (FTB) provides business entities, partnerships, and trusts the opportunity to voluntarily enter into a Filing Compliance Agreement (FCA) if they have a filing requirement for the past years, and an unpaid California tax liability.

Use Form 109, California Exempt Organization Business Income Tax Return, to figure the tax on the unrelated business income of the organization. Filing Form 109 does not replace the requirement to file Form 199, California Exempt Organization Annual Information Return, or FTB 199N.

Every organization with California tax-exempt status must file Form 109 if the gross income from an unrelated trade or business is more than $1,000.

Businesses are required to issue a 1099 form to a taxpayer (other than a corporation) who has received at least $600 or more in non-employment income during the tax year. For example, a taxpayer might receive a 1099 form if they received dividends, which are cash payments paid to investors for owning a company's stock.

The format of authorisation letter should include the date, name of the person to whom it is written, detail of the person who has been authorized (like name and identity proof), reason for his unavailability, duration of the authorized letter and action to be done by another person.

Format for Response Letter to income tax department for demand notice. Dear Sir, I request you to please refer to your notice under section ABC in context with assessment year 2016-17 in which it has been stated that a sum of INR 8450 is due on me as Income Tax.

The below format is useful for all kind of authorization letters that can be used in various departments. Name: Include the receiver's name. Address: Include the receiver's address. Location: Include receiver's location (Optional) Contact No: Include sender's contact number (Optional)

Dear Sir, I request you to please refer to your notice under section ABC in context with assessment year 2016-17 in which it has been stated that a sum of INR 8450 is due on me as Income Tax.