The U.S. Bankruptcy Code also allows individual debtors who meet certain financial criteria to adopt extended time payment plans for the payment of debts. An individual debtor on a regular income may submit a plan for installment payment of outstanding debts. This is called a Chapter 13 Plan. This plan must be confirmed by the court. Once it is confirmed, debts are paid in the manner specified in the plan. After all payments called for by the plan are made, the debtor is given a discharge. The plan is, in effect, a budget of the debtor's future income with respect to outstanding debts. The plan must provide for the eventual payment in full of all claims entitled to priority under the Bankruptcy Code. The plan will be confirmed if it is submitted in good faith and is in the best interest of the creditors.

A Chapter 13 plan must provide for the submission of all or such portion of future earnings or other future income of the debtor to the supervision and control of the trustee as is necessary for the execution of the plan. After the confirmation of a Chapter 13 plan, the court may exercise its discretion and order any entity from whom the debtor receives income to pay all or part of such income to the trustee.

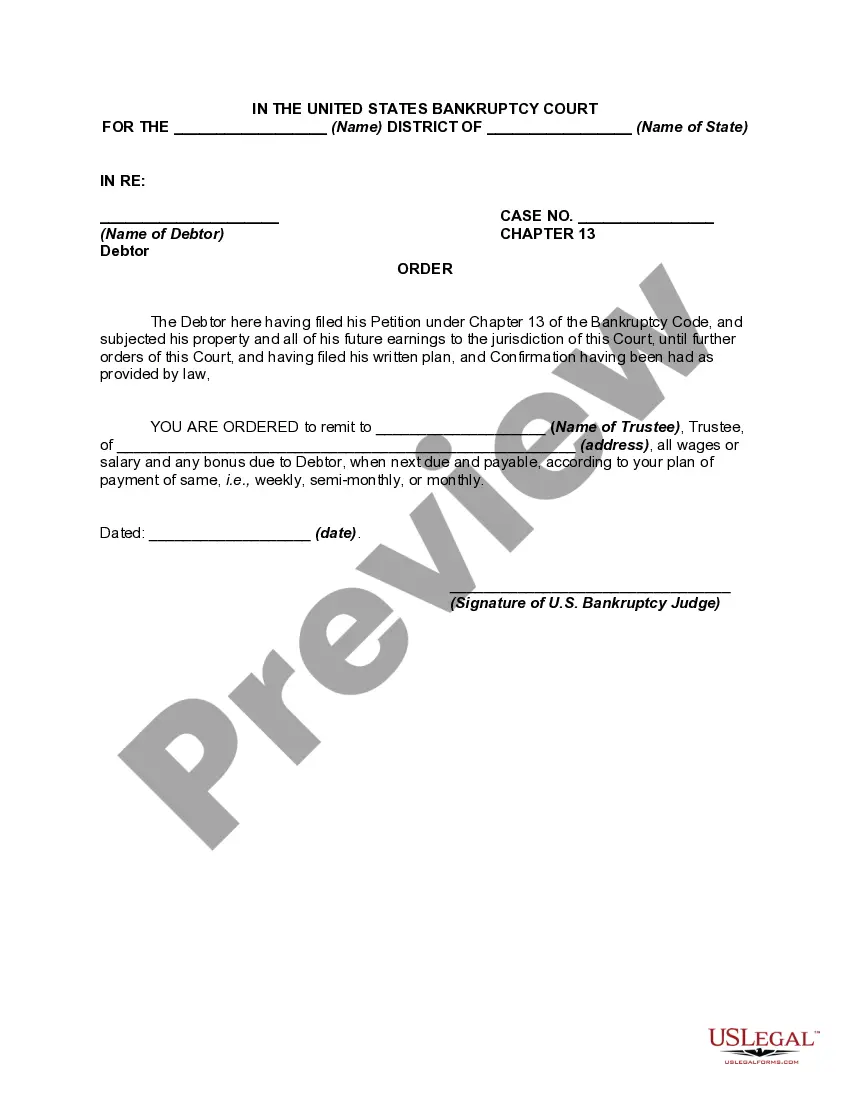

Title: San Antonio Texas Order Requiring Debtor's Employer to Remit Deductions from a Debtor's Paycheck to Trustee: A Comprehensive Overview Introduction: In San Antonio, Texas, a unique legal provision exists known as the Order Requiring Debtor's Employer to Remit Deductions from a Debtor's Paycheck to Trustee. This order imposes a mandatory obligation on employers within the jurisdiction to deduct and remit specific portions of a debtor's paycheck to the trustee overseeing the debtor's bankruptcy case. This article aims to provide a detailed description of this critical legal measure, highlighting its purpose, procedures, and potential variations. Key Points: 1. Purpose and Significance: — The primary objective of the Order Requiring Debtor's Employer to Remit Deductions from a Debtor's Paycheck to Trustee is to facilitate the repayment of debts owed by the debtor during a bankruptcy case. — This provision helps ensure a steady source of funds for the trustee to distribute amongst the creditors. — It offers reassurance to creditors that their claims will be addressed methodically and efficiently. 2. Procedure and Implementation: — Once a bankruptcy case is filed, the debtor's employer receives a notice from the court, introducing the Order Requiring Debtor's Employer to Remit Deductions from a Debtor's Paycheck to Trustee. — The employer is legally bound to adhere to this order and must deduct the specified amount from the debtor's paycheck as instructed by the trustee. — The deducted funds are then remitted directly to the trustee, who will distribute them amongst the creditors according to the court-approved plan. 3. Variations of the Order: While the fundamental principle of an Order Requiring Debtor's Employer to Remit Deductions from a Debtor's Paycheck to Trustee remains consistent, it is crucial to acknowledge potential variations and specific applications within the San Antonio, Texas legal framework. Some notable variations may include: a) Mandatory wage garnishment orders: These orders require the employer to withhold a predetermined percentage of the debtor's wages until the bankruptcy case concludes. b) Priority payment orders: Certain bankruptcy cases may prioritize specific creditors in the distribution of funds. c) Lump-sum payment orders: In unique circumstances, the court may authorize the debtor's employer to remit a one-time lump-sum payment rather than regular deductions. Conclusion: In summary, the Order Requiring Debtor's Employer to Remit Deductions from a Debtor's Paycheck to Trustee holds substantial importance for the smooth progress of bankruptcy cases in San Antonio, Texas. This legally binding provision ensures consistent repayment of debts owed by the debtor, ultimately alleviating the financial burden and concerns of creditors. Employers play a vital role in implementing this order by deducting the designated amounts from the debtor's paycheck and remitting them to the trustee. Understanding the purpose and procedures associated with this order is crucial for all parties involved in a bankruptcy case in San Antonio, Texas.Title: San Antonio Texas Order Requiring Debtor's Employer to Remit Deductions from a Debtor's Paycheck to Trustee: A Comprehensive Overview Introduction: In San Antonio, Texas, a unique legal provision exists known as the Order Requiring Debtor's Employer to Remit Deductions from a Debtor's Paycheck to Trustee. This order imposes a mandatory obligation on employers within the jurisdiction to deduct and remit specific portions of a debtor's paycheck to the trustee overseeing the debtor's bankruptcy case. This article aims to provide a detailed description of this critical legal measure, highlighting its purpose, procedures, and potential variations. Key Points: 1. Purpose and Significance: — The primary objective of the Order Requiring Debtor's Employer to Remit Deductions from a Debtor's Paycheck to Trustee is to facilitate the repayment of debts owed by the debtor during a bankruptcy case. — This provision helps ensure a steady source of funds for the trustee to distribute amongst the creditors. — It offers reassurance to creditors that their claims will be addressed methodically and efficiently. 2. Procedure and Implementation: — Once a bankruptcy case is filed, the debtor's employer receives a notice from the court, introducing the Order Requiring Debtor's Employer to Remit Deductions from a Debtor's Paycheck to Trustee. — The employer is legally bound to adhere to this order and must deduct the specified amount from the debtor's paycheck as instructed by the trustee. — The deducted funds are then remitted directly to the trustee, who will distribute them amongst the creditors according to the court-approved plan. 3. Variations of the Order: While the fundamental principle of an Order Requiring Debtor's Employer to Remit Deductions from a Debtor's Paycheck to Trustee remains consistent, it is crucial to acknowledge potential variations and specific applications within the San Antonio, Texas legal framework. Some notable variations may include: a) Mandatory wage garnishment orders: These orders require the employer to withhold a predetermined percentage of the debtor's wages until the bankruptcy case concludes. b) Priority payment orders: Certain bankruptcy cases may prioritize specific creditors in the distribution of funds. c) Lump-sum payment orders: In unique circumstances, the court may authorize the debtor's employer to remit a one-time lump-sum payment rather than regular deductions. Conclusion: In summary, the Order Requiring Debtor's Employer to Remit Deductions from a Debtor's Paycheck to Trustee holds substantial importance for the smooth progress of bankruptcy cases in San Antonio, Texas. This legally binding provision ensures consistent repayment of debts owed by the debtor, ultimately alleviating the financial burden and concerns of creditors. Employers play a vital role in implementing this order by deducting the designated amounts from the debtor's paycheck and remitting them to the trustee. Understanding the purpose and procedures associated with this order is crucial for all parties involved in a bankruptcy case in San Antonio, Texas.