The U.S. Bankruptcy Code also allows individual debtors who meet certain financial criteria to adopt extended time payment plans for the payment of debts. An individual debtor on a regular income may submit a plan for installment payment of outstanding debts. This is called a Chapter 13 Plan. This plan must be confirmed by the court. Once it is confirmed, debts are paid in the manner specified in the plan. After all payments called for by the plan are made, the debtor is given a discharge. The plan is, in effect, a budget of the debtor's future income with respect to outstanding debts. The plan must provide for the eventual payment in full of all claims entitled to priority under the Bankruptcy Code. The plan will be confirmed if it is submitted in good faith and is in the best interest of the creditors.

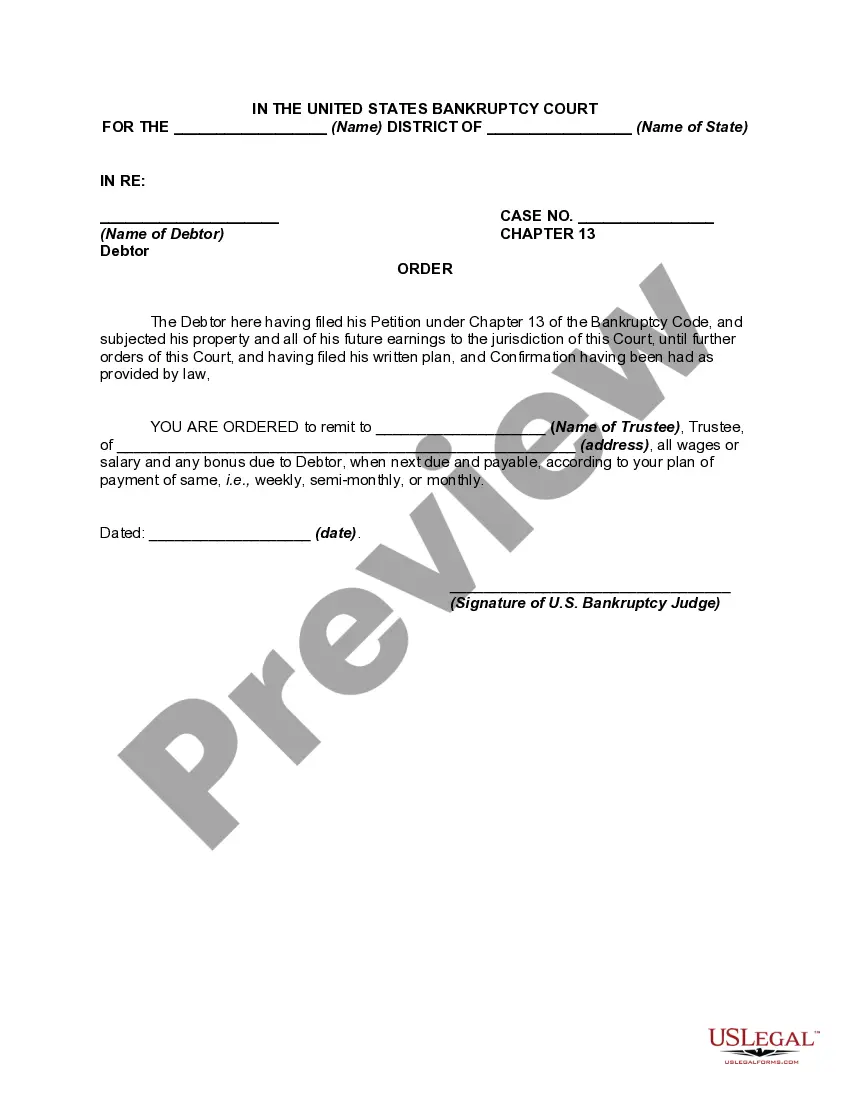

A Chapter 13 plan must provide for the submission of all or such portion of future earnings or other future income of the debtor to the supervision and control of the trustee as is necessary for the execution of the plan. After the confirmation of a Chapter 13 plan, the court may exercise its discretion and order any entity from whom the debtor receives income to pay all or part of such income to the trustee.

A Riverside California Order Requiring Debtor's Employer to Remit Deductions from a Debtor's Paycheck to Trustee is a legal tool utilized in bankruptcy cases to facilitate debt repayment. This order mandates an employer to withhold a specific amount from a debtor's paycheck and remit it directly to the appointed trustee overseeing the bankruptcy proceedings. This ensures that the debtor's obligations towards the bankruptcy estate are met, enabling appropriate distribution to creditors. There are two primary types of orders that fall under the category of Riverside California Order Requiring Debtor's Employer to Remit Deductions from a Debtor's Paycheck to Trustee: 1. Wage Garnishment Order: A wage garnishment order is issued by the bankruptcy court upon the request of the trustee. It instructs the debtor's employer to deduct a predetermined portion of the debtor's wages and forward it directly to the trustee. This type of order typically remains in effect until the debtor's bankruptcy case is completed or another court order supersedes it. 2. Wage Assignment Order: A wage assignment order is similar to a wage garnishment order but serves a different purpose. Instead of deducting a portion of the debtor's wages to repay specific creditors, this order allocates the withheld funds towards meeting the debtor's obligations under a reaffirmation agreement. A reaffirmation agreement is an arrangement made between the debtor and a creditor to retain certain property, such as a car or house, by continuing to make timely payments after bankruptcy. Keywords: Riverside California, Order Requiring Debtor's Employer, Remit Deductions, Paycheck, Trustee, bankruptcy cases, debt repayment, legal tool, employer withholding, bankruptcy proceedings, obligations, bankruptcy estate, creditors, wage garnishment order, wage assignment order, wage garnishment, wage assignment, wages, bankruptcy court, bankruptcy case, reaffirmation agreement.A Riverside California Order Requiring Debtor's Employer to Remit Deductions from a Debtor's Paycheck to Trustee is a legal tool utilized in bankruptcy cases to facilitate debt repayment. This order mandates an employer to withhold a specific amount from a debtor's paycheck and remit it directly to the appointed trustee overseeing the bankruptcy proceedings. This ensures that the debtor's obligations towards the bankruptcy estate are met, enabling appropriate distribution to creditors. There are two primary types of orders that fall under the category of Riverside California Order Requiring Debtor's Employer to Remit Deductions from a Debtor's Paycheck to Trustee: 1. Wage Garnishment Order: A wage garnishment order is issued by the bankruptcy court upon the request of the trustee. It instructs the debtor's employer to deduct a predetermined portion of the debtor's wages and forward it directly to the trustee. This type of order typically remains in effect until the debtor's bankruptcy case is completed or another court order supersedes it. 2. Wage Assignment Order: A wage assignment order is similar to a wage garnishment order but serves a different purpose. Instead of deducting a portion of the debtor's wages to repay specific creditors, this order allocates the withheld funds towards meeting the debtor's obligations under a reaffirmation agreement. A reaffirmation agreement is an arrangement made between the debtor and a creditor to retain certain property, such as a car or house, by continuing to make timely payments after bankruptcy. Keywords: Riverside California, Order Requiring Debtor's Employer, Remit Deductions, Paycheck, Trustee, bankruptcy cases, debt repayment, legal tool, employer withholding, bankruptcy proceedings, obligations, bankruptcy estate, creditors, wage garnishment order, wage assignment order, wage garnishment, wage assignment, wages, bankruptcy court, bankruptcy case, reaffirmation agreement.