The U.S. Bankruptcy Code also allows individual debtors who meet certain financial criteria to adopt extended time payment plans for the payment of debts. An individual debtor on a regular income may submit a plan for installment payment of outstanding debts. This is called a Chapter 13 Plan. This plan must be confirmed by the court. Once it is confirmed, debts are paid in the manner specified in the plan. After all payments called for by the plan are made, the debtor is given a discharge. The plan is, in effect, a budget of the debtor's future income with respect to outstanding debts. The plan must provide for the eventual payment in full of all claims entitled to priority under the Bankruptcy Code. The plan will be confirmed if it is submitted in good faith and is in the best interest of the creditors.

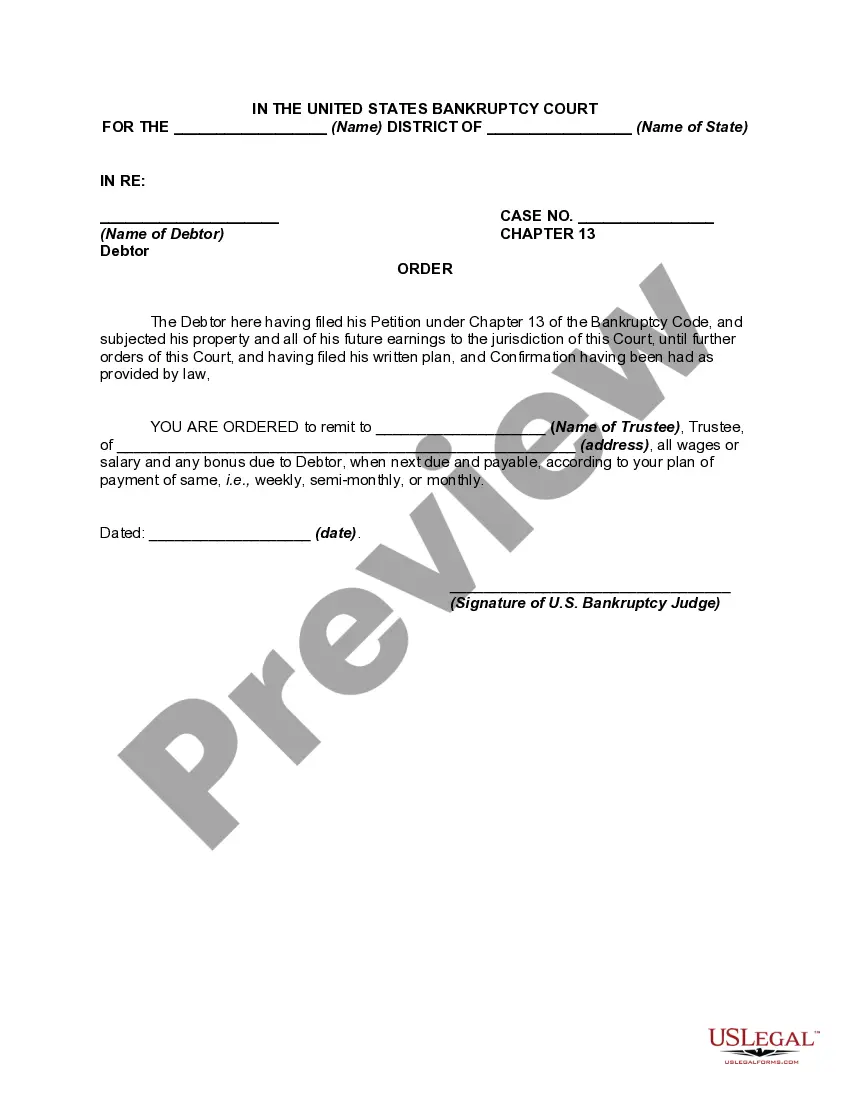

A Chapter 13 plan must provide for the submission of all or such portion of future earnings or other future income of the debtor to the supervision and control of the trustee as is necessary for the execution of the plan. After the confirmation of a Chapter 13 plan, the court may exercise its discretion and order any entity from whom the debtor receives income to pay all or part of such income to the trustee.

Middlesex Massachusetts Order Requiring Debtor's Employer to Remit Deductions from a Debtor's Paycheck to Trustee is a legal mechanism employed in Middlesex County, Massachusetts, to address debt repayment issues. This court-issued order mandates employers to deduct a specific amount from a debtor's paycheck and remit it to a trustee, who will distribute the funds to relevant creditors. This order comes into play when an individual fails to meet their financial obligations and becomes a debtor. It ensures that creditors receive their due payments while allowing debtors to repay their debts in an organized manner. By facilitating direct deductions from the debtor's paycheck, the trustee ensures consistent remittance, reducing the chances of default or further accumulation of outstanding debt. There can be various types of Middlesex Massachusetts Order Requiring Debtor's Employer to Remit Deductions from a Debtor's Paycheck to Trustee, depending on the specific circumstances and nature of the debt involved. These may include: 1. Wage Garnishment Order: This type of order authorizes the employer to withhold a specified amount or percentage of the debtor's wages to be remitted to the trustee for distribution to creditors. 2. Child Support Order: In cases where the debtor owes child support, this order directs the employer to deduct a specific amount from the debtor's paycheck and remit it to the trustee responsible for subsequent distribution to the custodial parent or designated agency. 3. Tax Debt Order: For debtors who owe back taxes, the order may instruct the employer to remit a portion of the debtor's wages directly to the trustee designated to handle tax liabilities. This helps satisfy the outstanding tax debt. 4. Student Loan Order: In cases where the debtor has defaulted on their student loans, an order can be issued to the employer, requiring them to withhold a predetermined amount from the debtor's paycheck. This amount is then sent to the trustee who will allocate it towards the repayment of the student loan debt. It is important to note that the specific names of these orders may vary, and additional categories or variations may exist based on different legislations and court practices. However, the underlying objective remains the same: to enforce debtor's repayment obligations and ensure the fair disbursement of funds to creditors via their employer and a trustee.