An escrow account refers to an account held in the name of the borrower which is returnable to the borrower on the performance of certain conditions.

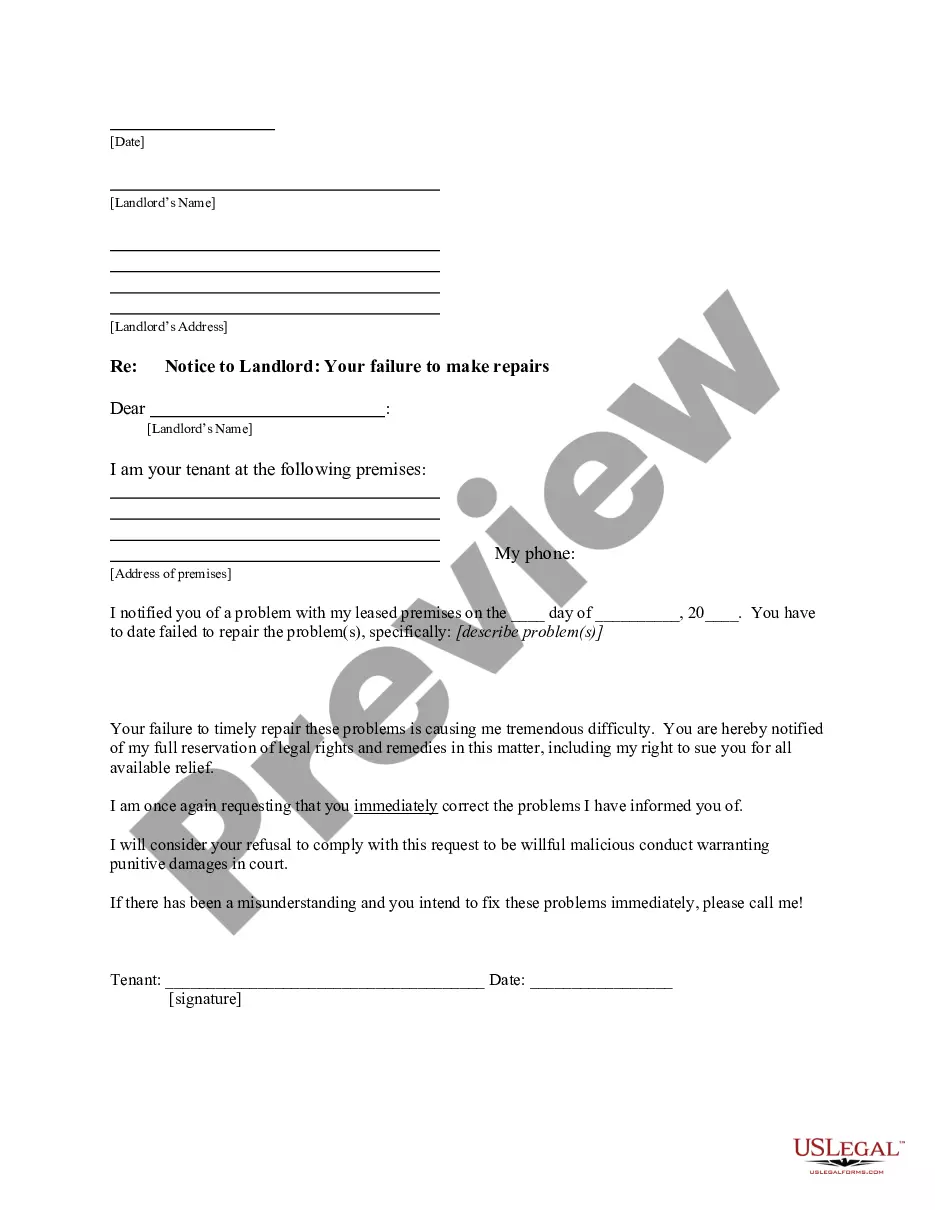

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

The Oakland Michigan Agreement for Direct Payment of Taxes, Assessments, and/or Insurance and Waiver of Escrow to be held by Lender is a legal document that outlines the responsibilities and obligations of the borrower and the lender regarding the payment of taxes, assessments, and/or insurance for a property located in Oakland, Michigan. This agreement is commonly used in real estate transactions and is designed to provide clarity and protection for both parties involved. Keywords: Oakland Michigan, Agreement for Direct Payment, Taxes, Assessments, Insurance, Waiver of Escrow, Lender There are several types of Oakland Michigan Agreements for Direct Payment of Taxes, Assessments, and/or Insurance and Waiver of Escrow to be held by Lender, including: 1. Residential Property Agreement: This type of agreement is specifically tailored for residential properties, such as single-family homes or condominiums, located in Oakland, Michigan. It addresses the payment of property taxes, assessments, and insurance premiums directly by the borrower, rather than through an escrow account. 2. Commercial Property Agreement: This agreement is designed for commercial properties, such as office buildings, retail spaces, or industrial complexes, located in Oakland, Michigan. It outlines the terms and conditions for the direct payment of taxes, assessments, and insurance by the borrower, without utilizing an escrow account. 3. Vacant Land Agreement: If the property in question is vacant land located in Oakland, Michigan, this agreement is used to establish the borrower's responsibility for the direct payment of taxes, assessments, and insurance, while waiving the need for an escrow account. 4. Multi-unit Residential Property Agreement: This agreement is specifically tailored for properties with multiple residential units, such as apartments or town homes, located in Oakland, Michigan. It addresses the direct payment of taxes, assessments, and insurance by the borrower, without involving an escrow account. In all these agreements, the borrower assumes the responsibility for making timely payments for taxes, assessments, and insurance premiums related to the property. The lender, on the other hand, agrees to waive the requirement of an escrow account for holding these funds and relies on the borrower's direct payments. It is important to note that these agreements should be carefully reviewed and understood by both parties before signing. Consulting with a legal professional familiar with Oakland, Michigan real estate laws is highly recommended ensuring compliance and protection of rights and interests.The Oakland Michigan Agreement for Direct Payment of Taxes, Assessments, and/or Insurance and Waiver of Escrow to be held by Lender is a legal document that outlines the responsibilities and obligations of the borrower and the lender regarding the payment of taxes, assessments, and/or insurance for a property located in Oakland, Michigan. This agreement is commonly used in real estate transactions and is designed to provide clarity and protection for both parties involved. Keywords: Oakland Michigan, Agreement for Direct Payment, Taxes, Assessments, Insurance, Waiver of Escrow, Lender There are several types of Oakland Michigan Agreements for Direct Payment of Taxes, Assessments, and/or Insurance and Waiver of Escrow to be held by Lender, including: 1. Residential Property Agreement: This type of agreement is specifically tailored for residential properties, such as single-family homes or condominiums, located in Oakland, Michigan. It addresses the payment of property taxes, assessments, and insurance premiums directly by the borrower, rather than through an escrow account. 2. Commercial Property Agreement: This agreement is designed for commercial properties, such as office buildings, retail spaces, or industrial complexes, located in Oakland, Michigan. It outlines the terms and conditions for the direct payment of taxes, assessments, and insurance by the borrower, without utilizing an escrow account. 3. Vacant Land Agreement: If the property in question is vacant land located in Oakland, Michigan, this agreement is used to establish the borrower's responsibility for the direct payment of taxes, assessments, and insurance, while waiving the need for an escrow account. 4. Multi-unit Residential Property Agreement: This agreement is specifically tailored for properties with multiple residential units, such as apartments or town homes, located in Oakland, Michigan. It addresses the direct payment of taxes, assessments, and insurance by the borrower, without involving an escrow account. In all these agreements, the borrower assumes the responsibility for making timely payments for taxes, assessments, and insurance premiums related to the property. The lender, on the other hand, agrees to waive the requirement of an escrow account for holding these funds and relies on the borrower's direct payments. It is important to note that these agreements should be carefully reviewed and understood by both parties before signing. Consulting with a legal professional familiar with Oakland, Michigan real estate laws is highly recommended ensuring compliance and protection of rights and interests.